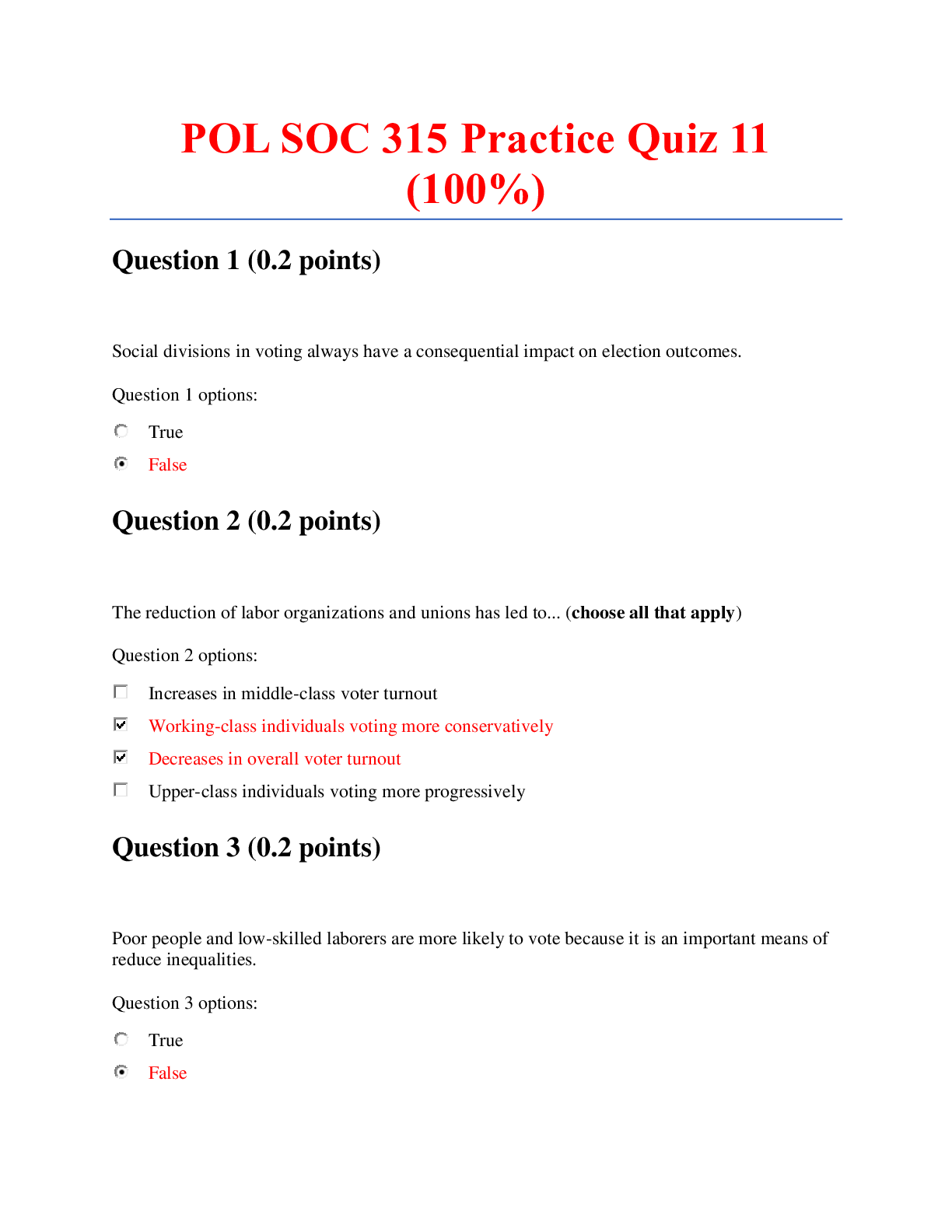

Financial Accounting > EXAM > Strayer University, WashingtonACC 557 Week 2: Modeling in High Uncertainty Quiz. 100% Answered (All)

Strayer University, WashingtonACC 557 Week 2: Modeling in High Uncertainty Quiz. 100% Answered

