Financial Accounting > EXAM > ACC 349 Final Exam Guide (New 2020, 2 Sets) Complete Solution Guide; University of Phoenix. (All)

ACC 349 Final Exam Guide (New 2020, 2 Sets) Complete Solution Guide; University of Phoenix.

Document Content and Description Below

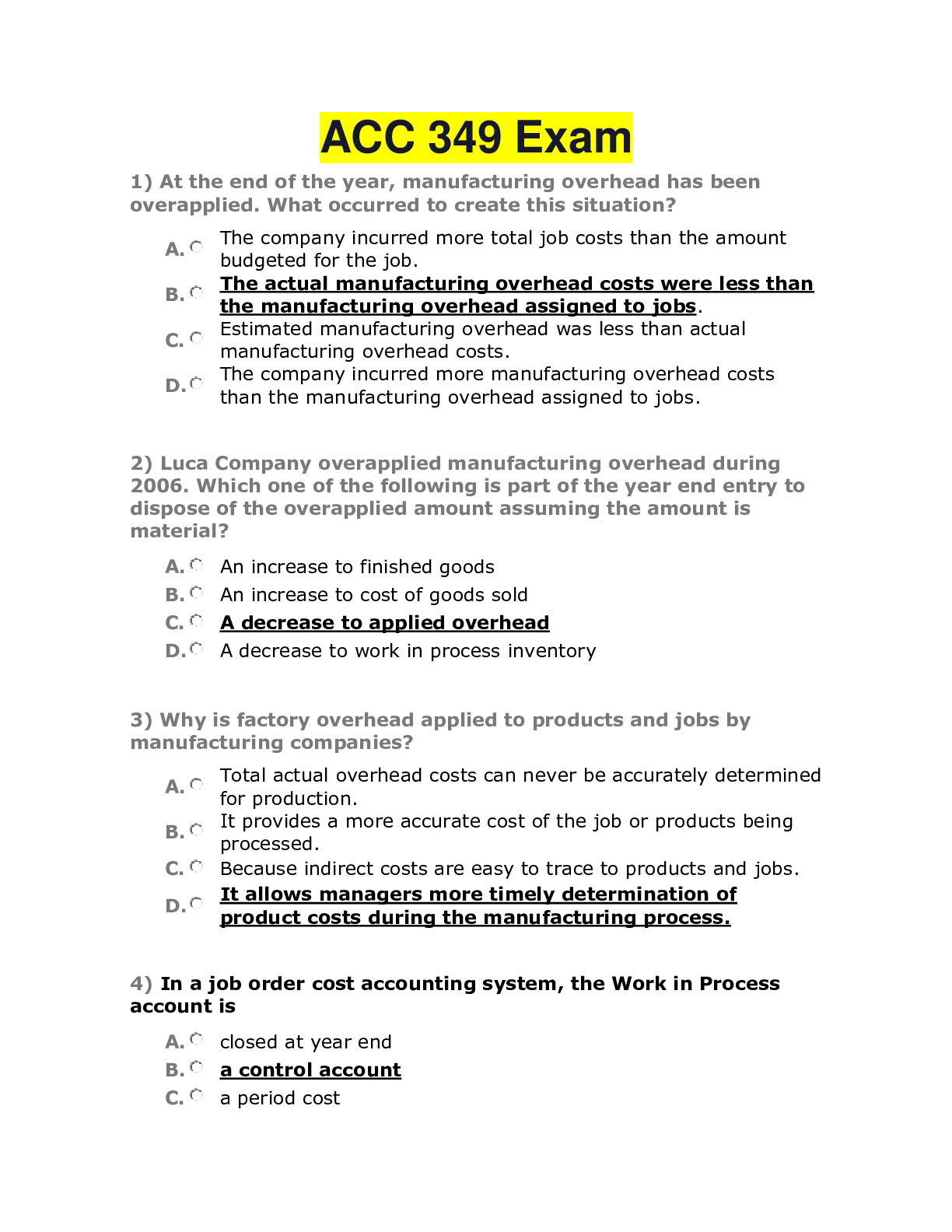

ACC 349 Exam 1) At the end of the year, manufacturing overhead has been overapplied. What occurred to create this situation? A. The company incurred more total job costs than the amount budgeted... for the job. B. The actual manufacturing overhead costs were less than the manufacturing overhead assigned to jobs. C. Estimated manufacturing overhead was less than actual manufacturing overhead costs. D. The company incurred more manufacturing overhead costs than the manufacturing overhead assigned to jobs. 2) Luca Company overapplied manufacturing overhead during 2006. Which one of the following is part of the year end entry to dispose of the overapplied amount assuming the amount is material? A. An increase to finished goods B. An increase to cost of goods sold C. A decrease to applied overhead D. A decrease to work in process inventory 3) Why is factory overhead applied to products and jobs by manufacturing companies? A. Total actual overhead costs can never be accurately determined for production. B. It provides a more accurate cost of the job or products being processed. C. Because indirect costs are easy to trace to products and jobs. D. It allows managers more timely determination of product costs during the manufacturing process. 4) In a job order cost accounting system, the Work in Process account is A. closed at year end B. a control account C. a period cost D. an expense 5) Which one of the following is an important feature of a job order cost system? A. Each must be completed before a new product order is accepted. B. Each job uses similar processes to produce. C. Each consists of features which distinguish it from the next. D. Each job has characteristics similar to the next. 6) Which of the following represents the two basic types of cost accounting systems? A. Job order and process cost systems B. Job order and batch systems C. Job order and job accumulation systems D. Process cost and batch systems 7) Which of the following represents the correct order in which inventories are reported on a manufacturer’s balance sheet? A. Raw materials, work in process, finished goods B. Finished goods, work in process, raw materials C. Work in process, finished goods raw materials D. Work in process, raw materials, finished goods 8) Which one of the following is indirect labor considered? A. Product cost B. Period cost C. Nonmanufacturing cost D. Raw material cost 9) Which of the following is an element of manufacturing overhead? A. Factory workers wages B. Plant manager’s salary C. Components used in calculators during production D. Flour used in manufactured cake mixes 10) Which of the following is NOT typical of traditional costing systems? Use of multiple cost drivers to allocate overhead A. Use of a single predetermined overhead rate B. Assumption of correlation between direct labor and incurrence of overhead cost C. Use of direct labor hours or direct labor cost to assign overhead D. Use of multiple cost drivers to allocate overhead The per-unit standards for direct labor are 2 direct labor hours at $12 per hour. If in producing 2,400 units, the actual direct labor cost was $51,200 for 4,000 direct labor hours worked, the total direct labor variance is $6,400 favorable 11) An activity that has a direct cause-effect relationship with the resources consumed is a(n) A. cost driver B. overhead rate C. cost pool D. product activity 12) A well-designed activity-based costing system starts with A. identifying the activity-cost pools B. computing the activity-based overhead rate C. assigning manufacturing overhead costs for each activity cost pool to products D. analyzing the activities performed to manufacture a product One of Astro Company's activity cost pools is machine setups, with estimated overhead of $150,000. Astro produces sparklers (400 setups) and lighters (600 setups). How much of the machine setup cost pool should be assigned to sparklers? $60,000 13) What sometimes makes implementation of activity-based costing difficult in service industries is