Financial Accounting > QUESTIONS & ANSWERS > ACC 3100 Baruch College, CUNY. MIDTERM REVIEW. All Worked Solutions (All)

ACC 3100 Baruch College, CUNY. MIDTERM REVIEW. All Worked Solutions

Document Content and Description Below

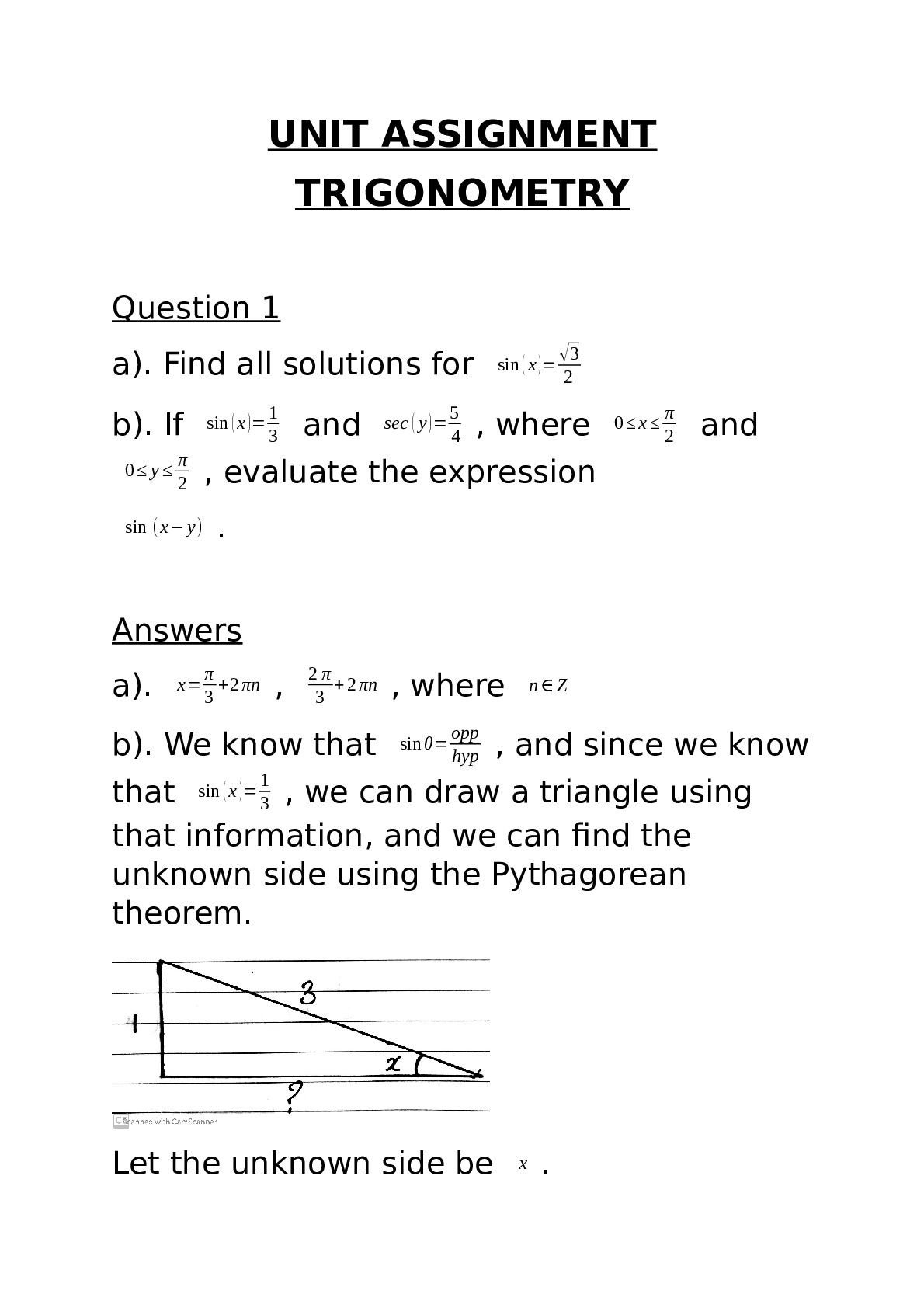

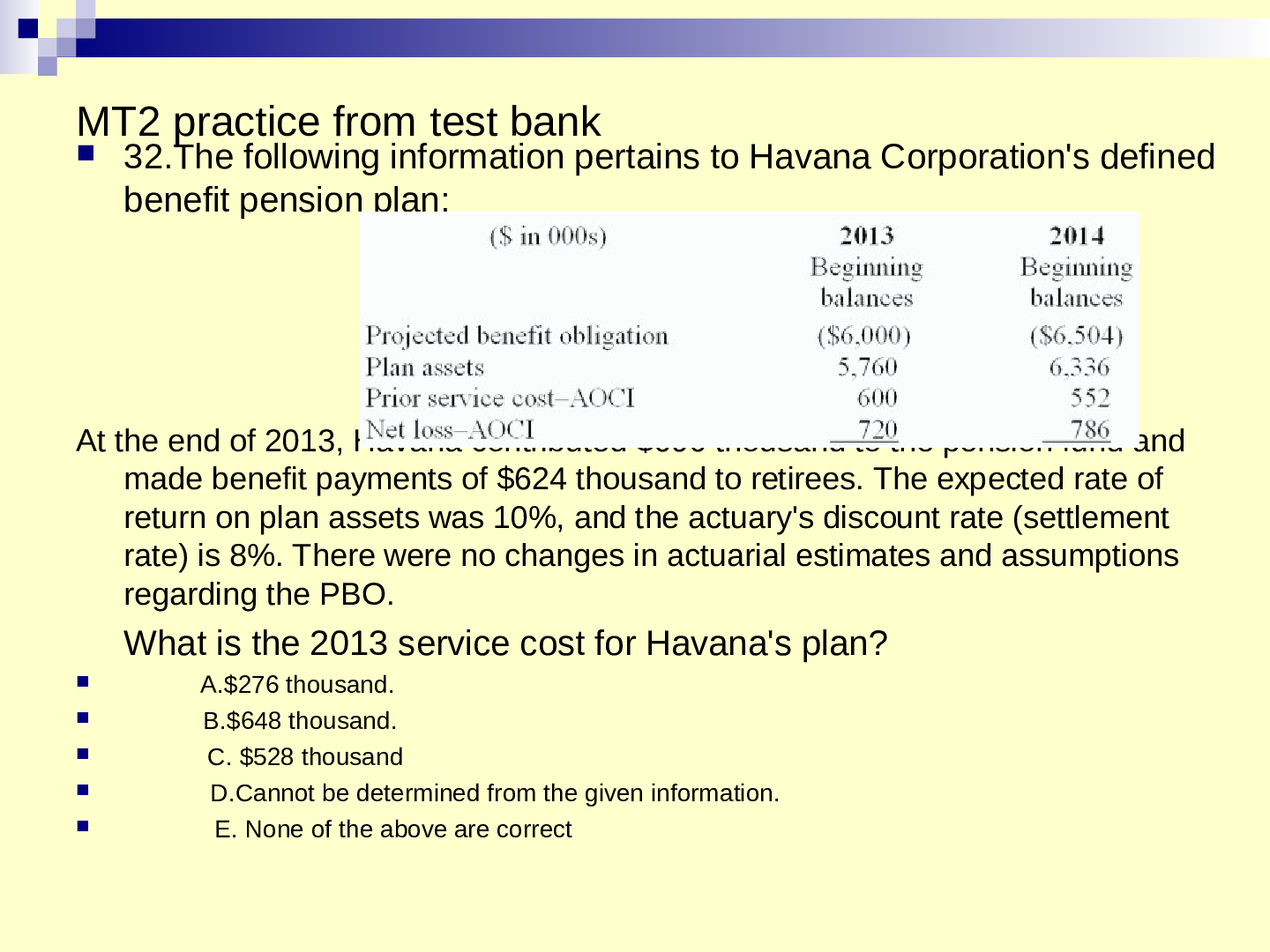

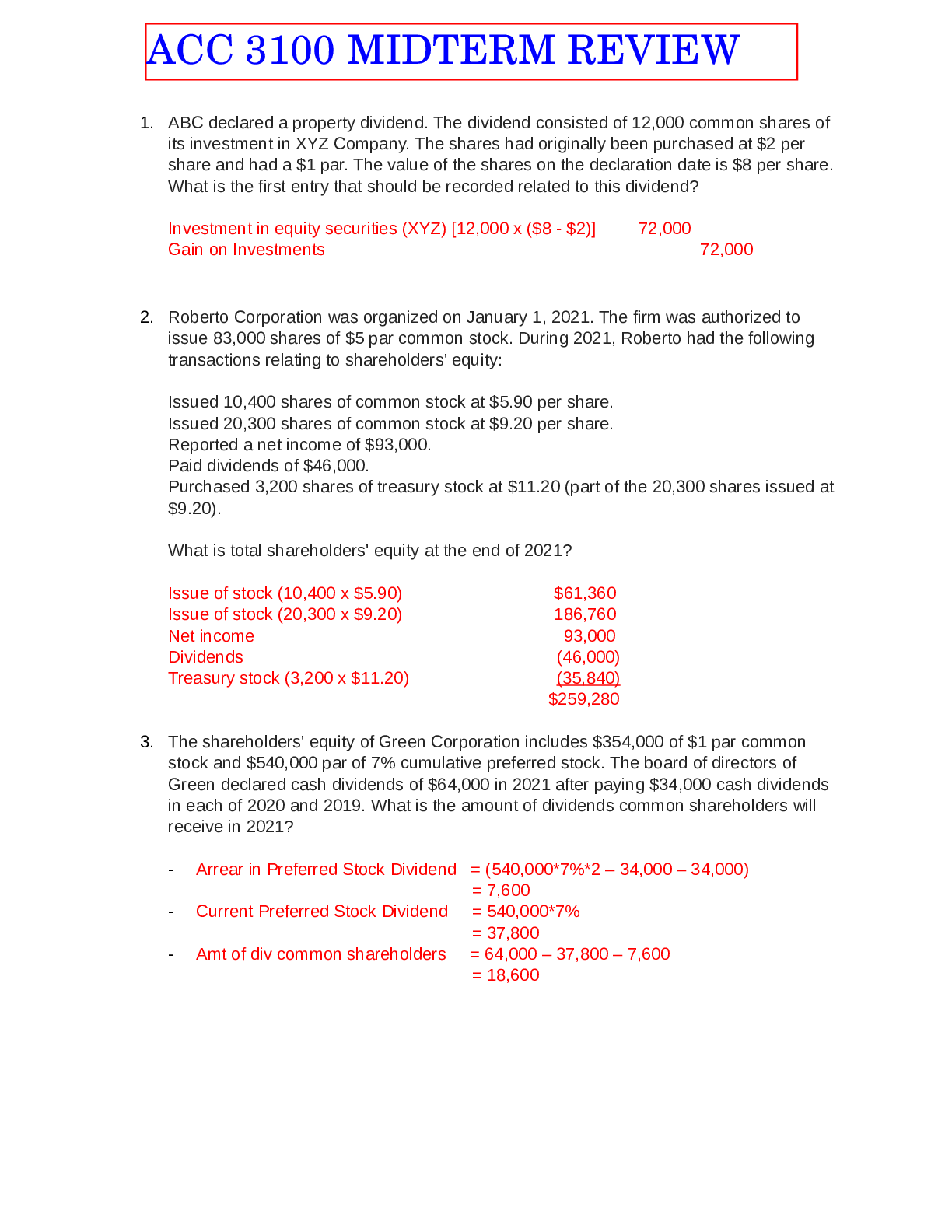

ACC 3100 Baruch College, CUNY. MIDTERM REVIEW. All Worked Solutions 1. ABC declared a property dividend. The dividend consisted of 12,000 common shares of its investment in XYZ Company. The shares h... ad originally been purchased at $2 per share and had a $1 par. The value of the shares on the declaration date is $8 per share. What is the first entry that should be recorded related to this dividend? 2. Roberto Corporation was organized on January 1, 2021. The firm was authorized to issue 83,000 shares of $5 par common stock. During 2021, Roberto had the following transactions relating to shareholders' equity: Issued 10,400 shares of common stock at $5.90 per share. Issued 20,300 shares of common stock at $9.20 per share. Reported a net income of $93,000. Paid dividends of $46,000. Purchased 3,200 shares of treasury stock at $11.20 (part of the 20,300 shares issued at $9.20). What is total shareholders' equity at the end of 2021? 3. The shareholders' equity of Green Corporation includes $354,000 of $1 par common stock and $540,000 par of 7% cumulative preferred stock. The board of directors of Green declared cash dividends of $64,000 in 2021 after paying $34,000 cash dividends in each of 2020 and 2019. What is the amount of dividends common shareholders will receive in 2021? 4. Isaac Inc. began operations in January 2021. For some property sales, Isaac recognizes income in the period of sale for financial reporting purposes. However, for income tax purposes, Isaac recognizes income when it collects cash from the buyer's installment payments. In 2021, Isaac had $670 million in sales of this type. Scheduled collections for these sales are as follows: 2021 $81 million 2022 127 million 2023 127 million 2024 160 million 2025 175 million $670 million Assume that Isaac has a 30% income tax rate and that there were no other differences in income for financial statement and tax purposes. Suppose that, in 2022, legislation revised the income tax rates so that Isaac would be taxed in 2023 and beyond at 25%, rather than 30%. Assume that there were no other differences in income for financial statement and tax purposes. Ignoring operating expenses and additional sales in 2022, what deferred tax liability would Isaac report in its year-end 2022 balance sheet? 