Financial Accounting > EXAM > Lehman College, CUNY - ACC 171Sumeya - ACC 171 - REVIEW AND PRACTICE CHAPTER 1 (All)

Lehman College, CUNY - ACC 171Sumeya - ACC 171 - REVIEW AND PRACTICE CHAPTER 1

Document Content and Description Below

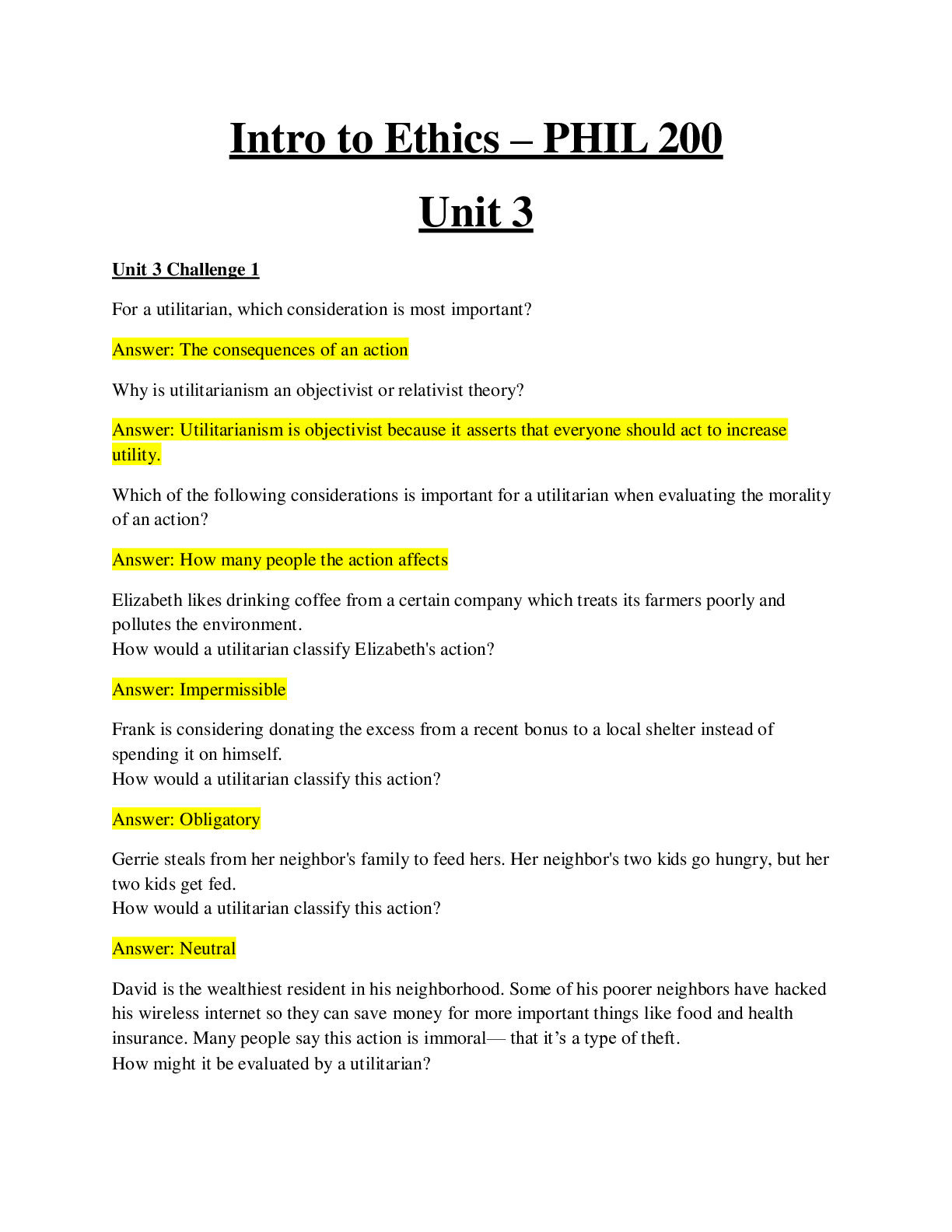

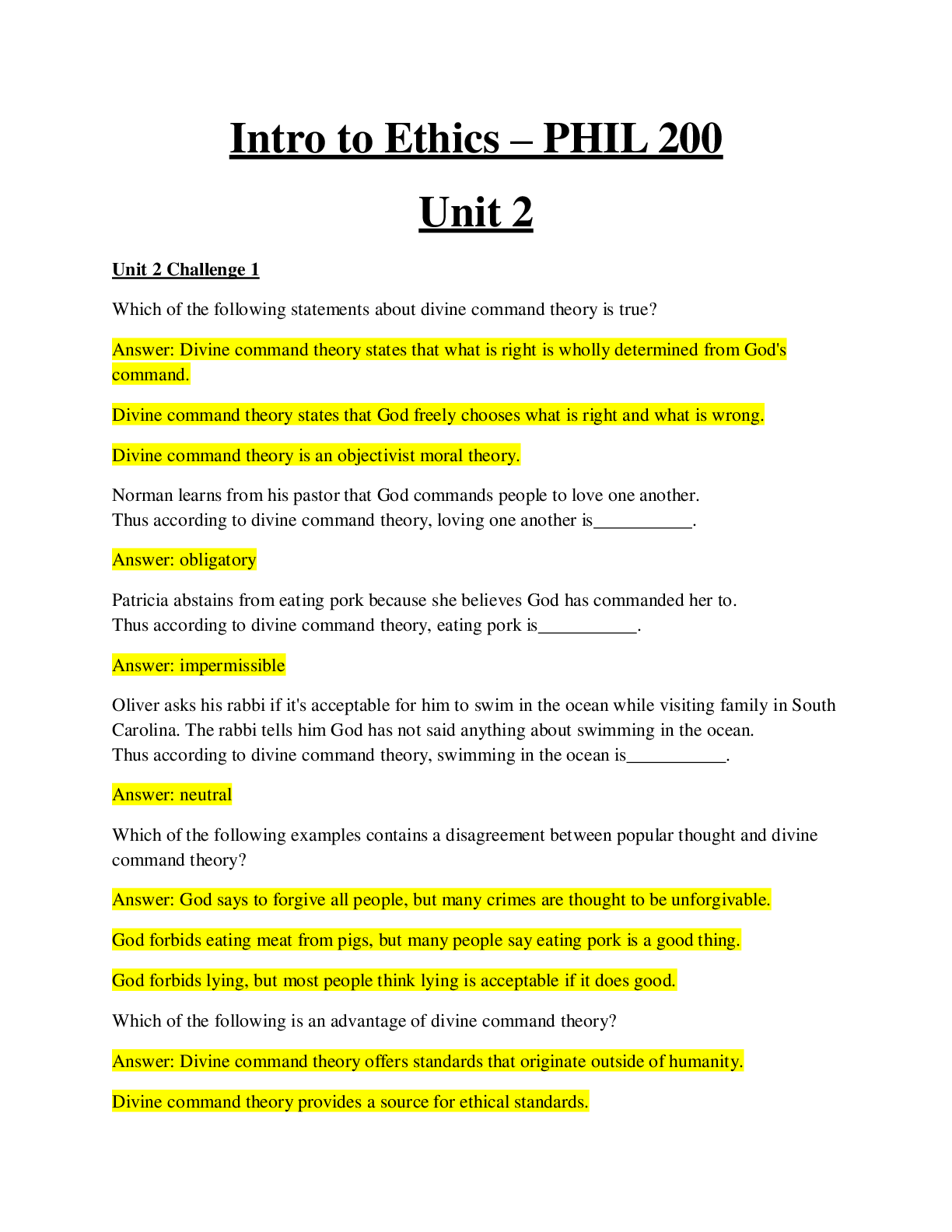

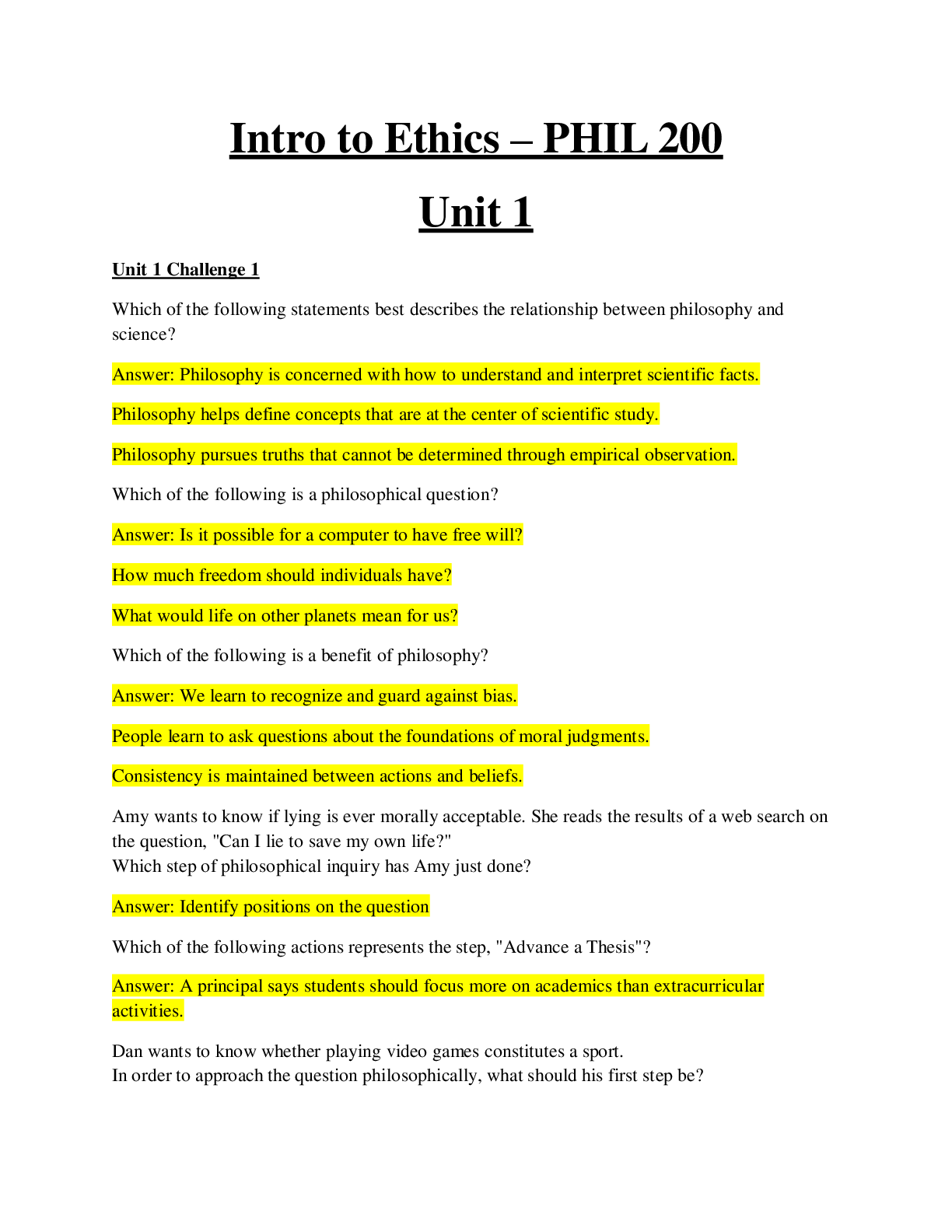

Lehman College, CUNY - ACC 171Sumeya - ACC 171 - REVIEW AND PRACTICE CHAPTER 1 REVIEW AND PRACTICE LEARNING OBJECTIVES REVIEW The Review and Practice section provides opportunities for students to ... review key concepts and terms as well as complete multiple-choice questions, exercises, and a comprehensive problem. Detailed solutions are also included. 1. 1. Identify the activities and users associated with accounting. 2. 2. Explain the building blocks of accounting: ethics, principles, and assumptions. 3. 3. State the accounting equation, and define its components. The basic accounting 4. 4. Analyze the effects of business transactions on the accounting equation. 5. 5 .Describe the four financial statements and how they are prepared. 6. 6. Explain the career opportunities in accounting. GLOSSARY REVIEW *Auditing *Forensic accounting *Management consulting *Private (or managerial) accounting *Public accounting *Taxation Accounting Assets Balance sheet Basic accounting equation Bookkeeping Convergence Corporation Drawings Economic entity assumption Ethics Expanded accounting equation Expenses Fair value principle Faithful representation Financial accounting Financial Accounting Standards Board (FASB) Generally accepted accounting principles (GAAP) Historical cost principle Income statement International Accounting Standards Board (IASB) International Financial Reporting Standards (IFRS) Investments by owner Liabilities Managerial accounting Monetary unit assumption Net income Net loss Owner's equity Owner's equity statement Partnership Proprietorship Relevance Revenues Sarbanes-Oxley Act (SOX) Securities and Exchange Commission (SEC) Statement of cash flows Transactions PRACTICE MULTIPLE-CHOICE QUESTIONS 1-1. (LO 1) Which of the following is not a step in the accounting process? • (a) Identification. • (b) Economic entity. • (c) Recording. • (d) Communication. 