A. the labeling of activities as value-added B. identifying activities, activity cost plus, and cost drivers C. that a larger proportion of overhead costs are company-wide costs D. attempting to reduce or eliminate nonvalue-added activities The cost to produce Part A was $10 per unit in 2005. During 2006, it has increased to $11 per unit. In 2006, Supplier Company has offered to supply Part A for $9 per unit. For the make-or-buy decision, 14) Which of the following is a nonvalue-added activity? A. Engineering design B. Machining C. Inspection D. Packaging 15) Each of the following is a limitation of activity-based costing EXCEPT A. It can be expensive to use. B. It is more complex than traditional costing. C. More cost pools are used. D. Some arbitrary allocations continue. 16) Poodle Company manufactures two products, Mini A and Maxi B. Poodle's overhead costs consist of setting up machines, $800,000; machining, $1,800,000; and inspecting, $600,000. Information on the two products is: Mini A Maxi B Direct labor hours 15,000 25,000 Machine setups 600 400 Machine hours 24,000 26,000 Inspections 800 700 Overhead applied to Mini A using activity-based costing is A. $1,200,000 B. $1,536,000 C. $1,664,000 D. $1,920,000 17) Which of the following factors would suggest a switch to activity-based costing? A. Production managers use data provided by the existing system. B. The manufacturing process has been stable. C. Product lines similar in volume and manufacturing complexity. D. Overhead costs constitute a significant portion of total costs. 18) Poodle Company manufactures two products, Mini A and Maxi B. Poodle's overhead costs consist of setting up machines, $800,000; machining, $1,800,000; and inspecting, $600,000. Information on the two products is: Mini A Maxi B Direct labor hours 15,000 25,000 Machine setups 600 400 Machine hours 24,000 26,000 Inspections 800 700 Overhead applied to Maxi B using traditional costing using direct labor hours is A. $2,000,000 B. $1,670,000 C. $1,280,000 D. $1,536,000 19) Seran Company has contacted Truckel Inc. with an offer to sell it 5,000 of the wickets for $18 each. If Truckel makes the wickets, variable costs are $11 per unit. Fixed costs are $12 per unit; however, $5 per unit is avoidable. Should Truckel make or buy the wickets? A. Make; savings = $10,000 B. Make; savings = $20,000 C. Buy; savings = $25,000 D. Buy; savings = $10,000 20) Max Company uses 10,000 units of Part A in producing its products. A supplier offers to make Part A for $7. Max Company has relevant costs of $8 a unit to manufacture Part A. If there is excess capacity, the opportunity cost of buying Part A from the supplier is A. $80,000 B. $70,000 C. $0 D. $10,000 21) Rosen, Inc. has 10,000 obsolete calculators, which are carried in inventory at a cost of $20,000. If the calculators are scrapped, they can be sold for $1.10 each (for parts). If they are repackaged, at a cost of $15,000, they could be sold to toy stores for $2.50 per unit. What alternative should be chosen, and why? A. Repackage; receive profit of $10,000. B. Scrap; incremental loss is $9,000. C. Scrap; profit is $1,000 greater. D. Repackage; revenue is $5,000 greater than cost. 22) Disney’s variable costs are 30% of sales. The company is contemplating an advertising campaign that will cost $22,000. If sales are expected to increase $40,000, by how much will the company's net income increase? A. $6,000 B. $12,000 C. $18,000 D. $28,000 23) H55 Company sells two products, beer and wine. Beer has a 10 percent profit margin and wine has a 12 percent profit margin. Beer has a 27 percent contribution margin and wine has a 25 percent contribution margin. If other factors are equal, which product should H55 push to customers? A. It should sell an equal quantity of both. B. Selling either results in the same additional income for the company C. Beer D. Wine Waco’s Widgets plans to sell 22,000 widgets during May, 19,000 units in June, and 20,000 during July. Waco keeps 10% of the next month’s sales as ending inventory. How many units should Waco produce during June? 24) Hartley, Inc. has one product with a selling price per unit of $200, the unit variable cost is $75, and the total monthly fixed costs are $300,000. How much is Hartley’s contribution margin ratio? A. 266.6% B. 37.5% C. 150%. D. 62.5%. 