Finance > EXAM > University of Phoenix - FIN 370: FIN370_WK4_CHAPTER 9 P1_RISK & RETURN. 47 Questions and Answers. (All)

University of Phoenix - FIN 370: FIN370_WK4_CHAPTER 9 P1_RISK & RETURN. 47 Questions and Answers.

Document Content and Description Below

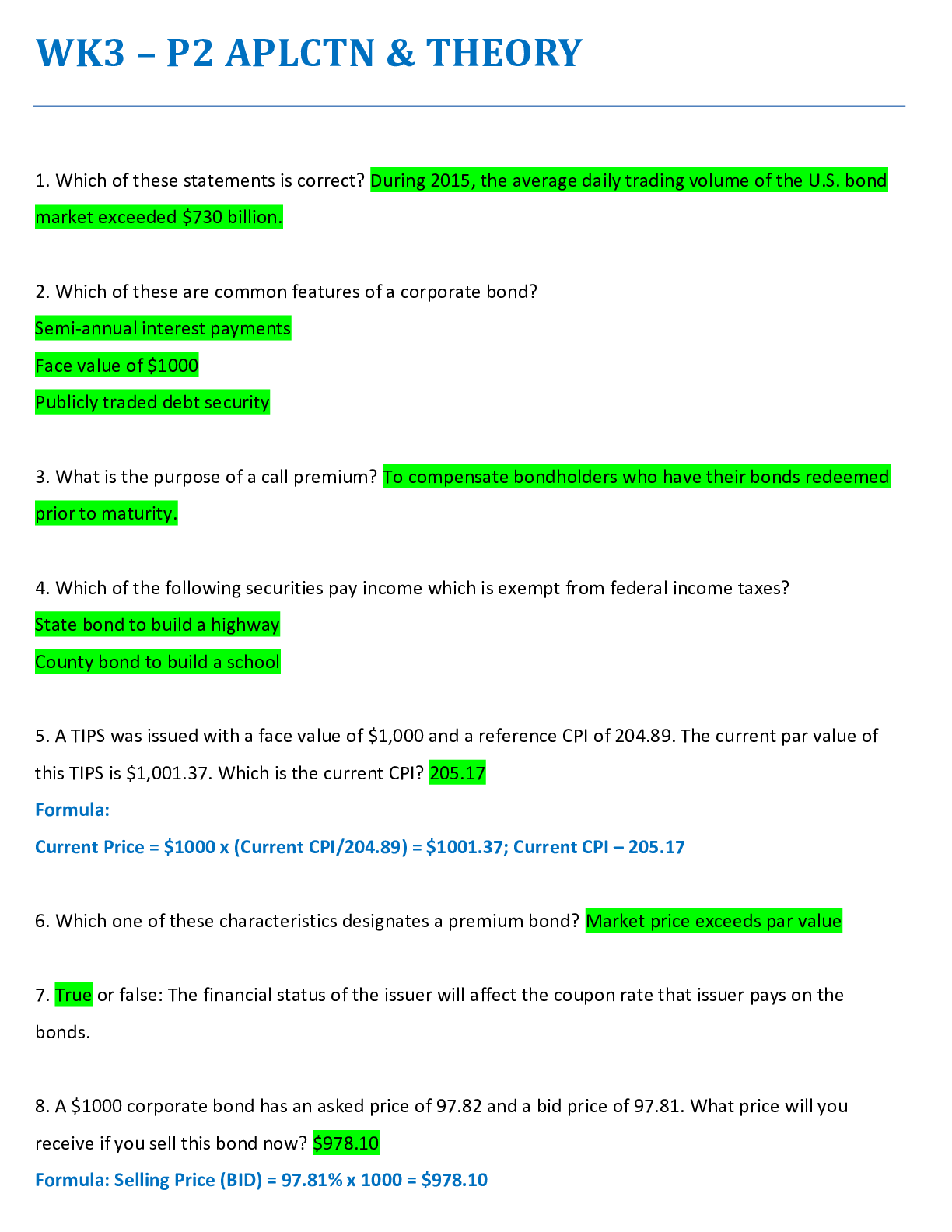

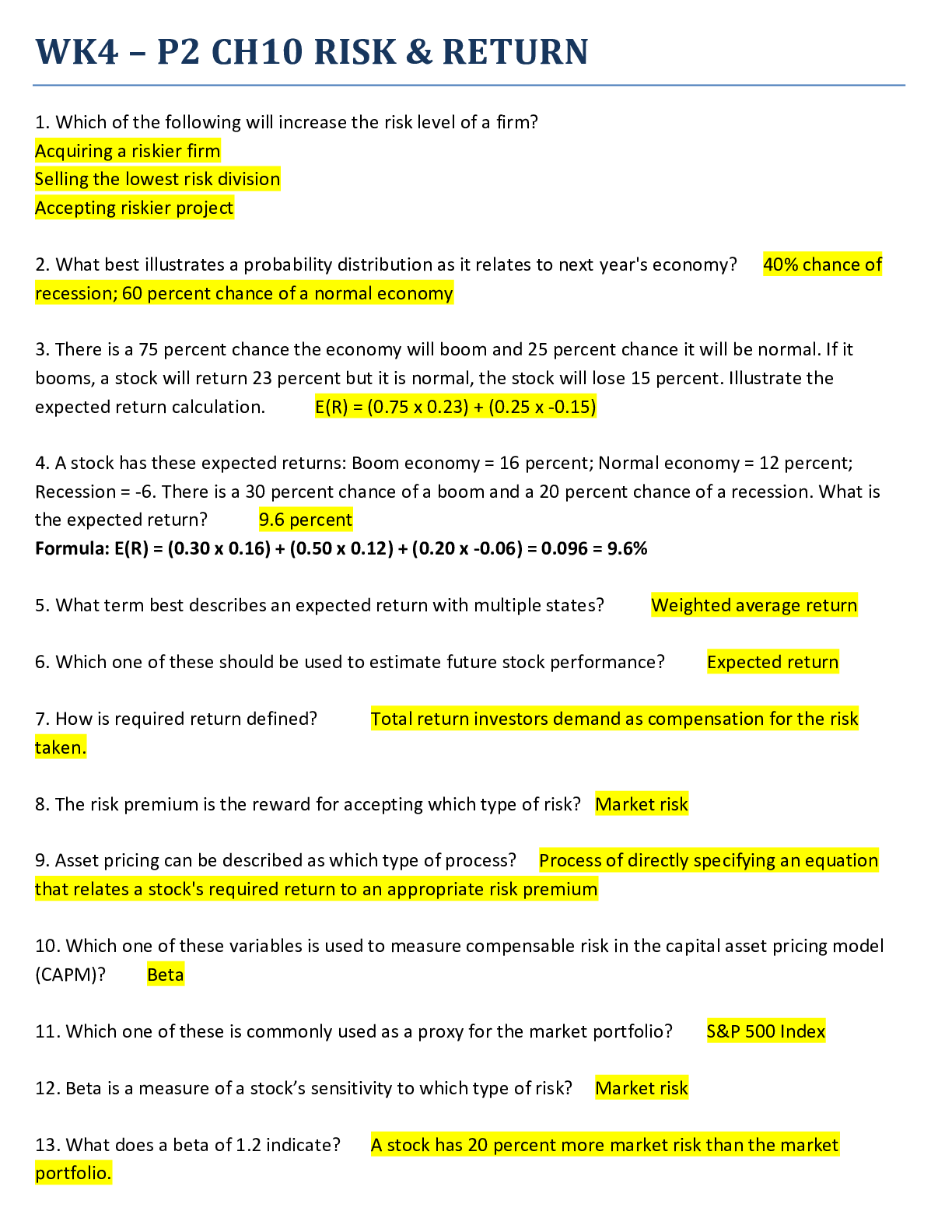

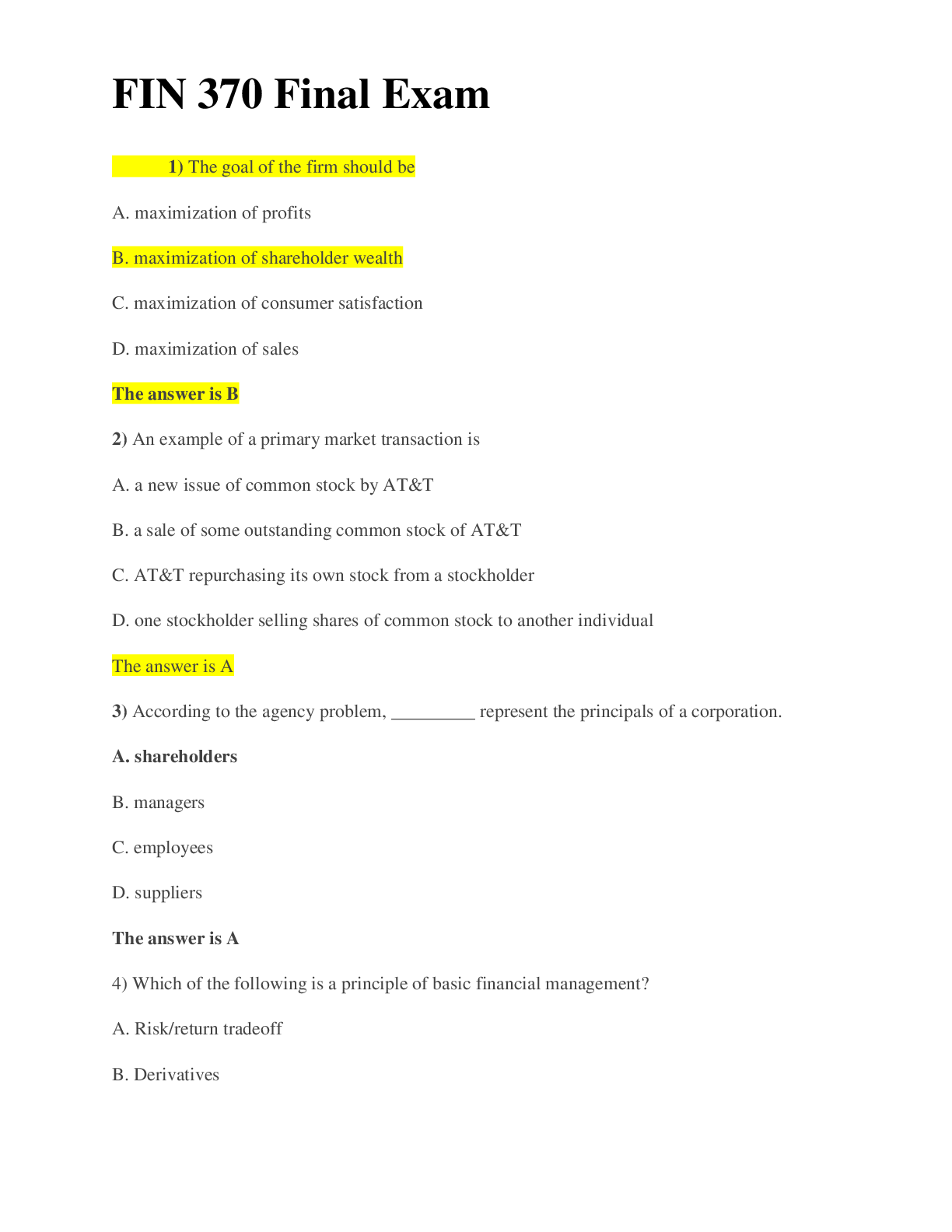

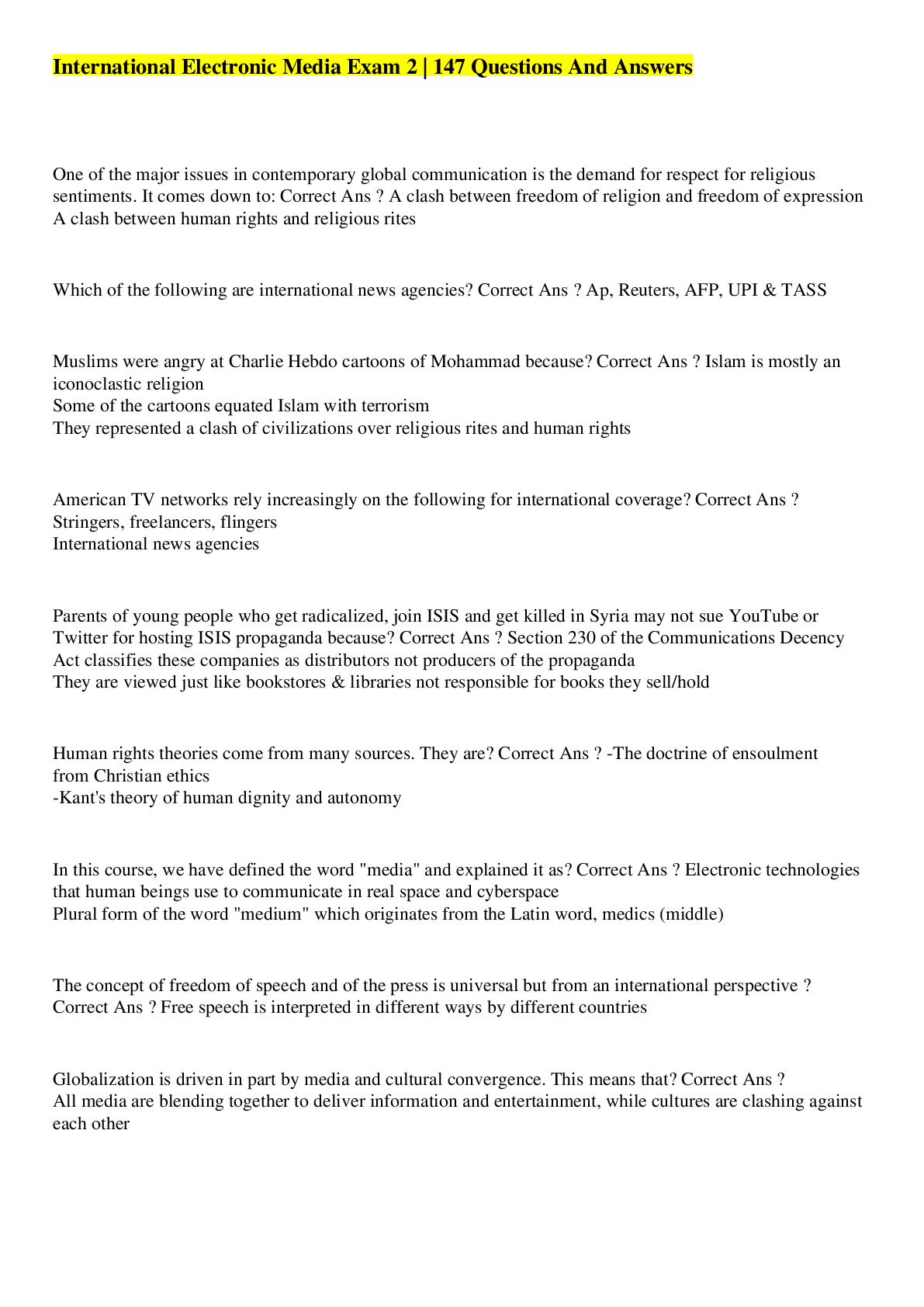

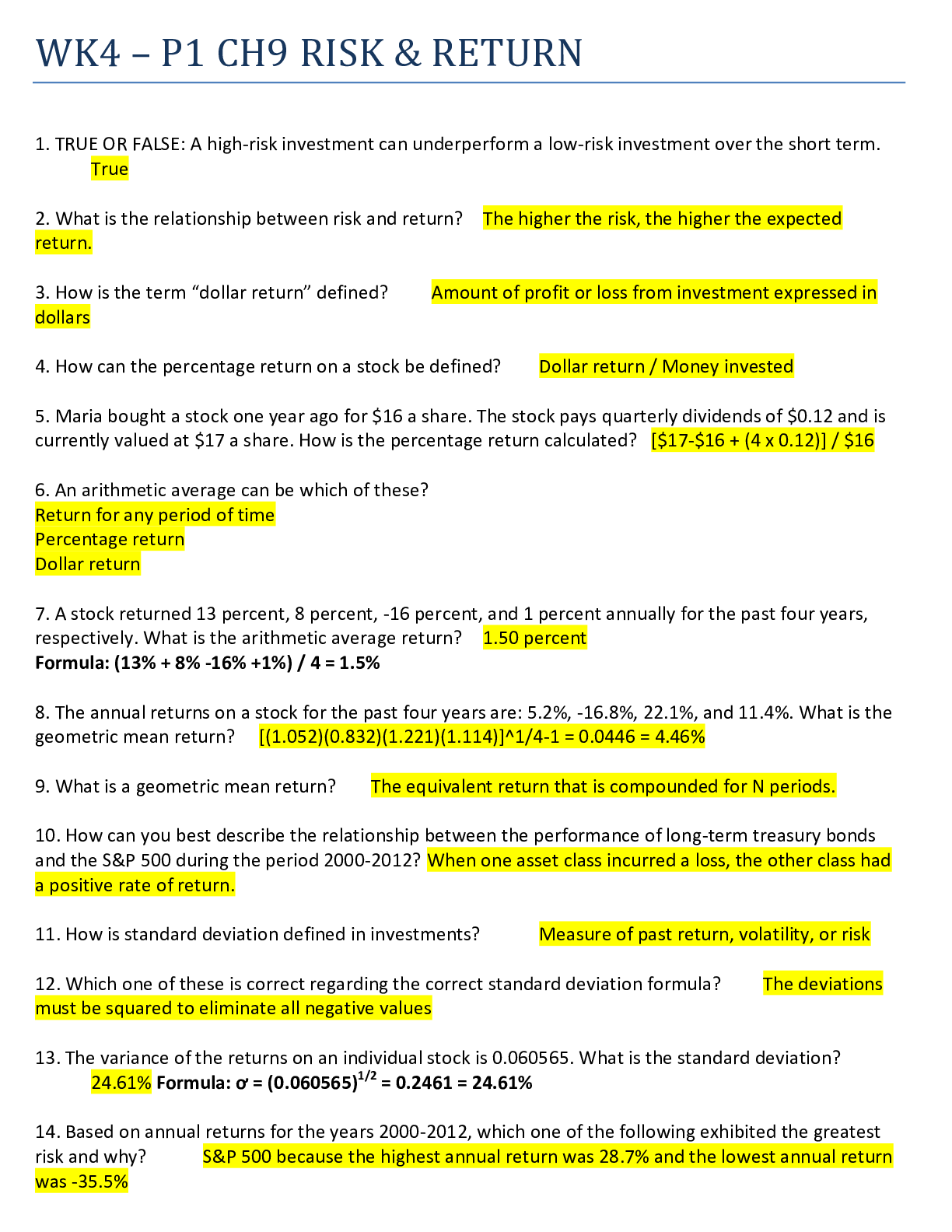

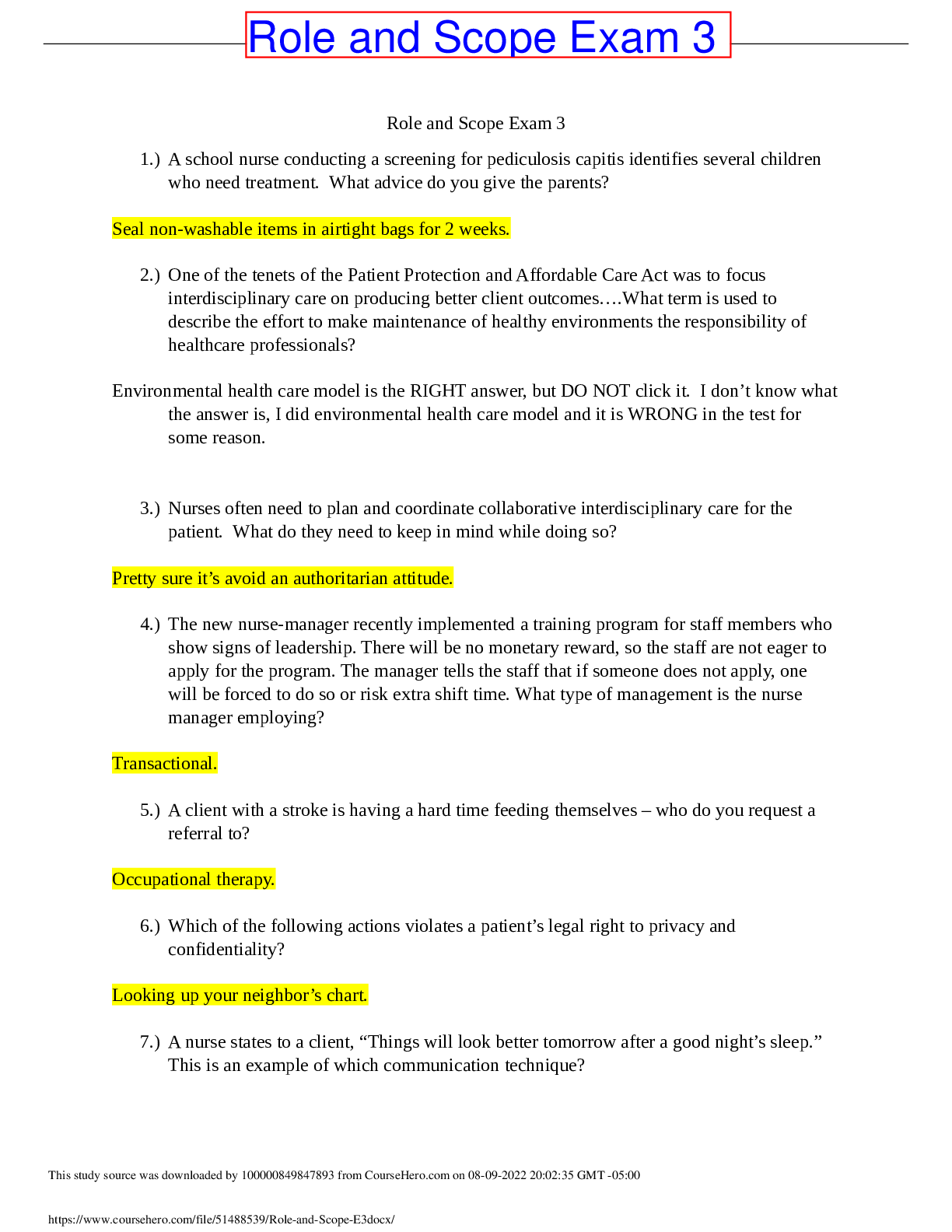

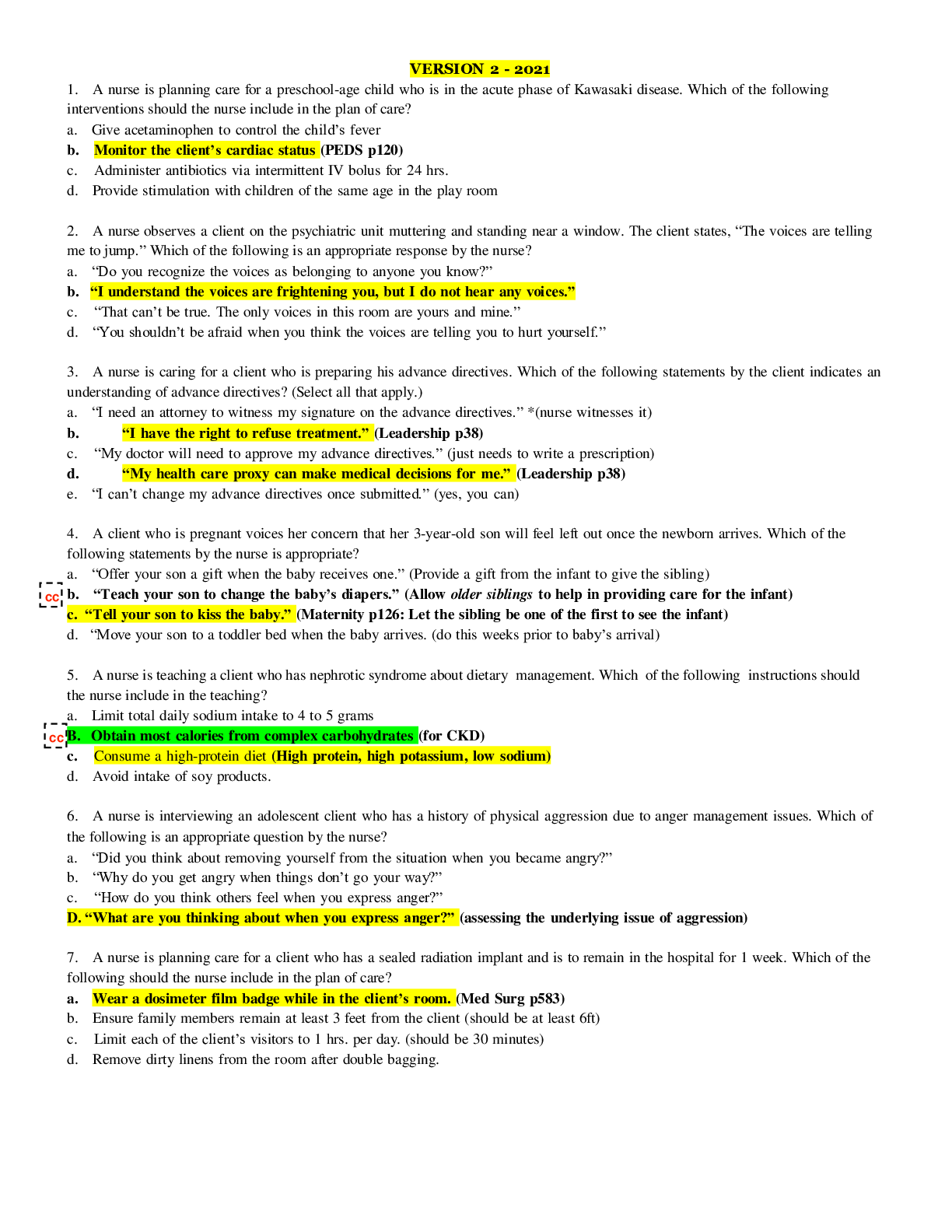

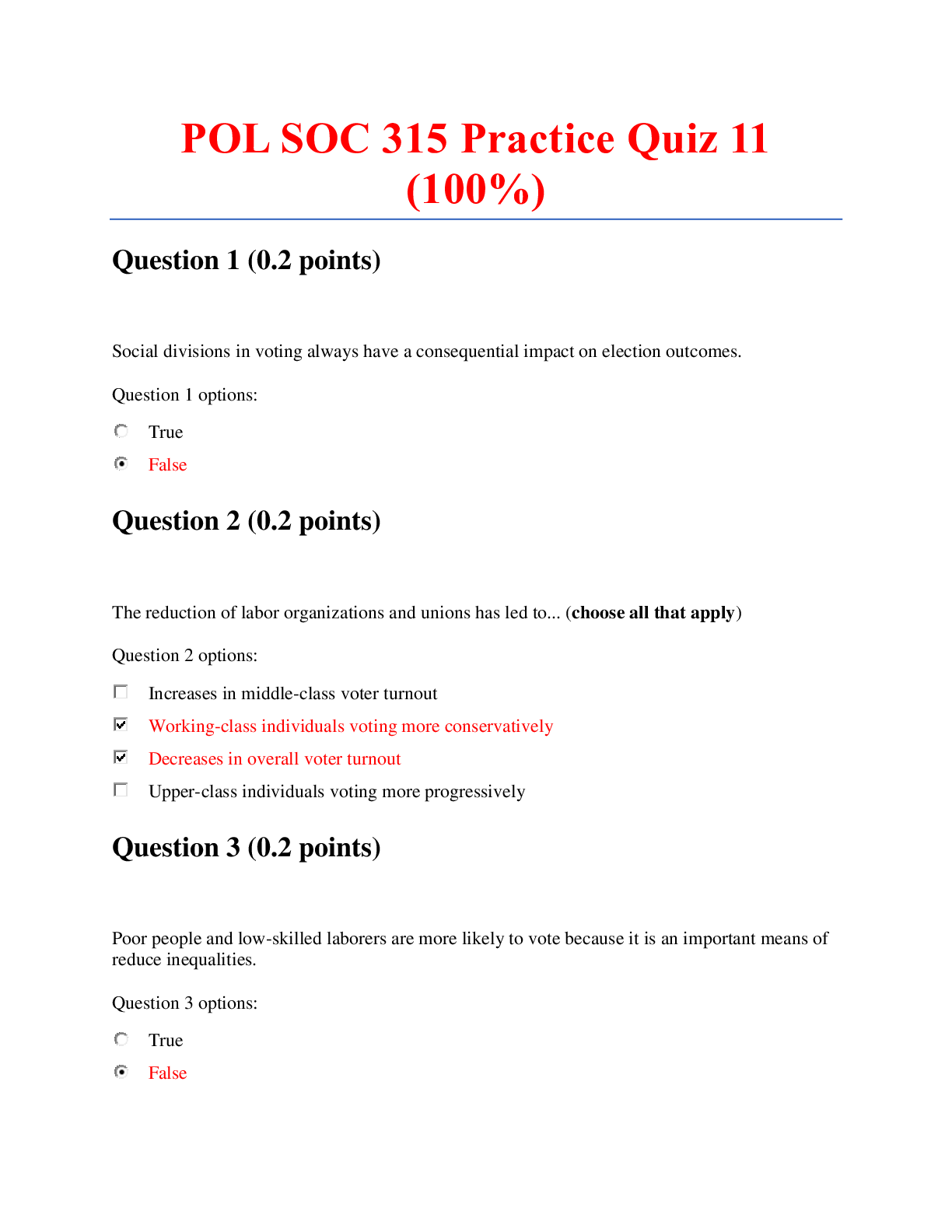

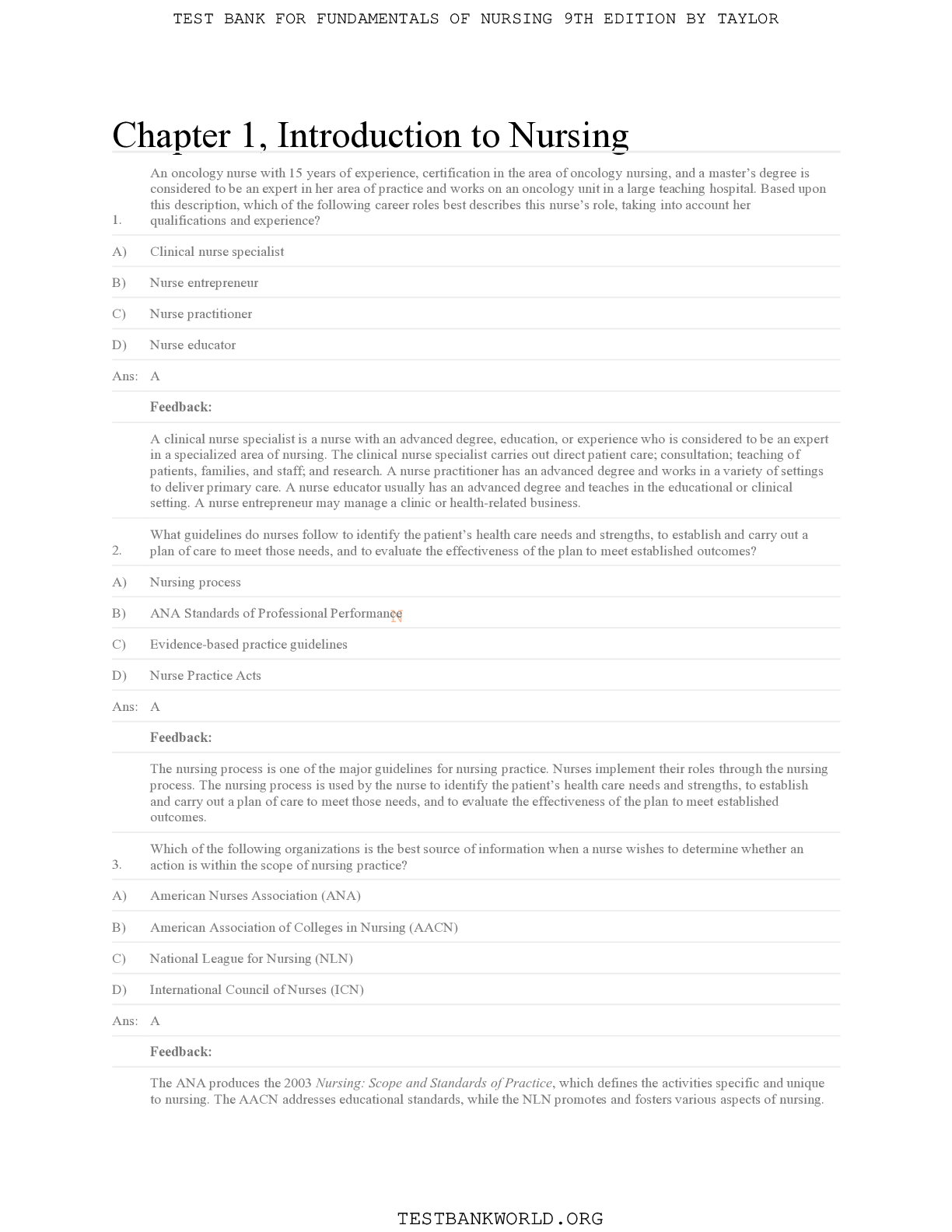

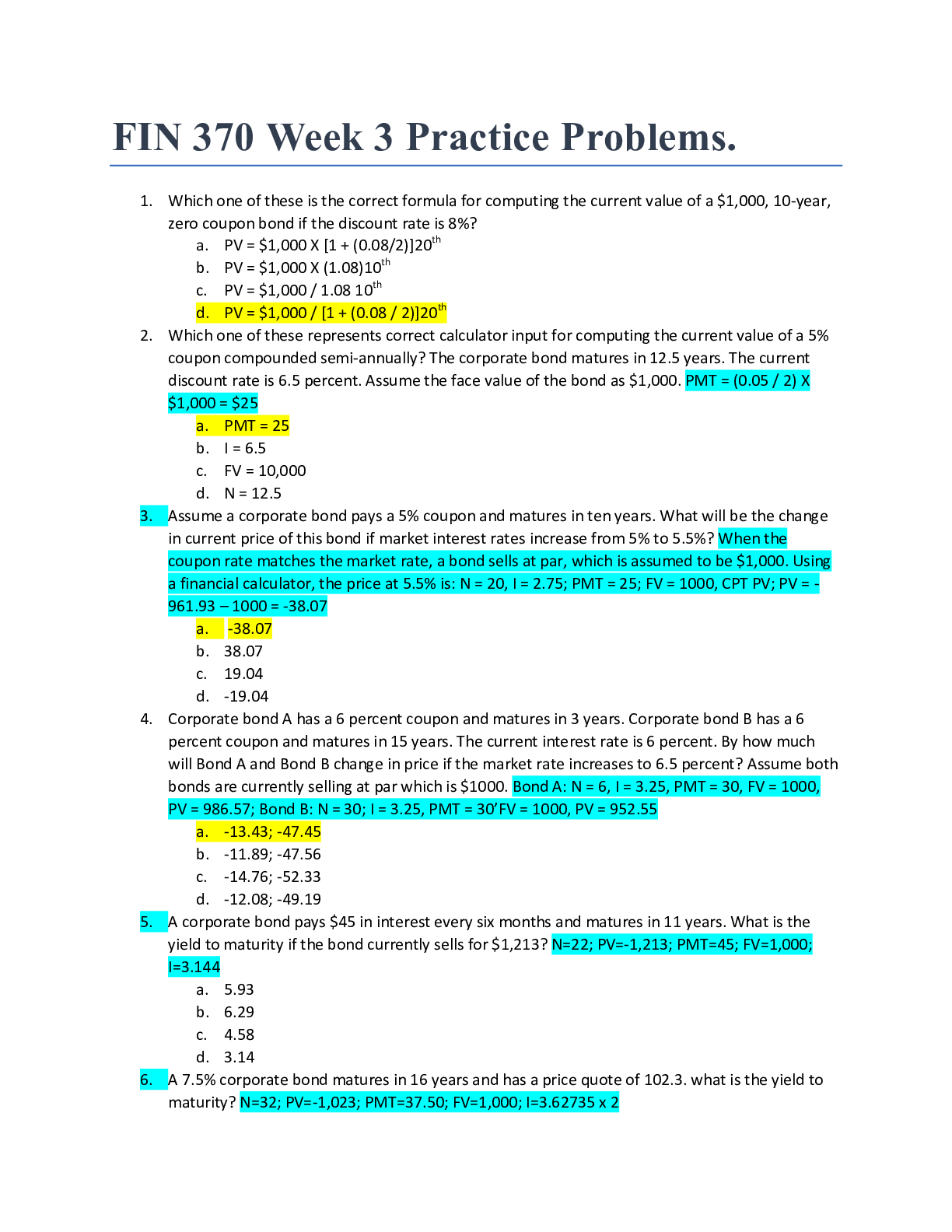

