Laker Company report

Document Content and Description Below

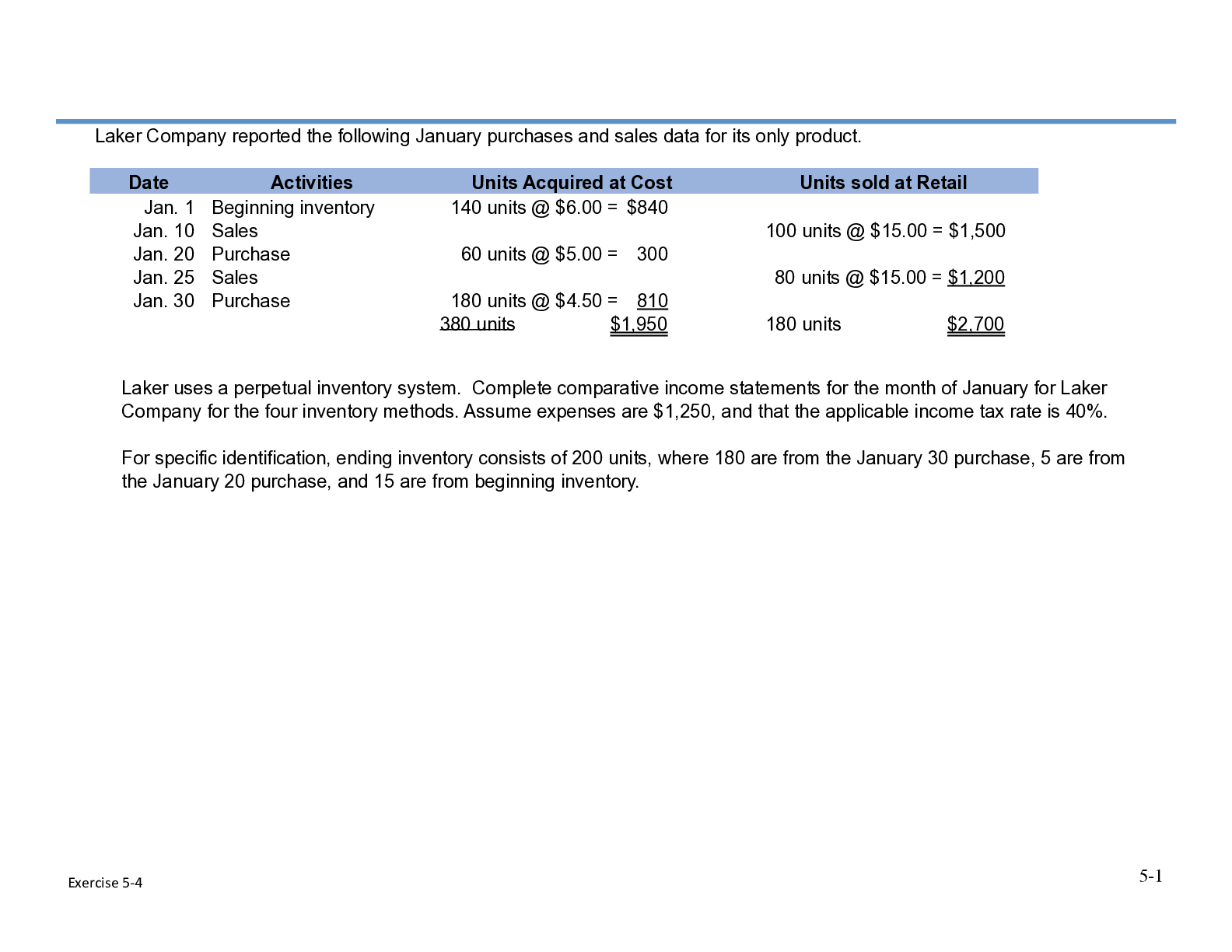

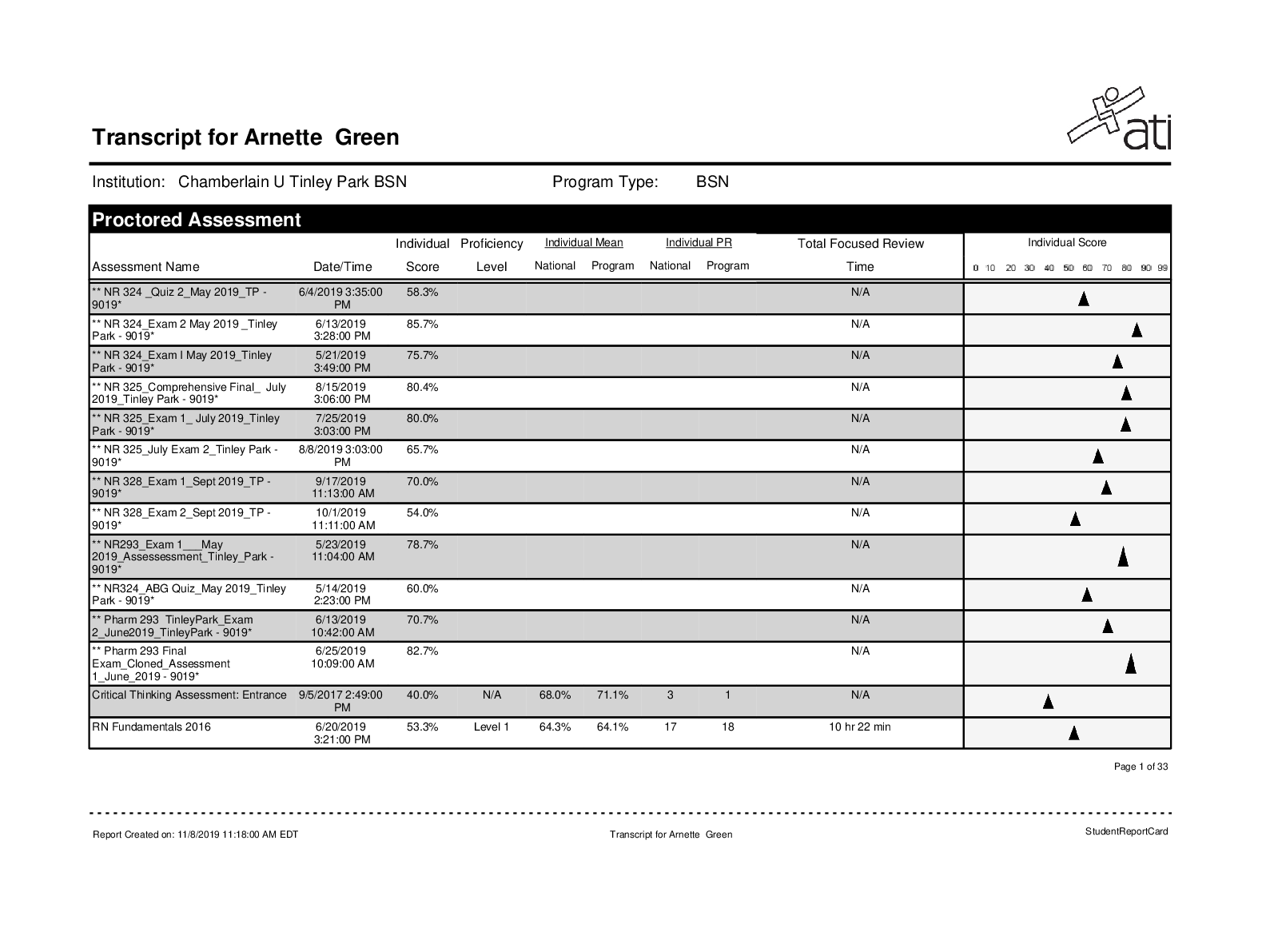

Laker Company report Laker Company reported the following January purchases and sales data for its only product. Date Jan. 1 Beginning inventory $840 Jan. 10 Sales 100 units @ $15.00 = $1,500 Jan... . 20 Purchase 300 Jan. 25 Sales 80 units @ $15.00 = $1,200 Jan. 30 Purchase 810 380 units $1,950 180 units $2,700 60 units @ $5.00 = 180 units @ $4.50 = Activities Units Acquired at Cost Units sold at Retail 140 units @ $6.00 = Laker uses a perpetual inventory system. Complete comparative income statements for the month of January for Laker Company for the four inventory methods. Assume expenses are $1,250, and that the applicable income tax rate is 40%. For specific identification, ending inventory consists of 200 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory. Exercise 5-‐4 5-2 Date Jan. 1 Beginning inventory $840 Jan. 10 Sales 100 units @ $15.00 = $1,500 Jan. 20 Purchase 300 Jan. 25 Sales 80 units @ $15.00 = $1,200 Jan. 30 Purchase 810 380 units $1,950 180 units $2,700 60 units @ $5.00 = 180 units @ $4.50 = For specific identification, ending inventory consists of 200 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory. Activities Units Acquired at Cost Units sold at Retail 140 units @ $6.00 = Date Activity Units Unit Cost Units Sold Unit Cost COGS Ending Inventory Units Cost per Unit Ending Inventory Cost Jan. 1 Beg. Inv. 140 $6.00 125 $6.00 $750 15 $6.00 $90 Jan. 20 Purchase 60 $5.00 55 $5.00 275 5 $5.00 25 Jan. 30 Purchase 180 $4.50 0 $4.50 0 180 $4.50 810 $1,025 $925 Specific identification. Available for Sale Cost of Goods Sold Ending Inventory Specific Weighted Identification Average FIFO LIFO Sales $2,700 Cost of goods sold 1,025 Gross profit 1,675 Operating expenses 1,250 Income before tax 425 Income tax expense (40%) 170 Net income $255 Income Statements For Month Ended January 31 Laker Company Exercise 5-‐4 5-3 Date # of units Cost per unit Inventory Value Units