Finance > CASE STUDY > London School of EconomicsFM 407Summative_Conrail Case Study (All)

London School of EconomicsFM 407Summative_Conrail Case Study

Document Content and Description Below

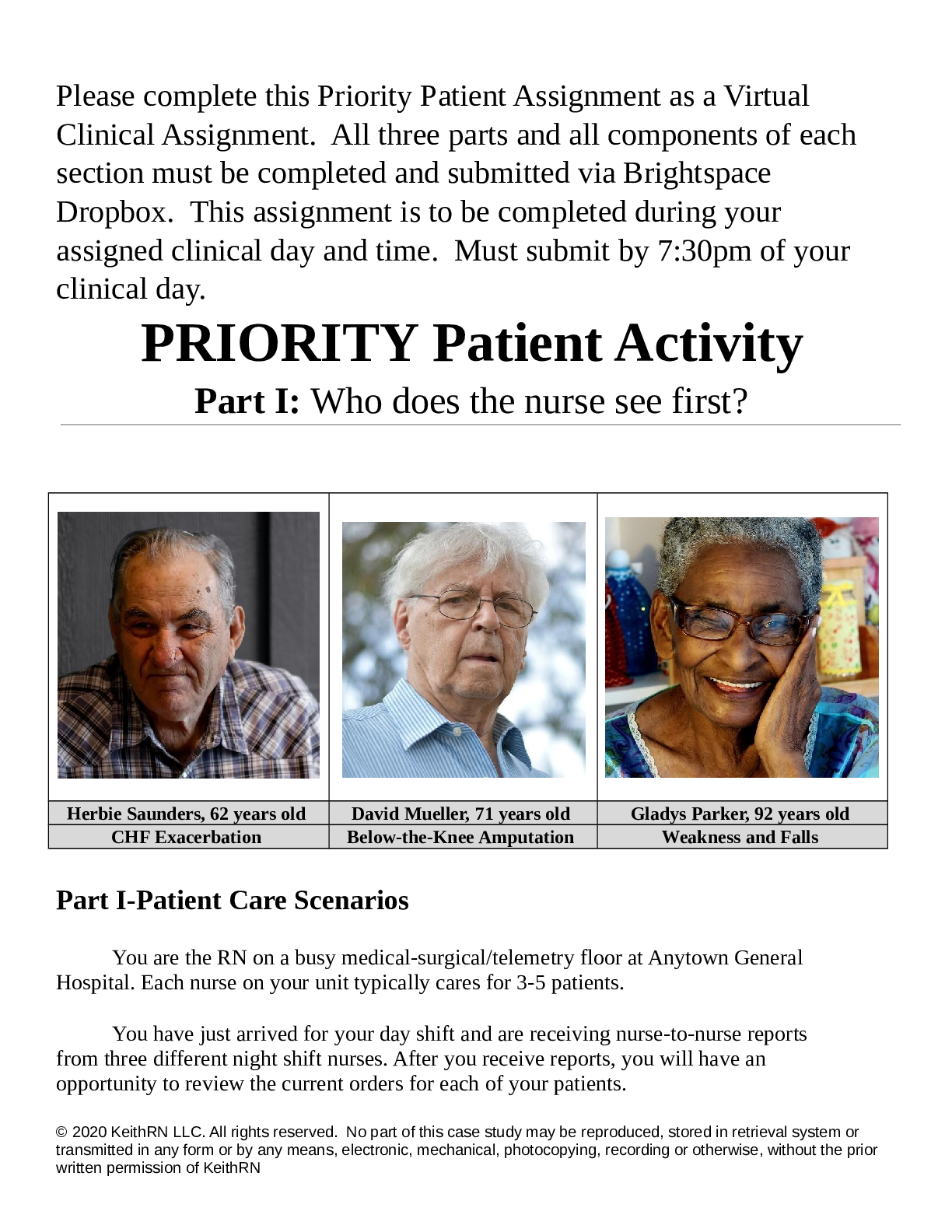

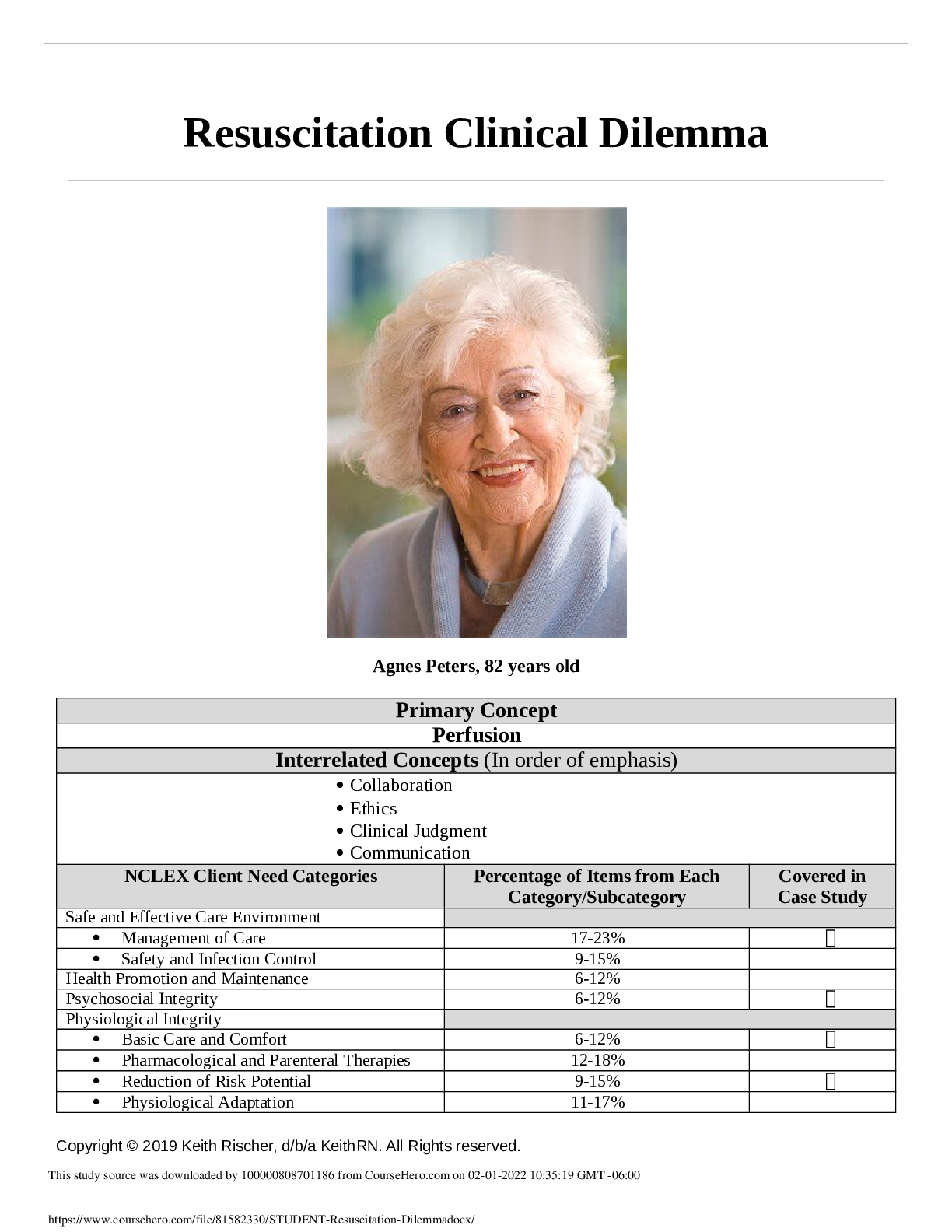

FM 407 Group Assignment: Conrail Case Group member: 20849, 18039, 18491, 22991, 14768 Strategy 1) How does the presence of two bidders (CSX and Norfolk) affect their interest in Conrail? Would the... ir interest be different if they were stand-alone bidders? Commenting on the importance of the deal, one analyst said, “Both [CSX and Norfolk Southern] are in a position where they cannot be willing to lose.” Another said, “The winner [will] obtain an overwhelming dominance of the Eastern and Midwestern rail freight markets. The loser [will] not only lose the instant battle, but, perhaps, its very existence.” The revenue increases would come from trucking and from the remaining Eastern railroad competitor. In other words, CSX-Conrail would steal revenue from Norfolk Southern or, alternatively, Norfolk Southern-Conrail would steal revenue from CSX. If they were stand-alone bidders, the investment value of Conrail to both CSX and Norfolk will be different. When bidding alone, the acquirer will enjoy the competitive advantage created by the combined entity. In other words, the bidder will be able to create synergies from the acquisition, steal revenue from competitors, and doesn’t need to worry about the cost of losing the bid. Since the company is the only bidder in the market, even if the transaction fails, the status quo can be maintained because Conrail will continue to operate as a stand-alone entity without merging. This model will be different from the model with the presence of another bidder. For instance, if Conrail is merged with Norfolk rather than CSX, CSX not only lost the opportunity to create synergies, but also faces a harsher competition from Norfolk, which would cut a piece of the market from CSX. Norfolk, however, will