5. The following partial info is taken from the comparative balance sheet of Levi Corp: Shareholder’s Equity 12/31/2021 12/31/2020 Common stock, $5 par; 26 million shares authorized;21 million shares issued and 17 million shares outstanding at 12/31/2021; and ____million shares issued and ____shares outstanding at 12/31/2020. $105 million $85 million Additional paid-in capital on common stock 526 million 398 million Retained earnings 203 million 163 million Treasury common stock, at cost, 4 million shares at 12/31/2021 and 2 millionshares at 12/31/2020 (78 million) (56 million) Total shareholders’ equity $756 million $590 million How many of Levi’s common shares were outstanding on 12/31/2020? 6. Pension data for the Ben Franklin Company include the following for the current calendar year: Discount rate, 10% Expected return on plan assets, 12% Actual return on plan assets, 11% Service cost, $300,000 January 1: PBO $1,500,000 ABO 1,100,000 Plan assets 1,600,000 Amortization of prior service cost 30,000 Amortization of net gain 5,000 December 31: Cash contributions to pension fund 230,000 Benefit payments to retirees 250,000 Required: 1. Determine pension expense for the year. 2. Prepare the journal entries to record pension expense and funding for the year. 7. The following partial information is taken from the comparative balance sheet of Levi Corporation: Shareholder’s Equity 12/31/2021 12/31/2020 Common stock, $5 par; 34 million shares authorized;29 million shares issued and 22 million shares outstanding at 12/31/2021; and ____million shares issued and ____shares outstanding at 12/31/2020. $145 million $110 million Additional paid-in capital on common stock 521 million 392 million Retained earnings 194 million 158 million Treasury common stock, at cost, 7 million shares at 12/31/2021 and 3 millionshares at 12/31/2020 (80 million) (45 million) Total shareholders’ equity $780 million $615 million What was the avg price of the additional treasury shares purchased by Levi during 2021 8. The