25) Which cost is charged to the product under variable costing? A. Fixed administrative expenses B. Fixed manufacturing overhead C. Variable administrative expenses D. Variable manufacturing overhead Gottberg Mugs is planning to sell 2,000 mugs and produce 2,200 mugs during April. Each mug requires 2 pounds of resin and a half hour of direct labor. Resin costs $1 per pound and employees of the company are paid $12.50 per hour. Manufacturing overhead is applied at a rate of 120% of direct labor costs. Gottberg has 2,000 pounds of resin in beginning inventory and wants to have 2,400 pounds in ending inventory. How much is the total amount of budgeted direct labor for April? 26) Orbach Company sells its product for $40 per unit. During 2005, it produced 60,000 units and sold 50,000 units (there was no beginning inventory). Costs per unit are: direct materials $10, direct labor $6, and variable overhead $2. Fixed costs are: $480,000 manufacturing overhead, and $60,000 selling and administrative expenses. The per unit manufacturing cost under absorption costing is A. $27 B. $18 C. $26 D. $16 27) Which cost is NOT charged to the product under variable costing? A. Fixed manufacturing overhead B. Direct labor C. Variable manufacturing overhead D. Direct materials 28) If standard costs are incorporated into the accounting system, A. approval of the stockholders is required B. it can eliminate the need for the budgeting process C. the accounting system will produce information which is less relevant than the historical cost accounting system D. it may simplify the costing of inventories and reduce clerical costs 29) The difference between a budget and a standard is that A. standards are excluded from the cost accounting system, whereas budgets are generally incorporated into the cost accounting system B. a budget expresses management's plans, while a standard reflects what actually happened C. a budget expresses a total amount while a standard expresses a unit amount D. a budget expresses what costs were, while a standard expresses what costs should be 30) A standard cost is A. the historical cost of producing a product last year B. a cost which is paid for a group of similar products C. a predetermined cost D. the average cost in an industry 31) The standard rate of pay is $5 per direct labor hour. If the actual direct labor payroll was $19,600 for 4,000 direct labor hours worked, the direct labor price (rate) variance is A. $500 favorable B. $400 unfavorable C. $500 unfavorable D. $400 favorable 32) A company developed the following per-unit standards for its product: 2 pounds of direct materials at $6 per pound. Last month, 2,000 pounds of direct materials were purchased for $11,400. The direct materials price variance for last month was A. $600 unfavorable B. $11,400 favorable C. $300 favorable D. $600 favorable 33) The total variance is $10,000. The total materials variance is $4,000. The total labor variance is twice the total overhead variance. What is the total overhead variance? A. $4,000 B. $1,000 C. $3,000 D. $2,000 34) Which of the following statements is FALSE? A. The overhead volume variance is favorable if standard hours allowed for output is greater than the standard hours at normal capacity. B. The overhead volume variance indicates whether plant facilities were used efficiently during the period. C. The overhead volume variance relates solely to fixed costs. D. The costs that cause the overhead volume variance are usually controllable costs. 35) The overhead volume variance relates only to A. all manufacturing costs B. variable overhead costs C. both variable and fixed overhead costs D. fixed overhead costs 36) If the standard hours allowed are less than the standard hours at normal capacity, the volume variance A. will be greater than the controllable variance B. will be unfavorable C. will be favorable D. cannot be calculated 37) During December, the capital budget indicates a $280,000 purchase of equipment. The ending November cash balance is budgeted to be $40,000. Cash receipts are $840,000, and cash disbursements are $610,000 during December. The company wants to maintain a minimum cash balance of $20,000. What is the minimum cash loan that must be planned to be borrowed from the bank during December? A. $0 B. $50,000 C. $10,000 