1-2. (LO 1) Which of the following statements about users of accounting information is incorrect? • (a) Management is an internal user. • (b) Taxing authorities are external users. • (c) Present creditors are external users. • (d) Regulatory authorities are internal users. 1-3. (LO 2) The historical cost principle states that: • (a) assets should be initially recorded at cost and adjusted when the fair value changes. • (b) activities of an entity are to be kept separate and distinct from its owner. • (c) assets should be recorded at their cost. • (d) only transaction data capable of being expressed in terms of money be included in the accounting records. 1-4. (LO 2) Which of the following statements about basic assumptions is correct? • (a) Basic assumptions are the same as accounting principles. • (b) The economic entity assumption states that there should be a particular unit of accountability. • (c) The monetary unit assumption enables accounting to measure employee morale. • (d) Partnerships are not economic entities. 1-5. (LO 2) The three types of business entities are: • (a) proprietorships, small businesses, and partnerships. • (b) proprietorships, partnerships, and corporations. • (c) proprietorships, partnerships, and large businesses. • (d) financial, manufacturing, and service companies. 1-6. (LO 3) Net income will result during a time period when: • (a) assets exceed liabilities. • (b) assets exceed revenues. • (c) expenses exceed revenues. • (d) revenues exceed expenses. 1-7. (LO 3) As of December 31, 2017, Kent Company has assets of $3,500 and owner's equity of $2,000. What are the liabilities for Kent Company as of December 31, 2017? • (a) $1,500. • (b) $1,000. • (c) $2,500. • (d) $2,000. • (a) $1,500. (LO 4) Performing services on account will have the following effects on the components of the basic accounting equation: • (a) increase assets and decrease owner's equity. • (b) increase assets and increase owner's equity. • (c) increase assets and increase liabilities. • (d) increase liabilities and increase owner's equity. 1-9. (LO 4) Which of the following events is not recorded in the accounting records? • (a) Equipment is purchased on account. • (b) An employee is terminated. • (c) A cash investment is made into the business. • (d) The owner withdraws cash for personal use. 1-10. (LO 4) During 2017, Bruske Company's assets decreased $50,000 and its liabilities decreased $50,000. Its owner's equity therefore: • (a) increased $50,000. • (b) decreased $50,000. • (c) decreased $100,000. • (d) did not change. 1-11. (LO 4) Payment of an account payable affects the components of the accounting equation in the following way. • (a) Decreases owner's equity and decreases liabilities. • (b) Increases assets and decreases liabilities. • (c) Decreases assets and increases owner's equity. • (d) Decreases assets and decreases liabilities. 1-12. (LO 5) Which of the following statements is false? • (a) A statement of cash flows summarizes information about the cash inflows (receipts) and outflows (payments) for a specific period of time. • (b) A balance sheet reports the assets, liabilities, and owner's equity at a specific date. • (c) An income statement presents the revenues, expenses, changes in owner's equity, and resulting net income or net loss for a specific period of time. • (d) An owner's equity statement summarizes the changes in owner's equity for a specific period of time. (LO 5) On the last day of the period, Alan Cesska Company buys a $900 machine on credit. This transaction will affect the: • (a) income statement only. • (b) balance sheet only. • (c) income statement and owner's equity statement only. • (d) income statement, owner's equity statement, and balance sheet. 