Financial Accounting > EXAM > ACCT 612 Module 4 Tax Research Problems 1 (Liberty University) Already Graded A (All)

ACCT 612 Module 4 Tax Research Problems 1 (Liberty University) Already Graded A

Document Content and Description Below

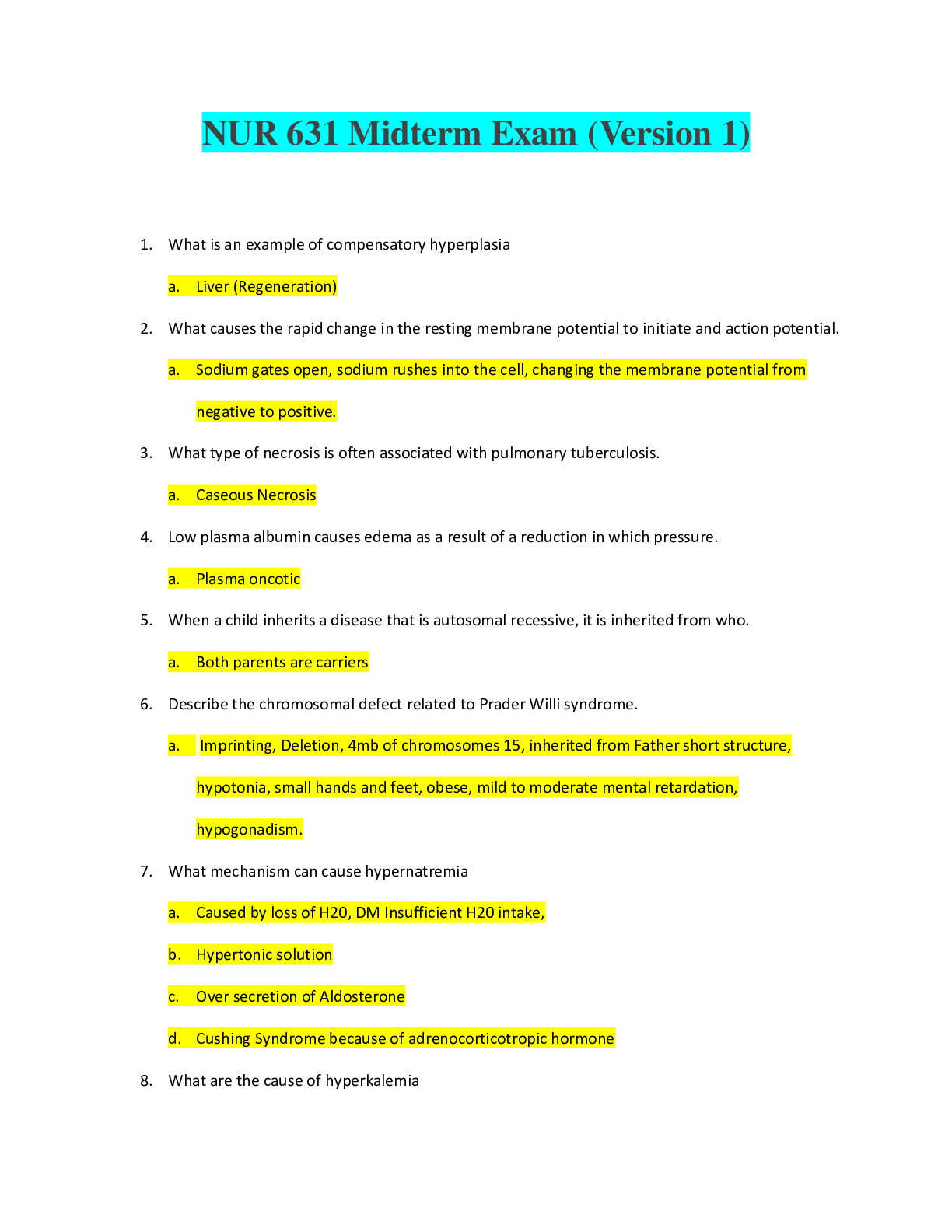

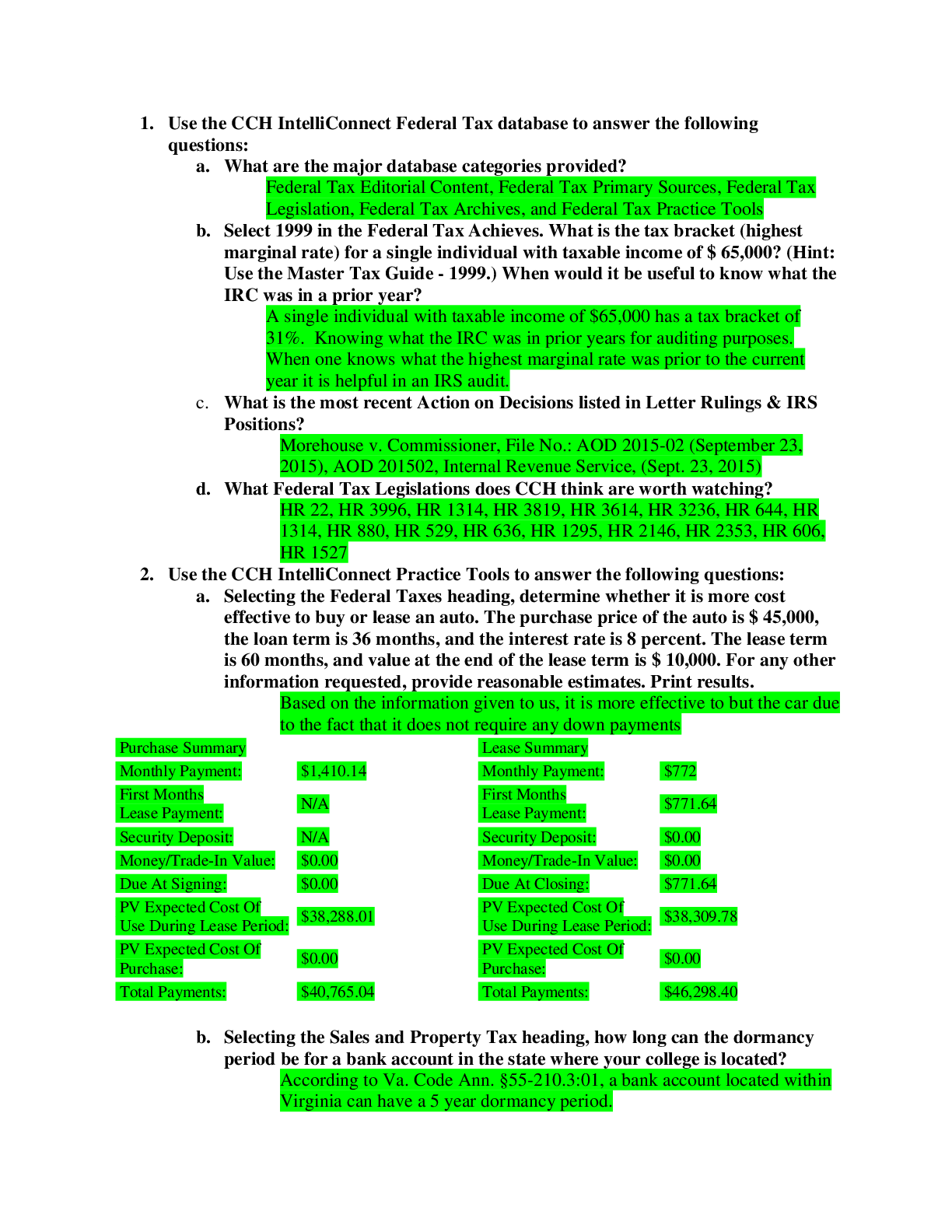

ACCT 612 Module 4 Tax Research Problems 1 (Liberty University) Problems: 1. Use the CCH IntelliConnect Federal Tax database to answer the following questions? What are the major database categories pr... ovided? Select 1999 in the Federal Tax Achieves. What is the tax bracket ( highest marginal rate) for a single indi-vidual with taxable income of $ 65,000? ( Hint: Use the Master Tax Guide - 1999.) When would it be use-ful to know what the IRC was in a prior year? What is the most recent Action on Decisions listed in Letter Rulings & IRS Positions? What Federal Tax Legislations does CCH think are worth watching? 2. Use the CCH IntelliConnect Practice Tools to answer the following questions: a. Selecting the Federal Taxes heading, determine whether it is more cost effective to buy or lease an auto. The purchase price of the auto is $ 45,000, the loan term is 36 months, and the interest rate is 8 percent. The lease term is 60 months, and value at the end of the lease term is $ 10,000. For any other informa-tion requested, provide reasonable estimates. Print results. It is more cost effective to buy the car because the total payments are less than the lease. Selecting the Sales and Property Tax heading, how long can the dormancy period be for a bank account in the state where your college is located? 3. Use the CCH IntelliConnect Browse function and select the Federal Tax Editorial Content heading to answer the following questions: Using Quick Answers Tax Rates and Tables determine what the high- cost localities per diem rate was for the most current period.. 4. Use the CCH IntelliConnect Practice Tools database to answer the following questions: Using the Federal Withholding Calculator, determine what your withholding should be, based on what you would like your income to be upon graduation and your current family situation. Print results 5. Indicate the relevant information requested for CCH IntelliConnect SFITR, paragraph 12,623.025 6. Use the CCH IntelliConnect Citator to answer the following questions regarding Notice 2010- 10: 7. Use the CCH IntelliConnect Citator to evaluate the 1956 William George Tax Court case 8. Use CCH IntelliConnect Citator to answer the following questions 9. Use the CCH IntelliConnect Citator to evaluate the 290th Revenue Ruling issued in 1955 10. Use the CCH IntelliConnect Citator to answer the following questions regarding the 19th Revenue Procedure of 2002 [Show More]

Last updated: 1 year ago

Preview 1 out of 5 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Sep 13, 2019

Number of pages

5

Written in

Additional information

This document has been written for:

Uploaded

Sep 13, 2019

Downloads

0

Views

95