D. $30,000 38) Waco’s Widgets plans to sell 22,000 widgets during May, 19,000 units in June, and 20,000 during July. Waco keeps 10% of the next month’s sales as ending inventory. How many units should Waco produce during June? A. 19,000 B. 19,100 C. 21,000 D. 18,900 The difference between a budget and a standard is that a budget expresses a total amount while a standard expresses a unit amount 39) At January 1, 2004, Barry, Inc. has beginning inventory of 4,000 widgets. Barry estimates it will sell 35,000 units during the first quarter of 2004 with a 10% increase in sales each quarter. Barry’s policy is to maintain an ending inventory equal to 25% of the next quarter’s sales. Each widget costs $1 and is sold for $1.50. How much is budgeted sales revenue for the third quarter of 2004? A. $42,350 B. $63,525 C. $63,000 D. $57,525 40) Prices are set by the competitive market when A. a product is not easily distinguished from competing products B. a company can effectively differentiate its product from others C. there are no other producers capable of manufacturing a similar item D. the product is specially made for a customer 41) In cost-plus pricing, the markup percentage is computed by dividing the desired ROI per unit by the A. variable cost per unit B. total manufacturing cost per unit C. total cost per unit D. fixed cost per unit 42) The cost-plus pricing approach's major advantage is A. it can be used to determine a product’s target cost B. that sales volume has no effect on per unit costs C. it is simple to compute D. it considers customer demand 1) What is the best way to handle manufacturing overhead costs in order to get the most timely job cost information? 2) At the end of the year, manufacturing overhead has been overapplied. What occurred to create this situation? 3) Luca Company overapplied manufacturing overhead during 2006. Which one of the following is part of the year end entry to dispose of the overapplied amount assuming the amount is material? 4) Which of the following would be accounted for using a job order cost system? 5) Which one of the following is NEVER part of recording the issuance of raw materials in a job order cost system? Disney’s variable costs are 30% of sales. The company is contemplating an advertising campaign that will cost $22,000. If sales are expected to increase $40,000, by how much will the company's net income increase? Which of the following is NOT typical of traditional costing systems? 6) What is unique about the flow of costs in a job order cost system? 7) Which one of the following costs would be included in manufacturing overhead of a lawn mower manufacturer? 8) What broad functions do the management of an organization perform? 9) Which of the following represents the correct order in which inventories are reported on a manufacturer’s balance sheet? 10) In traditional costing systems, overhead is generally applied based on 11) An activity that has a direct cause-effect relationship with the resources consumed is a(n) 12) A well-designed activity-based costing system starts with 13) Which of the following factors would suggest a switch to activity-based costing? 14) All of the following statements are correct EXCEPT that 15) What sometimes makes implementation of activity-based costing difficult in service industries is 16) One of Astro Company's activity cost pools is machine setups, with estimated overhead of $150,000. Astro produces sparklers (400 setups) and lighters (600 setups). How much of the machine setup cost pool should be assigned to sparklers? 17) Poodle Company manufactures two products, Mini A and Maxi B. Poodle's overhead costs consist of setting up machines, $800,000; machining, $1,800,000; and inspecting, $600,000. Information on the two products is: Mini A Maxi B Direct labor hours 15,000 25,000 Machine setups 600 400 Machine hours 24,000 26,000 Inspections 800 700 Overhead applied to Mini A using activity-based costing is 18) Poodle Company manufactures two products, Mini A and Maxi B. Poodle's overhead costs consist of setting up machines, $800,000; machining, $1,800,000; and inspecting, $600,000. Information on the two products is: Mini A Maxi B Direct labor hours 15,000 25,000 Machine setups 600 400 Machine hours 24,000 26,000 Inspections 800 700 Overhead applied to Maxi B using activity-based costing is 19) Seran Company has contacted Truckel Inc. with an offer to sell it 5,000 of the wickets for $18 each. If Truckel makes the wickets, variable costs are $11 per unit. Fixed costs are $12 per unit; however, $5 per unit is avoidable. Should Truckel make or buy the wickets? 