1-14. (LO 5) The financial statement that reports assets, liabilities, and owner's equity is the: • (a) income statement. • (b) owner's equity statement. • (c) balance sheet. • (d) statement of cash flows. • (c) 1-15. (LO 6) Services performed by a public accountant include: • (a) auditing, taxation, and management consulting. • (b) auditing, budgeting, and management consulting. • (c) auditing, budgeting, and cost accounting. • (d) auditing, budgeting, and management consulting. • (a) auditing, taxation, and management consulting. Auditing, taxation, and management consulting are all services performed by public accountants. The other choices are incorrect because public accountants do not perform budgeting or cost accounting. PRACTICE EXERCISES 1-1. Analyze the effect of transactions. (LO 3, 4) Selected transactions for Fabulous Flora Company are listed below. • 1.Made cash investment to start business. • 2.Purchased equipment on account. • 3.Paid salaries. • 4.Billed customers for services performed. • 5.Received cash from customers billed in (4). • 6.Withdrew cash for owner's personal use. • 7.Incurred advertising expense on account. • 8.Purchased additional equipment for cash. • 9.Received cash from customers when service was performed. Instructions List the numbers of the above transactions and describe the effect of each transaction on assets, liabilities, and owner's equity. For example, the first answer is: (1) Increase in assets and increase in owner's equity. Solution 1-2. Analyze the effect of transactions on assets, liabilities, and owner's equity. (LO 3, 4) Alma's Payroll Services Company entered into the following transactions during May 2017. • 1.Purchased computers for $15,000 from Bytes of Data on account. • 2.Paid $3,000 cash for May rent on storage space. • 3.Received $12,000 cash from customers for contracts billed in April. • 4.Performed