following information pertains to Havana Corporation's defined benefit pension plan: ($ in thousands) 2021 Beginning balances 2022 Beginning balances Project benefit obligation $(8,000) $(8,504) Plan assets 7,700 8,336 Prior service cost - AOCI 800 720 Net loss - AOCI $ 920 $ 990 At the end of 2021, Havana contributed $740 thousand to the pension fund and benefit payments of $794 thousand were made to retirees. The expected rate of return on plan assets was 10%, and the actuary's discount rate is 7%. There were no changes in actuarial estimates and assumptions regarding the PBO. What is Havana’s 2021 gain or loss on plan assets? Loss on plan assets is $80,000. 9. The following information pertains to Havana Corporation's defined benefit pension plan: ($ in thousands) 2021 Beginning balances 2022 Beginning balances Project benefit obligation $(7,500) $(8,004) Plan assets 7,200 7,836 Prior service cost - AOCI 750 700 Net loss - AOCI $ 870 $ 950 At the end of 2021, Havana contributed $755 thousand to the pension fund and benefit payments of $744 thousand were made to retirees. The expected rate of return on plan assets was 10%, and the actuary's discount rate is 7%. There were no changes in actuarial estimates and assumptions regarding the PBO. What is Havana's 2021 actual return on plan assets? $625,000 10. In the current year, Bruno Corporation collected rent of $3,150,000. For income tax reporting, the rent is taxed when collected. For financial reporting, the rent is recognized as income in the period earned. At the end of the current year, the unearned portion of the rent collected in the current year amounted to $310,000. Bruno had no temporary differences at the beginning of the current year. Assume an income tax rate of 25%. Required: The current year's income tax liability from the tax return is $710,000. Prepare the journal entry to record income taxes for the year. 11. Yellow Enterprises reported the following ($ in thousands) as of December 31, 2021. All accounts have normal balances. Deficit (debit balance in retained earnings) $1,100 Common stock 2,900 Paid-in capital – share repurchase 1,100 Treasury stock (at cost) 350 Paid-in capital – excess of par 31,800 During 2022 ($ in thousands), net income was $10,800; 25% of the treasury stock was resold for $580; cash dividends declared