Finance > QUESTIONS & ANSWERS > Principle of Finance Milestone 3 Sophia Course Answered| Sophia Finance Milestone 3 (complete fall 2 (All)

Principle of Finance Milestone 3 Sophia Course Answered| Sophia Finance Milestone 3 (complete fall 2021/2022)

Document Content and Description Below

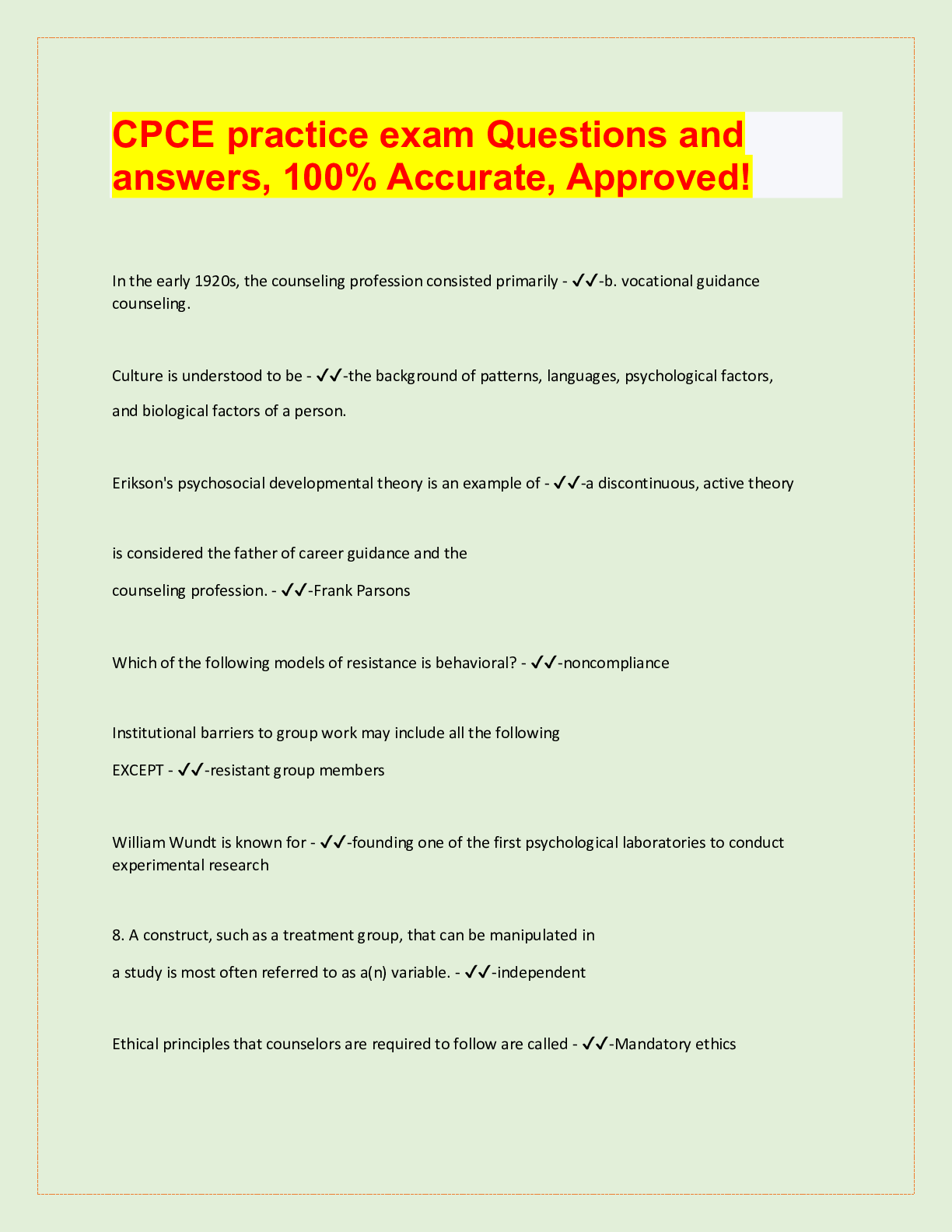

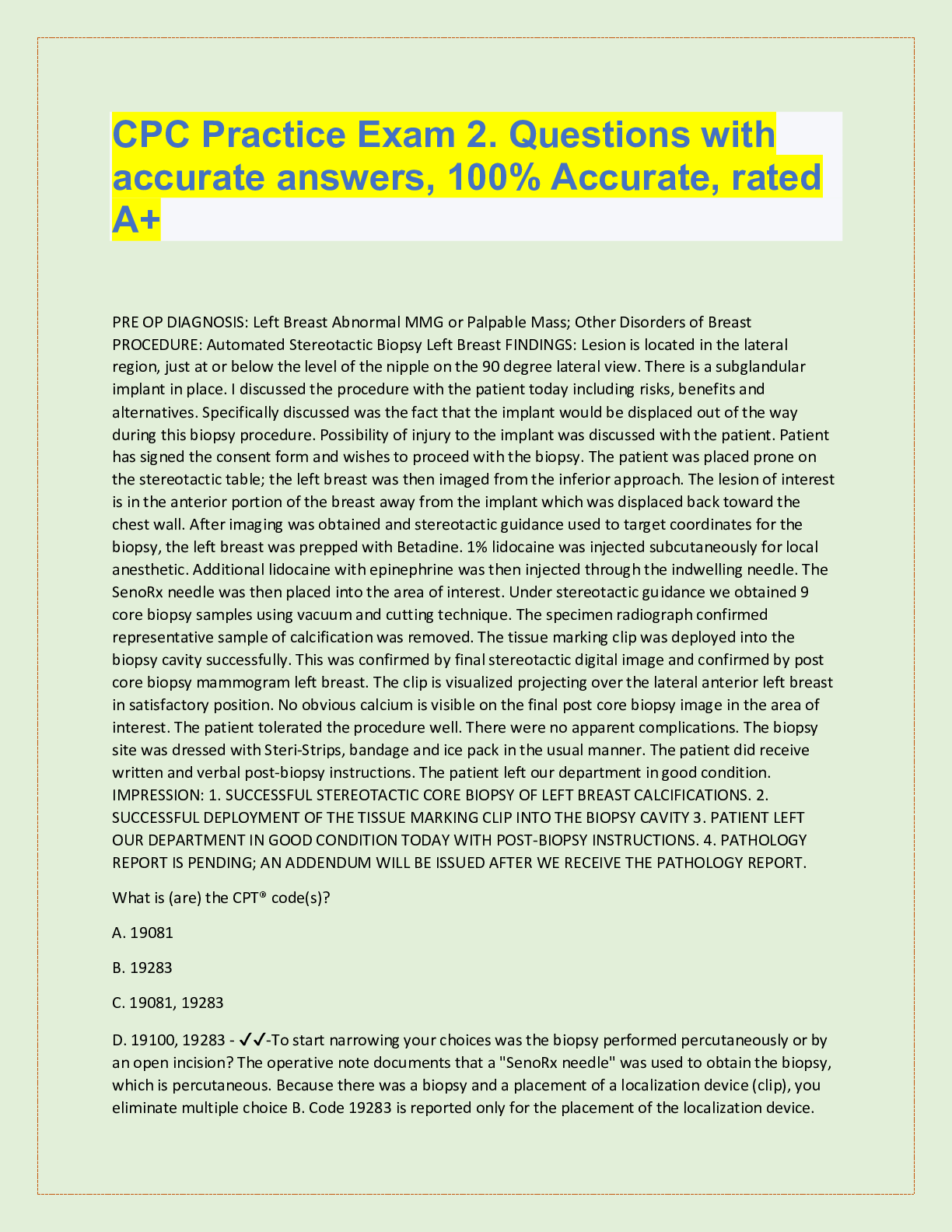

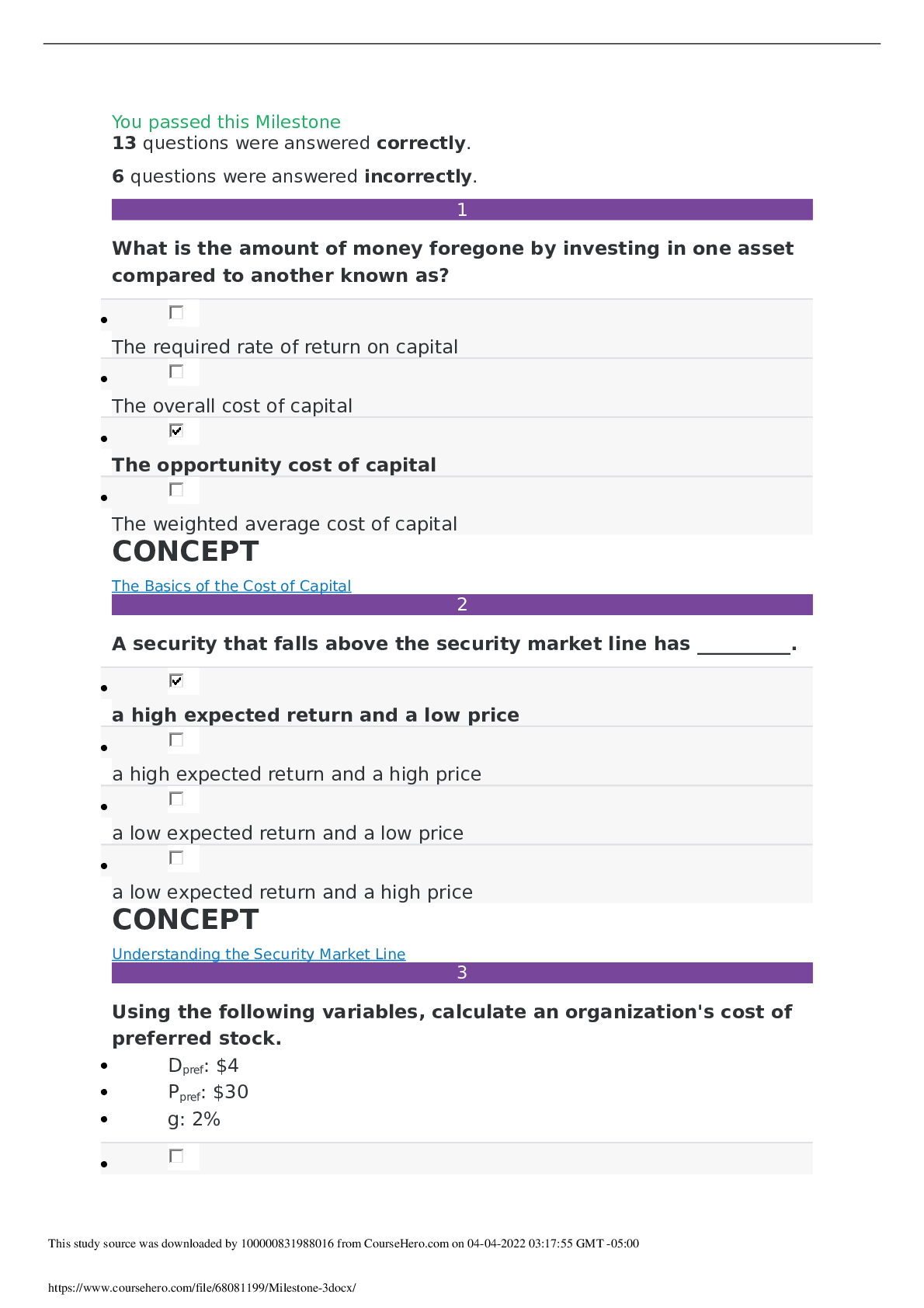

You passed this Milestone 13 questions were answered correctly. 6 questions were answered incorrectly. 1 What is the amount of money foregone by investing in one asset compared to another known a... s? The required rate of return on capital The overall cost of capital The opportunity cost of capital The weighted average cost of capital CONCEPT The Basics of the Cost of Capital 2 A security that falls above the security market line has __________. a high expected return and a low price a high expected return and a high price a low expected return and a low price a low expected return and a high price CONCEPT Understanding the Security Market Line 3 Using the following variables, calculate an organization's cost of