20) Rosen, Inc. has 10,000 obsolete calculators, which are carried in inventory at a cost of $20,000. If the calculators are scrapped, they can be sold for $1.10 each (for parts). If they are repackaged, at a cost of $15,000, they could be sold to toy stores for $2.50 per unit. What alternative should be chosen, and why? 21) The cost to produce Part A was $10 per unit in 2005. During 2006, it has increased to $11 per unit. In 2006, Supplier Company has offered to supply Part A for $9 per unit. For the make-or-buy decision, In most cases, prices are set by the 22) Hartley, Inc. has one product with a selling price per unit of $200, the unit variable cost is $75, and the total monthly fixed costs are $300,000. How much is Hartley’s contribution margin ratio? Which one of the following is indirect labor considered? 23) Which statement describes a fixed cost? 24) Pixar’s variable costs are 30% of sales. The company is contemplating an advertising campaign that will cost $22,000. If sales are expected to increase $40,000, by how much will the company's net income increase? 25) Variable costing 26) Which cost is NOT charged to the product under variable costing? 27) Bostemic Company sells its product for $40 per unit. During 2005, it produced 60,000 units and sold 50,000 units (there was no beginning inventory). Costs per unit are: direct materials $10, direct labor $6, and variable overhead $2. Fixed costs are: $480,000 manufacturing overhead, and $60,000 selling and administrative expenses. The per unit manufacturing cost under absorption costing is Which cost is NOT charged to the product under absorption costing? 28) Which of the following is NOT considered an advantage of using standard costs? 29) The difference between a budget and a standard is that 30) If a company is concerned with the potential negative effects of establishing standards, they should 31) The per-unit standards for direct materials are 2 gallons at $4 per gallon. Last month, 11,200 gallons of direct materials that actually cost $42,400 were used to produce 6,000 units of product. The direct materials quantity variance for last month was 32) The standard number of hours that should have been worked for the output attained is 8,000 direct labor hours and the actual number of direct labor hours worked was 8,400. If the direct labor price variance was $8,400 unfavorable, and the standard rate of pay was $18 per direct labor hour, what was the actual rate of pay for direct labor? 33) The total variance is $10,000. The total materials variance is $4,000. The total labor variance is twice the total overhead variance. What is the total overhead variance? 34) Manufacturing overhead costs are applied to work in process on the basis of 35) The overhead volume variance relates only to 36) If the standard hours allowed are less than the standard hours at normal capacity, 37) Grover Mugs is planning to sell 2,000 mugs and mugs during April. Each mug requires 2 pounds of resin and a half hour of direct labor. Resin costs $1 per pound and employees of the company are paid $12.50 per hour. Manufacturing overhead is applied at a rate of 120% of direct labor costs. Gottberg has 2,000 pounds of resin in beginning inventory and wants to have 2,400 pounds in ending inventory. How much is the total amount of budgeted direct labor for April? 38) Artimis Hats is planning to sell 600 straw hats. Each hat requires a half pound of straw and a quarter hour of direct labor. Straw costs $0.20 per pound and employees of the company are paid $22 per hour. Lewis has 80 pounds of straw and 40 hats in beginning inventory and wants to have 50 pounds of straw and 60 hats in ending inventory. How many units should Lewis Hats produce in April? 39) At January 1, 2004, Barry, Inc. has beginning inventory of 4,000 widgets. Johnny estimates it will sell 35,000 units during the first quarter of 2004 with a 10% increase in sales each quarter. Barry’s policy is to maintain an ending inventory equal to 25% of the next quarter’s sales. Each widget costs $1 and is sold for $1.50. How much is budgeted sales revenue for the third quarter of 2004? 