Business > QUESTIONS & ANSWERS > Health and Accident Insurance 25 Questions with 100% Correct Answers (All)

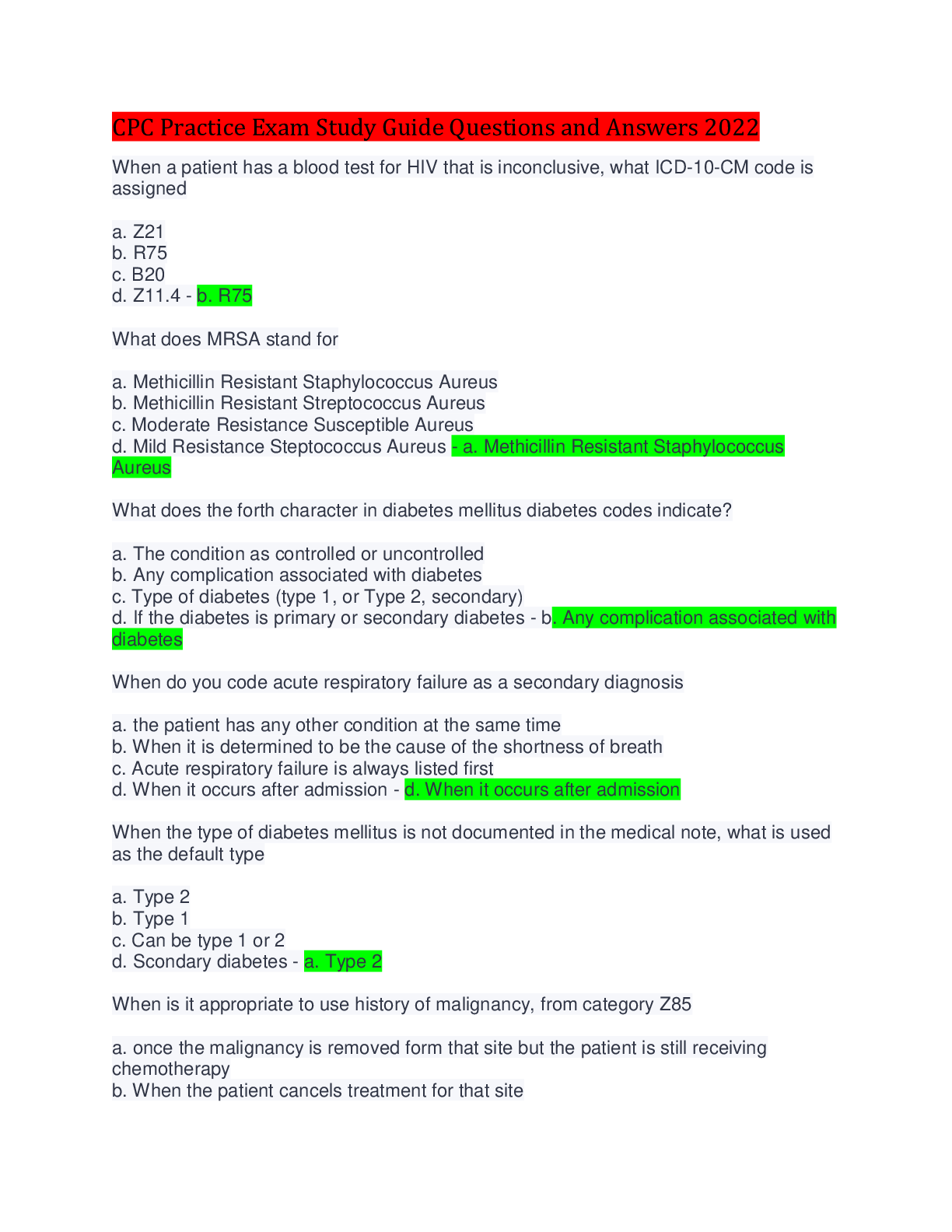

Health and Accident Insurance 25 Questions with 100% Correct Answers

Document Content and Description Below

Health and Accident Insurance 25 Questions with 100% Correct Answers A group Disability Income plan that pays tax-free benefits to covered employees is considered Non-contributory partially contri... butory group contributory fully contributory Answerfully- contributory According to HIPAA, when an insured individual leaves an employer and immediately begins working for a new company that offers group health insurance, the individual is eligible for coverage upon hire must wait 360 days to be eligible for coverage must continue coverage with the previous employer is eligible for only health insurance, not life or dental insurance AnswerIs eligible for coverage upon hire An employer is issued a group medical insurance policy. This single contract is known as a(n) entire contract master policy certificate of coverage employer contract AnswerMaster Policy An insurer has the right to recover payment made to the insured from the negligent party. These rights are called contributory indemnity estoppel subrogation Answersubrogation Coordination of Benefits regulation applies to all of the following plans EXCEPTGroup vision plan Preferred Provider Organization plan Self-funded group health plan Group health plan AnswerPPOs Credit Accident and Health plans are designed to permit creditors the ability to require that coverage be purchased through insurers of their choice provide permanent protection help pay off existing loans during periods of disability not permit free choice of coverage selection AnswerHelp pay off existing loans during periods of disability Health insurance involves two perils, accident and ____. death sickness disability liability Answersickness In an employer-sponsored contributory group Disability Income plan, the employer pays 60% of the premium and each employee pays 40% of the premium. Any income benefits paid are taxed to the employee at Employee has no tax liability 40% of the benefit 60% of the benefit 100% of benefit Answer60% of the benefit Justin is receiving disability income benefits from a group policy paid for by his employer. How are these benefits treated for tax purposes? Partially taxable income Non-taxable incomeTaxable income Conditionally taxable income AnswerTaxable income Mark continues working after the age of 65 and is covered through his employer's group health plan. Which of the following statements is TRUE? He's not eligible for Medicare His group health plan and Medicare pay 50/50 Medicare is the secondary payer Medicare is the primary payer AnswerMedicare is the secondary payer Ron has a new employer and wishes to enroll in the company's group health plan. In determining whether his pre-existing health condition applies, Ron cannot have more than a ___ day gap without previous health insurance. 45 63 75 90 Answer63 [Show More]

Last updated: 1 year ago

Preview 1 out of 32 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 04, 2022

Number of pages

32

Written in

Additional information

This document has been written for:

Uploaded

Aug 04, 2022

Downloads

0

Views

182

.png)

.png)

.png)

.png)

.png)