Financial Accounting > QUESTIONS & ANSWERS > ACCT 505 Final Exam Guide questions and answers solution docs 2020 (All)

ACCT 505 Final Exam Guide questions and answers solution docs 2020

Document Content and Description Below

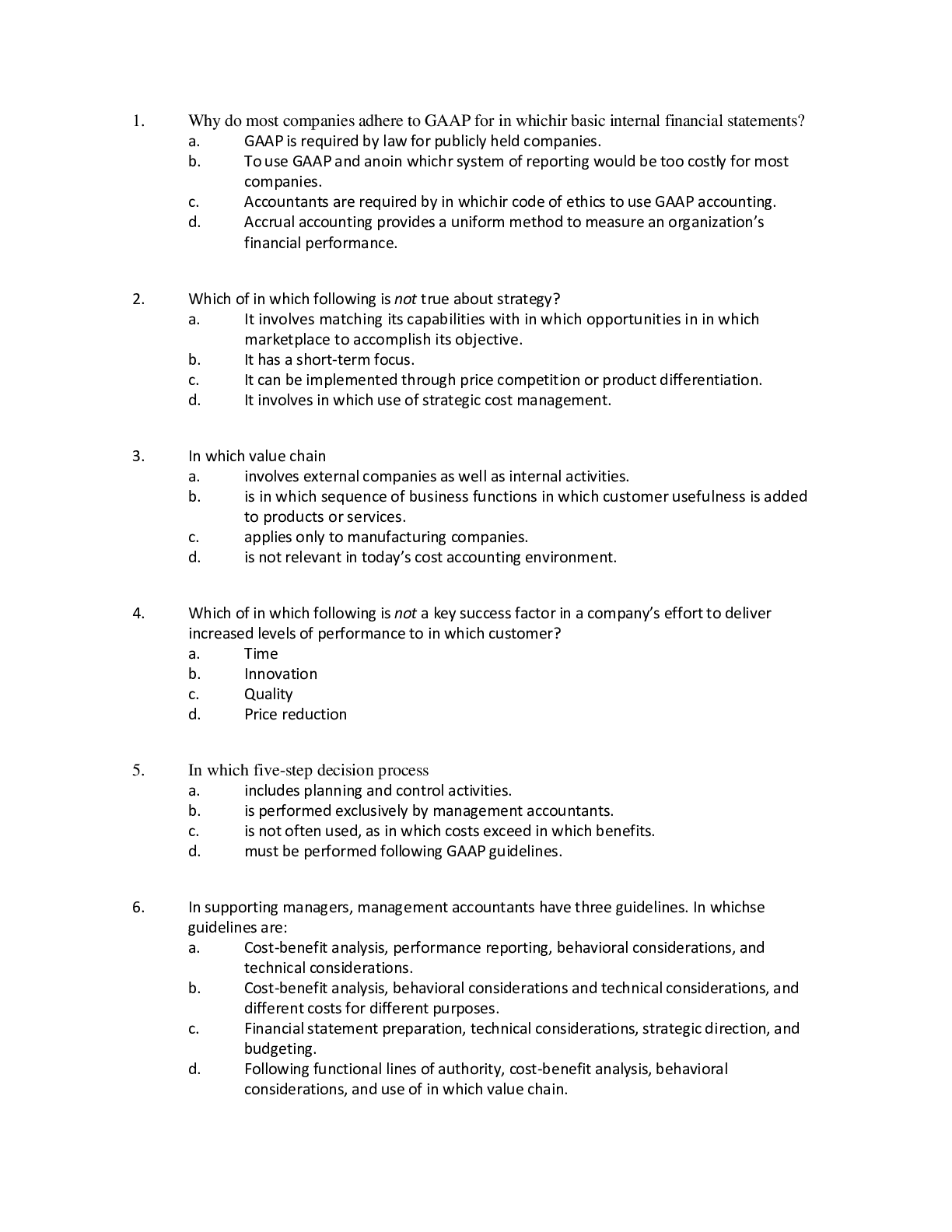

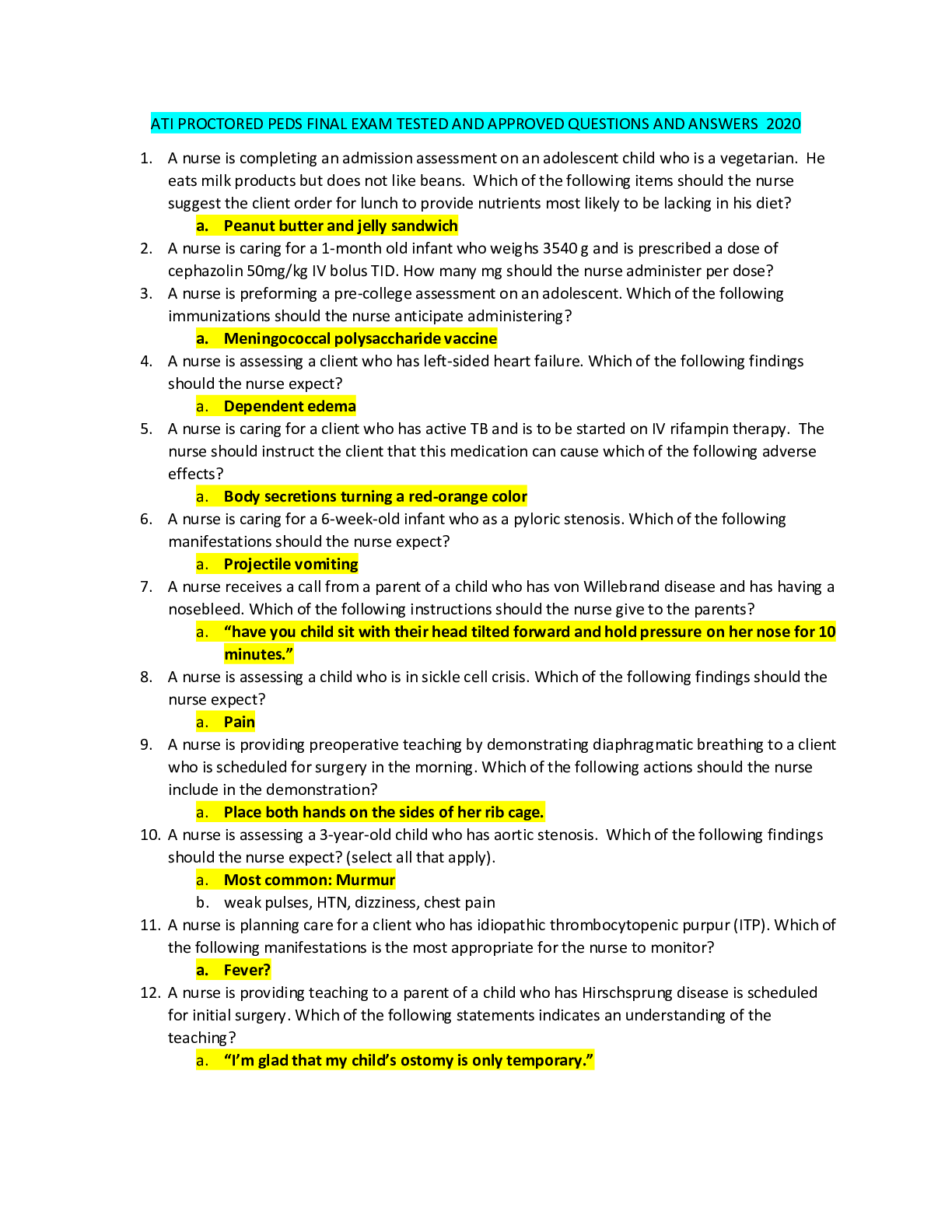

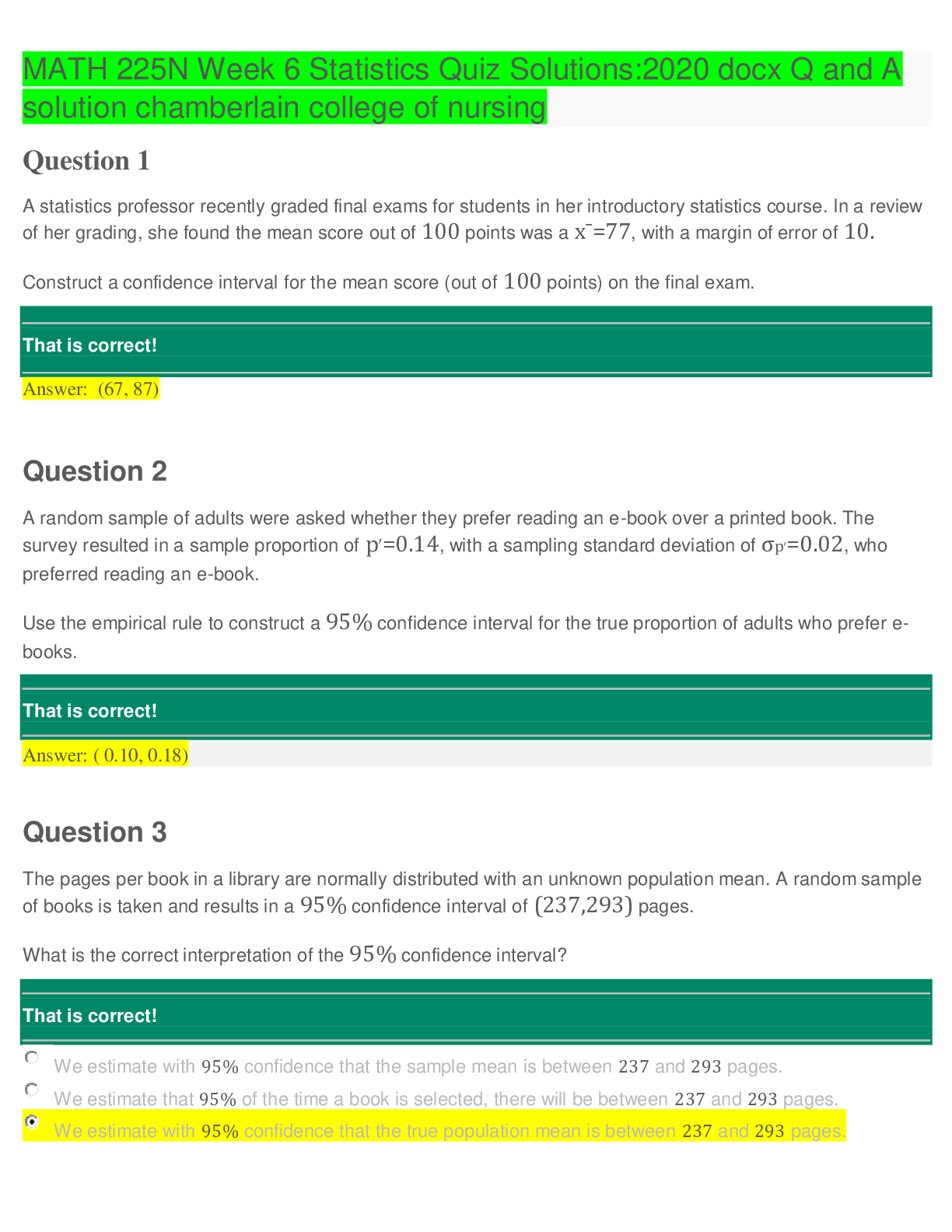

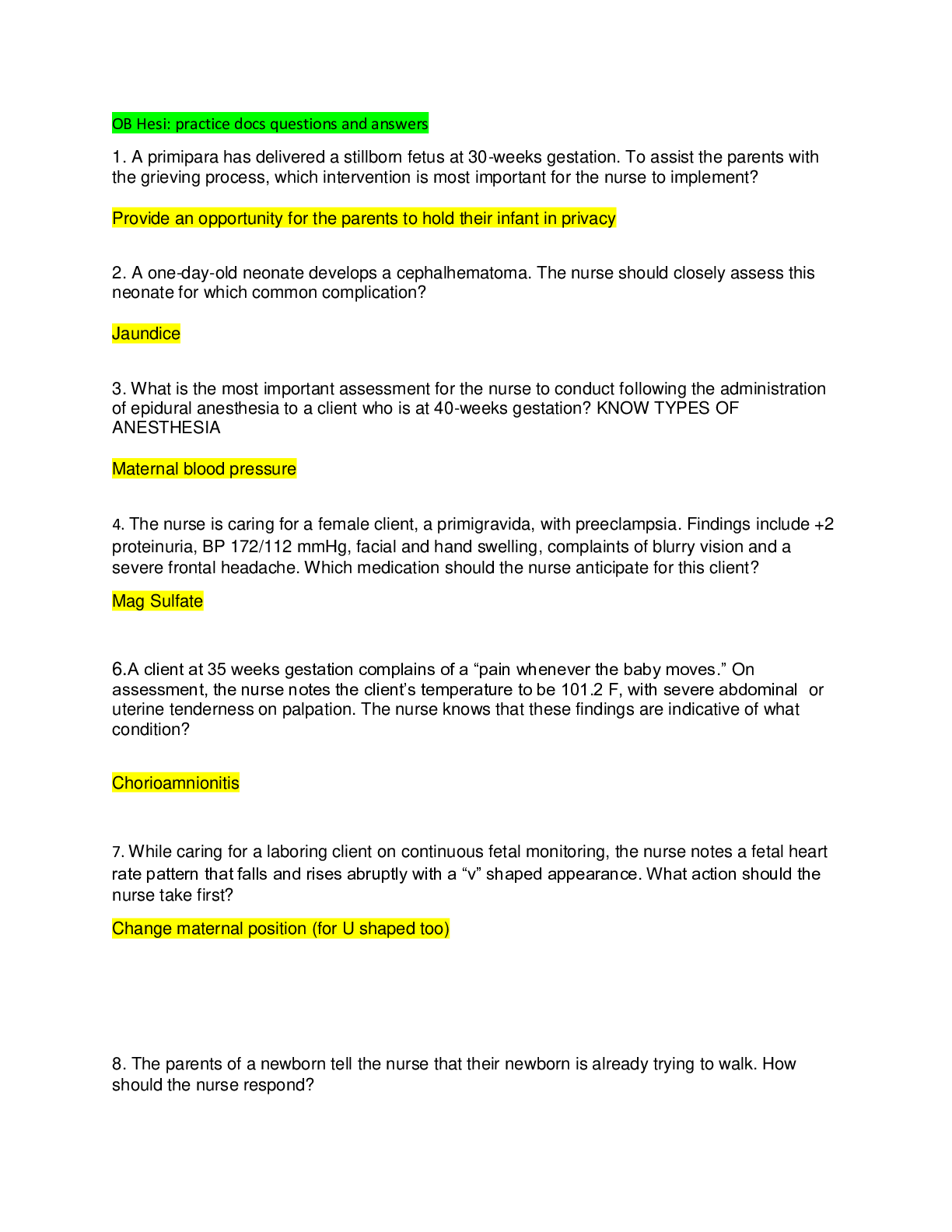

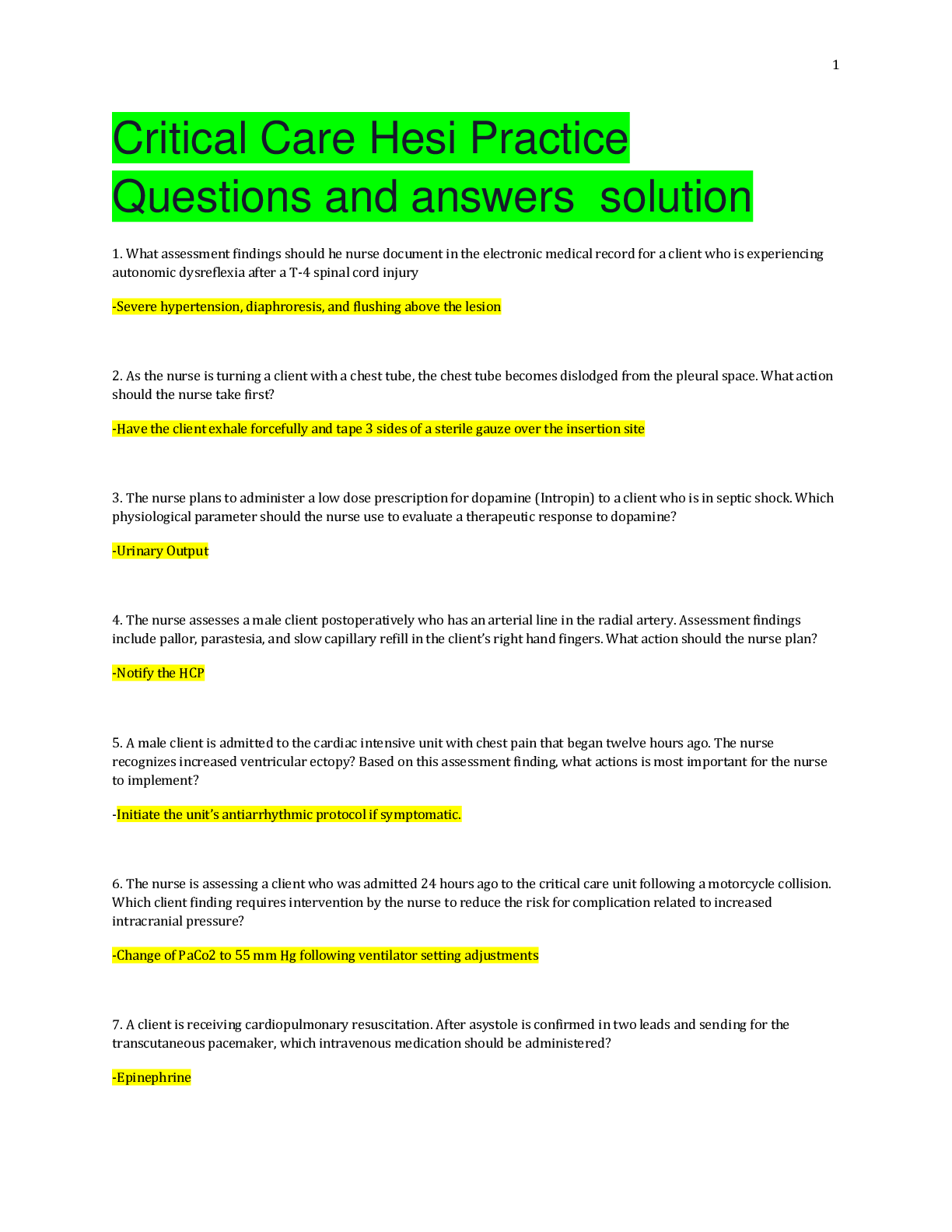

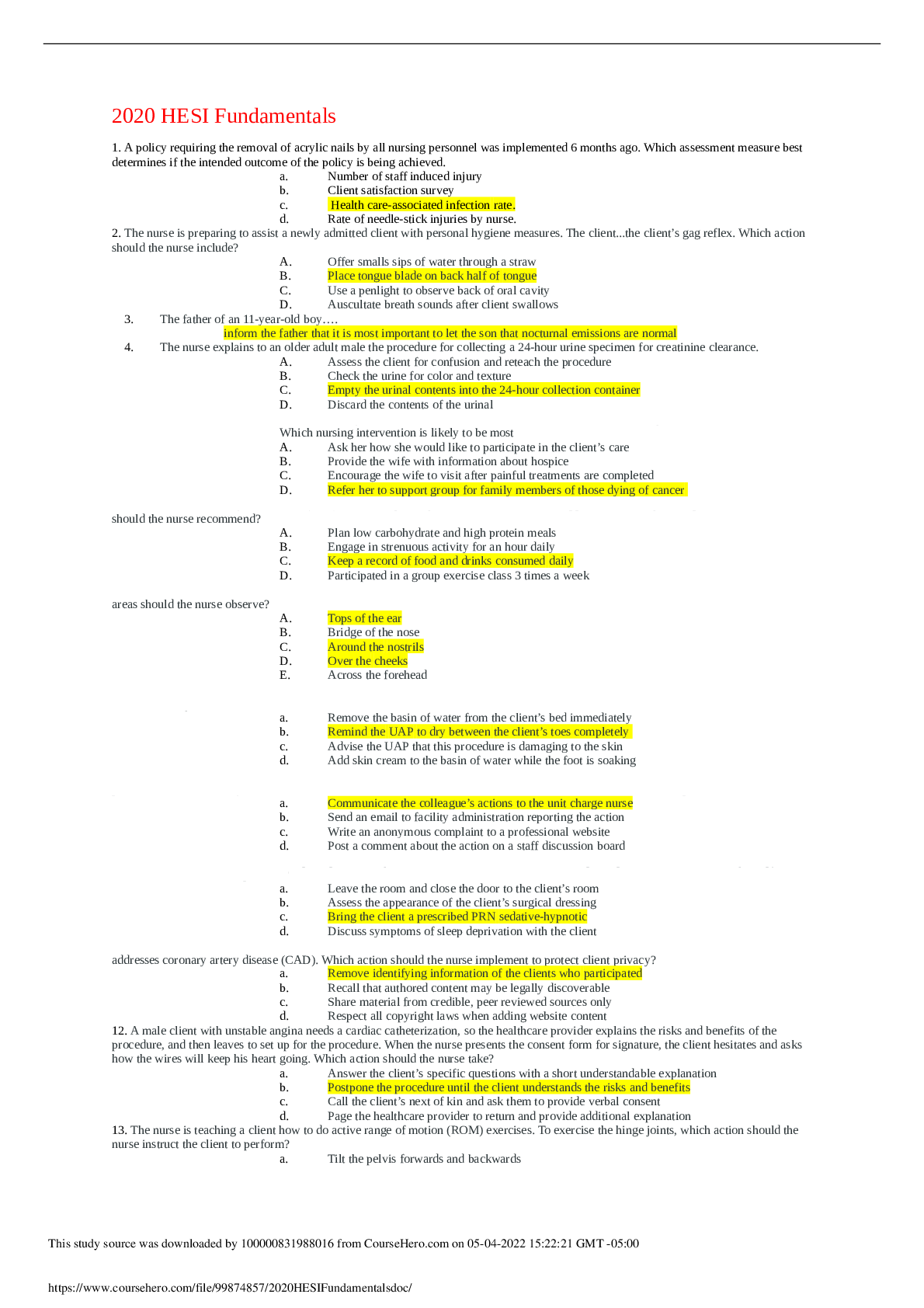

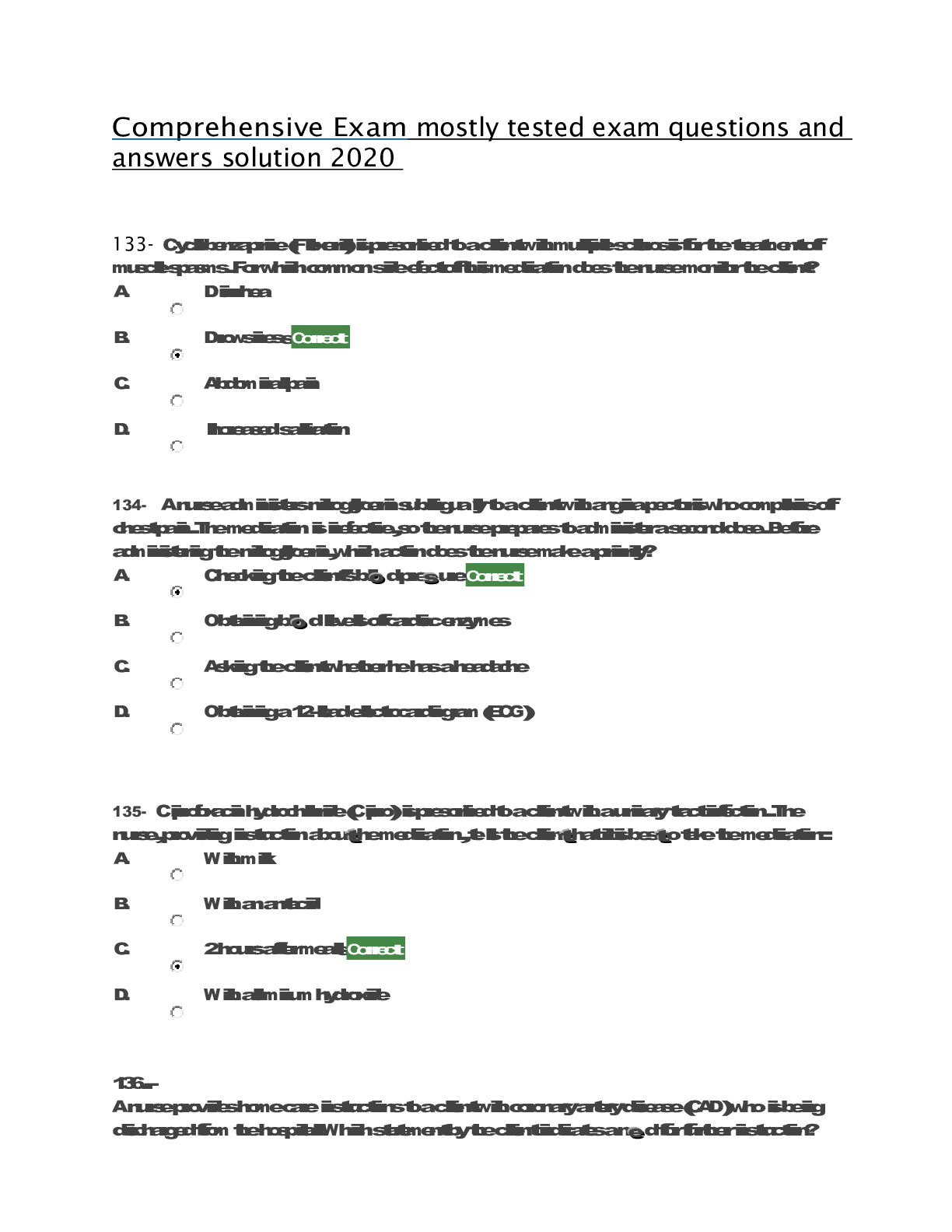

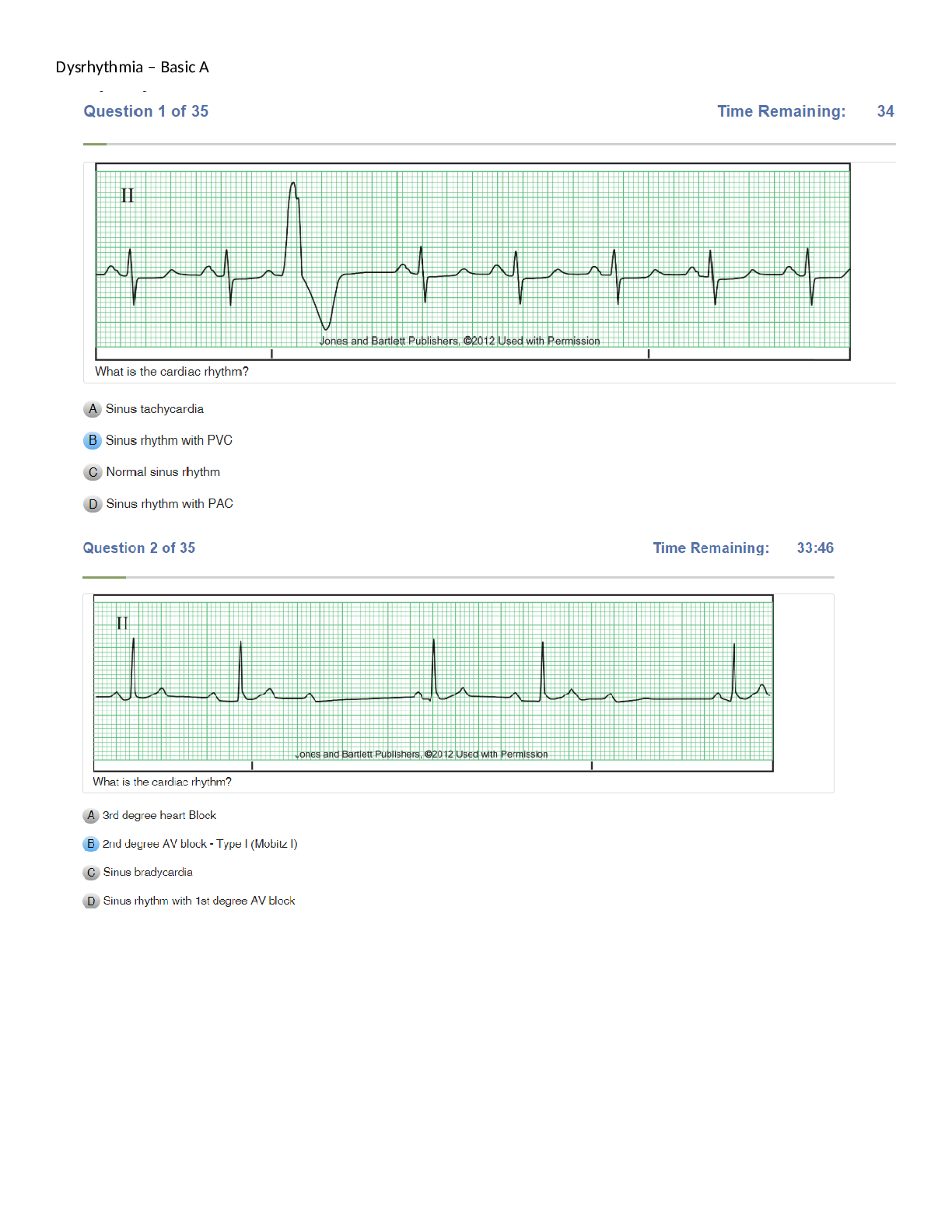

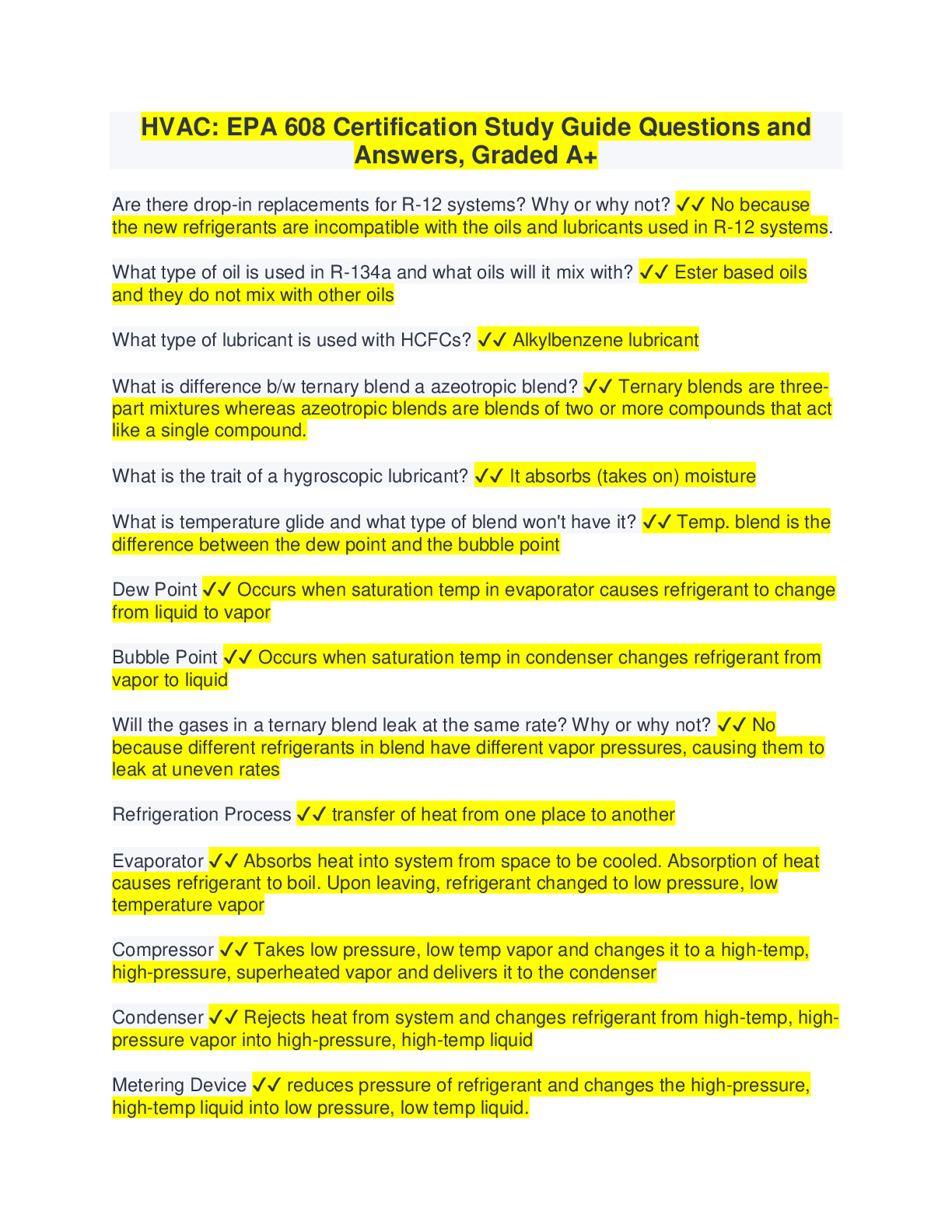

ACCT 505 Final Exam Guide questions and answers solution docs 2020 1 (TCO E) Preparing purchase orders is a(n) (Points : 5) 2. (TCO G) Given the following data, what would ROI be? Sales $7... 0,000 Net operating income $10,000 Contribution margin $20,000 Average operating assets $50,000 Stockholder's equity $25,000 (Points : 5) 3. (TCO C) Heckaman Corporation produces and sells a single product. Data concerning that product appear below. Selling price per unit $115.00 Variable expense per unit $56.35 Fixed expense per month $299,115 Required: Determine the monthly breakeven in unit or dollar sales. Show your work! (Points : 25) 4. TCO B) Industrial Supply Corporation uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month are listed below. Work in process, beginning: Units in beginning work in process inventory 400 Materials costs $6,900 Conversion costs $2,500 Percent complete for materials 80% Percent complete for conversion 15% Units started into production during the month 6,000 Units transferred to the next department during the month 5,200 Materials costs added during the month $112,500 Conversion costs added during the month $210,300 Ending work in process: Units in ending work-in-process inventory 1,200 Percentage complete for materials 75% Percentage complete for conversion 30% Required: Calculate the equivalent units for conversion for the month in the first processing department. (Points : 25) 5. (TCO D) Topple Company produces a single product. Operating data for the company and its absorption costing income statement for the last year are presented below. Units in beginning inventory 0 Units produced 9,000 Units sold 7,000 Sales $100,000 Less cost of goods sold: Beginning inventory 0 Add cost of goods manufactured 54,000 Goods available for sale 54,000 Less ending inventory 12,000 Cost of goods sold 42,000 Gross margin 58,000 Less selling and admin. expenses 28,000 Net operating income $30,000 Variable manufacturing costs are $4 per unit. Fixed manufacturing overhead totals $18,000 for the year. The fixed manufacturing overhead was applied at a rate of $2 per unit. Variable selling and administrative expenses were $1 per unit sold. Required: Prepare a new income statement for the year using variable costing. Comment on the differences between the absorption costing and the variable costing income statements. (Points : 30) (Ignore income taxes in this problem.) Sampson Beauty Products Corporation is considering the production of a new conditioning shampoo that will require the purchase of new mixing machinery. The machinery will cost $550,000, is expected to have a useful life of 10 years, and is expected to have a salvage value of $55,000 at the end of 10 years. The machinery will also need a $35,000 overhaul at the end of Year 5. A $50,000 increase in working capital will be needed for this investment project. The working capital will be released at the end of the 10 years. The new shampoo is expected to generate net cash inflows of 95,000 per year for each of the 10 years. Sampson's discount rate is 16%. 