Financial Accounting > Report > Laker Company report (All)

Laker Company report

Document Content and Description Below

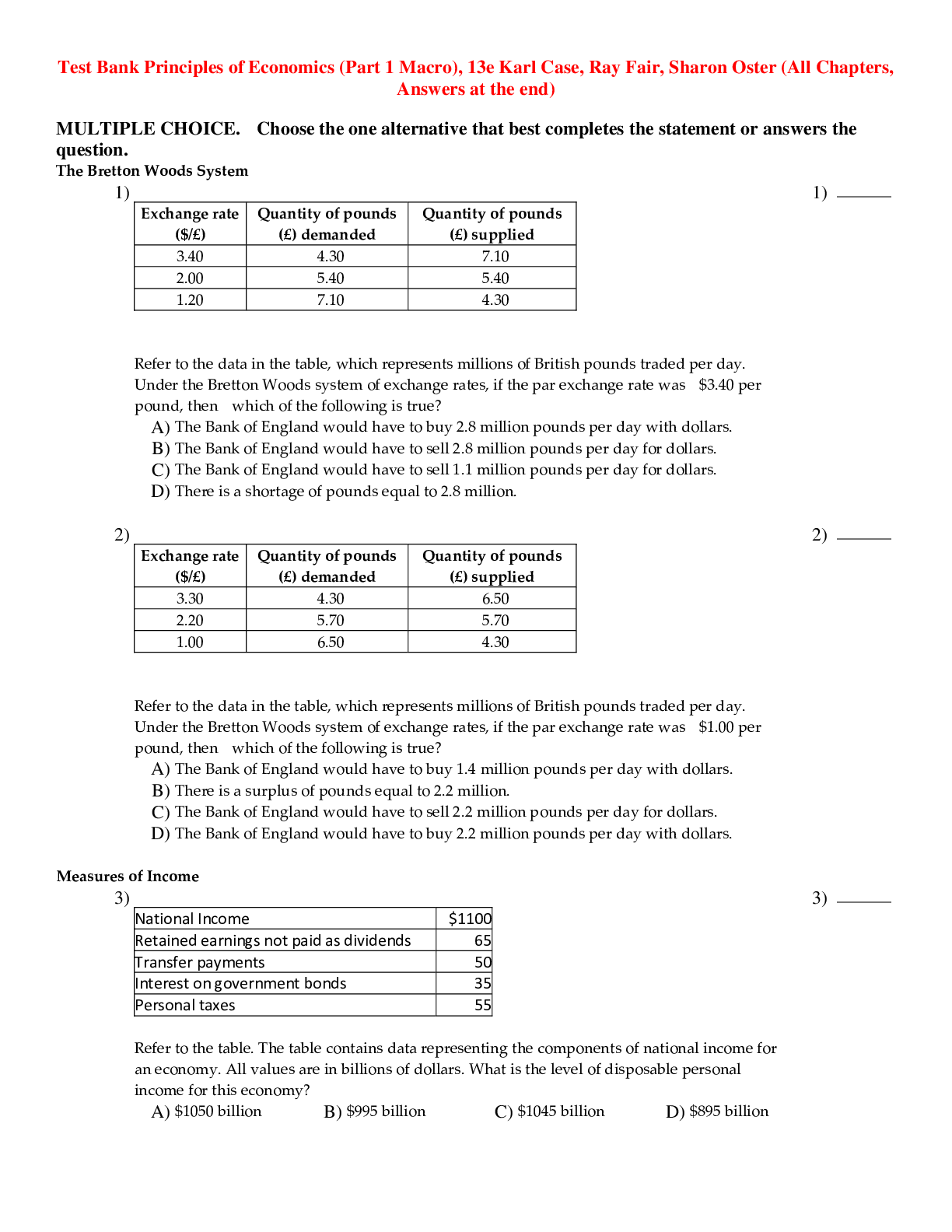

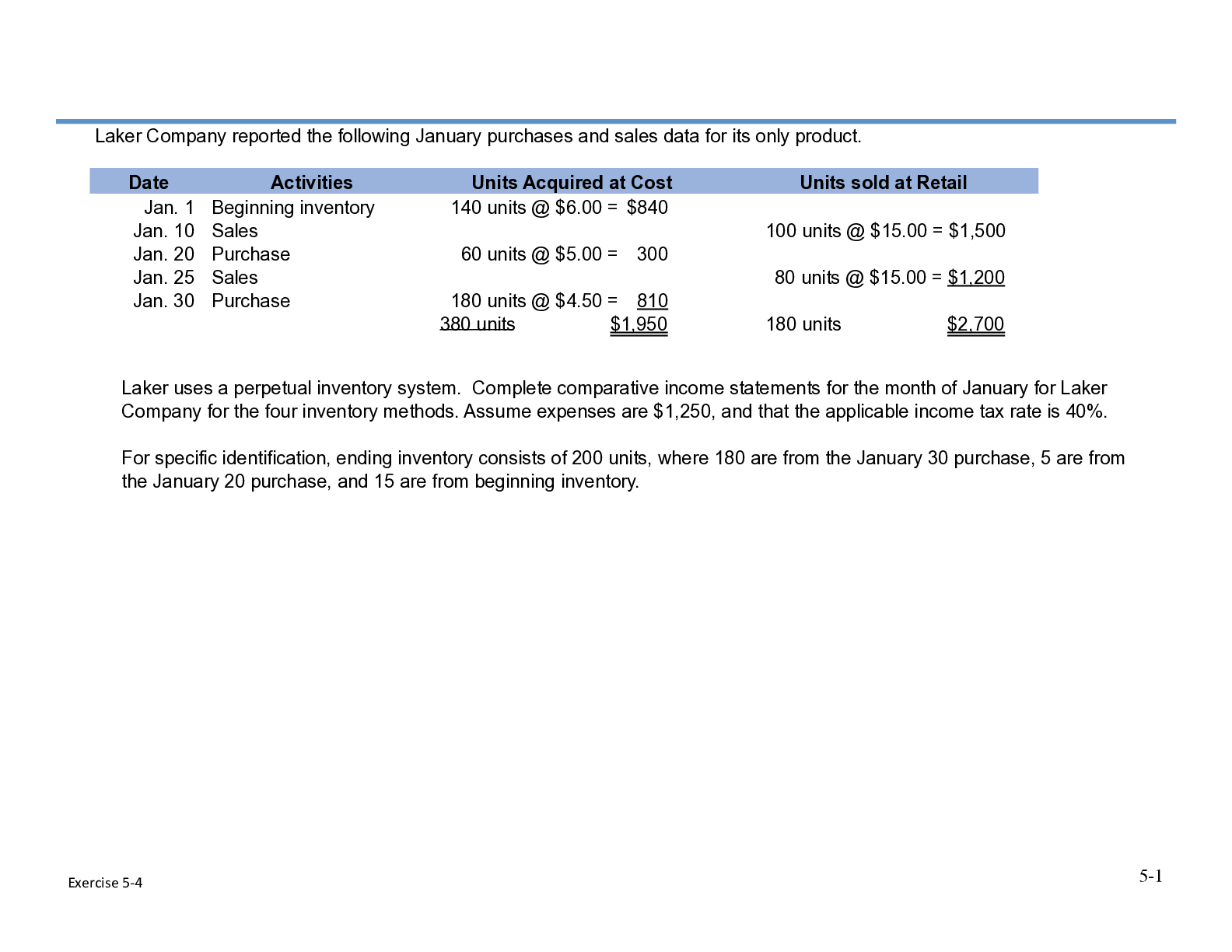

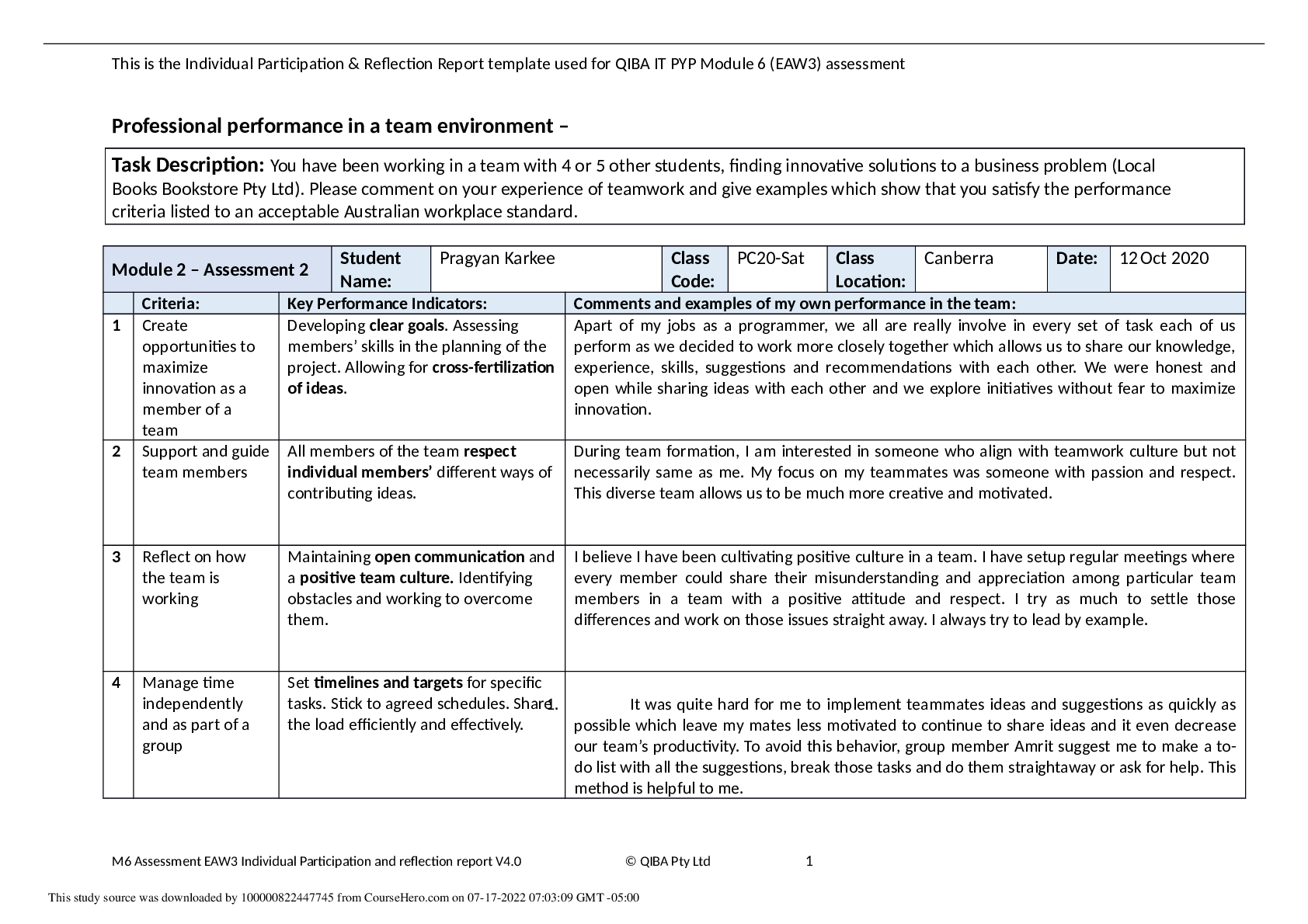

Laker Company report Laker Company reported the following January purchases and sales data for its only product. Date Jan. 1 Beginning inventory $840 Jan. 10 Sales 100 units @ $15.00 = $1,500 Jan... . 20 Purchase 300 Jan. 25 Sales 80 units @ $15.00 = $1,200 Jan. 30 Purchase 810 380 units $1,950 180 units $2,700 60 units @ $5.00 = 180 units @ $4.50 = Activities Units Acquired at Cost Units sold at Retail 140 units @ $6.00 = Laker uses a perpetual inventory system. Complete comparative income statements for the month of January for Laker Company for the four inventory methods. Assume expenses are $1,250, and that the applicable income tax rate is 40%. For specific identification, ending inventory consists of 200 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory. Exercise 