were $800; cash dividends paid were $440. What ($ in thousands) was shareholders' equity as of December 31, 2022? $44,930 12. A company's postretirement health care benefit plan had an APBO of $300,000 on January 1, 2021. During 2021, retiree benefits paid were $43,500. The discount rate for the plan for this year was 10%. Service cost for 2021 was $87,000. Plan assets (fair value) increased during the year by $50,600. The amount of the APBO at December 31, 2021, was: $373,500 13. During the current year, Stern Company had pretax accounting income of $38 million. Stern's only temporary difference for the year was rent received for the following year in the amount of $29 million. Stern's taxable income for the year would be: $67 million 14. Several years ago, Western Electric Corp. purchased equipment for $21,500,000. Western uses straight-line depreciation for financial reporting and accelerated depreciation for tax purposes. At December 31, 2020, the carrying value of the equipment was $19,350,000 and its tax basis was $16,125,000. At December 31, 2021, the carrying value of the equipment was $17,200,000 and the tax basis was $11,825,000. There were no other temporary differences and no permanent differences. Pretax accounting income for the current year was $26,500,000. A tax rate of 25% applies to all years. Required: Prepare the journal entry to record Western's income tax expense for the current year. ANSWER: 15. Louie Company has a defined benefit pension plan. On December 31 (the end of the fiscal year), the company received the PBO report from the actuary. The following information was included in the report: ending PBO, $117,000; benefits paid to retirees, $12,500; interest cost, $8,000. The discount rate applied by the actuary was 10%. What was the service cost for the year? 16. For the current year ($ in millions), Centipede Corp. had $104 in pretax accounting income. This included warranty expense of $8 and $25 in depreciation expense. 7 million of warranty costs were incurred, and depreciation deductions in the tax return amounted to $40. In the absence of other temporary or permanent differences, what was Centipede's income tax payable currently, assuming a tax rate of 25%? 