Finance > EXAM > University of Phoenix - FIN 370 FIN370_WK4_CHPTR 10 P2_RISK & RETURN. Document contains 58 questions (All)

University of Phoenix - FIN 370 FIN370_WK4_CHPTR 10 P2_RISK & RETURN. Document contains 58 questions and Answers. 100% Correct.

Document Content and Description Below

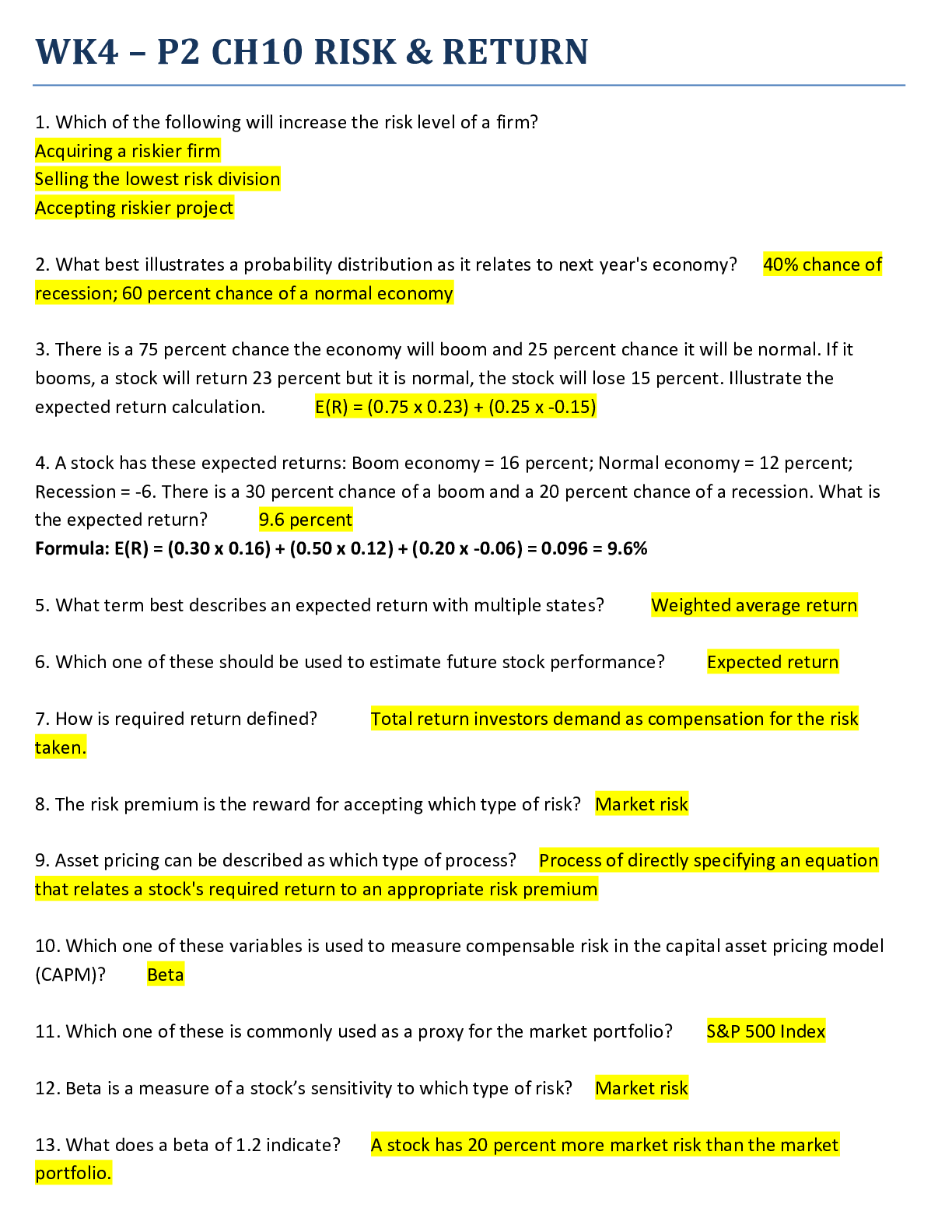

WK4 – P2 CH10 RISK & RETURN 1. Which of the following will increase the risk level of a firm? 2. What best illustrates a probability distribution as it relates to next year's economy? 3. Ther... e is a 75 percent chance the economy will boom and 25 percent chance it will be normal. If it booms, a stock will return 23 percent but it is normal, the stock will lose 15 percent. Illustrate the expected return calculation. 4. A stock has these expected returns: Boom economy = 16 percent; Normal economy = 12 percent; Recession = -6. There is a 30 percent chance of a boom and a 20 percent chance of a recession. What is the expected return? 5. What term best describes an expected return with multiple states? 6. Which one of these should be used to estimate future stock performance? 7. How is required return defined? 8. The risk premium is the reward for accepting which type of risk? Market risk 9. Asset pricing can be described as which type of process? 10. Which one of these variables is used to measure compensable risk in the capital asset pricing model (CAPM)? Beta 11. Which one of these is commonly used as a proxy for the market portfolio? 12. Beta is a measure of a stock’s sensitivity to which type of risk? 13. What does a beta of 1.2 indicate? 14. Which one of these is a factor that most affects the level of a firm's beta? 15. Which of these are characteristics of the security market line (SML)? Select all that apply Passes through the market rate of return 16. Which of these are correct versions of the Capital Asset Pricing Model (CAPM)? 17. A stock has a beta of 1.2, the market rate of return is 11.3 percent, and the risk-free rate is 4.2 percent. How is the expected return on the stock computed? 18. You invest equal amounts of money in four stocks with betas 1.4, 2.6, 0.3, and 0.7. What is the portfolio beta? 19. How is a portfolio beta computed when the portfolio consists of $800 in stock A with a beta of 2.6 and $60 in a risk-free asset? 20. Which one of these correctly defines a portfolio beta? Assume varying amounts are invested in each security. 21. A portfolio consists of 500 of stock A, 200 of stock B, and 600 of stock C. The stock betas are 1.3, 2.2, and 0.5 for stocks A,B,C. How is the portfolio beta computed? 22. What is the definition of an efficient market? 23. Which one of these defines the efficient market hypothesis (EMH)? A t 24. How is a stock market bubble defined? Period of overinflated 25. The market portfolio has which of these characteristics? No firm specific risk 26. Beta measures which of these? 27. What type of security, if any, has a zero beta? 28. The security market line (SML) graphs required return against which risk measure? 29. What type of relationship exists between risk and risk premiums? 30. Which one of these best defines the standard deviation of expected returns given multiple economic states? 31. A stock is expected to return 11 percent in a normal economy, 16 percent in a boom, and lose 9 percent in a recession. There is a 20 percent chance the economy will boom and a 10 percent chance of a recession. What is the standard deviation of the expected returns? Formula: 32. How is the market risk premium defined? Return on the market portfolio – Risk-free of interest. 