WK4 – P1 CH9 RISK & RETURN 1. TRUE OR FALSE: A high-risk investment can underperform a low-risk investment over the short term. 2. What is the relationship between risk and return? The 3. ... How is the term “dollar return” defined? Amount of 4. How can the percentage return on a stock be defined? 5. Maria bought a stock one year ago for $16 a share. The stock pays quarterly dividends of $0.12 and is currently valued at $17 a share. How is the percentage return calculated? 6. An arithmetic average can be which of these? Return for any period of time 7. A stock returned 13 percent, 8 percent, -16 percent, and 1 percent annually for the past four years, respectively. What is the arithmetic average return? 8. The annual returns on a stock for the past four years are: 5.2%, -16.8%, 22.1%, and 11.4%. What is the geometric mean return? 9. What is a geometric mean return? The 10. How can you best describe the relationship between the performance of long-term treasury bonds and the S&P 500 during the period 2000-2012? When one ass 11. How is standard deviation defined in investments? 12. Which one of these is correct regarding the correct standard deviation formula? The 13. The variance of the returns on an individual stock is 0.060565. What is the standard deviation? 14. Based on annual returns for the years 2000-2012, which one of the following exhibited the greatest risk and why? 15. Which of these correctly describe the returns on long term Treasury bonds for the period 1950-2012? Higher returns than T-bill returns over the