Sold Unit Cost COGS Beginning inventory 140 $6.000 $840 Sale - Jan. 10 (100) $6.000 (600) 100 $6.000 $600 Subtotal Average Cost 40 $6.000 240 Purchase - January 20 60 $5.000 300 Subtotal Average Cost 100 $5.400 540 Sale - Jan. 25 (80) $5.400 (432) 80 $5.400 432 Subtotal Average Cost 20 $5.400 108 Purchase - January 30 180 $4.500 810 Total 200 $4.590 $918 180 $1,032 Weighted average Inventory on hand Cost of Goods Sold Date Jan. 1 Beginning inventory $840 Jan. 10 Sales 100 units @ $15.00 = $1,500 Jan. 20 Purchase 300 Jan. 25 Sales 80 units @ $15.00 = $1,200 Jan. 30 Purchase 810 380 units $1,950 180 units $2,700 60 units @ $5.00 = 180 units @ $4.50 = Activities Units Acquired at Cost Units sold at Retail 140 units @ $6.00 = Specific Weighted Identification Average FIFO LIFO Sales $2,700 $2,700 Cost of goods sold 1,025 1,032 Gross profit 1,675 1,668 Operating expenses 1,250 1,250 Income before tax 425 418 Income tax expense (40%) 170 167 Net income $255 $251 Income Statements For Month Ended January 31 Laker Company Exercise 5-‐4 5-4 Available for Sale Date Units Unit Cost Units Sold Unit Cost COGS Units Sold Unit Cost COGS Units in Ending Inventory Unit Cost Ending Inventory Value Beginning Inv. 140 $6.00 100 $6.00 $600 40 $6.00 $240 0 $6.00 $0 Purchases: Jan. 20 60 $5.00 40 $5.00 200 20 $5.00 100 Jan. 30 180 $4.50 180 $4.50 810 $600 $440 200 $910 Cost of Goods Sold - January 10 Cost of Goods Sold - January 25 Ending Inventory Perpetual FIFO Date Jan. 1 Beginning inventory $840 Jan. 10 Sales 100 units @ $15.00 = $1,500 Jan. 20 Purchase 300 Jan. 25 Sales 80 units @ $15.00 = $1,200 Jan. 30 Purchase 810 380 units $1,950 180 units $2,700 60 units @ $5.00 = 180 units @ $4.50 = Activities Units Acquired at Cost Units sold at Retail 140 units @ $6.00 = Specific Weighted Identification Average FIFO LIFO Sales $2,700 $2,700 $2,700 Cost of goods sold 1,025 1,032 1,040 Gross profit 1,675 1,668 1,660 Operating expenses 1,250 1,250 1,250 Income before tax 425 418 410 Income tax expense (40%) 170 167 164 Net income $255 $251 $246 Income Statements