17. At December 31, 2021, Moonlight Bay Resorts had the following deferred income tax items: Deferred tax asset of $90 million related to a current liability Deferred tax asset of $54 million related to a noncurrent liability Deferred tax liability of $156 million related to a noncurrent asset Deferred tax liability of $108 million related to a current asset Moonlight Bay should report in its December 31, 2021, balance sheet a: 19. Boxer Company owned 25,000 shares of King Company that were purchased in 2019 for $370,000. On May 1, 2021, Boxer declared a property dividend of 1 share of King for every 10 shares of Boxer stock. On that date, there were 55,000 shares of Boxer stock outstanding. The market price of the King stock was $29 per share on the date of declaration and $37 per share on the date of distribution. By how much is retained earnings reduced by the property dividend? 20. The board of directors of Capstone Inc. declared a $0.70 per share cash dividend on its $1 par common stock. On the date of declaration, there were 50,000 shares authorized, 26,000 shares issued, and 5,600 shares held as treasury stock. What is the entry for the dividend declaration? 21. Tim Howard Gloves issued 5.75% bonds with a face amount of $39 million, together with 12 million shares of its $1 par common stock, for a combined cash amount of $74 million. The fair value of Howard's stock cannot be determined. The bonds would have sold for $33 million if issued separately. For this transaction, Howard should record paidin capital—excess of par in the amount of: 22. The following information relates to Hatami Company's defined benefit pension plan during the current reporting year: Plan assets at fair value, January 1 $660,000,000 Expected return on plan assets 56,000,000 Actual return on plan assets 46,000,000 Contributions to the pension fund (end of year) 96,000,000 Amortization of net loss 0 Pension benefits paid (end of year) 38,000,000 Pension expense 66,000,000 Determine the balance of pension plan assets at fair value on December 31. 23. Plutonic Inc. had $560 million in taxable income for the current year. Plutonic also had an increase in deferred tax liabilities of $66 million and recognized tax expense of $112 million. The company is subject to a tax rate of 25%. The change in deferred tax assets (ignoring any valuation allowance) was a/an: 24. The following information relates to Franklin Freightways