period 16. True or false: T-bills are considered to be risk-free because their standard deviation of return is always zero. 17. Which statement is true? Investing in 18. Which of the following exemplifies market risk? An increase in inflation 19. What is firm-specific risk? 20. Market risk applies to which of the following? 21. Stock investors cannot avoid which type of risk? 22. What is the primary focus of modern portfolio theory (MPT)? Minimizing 23. Which one of these best describes diversification? 24. How is correlation defines? Measure of 25. What determines the weights to be used in computing a portfolio rate of return? Market v 26. Which of the following are examples of diversifiable risk? Frau 27. How can firm specific risk be defined? 28. Modern portfolio theory (MPT) is designed to achieve which one of these? Highest return for a given level of risk 29. Which of these represents an optimal portfolio comprised of two stocks? 30. How is the capital gain or loss on a stock investment computed? Ending stoc 31. Roger purchased a stock for $16 a share. The stock paid a $1 annual dividend and increased in price by $2 a year for the following three years. What is the arithmetic average annual capital gain? The arithmetic average annual total return? 32. Which rate of return best illustrates the historical performance of a security over time? 33. Which of these best summarizes market performance for the period 1950-2012? 34. The price of a stock at the end of the past three years has been $14, 12, and $11 with $11 being the latest price. The stock pays an annual dividend of $1 per share. What is the average annual capital gain for the past two years? The average annual total return? 35. What is the definition of the coefficient of variation? 36. What does a correlation value of zero indicate? No relationship between the co- 37. For the past three years a stock has provided an average return of 11.6 percent with a variance of 0.02789. What is the coefficient of variation (CoV)? 38. On a graph with expected return on the vertical axis and standard deviation on the horizontal axis, where is an efficient portfolio located? At the highest return 39. A stock has a variance of 0.02468, a current price of $28 a share, and an average rate of return of 14.4 percent. How is the coefficient of variation (CoV) computed? 40. You want to invest in two stocks that will provide you with the most diversified portfolio. You should select the two stocks with which one of these correlation values? 41. Assume a portfolio with a return of 12 percent with a standard deviation of 18 percent is an efficient portfolio. Which one of these is most apt to also be an efficient portfolio? 13 Explanation: this could be an efficient portfolio as both its return and risk levels are higher than the given efficient portfolio. 42. Marta is risk-adverse, which is her primary investment concern. Which one of these represents an optimal portfolio for her? 43. What does an increase in the coefficient of variation (CoV) for a security indicate? 44. Which statement is true? The higher the long- 45. What benefit is derived from the use of standard deviation when measuring rates of return? 46. How does correlation relate to total risk? 47. Luther invested $1,500 in stock A with a return of 11.6 percent, $500 in stock B with a return of 19 percent, and $1,000 in bond C with a return of 6.7 percent. What is the portfolio return? [Show More]

Last updated: 1 year ago

Preview 1 out of 5 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 19, 2020

Number of pages

5

Written in

Additional information

This document has been written for:

Uploaded

Dec 19, 2020

Downloads

0

Views

32

.png)