33. Why do managers need to understand the shareholder's required returns? Managers must ensure firms adequately reward their investors Managers must understand that increasing the risk level of a firm will increase the returns required by 34. Which of the following are means of executive compensation that are directly affected by the value of a firm's stock? 35. Which one of these formulas correctly computes the return required by an investor? 36. Which statement applies to the efficient market hypothesis? Security prices fully reflect all 37. A stock sells for $18 a share, the next dividend will be $1.54 per share, and the dividend increases by 2.5 percent annually. What is the required return? 11.06 percent 38. Which one of these is an argument for market efficiency? 39. Which one of these is most apt to the result of irrational investor behavior? 40. Which of these is the study of the cognitive processes and biases associated with making financial and economic decisions? 41. Which of these are characteristics associated with overconfident investors? Select all that apply. Valuing a stock too high based on their knowledge of the firm. 42. Which of these correctly state a condition necessary for efficient securities markets to exist? Many buyers and sellers 43. Which one of these correctly defines a level of market efficiency? Semi- 44. Lucas was just charged with insider trading. What form of market efficiency cannot exist if this charge is true? 45. Which one of these is an indicator of an inefficient securities market? A firm jus 46. Overconfidence causes individuals to do which one of these? 47. Which of these are key factors to consider when using beta to compute a required return? Beta values are estimates, not facts. 48. Which of the following are sources for finding the beta of a stock? 49. Which of the following help explain why beta values on the same stock can vary, if in fact they do vary? Returns for different reporting intervals were used i.e. weekly versus monthly return. 50. Using returns for what length of time is most common when computing beta? 51. What does it mean if a stock plots on a security market line (SML) graph to the left of the market portfolio? 52. Which two points define the capital market line? Risk-free rate and 53. Terry loves taking risks and has sufficient assets to be able to "bet on the market". A stock with which one of these betas will tend to appeal the most to Terry? 54. An investor wants to create a portfolio that has a beta close to that of the overall market. The investor wants to invest half of the portfolio in a risk-free asset and the other half in a single stock. Given the following stocks, which one should the investor purchase? 55. A portfolio of ten stocks has a beta 1.12. The desired portfolio should have 25 percent more market risk than the overall market. If one more security is to be added to this portfolio, which security should be selected? 56. Why should investors prefer a portfolio lying on the capital market line to those found on the efficient frontier? 57. If you buy a stock with a beta of 1.43 when the risk-free rate is 2.4 percent and the market rate is 8.7 percent, what is your expected rate of return? 58. If a stock has more market risk than the market portfolio and is overpriced, where will it plot on a security market line graph? [Show More]

Last updated: 1 year ago

Preview 1 out of 6 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 19, 2020

Number of pages

6

Written in

Additional information

This document has been written for:

Uploaded

Dec 19, 2020

Downloads

0

Views

104

.png)