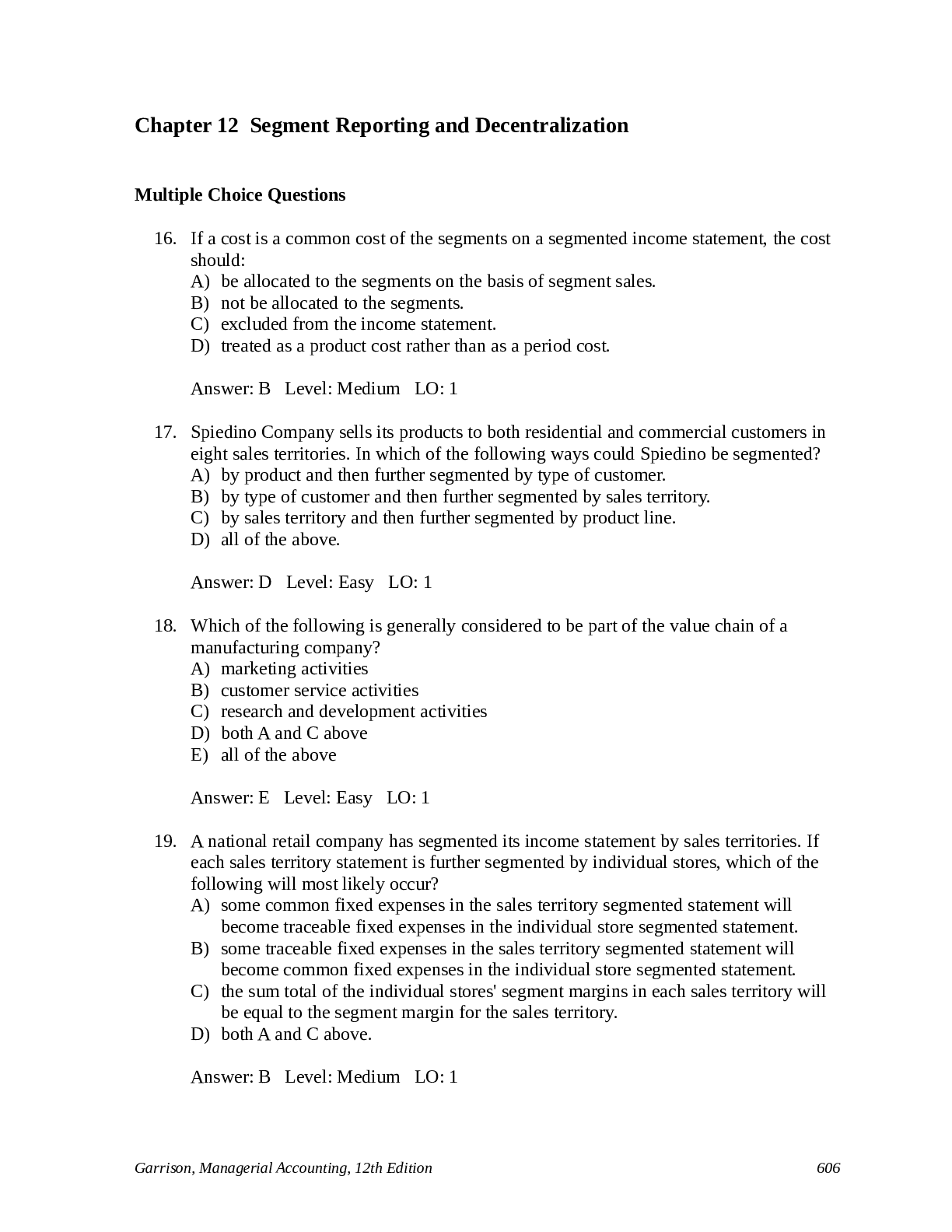

Financial Accounting > EXAM > Managerial_Accounting_Garrison Cost-of-Cap. Questions & Answers (All)