Document Content and Description Below

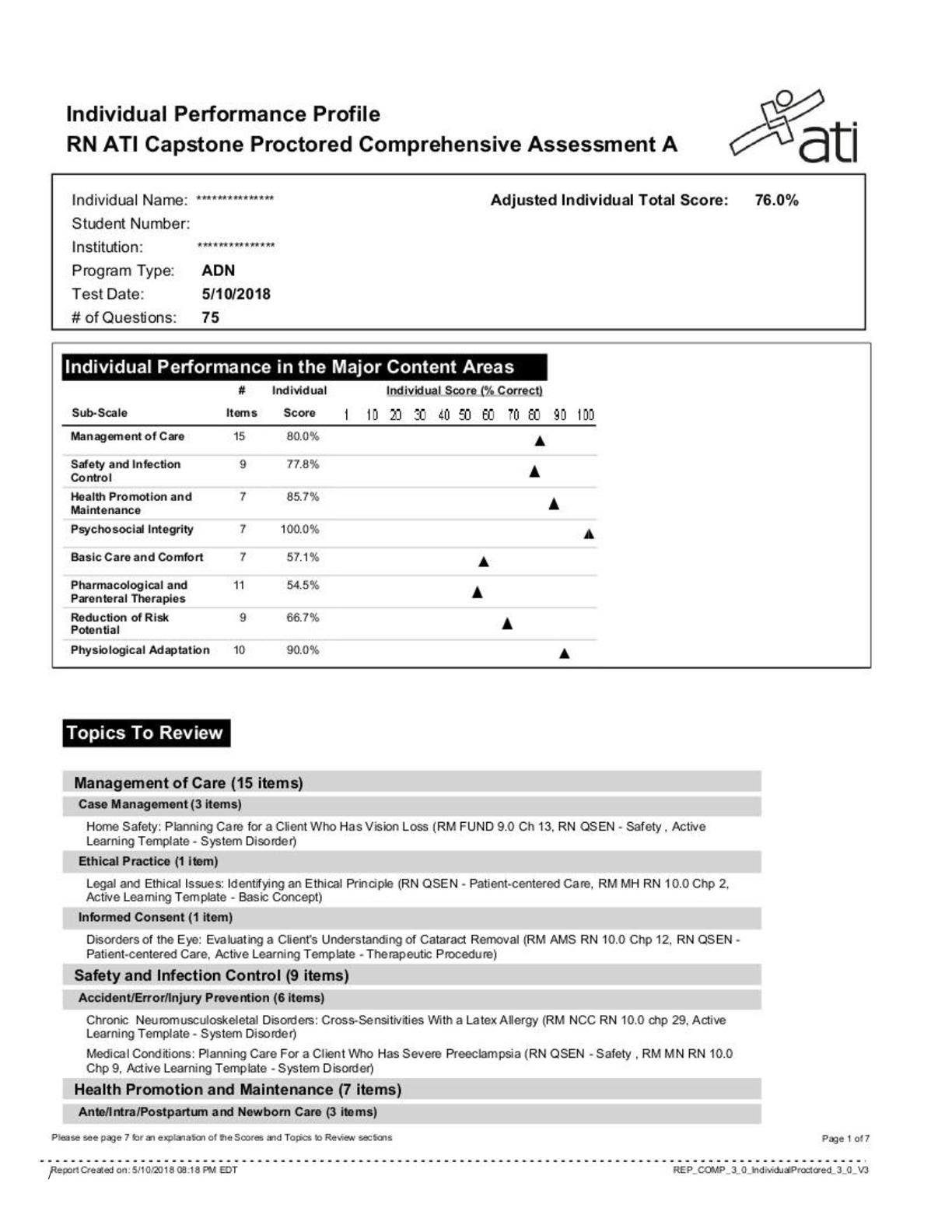

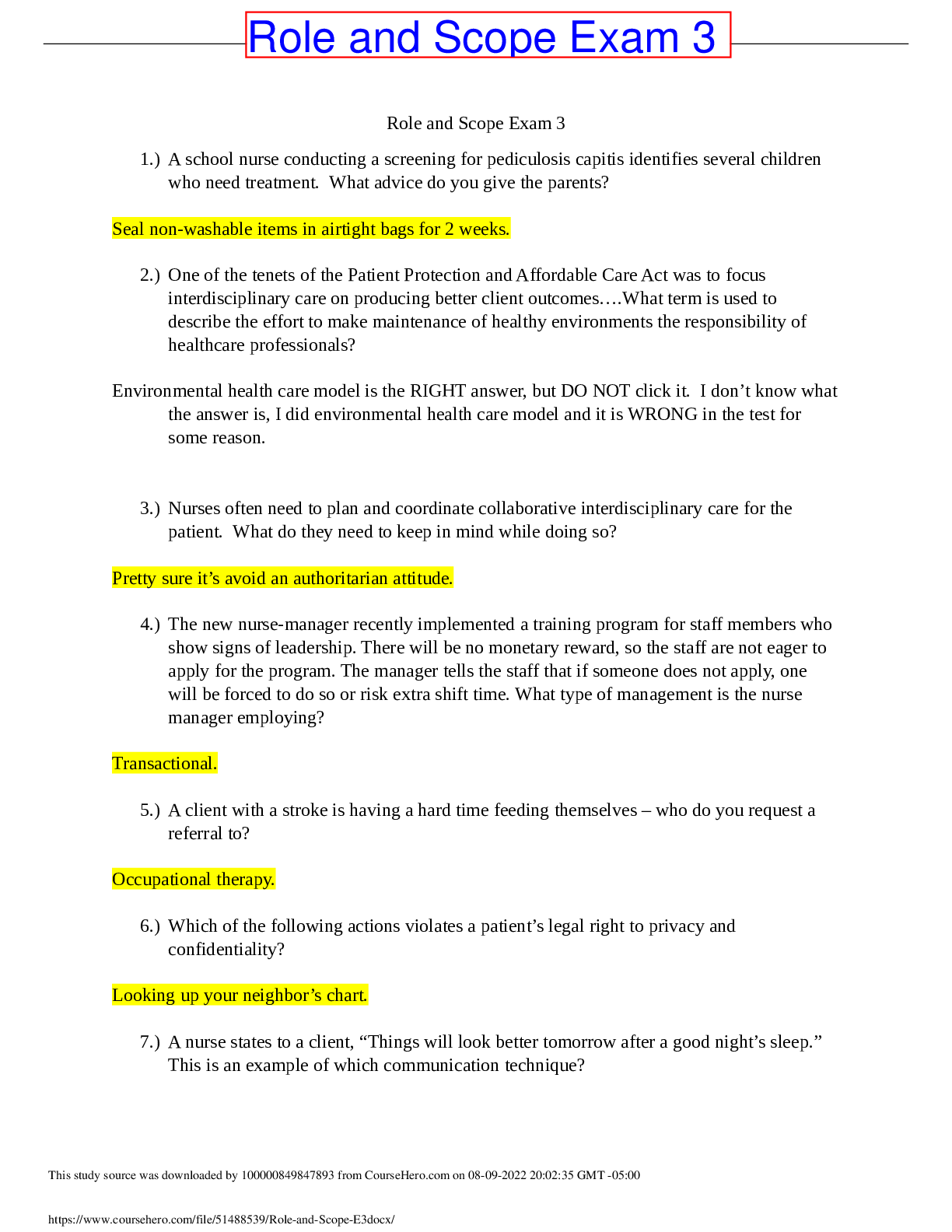

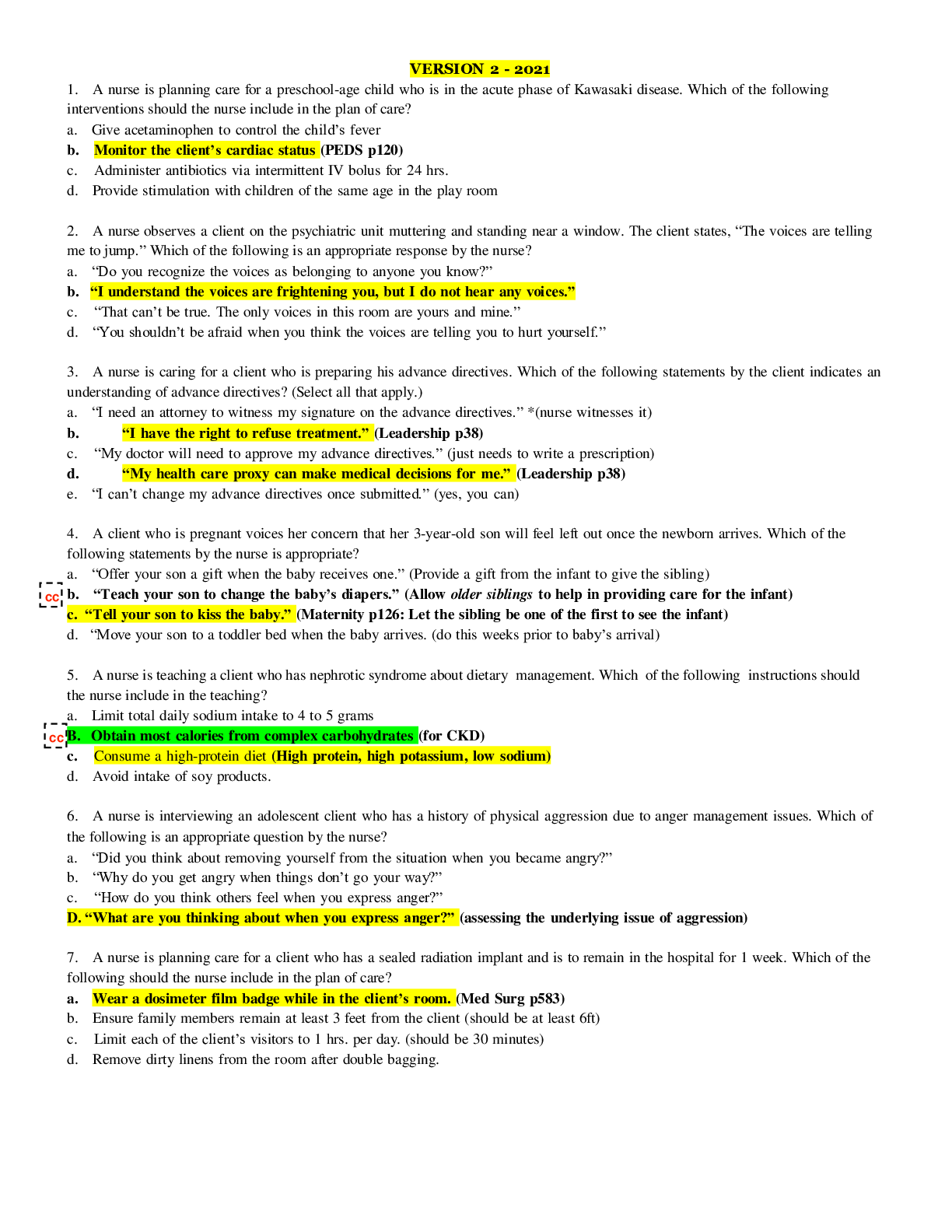

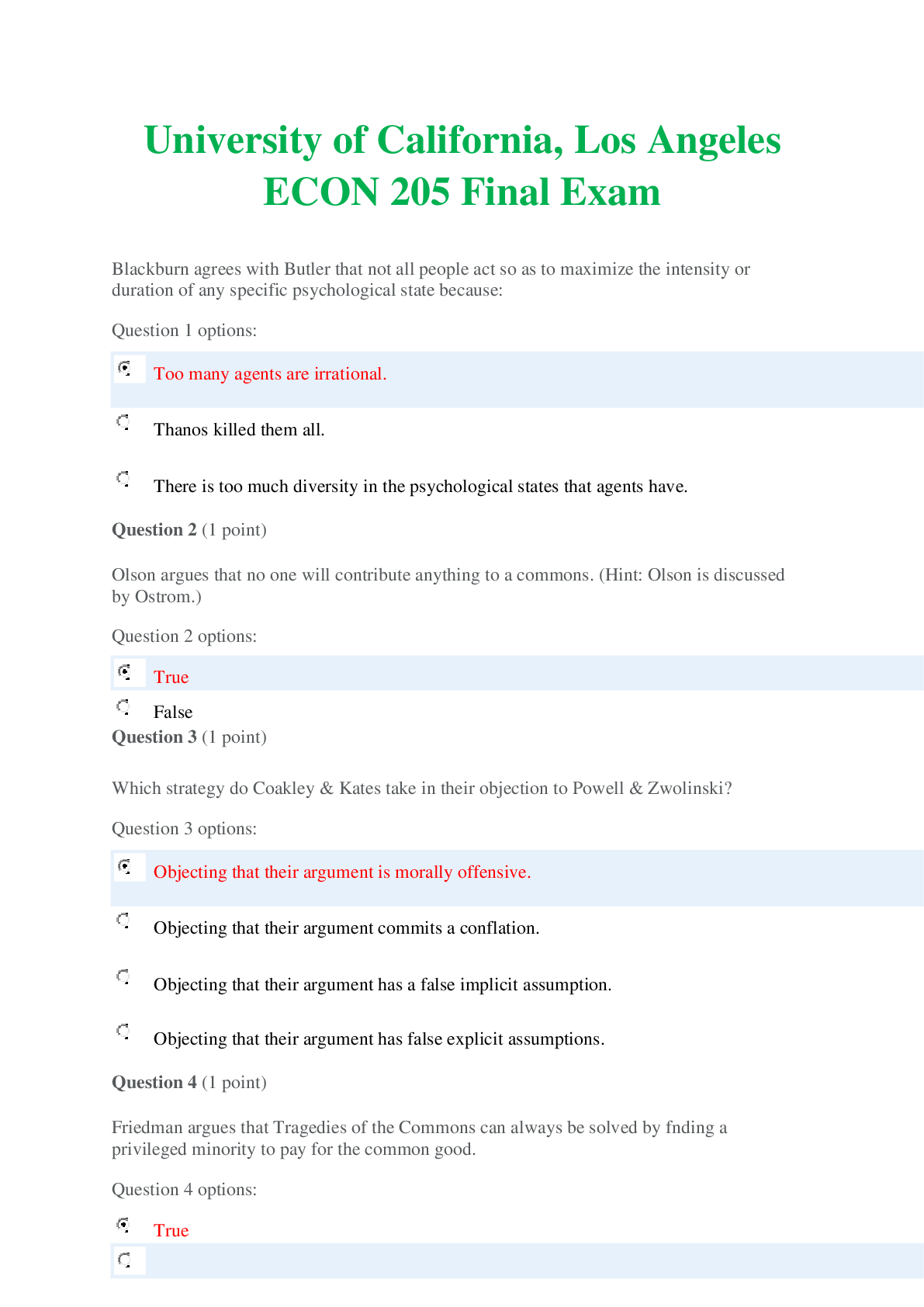

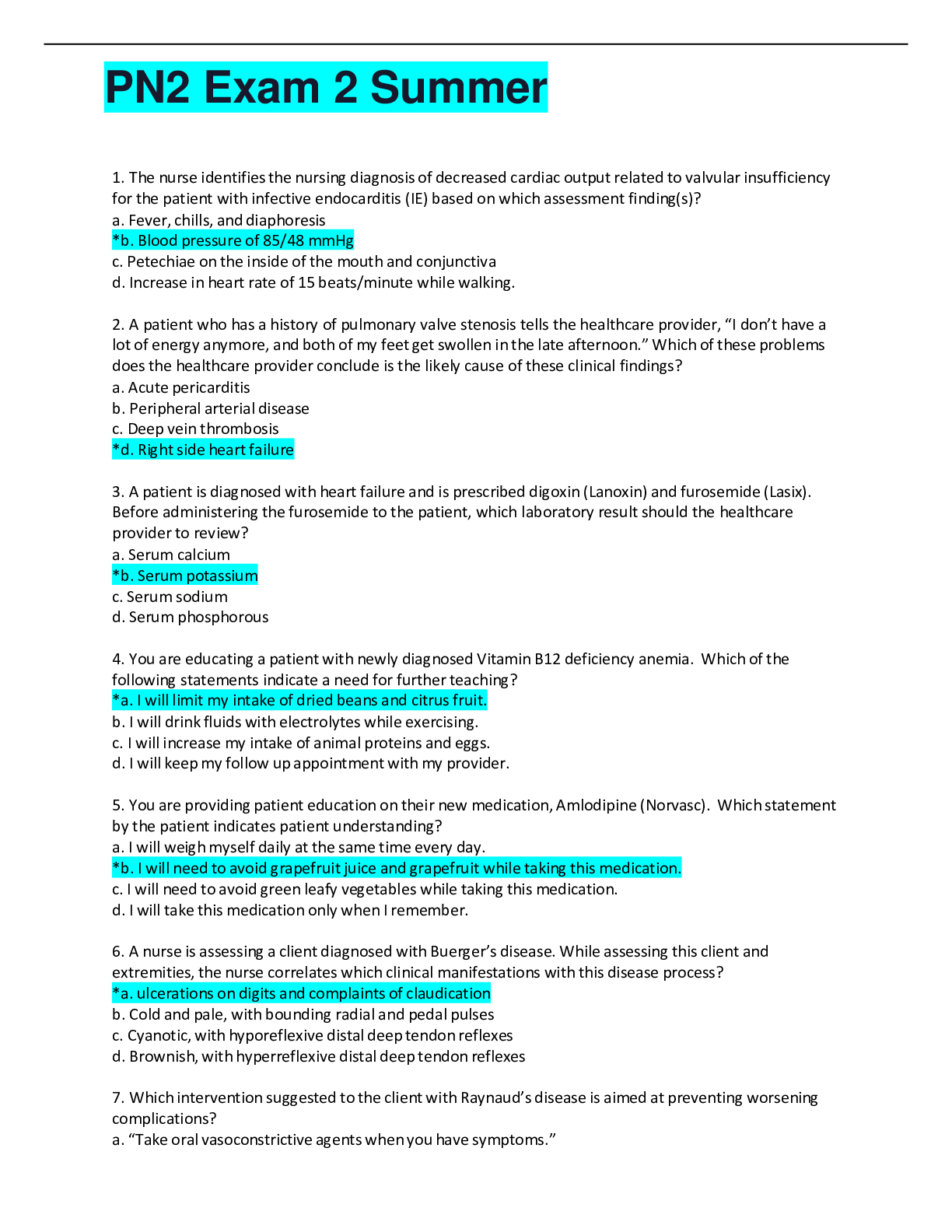

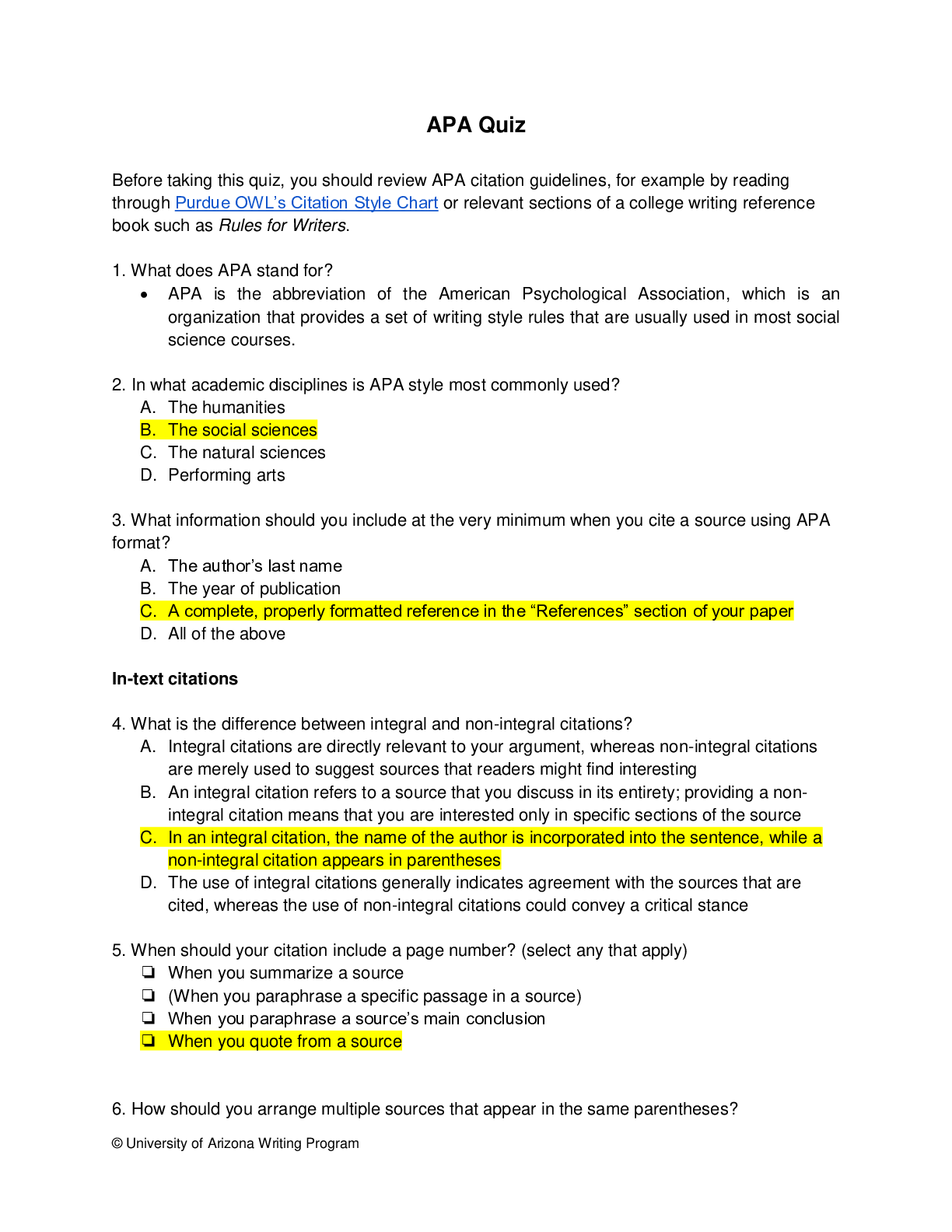

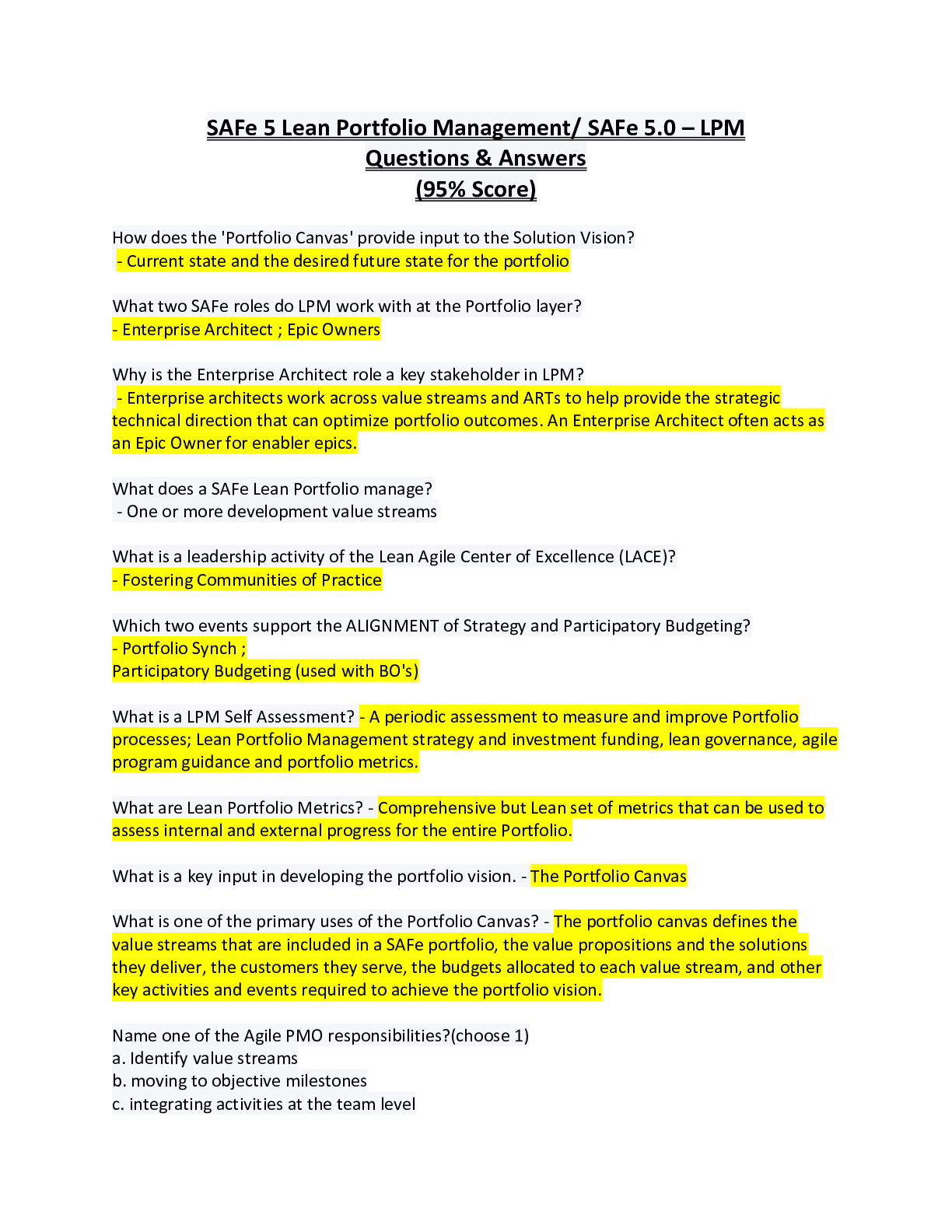

Week 2: Modeling in High Uncertainty Quiz 1. This question relates to content of Session 1 and is based on the following example. Consider a model for describing a random return on Stock C next week... , RC. According to this model, RC can be described using the following 5 scenarios. You can find these data in the posted file Stock C.xlsx. What is the expected value of the return on Stock C next week, i.e., what is the value of E[RC]? Choose the closest from the answers below. 