preferred stock. Dpref: $4 Ppref: $30 g: 2% This study source was downloaded by 100000831988016 from CourseHero.com on 04-04-2022 03:17:55 GMT -05:00 https://www.coursehero.com/file/68081199/Milestone-3docx/ 24% 15.33% $12.66% 15% CONCEPT Valuing Different Costs 4 Which of the following is true of unsystematic risk? The correlation among the returns of assets within a portfolio are irrelevant to this type of risk. It can be diversified away by relying on the lack of a tight positive relationship among the returns of a set of individual assets. Its presence commands a return in excess of the risk-free rate. It is also known as non-diversifiable risk. CONCEPT Diversification 5 You own a small manufacturing business that produces widgets. You have spent $100,000 acquiring the fixed assets you need to produce widgets. Each widget costs you $4 to make and they sell for $22 each, so your variable cost is 18.2% of the overall revenue. At your current level of operating leverage, how many widgets must you sell to break even? 18,200 9,450 This study source was downloaded by 100000831988016 from CourseHero.com on 04-04-2022 03:17:55 GMT -05:00 https://www.coursehero.com/file/68081199/Milestone-3docx/ 4,546 5,556 CONCEPT Thinking About Operating Leverage 6 The risk that a bank will receive less interest from a lending product than it originally anticipated is known as __________. operational risk interest rate risk market risk prepayment risk CONCEPT Risk 7 Which of the following is a tenet of weak-form efficiency? Markets, in general, are informationally inefficient, so investors can earn excess returns by studying patterns. The market is impossible to predict because investors make decisions in a biased, emotionally-driven fashion. Analyzing patterns in the past pricing of securities will not yield information that will enable investors to "beat" the market. The prices of securities reflect all known present information, but do not account for past [Show More]

Last updated: 1 year ago

Preview 1 out of 9 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 04, 2022

Number of pages

9

Written in

Additional information

This document has been written for:

Uploaded

Apr 04, 2022

Downloads

0

Views

92

.png)

.png)

.png)

.png)

.png)

.png)