Managerial_Accounting_Garrison Cost-of-Cap. Questions & Answers

Document Content and Description Below

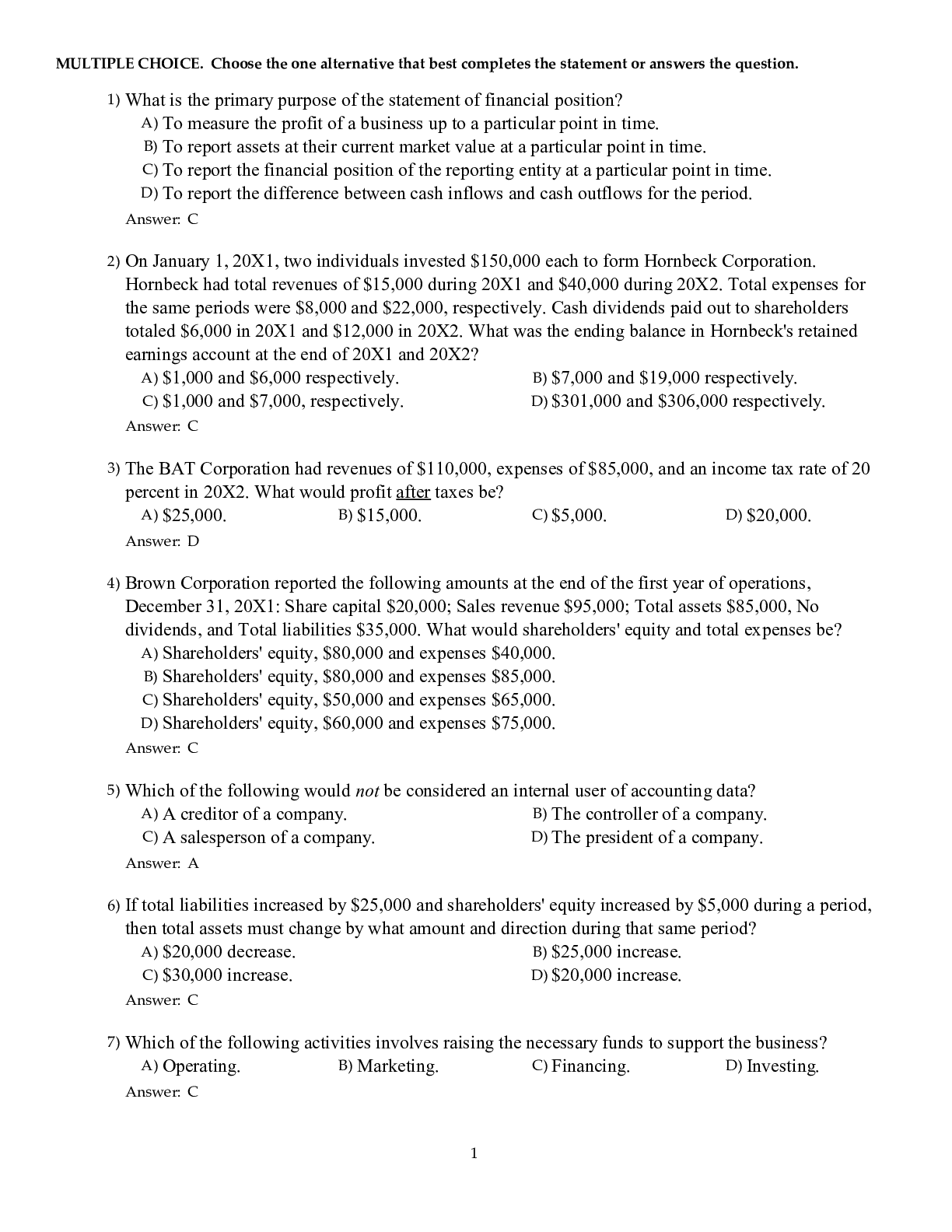

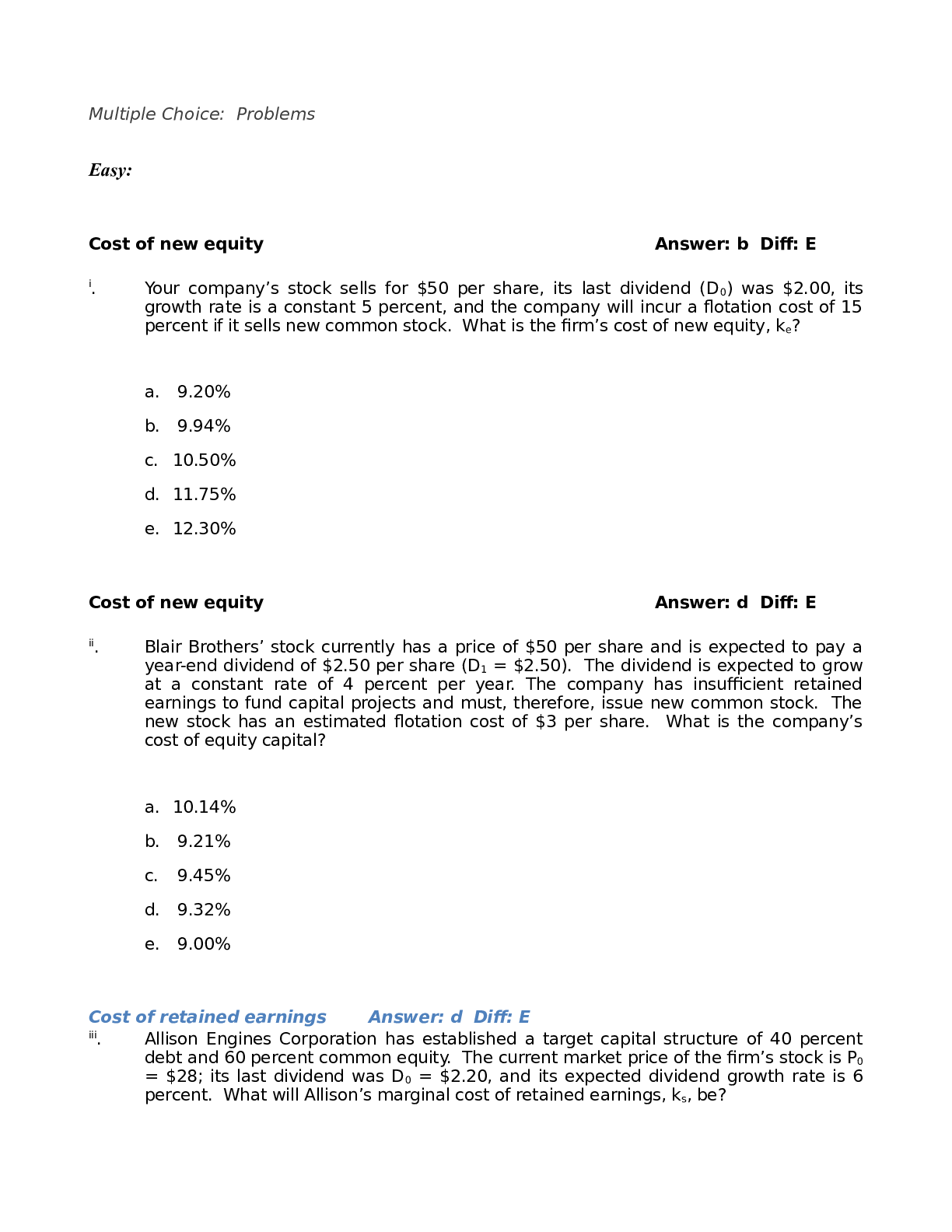

Cost of new equity Answer: b Diff: E i . Your company’s stock sells for $50 per share, its last dividend (D0) was $2.00, its growth rate is a constant 5 percent, and the company will incur a flot... ation cost of 15 percent if it sells new common stock. What is the firm’s cost of new equity, ke? a. 9.20% b. 9.94% c. 10.50% d. 11.75% e. 12.30% Cost of new equity Answer: d Diff: E ii . Blair Brothers’ stock currently has a price of $50 per share and is expected to pay a year-end dividend of $2.50 per share (D1 = $2.50). The dividend is expected to grow at a constant rate of 4 percent per year. The company has insufficient retained earnings to fund capital projects and must, therefore, issue new common stock. The new stock has an estimated flotation cost of $3 per share. What is the company’s cost of equity capital? a. 10.14% b. 9.21% c. 9.45% d. 9.32% e. 9.00% Cost of retained earnings Answer: d Diff: E iii . Allison Engines Corporation has established a target capital structure of 40 percent debt and 60 percent common equity. The current market price of the firm’s stock is P0 = $28; its last dividend was D0 = $2.20, and its expected dividend growth rate is 6 percent. What will Allison’s marginal cost of retained earnings, ks, be? a. 15.8% b. 13.9% c. 7.9% d. 14.3% e. 9.7% WACC Answer: a Diff: E iv. An analyst has collected the following information regarding Christopher Co.: The company’s capital structure is 70 percent equity and 30 percent debt. The yield to maturity on the company’s bonds is 9 percent. The company’s year-end dividend is forecasted to be $0.80 a share. The company expects that its dividend will grow at a constant rate of 9 percent a year. The company’s stock price is $25. The company’s tax rate is 40 percent. The company anticipates that it will need to raise new common stock this year, and total flotation costs will equal 10 percent of the