payroll services for Magic Construction Company for $2,500 cash. • 5.Paid Northern Ohio Power Co. $7,000 cash for energy usage in May. • 6.Alma invested an additional $25,000 in the business. • 7.Paid Bytes of Data for the computers purchased in (1) above. • 8.Incurred advertising expense for May of $900 on account. Instructions Indicate with the appropriate letter whether each of the transactions above results in: (a) an increase in assets and a decrease in assets. (b) an increase in assets and an increase in owner's equity. (c) an increase in assets and an increase in liabilities. (d) a decrease in assets and a decrease in owner's equity. (e) a decrease in assets and a decrease in liabilities. (f) an increase in liabilities and a decrease in owner's equity. (g) an increase in owner's equity and a decrease in liabilities. PRACTICE PROBLEM Prepare a tabular presentation and financial statements. (LO 4, 5) Joan Robinson opens her own law office on July 1, 2017. During the first month of operations, the following transactions occurred. • 1.Joan invested $11,000 in cash in the law practice. • 2.Paid $800 for July rent on office space. • 3.Purchased equipment on account $3,000. • 4.Performed legal services to clients for cash $1,500. • 5.Borrowed $700 cash from a bank on a note payable. • 6.Performed legal services for client on account $2,000. • 7.Paid monthly expenses: salaries and wages $500, utilities $300, and advertising $100. • 8.Joan withdrew $1,000 cash for personal use. Instructions (a) Prepare a tabular summary of the transactions. (b) Prepare the income statement, owner's equity statement, and balance sheet at July 31, 2017, for Joan Robinson, Attorney. Solution • (a) • (b) [Show More]

Last updated: 1 year ago

Preview 1 out of 18 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 28, 2020

Number of pages

18

Written in

Additional information

This document has been written for:

Uploaded

May 28, 2020

Downloads

0

Views

39