2. This question relates to content of Session 1 and is based on the following example. Consider a model for describing a random return on Stock C next week, RC. According to this model, RC can be described using the following 5 scenarios. You can find these data in the posted file Stock C.xlsx. What is the standard deviation of the return on Stock C next week, i.e., what is the value of SD[RC]? Choose the closest from the answers below. 3. This question relates to content of Session 1 and is based on the following example. Consider a model for describing a random return on Stock C next week, RC. According to this model, RC can be described using the following 5 scenarios. You can find these data in the posted file Stock C.xlsx. What is the probability that the return on Stock C next week is negative? Choose the closest 4. This question relates to content of Sessions 1 and 2 and is based on the following example. Consider a model for describing random returns on Stocks D and E next week, RD and RE. According to this model, RD and RE can be described using the following 3 scenarios. You can find these data in the posted file Stocks DE.xlsx. Let E[RD] and E[RE] be the expected return values for Stocks D and E next week, respectively, and let SD[RD] and SD[RE] be the standard deviations of the returns for Stocks D and E next week, respectively. Which of the following statements is correct? 5. This question relates to content of Sessions 1 and 2 and is based on the following example. Consider a model for describing random returns on Stocks D and E next week, RD and RE. According to this model, RD and RE can be described using the following 3 scenarios. You can find these data in the posted file Stocks DE.xlsx. What is the value of the correlation coefficient between RD and RE? Choose the closest answer from the ones presented below. 6. This question relates to content of Sessions 1 and 2 and is based on the following example. Consider a model for describing random returns on Stocks D and E next week, RD and RE. According to this model, RD and RE can be described using the following 3 scenarios. You can find these data in the posted file Stocks DE.xlsx. Suppose that a financial company invests $100,000 in the Stock D and $200,000 in the Stock E now. What is the highest possible