amount issued. Assume the company accounts for flotation costs by adjusting the cost of capital. Given this information, calculate the company’s WACC. a. 10.41% b. 12.56% c. 10.78% d. 13.55% e. 9.29% WACCAnswer: a Diff: E v .Flaherty Electric has a capital structure that consists of 70 percent equity and 30 percent debt. The company’s long-term bonds have a before-tax yield to maturity of 8.4 percent. The company uses the DCF approach to determine the cost of equity. Flaherty’s common stock currently trades at $45 per share. The year-end dividend (D1) is expected to be $2.50 per share, and the dividend is expected to grow forever at a constant rate of 7 percent a year. The company estimates that it will have to issue new common stock to help fund this year’s projects. The flotation cost on new common stock issued is 10 percent, and the company’s tax rate is 40 percent. What is the company’s weighted average cost of capital, WACC? a. 10.73% b. 10.30% c. 11.31% d. 7.48% e. 9.89% WACCAnswer: b Diff: E vi.Billick Brothers is estimating its WACC. The company has collected the following information: Its capital structure consists of 40 percent debt and 60 percent common equity. The company has 20-year bonds outstanding with a 9 percent annual coupon that are trading at par. The company’s tax rate is 40 percent. The risk-free rate is 5.5 percent. The market risk premium is 5 percent. The stock’s beta is 1.4. What is the company’s WACC? a. 9.71% b. 9.66% c. 8.31% d. 11.18% e. 11.10% Divisional risk Answer: c Diff: E vii.Dandy Product’s overall weighted average required rate of return is 10 percent. Its yogurt division is riskier than average, its fresh produce division has average risk, and its institutional foods division has below-average risk. Dandy adjusts for both divisional and project risk by adding or subtracting 2 percentage points. Thus, the maximum adjustment is 4 percentage points. What is the risk-adjusted required rate of return for a low-risk project in the yogurt division? a. 6% b. 8% c. 10% d. 12% e. 14% Retained earnings break point Answer: e Diff: E viii.Stephenson & Sons has a capital structure that consists of 20 percent equity and 80 percent debt. The company expects to report $3 million in net income this year, and 60 percent of the net income will be paid out as dividends. How large must the firm’s capital budget be this year without it having to issue any new common stock? a. $ 1.20 million b. $13.00 million c. $ 1.50 million d. $ 0.24 million e. $ 6.00 million Medium: Cost of retained earnings Answer: d Diff: M ix.The common stock of Anthony Steel has a beta of 1.20. The risk-free rate is 5 percent and the market risk premium (kM - kRF) is 6 percent. Assume the firm will be able to use retained earnings to fund the equity portion of its capital budget. What is the company’s cost of retained earnings, ks? a. 7.0% b. 7.2% c. 11.0% d. 12.2% e. 12.4% Cost of external equity Answer: d Diff: M x .A company just paid a $2.00 per share dividend on its common stock (D0 = $2.00). The dividend is expected to grow at a constant rate of 7 percent per year. The stock currently sells for $42 a share. If the company issues additional stock, it must pay its investment banker a flotation cost of $1.00 per share. What is the cost of external equity, ke? a. 11.76% b. 11.88% c. 11.98% d. 12.22% e. 12.30% Component cost of debt Answer: b Diff: M xi.Hamilton Company’s 8 percent coupon rate, quarterly payment, $1,000 par value bond, which matures in 20 years, currently sells at a price of $686.86. The company’s tax rate is 40 percent. Based on the nominal interest rate, not the EAR, what is the firm’s component cost of debt for purposes of calculating the WACC? a. 3.05% b. 7.32% c. 7.36% d. 12.20% e. 12.26% WACC Answer: e Diff: M N xii.Trojan Services’ CFO is interested in estimating the company’s WACC and has collected the following information: The company has bonds outstanding that mature in 26 years with an annual coupon of 7.5 percent. The bonds have a face value of $1,000 and sell in the market today for $920. The risk-free rate is 6 percent. The market risk premium is 5 percent. The stock’s