act as a market disruptor by initiating the hostile takeover on Conrail. Norfolk will benefit from this strategy by preventing CSX from successfully complete the transaction, which will safeguard its market share. There are three outcomes for Norfolk, winning the bid, status quo, and losing the bid to CSX, all of which make Norfolk better off than doing nothing. Ideally, Norfolk prefers to acquire Conrail cheaply and catch the synergy, just like CSX does. Alternatively, Norfolk would like to maintain the status quo as well, leaving Norfolk’s market shares unharmed. At the worst-case scenario when Norfolk loses the bid, it has already bidden up the acquisition price for its opponent CSX. Although this is a secondary consideration for Norfolk’s management, we can easily see the financial burden that either one of the companies will face after finishing the transaction with a bid-up-price. If Norfolk forces CSX to give a more appealing price bid on Conrail, CSX might raise new debt and worsen its financial burden. In other words, Norfolk is better off acting as a disruptor on this deal no matter the outcome. This is especially true when the Conrail management is already friendly with CSX. As we can see from Exhibit 6a from article B, the opportunity costs for both Norfolk and CSX come from the market share they would lose if their opponents capture the market share from merging with Conrail. Thus, when evaluating the deal, both CSX and Norfolk will have to evaluate the opportunity cost they have if the other company complete the transaction. Both companies have to make their decision based on the synergies they would have from completing the transaction, and the opportunity cost and compare them to the bid price of Conrail. Valuation [Show More]

Last updated: 1 year ago

Preview 1 out of 11 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 14, 2021

Number of pages

11

Written in

Additional information

This document has been written for:

Uploaded

Aug 14, 2021

Downloads

0

Views

40

.png)

.png)