For Month Ended January 31 Laker Company Exercise 5-‐4 5-5 Available for Sale Date Units Unit Cost Units Sold Unit Cost COGS Units Sold Unit Cost COGS Units in Ending Inventory Unit Cost Ending Inventory Value Beginning Inv. 140 $6.00 100 $6.00 $600 20 $6.00 $120 20 $6.00 $120 Purchases: Jan. 20 60 $5.00 60 $5.00 300 0 $5.00 0 Jan. 30 180 $4.50 180 $4.50 810 $600 $420 200 $930 Cost of Goods Sold - January 10 Cost of Goods Sold - January 25 Ending Inventory Perpetual LIFO Total Date Jan. 1 Beginning inventory $840 Jan. 10 Sales 100 units @ $15.00 = $1,500 Jan. 20 Purchase 300 Jan. 25 Sales 80 units @ $15.00 = $1,200 Jan. 30 Purchase 810 380 units $1,950 180 units $2,700 60 units @ $5.00 = 180 units @ $4.50 = Activities Units Acquired at Cost Units sold at Retail 140 units @ $6.00 = Specific Weighted Identification Average FIFO LIFO Sales $2,700 $2,700 $2,700 $2,700 Cost of goods sold 1,025 1,032 1,040 1,020 Gross profit 1,675 1,668 1,660 1,680 Operating expenses 1,250 1,250 1,250 1,250 Income before tax 425 418 410 430 Income tax expense (40%) 170 167 164 172 Net income $255 $251 $246 $258 Income Statements For Month Ended January 31 Laker Company Exercise 5-‐4 5-6 Specific Weighted Identification Average FIFO LIFO Sales $2,700 $2,700 $2,700 $2,700 Cost of goods sold 1,025 1,032 1,040 1,020 Gross profit 1,675 1,668 1,660 1,680 Operating expenses 1,250 1,250 1,250 1,250 Income before tax 425 418 410 430 Income tax expense (40%) 170 167 164 172 Net income $255 $251 $246 $258 Income Statements For Month Ended January 31 Laker Company 1. Which method yields the highest net income? LIFO 2. Does net income using weighted average fall between that using FIFO and LIFO? Yes 3. If costs were rising instead of falling, which method would yield the highest net income? FIFO [Show More]

Last updated: 1 year ago

Preview 1 out of 13 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Feb 06, 2023

Number of pages

13

Written in

Additional information

This document has been written for:

Uploaded

Feb 06, 2023

Downloads

0

Views

75

.png)