beta is 1.2. The company’s tax rate is 40 percent. The company’s target capital structure consists of 70 percent equity and 30 percent debt. The company uses the CAPM to estimate the cost of equity and does not include flotation costs as part of its cost of capital. What is Trojan’s WACC? a. 9.75% b. 9.39% c. 10.87% d. 9.30% e. 9.89% WACC Answer: a Diff: M xiii.A company has determined that its optimal capital structure consists of 40 percent debt and 60 percent equity. Assume the firm will not have enough retained earnings to fund the equity portion of its capital budget. Also, assume the firm accounts for flotation costs by adjusting the cost of capital. Given the following information, calculate the firm’s weighted average cost of capital. kd = 8%. Net income = $40,000. Payout ratio = 50%. Tax rate = 40%. P0 = $25. Growth = 0%. Shares outstanding = 10,000. Flotation cost on additional equity = 15%. a. 7.60% b. 8.05% c. 11.81% d. 13.69% e. 14.28% WACC Answer: b Diff: M xiv.Hatch Corporation’s target capital structure is 40 percent debt, 50 percent common stock, and 10 percent preferred stock. Information regarding the company’s cost of capital can be summarized as follows: The company’s bonds have a nominal yield to maturity of 7 percent. The company’s preferred stock sells for $42 a share and pays an annual dividend of $4 a share. The company’s common stock sells for $28 a share, and is expected to pay a dividend of $2 a share at the end of the year (i.e., D1 = $2.00). The dividend is expected to grow at a constant rate of 7 percent a year. The firm will be able to use retained earnings to fund the equity portion of its capital budget. The company’s tax rate is 40 percent. What is the company’s weighted average cost of capital (WACC)? a. 9.25% b. 9.70% c. 10.03% d. 10.59% e. 11.30% [Show More]

Last updated: 1 year ago

Preview 1 out of 37 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jul 15, 2022

Number of pages

37

Written in

Additional information

This document has been written for:

Uploaded

Jul 15, 2022

Downloads

0

Views

60