40) In most cases, prices are set by the 41) A company must price its product to cover its costs and earn a reasonable profit in 42) The cost-plus pricing approach's major advantage is 1. Cost accounting is primarily concerned with accumulating information about product costs. 2. A job order cost system is most appropriate when a large volume of uniform products are produced. 3. A process cost accounting system is appropriate for homogeneous products that are continuously mass produced. 4. The perpetual inventory method cannot be used in a job order cost system. 5. A job order cost system and a process cost system are two alternative methods for valuing inventories. 6. A job order cost system identifies costs with a particular job rather than with a set time period. 7. A company may use either a job order cost system or a process cost system, but not both. 8. Raw Materials Inventory, Factory Labor, and Manufacturing Overhead are all control accounts in the general ledger when a job order cost accounting system is used. 9. Accumulating and assigning manufacturing costs are two important activities in a job order cost system. 10. Recording the acquisition of raw materials is a part of accumulating manufacturing costs. 11. Manufacturing costs are generally incurred in one period and recorded in a subsequent period. 12. The Purchases account is credited for all raw materials purchase returns and allowances. 13. The stores ledger cards are the subsidiary ledger for Raw Materials Inventory control account in the general ledger. 14. When raw materials are purchased, the Work in Process Inventory account is debited. 15. Factory labor should be assigned to selling and administrative expenses on a proportionate basis. 16. Fringe benefits and payroll taxes associated with factory workers should be accumulated as a part of Factory Labor. 17. Job order cost sheets constitute the subsidiary ledger of the control account Work in Process Inventory. 18. In a job order cost system, each entry to the Work In Process Inventory account should be accompanied by a posting to one or more job cost sheets. 19. Direct materials requisitioned from the storeroom should be charged to the Work in Process Inventory account and the job cost sheets for the individual jobs on which the material was used. 20. Manufacturing overhead is the only product cost that can be assigned to jobs as soon as the costs are incurred. 21. There should be a separate job cost sheet for each job. 22. Actual manufacturing overhead costs are assigned to each job by tracing each overhead cost to a specific job. 23. The formula for the predetermined overhead rate is estimated annual overhead costs divided by an estimated activity base. 24. Actual manufacturing overhead costs should be charged to the Work in Process Inventory account as they are incurred. 25. A good system of internal control requires that the job order cost sheet be destroyed as soon as the job is complete. 26. Finished Goods Inventory is charged for the cost of jobs completed during a period. 27. When goods are sold, the Cost of Goods Sold account is debited and the Work in Process Inventory account is credited. 28. Total manufacturing costs for a period consists of the costs of direct material used, the cost of direct labor incurred, and the manufacturing overhead applied during the period. 29. Over applied overhead means that actual manufacturing overhead costs were greater than the manufacturing overhead costs applied to jobs. 30. If monthly financial statements are prepared, under applied overhead is shown as a prepaid expense on the balance sheet. 1) What is the best way to handle manufacturing overhead costs in order to get the most timely job cost information? A. The company should add actual manufacturing overhead costs to jobs as soon as the overhead costs are incurred. B. The company should determine an allocation rate as soon as the actual costs are known, and then apply manufacturing overhead to jobs. C. The company should apply overhead using an estimated rate throughout the year. D. The company should account for only the direct production costs. 