6. (TCO I) (Ignore income taxes in this problem.) Simpson Beauty Products Corporation is considering the production of a new conditioning shampoo that will require the purchase of new mixing machinery. The machinery will cost $700,000, is expected to have a useful life of 10 years, and is expected to have a salvage value of $70,000 at the end of 10 years. The machinery will also need a $45,000 overhaul at the end of Year 5. A $60,000 increase in working capital will be needed for this investment project. The working capital will be released at the end of the 10 years. The new shampoo is expected to generate net cash inflows of $150,000 per year for each of the 10 years. Simpson's discount rate is 18%. Required: Part A: What is the net present value of this investment opportunity? Part B: Based on your answer to (a) above, should Simpson go ahead with the new conditioning shampoo? (Points : 30) 7. (TCO A) The following data (in thousands of dollars) have been taken from the accounting records of Karmana Corporation for the just-completed year. Sales ...............................................................................................$1,500 Raw materials inventory, beginning ...............................................$20 Raw materials inventory, ending ..........................,.........................$40 Purchases of raw materials .............................................................$150 Direct labor .......................................................................................$180 Manufacturing overhead ...............................................................$250 Administrative expenses ...............................................................$100 Selling expenses .............................................................................$140 Work-in-process inventory, beginning ........................................$80 Work-in-process inventory, ending .............................................$50 Finished goods inventory, beginning ........................................$125 Finished goods inventory, ending ...............................................$60 Use these data to prepare (in thousands of dollars) a schedule of Cost of Goods Manufactured and a Schedule of Cost of Goods Sold for the year. In addition, elaborate on the relationship between these schedules as they relate to the flow of product costs in a manufacturing company. (Points : 25) Sales ........................................................................ $1,000 Raw materials inventory, beginning ........................$130 Raw materials inventory, ending ................................$90 Purchases of raw materials ........................................$220 Direct labor ..................................................................$240 Manufacturing overhead ..........................................$210 Administrative expenses ...........................................$200 Selling expenses ............................................... .........$240 Work-in-process inventory, beginning ....................$25 Work-in-process inventory, ending ..........................$45 Finished goods inventory, beginning .....................$200 Finished goods inventory, ending ...........................$160 8. (TCO F) Matuseski Corporation is preparing its cash budget for October. The budgeted beginning cash balance is $54,000. Budgeted cash receipts total $127,000 and budgeted cash disbursements total $99,000. The desired ending cash balance is $100,000. The company can borrow up to $150,000 at any time from a local bank, with interest not due until the following month. Required: Prepare the company's cash budget for October in good form. Make sure to indicate what borrowing, if any, would be needed to attain the desired ending cash balance. (Points : 25) 9. (TCO F) Bella Lugosi Holdings, Inc. (BLH), has collected the following operating information for its current month's activity. Using this information, prepare a flexible budget analysis to determine how well BLH performed in terms of cost control. Actual Costs Incurred Static Budget Activity level (in units) 5,250 5,178 Variable costs: Indirect materials $24,182 $23,476 Utilities $22,356 $22,674 Fixed costs: Administration $63,450 $65,500 Rent $65,317 $63,904 (Points : 25) 10. (TCO H) Lindon Company uses 10,000 units of Part Y each year as a component in the assembly of one of its products. The company is presently producing Part Y internally at a total cost of $100,000 as follows. Direct materials............................................... $20,000 Direct labor...................................................... 40,000 Variable manufacturing overhead...................... 16,000 Fixed manufacturing overhead....................... 24,000 Total costs.......................................................100,000 An outside supplier has offered to provide Part Y at a price of $10 per unit. If Lindon stops producing the part internally, one third of the fixed manufacturing overhead would be eliminated. Required: Should Lindon Company make or buy the part? Prepare a make-or-buy analysis showing the annual advantage or disadvantage of accepting the outside supplier's offer. (Points : 30) 11. (TCO B) Wahr Corporation bases its predetermined overhead rate on the estimated labor hours for the upcoming year. At the beginning of the most recently completed year, the company estimated the labor hours for the upcoming year at 35,000. The estimated variable manufacturing overhead was $7.25 per labor hour and the estimated total fixed manufacturing overhead was $585,000. The actual labor hours for the year turned out to be 33,000. Required: Compute the company's predetermined overhead rate for the recently completed year. (Points : 25) [Show More]

Last updated: 1 year ago

Preview 1 out of 8 pages

ans (1).png)

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Nov 11, 2020

Number of pages

8

Written in

Additional information

This document has been written for:

Uploaded

Nov 11, 2020

Downloads

0

Views

23

2020 ans.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)