Finance > CASE STUDY > London School of EconomicsFM 407 Summative MARVEL BANKRUPTCY CASE (All)

London School of EconomicsFM 407 Summative MARVEL BANKRUPTCY CASE

Document Content and Description Below

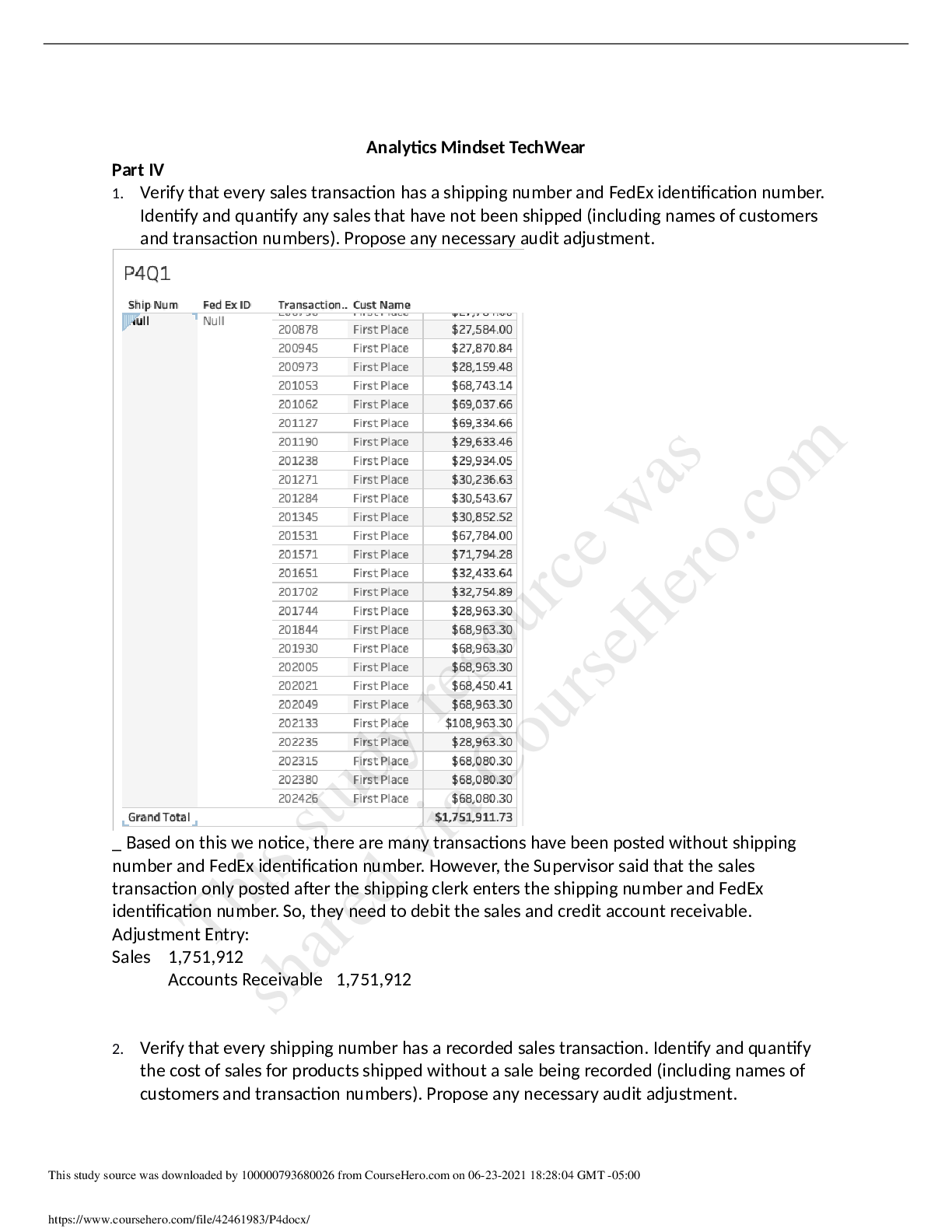

MARVEL BANKRUPTCY CASE 1. Why is Marvel in financial distress? Bad luck? Bad strategy? Bad implementation? When possible, back your claims with numbers Shortly after their third issuance, Marvel su... ffered from poor economics and business landscape. Marvel’s core business began to falter. The decline in sales was largely driven by disappointed collectors who had viewed comic books as a form of investment. Marvel had increased the monthly comic titles from 45 to 140 and raised the prices from 1.5$ to 3% respectively. But collectors failed to realise returns on those investments and reduced their purchases significantly. Due to poor conversion rates for comic book purchasers, the business began to falter with Marvel losing 19% sales across all distribution channels. The market faced a changing demographic with core readers replaced majorly by speculative collectors. With the comic book market dynamics on the downturn, the trading market suffered too with strikes in both professional hockey and baseball. Due to this downturn in business, trading cards had to increasingly compete with other forms of entertainment. A prime example was Jill Krutick, a Smith Barney analyst slashing earnings estimates of Marvel. The trading card sales dropped by 30% over the next two years. Marvel reported a 33% drop in its first quarter net income of 1995 with an investment newsletter recommending shorting the stock. Marvel’s earnings from baseball and hockey trading cards dropped while the company continued to take on further debt to fund acquisitions. When a stable flow of revenue is disrupted, taking on more debt significantly increases the costs of financial distress and negates all the positive tax shields achieved by taking on debt. This indicates a poor financing growth strategy undertaken at times of business downturn and slowing market dynamics. Marvel was quick to undertake acquisitions with debt to diversify the company. However, this was a poor business decision since Marvel lost 48.5$ million in 1995 mainly from its comic book and publishing segments. This resulted in an increased difficulty to repay bank loans and keep up with its interest payments. During times of high financial distress, companies often face a situation of debt overhang and asset substitution wherein it is difficult to undertake profitable investments due to high leverage conditions. Following a period of decreasing revenue and profitability, Marvel violated a specific bank loan covenant in 1996, resulting in the need for restructuring to protect itself from bankruptcy. Exhibit 2 shows an increasing stock price up to November 1993 wherein the company is maintaining a stable revenue inflow and undertaking acquisitions with debt. This provided a positive tax shield and increased the stock price and valuation of the company. However, post an economic downturn, poor debt investment decisions and failing growth strategy, the costs of financial distress caused the company to face financial trouble and file a restructuring strategy to avoid bankruptcy. Following the bank loan violation, Moody’s downgraded Marvel’s public debt, causing its zero-coupon bonds price to fall by 41%. 2. Why did Marvel file for Chapter 11 rather than restructure out-of-court? When a company is facing financial distress, it looks to restructure its liabilities by a private workout i.e., out of court restructuring or Formal Bankruptcy procedure. However, Marvel choose to undertake chapter 11 rather than out of court restructuring and settlement. It is primarily due to the following reasons: [Show More]

Last updated: 1 year ago

Preview 1 out of 9 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 14, 2021

Number of pages

9

Written in

Additional information

This document has been written for:

Uploaded

Aug 14, 2021

Downloads

0

Views

104

.png)

.png)