for its first year of operations (data in millions of dollars): Pretax accounting income: $ 663 Pretax accounting income included: Overweight fines (not deductible for tax purposes) 5 Depreciation expense 115 Depreciation in the tax return 335 The applicable tax rate is 25%. There are no other temporary or permanent differences. Which of the following must Franklin Freightways disclose related to the income tax expense reported in the income statement ($ in millions)? 25. During its first year of operations, Cole's Electronics Inc. completed the following transactions relating to shareholders' equity. January 5: Issued 2,500,000 shares of common stock for $20 per share. February 12: Issued 15,000 shares of common stock to accountants for $300,000 of professional services. The articles of incorporation authorize 5,000,000 shares of common stock with a par of $1 per share and 1,000,000 preferred shares with a par of $100 per share. Required: Record the above transactions in general journal form. 26. Wayne Co. had a decrease in deferred tax liability of $32 million, a decrease in deferred tax assets of $22 million, and an increase in tax payable of $112 million. The company is subject to a tax rate of 25%. The total income tax expense for the year was: 27. Woody Corp. had taxable income of $8,225 in the current year. The amount of depreciation reported in the tax return was $2,925, while the amount of depreciation reported in the income statement was $775. Assuming no other differences between tax and accounting income, Woody's pretax accounting income was: $10,375 28. The corporate charter of Llama Co. authorized the issuance of 19 million, $1 par common shares. During 2021, its first year of operations, Llama had the following transactions: January 1 sold 4 million shares at $24 per share June 3 purchased 11 million shares of treasury stock at $27 per share December 28 sold the 2 million shares of treasury stock at $29 per share What amount should Llama report as additional paid-in capital in its December 31, 2021, balance sheet? [Show More]

Last updated: 1 year ago

Preview 1 out of 12 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 09, 2023

Number of pages

12

Written in

Additional information

This document has been written for:

Uploaded

Apr 09, 2023

Downloads

0

Views

87