value of profit, in $, associated with this investment that the company can earn next week? Choose the closest answer from the ones presented below. 7. This question relates to content of Sessions 1 and 2 and is based on the following example. Consider a model for describing random returns on Stocks D and E next week, RD and RE. According to this model, RD and RE can be described using the following 3 scenarios. You can find these data in the posted file Stocks DE.xlsx. Under the investment plan of Q6, what is the expected value of profit, in $, that the company will earn next week? Choose the closest answer from the ones presented below. 8. This question relates to the two-stock example considered in Session 3. In answering these questions, you can use the Excel file TwoStocks_Solved.xlsx. Suppose that an investor is considering a portfolio with XA =75,000, XB = 25,000. In other words, the investor decides to put $75,000 in the Stock A and $25,000 in the Stock B “today”. What is the expected profit, in $, such a portfolio will earn tomorrow? Choose the closest answer from the ones presented below. 9. This question relates to the two-stock example considered in Session 3. In answering these questions, you can use the Excel file TwoStocks_Solved.xlsx. What is the value of the standard deviation of profits, in $, for the portfolio considered in Q8? Choose the closest answer from the ones presented below. 10. This question relates to the two-stock example considered in Session 3. In answering these questions, you can use the Excel file TwoStocks_Solved.xlsx. Suppose that an investor would like to split $100,000 between Stocks A and Stock B “today” so as to maximize the expected profit “tomorrow” irrespective of the standard deviation of the resulting profit. In other words, suppose that the investor “drops” the constraint on the maximum allowable value of the standard deviation of profits, while keeping the rest of the constraints in the portfolio problem. Which of the following choices describes the optimal portfolio in this case? [Show More]

Last updated: 1 year ago

Preview 1 out of 6 pages

.png)

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jul 04, 2022

Number of pages

6

Written in

Additional information

This document has been written for:

Uploaded

Jul 04, 2022

Downloads

0

Views

44