2) When a job is completed, what happens to the cost of the job? A. It is removed from materials inventory and included in work in process. B. It is removed from work in process and included in finished goods. C. It is removed from finished goods and included in cost of goods sold. D. It is removed from work in process and included in cost of goods sold. 3) What does cost accounting measure, record, and report? A. Manufacturing processes B. Managerial accounting decisions C. Future costs D. Product costs 4) What is unique about the flow of costs in a job order cost system? A. Each job is costed separately in a Work in Process subsidiary ledger. B. There are no costs remaining in Work in Process at year end. C. It involves accumulating material, labor, and manufacturing overhead costs as they are incurred in order to determine the job cost. D. Job costs cannot be measured until all overhead costs are determined. 5) Which one of the following is NEVER part of recording the issuance of raw materials in a job order cost system? A. Debit Work in Process Inventory B. Credit Raw Materials Inventory C. Debit Finished Goods Inventory D. Debit Manufacturing Overhead 6) Which one of the following is an important feature of a job order cost system? A. Each must be completed before a new product order is accepted. B. Each job has characteristics similar to the next. C. Each consists of features which distinguish it from the next. D. Each job uses similar processes to produce. 7) What broad functions do the management of an organization perform? A. Directing, manufacturing, and controlling B. Planning, manufacturing, and controlling C. Planning, directing, and controlling D. Planning, directing, and selling 8) Which one of the following is indirect labor considered? A. Product cost B. Raw material cost C. Nonmanufacturing cost D. Period cost 9) Which one of the following costs would be included in manufacturing overhead of a lawn mower manufacturer? A. The cost of the wheels B. The wages earned by motor assemblers C. The cost of the fuel lines that run from the motor to the gas tank D. Depreciation on the testing equipment 10) Which of the following is NOT typical of traditional costing systems? A. Assumption of correlation between direct labor and incurrence of overhead cost B. Use of multiple cost drivers to allocate overhead C. Use of direct labor hours or direct labor cost to assign overhead D. Use of a single predetermined overhead rate Which of the following statements is FALSE? A standard cost is more accurate than a budgeted cost Which cost is charged to the product under variable costing? 11) An activity that has a direct cause-effect relationship with the resources consumed is a(n) A. cost pool B. product activity C. overhead rate D. cost driver 12) In traditional costing systems, overhead is generally applied based on A. direct material dollars B. units of production C. machine hours D. direct labor 13) Which of the following is a value-added activity? A. Inventory storage B. Inspections C. Machinery repair D. Engineering design 14) All of the following statements are correct EXCEPT that A. a larger proportion of overhead costs are company-wide costs in service industries B. the general approach to identifying activities and activity cost pools is the same in a service company as in a manufacturing company C. the objective of installing ABC in service firms is different than it is in a manufacturing firm D. activity-based costing has been widely adopted in service industries 15) Which of the following factors would suggest a switch to activity-based costing? A. The manufacturing process has been stable. B. Production managers use data provided by the existing system. C. Overhead costs constitute a significant portion of total costs. D. Product lines similar in volume and manufacturing complexity. H55 Company sells two products, beer and wine. Beer has a 10 percent profit margin and wine has a 12 percent profit margin. Beer has a 27 percent contribution margin and wine has a 25 percent contribution margin. If other factors are equal, which product should H55 push to customers? [Show More]

Last updated: 1 year ago

Preview 1 out of 22 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Feb 16, 2020

Number of pages

22

Written in

Additional information

This document has been written for:

Uploaded

Feb 16, 2020

Downloads

0

Views

48