5-‐4 5-2 Date Jan. 1 Beginning inventory $840 Jan. 10 Sales 100 units @ $15.00 = $1,500 Jan. 20 Purchase 300 Jan. 25 Sales 80 units @ $15.00 = $1,200 Jan. 30 Purchase 810 380 units $1,950 180 units $2,700 60 units @ $5.00 = 180 units @ $4.50 = For specific identification, ending inventory consists of 200 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory. Activities Units Acquired at Cost Units sold at Retail 140 units @ $6.00 = Date Activity Units Unit Cost Units Sold Unit Cost COGS Ending Inventory Units Cost per Unit Ending Inventory Cost Jan. 1 Beg. Inv. 140 $6.00 125 $6.00 $750 15 $6.00 $90 Jan. 20 Purchase 60 $5.00 55 $5.00 275 5 $5.00 25 Jan. 30 Purchase 180 $4.50 0 $4.50 0 180 $4.50 810 $1,025 $925 Specific identification. Available for Sale Cost of Goods Sold Ending Inventory Specific Weighted Identification Average FIFO LIFO Sales $2,700 Cost of goods sold 1,025 Gross profit 1,675 Operating expenses 1,250 Income before tax 425 Income tax expense (40%) 170 Net income $255 Laker Company reported the following January purchases and sales data for its only product. Date Jan. 1 Beginning inventory $840 Jan. 10 Sales 100 units @ $15.00 = $1,500 Jan. 20 Purchase 300 Jan. 25 Sales 80 units @ $15.00 = $1,200 Jan. 30 Purchase 810 380 units $1,950 180 units $2,700 60 units @ $5.00 = 180 units @ $4.50 = Activities Units Acquired at Cost Units sold at Retail 140 units @ $6.00 = Laker uses a perpetual inventory system. Complete comparative income statements for the month of January for Laker Company for the four inventory methods. Assume expenses are $1,250, and that the applicable income tax rate is 40%. For specific identification, ending inventory consists of 200 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory. Exercise 5-‐4 5-2 Date Jan. 1 Beginning inventory $840 Jan. 10 Sales 100 units @ $15.00 = $1,500 Jan. 20 Purchase 300 Jan. 25 Sales 80 units @ $15.00 = $1,200 Jan. 30 Purchase 810 380 units $1,950 180 units $2,700 60 units @ $5.00 = 180 units @ $4.50 = For specific identification, ending inventory consists of 200 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory. Activities Units Acquired at Cost Units sold at Retail 140 units @ $6.00 = Date Activity Units Unit Cost Units Sold Unit Cost COGS Ending Inventory Units Cost per Unit Ending Inventory Cost Jan. 1 Beg. Inv. 140 $6.00 125 $6.00 $750 15 $6.00 $90 Jan. 20 Purchase 60 $5.00 55 $5.00 275 5 $5.00 25 Jan. 30 Purchase 180 $4.50 0 $4.50 0 180 $4.50 810 $1,025 $925 Specific identification. Available for Sale Cost of Goods Sold Ending Inventory Specific Weighted Identification Average FIFO LIFO Sales $2,700 Cost of goods sold 1,025 Gross profit 1,675 Operating expenses 1,250 Income before tax 425 Income tax expense (40%) 170 Net income $255 [Show More]

Last updated: 1 year ago

Preview 1 out of 13 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Oct 24, 2022

Number of pages

13

Written in

Additional information

This document has been written for:

Uploaded

Oct 24, 2022

Downloads

0

Views

67

.png)