Finance > EXAM REVIEW > FINC 5000 Week 9 Final Exam Part A Answers (Webster University) (Study Guide) 2019_Guaranteed 100% S (All)

FINC 5000 Week 9 Final Exam Part A Answers (Webster University) (Study Guide) 2019_Guaranteed 100% Score.

Document Content and Description Below

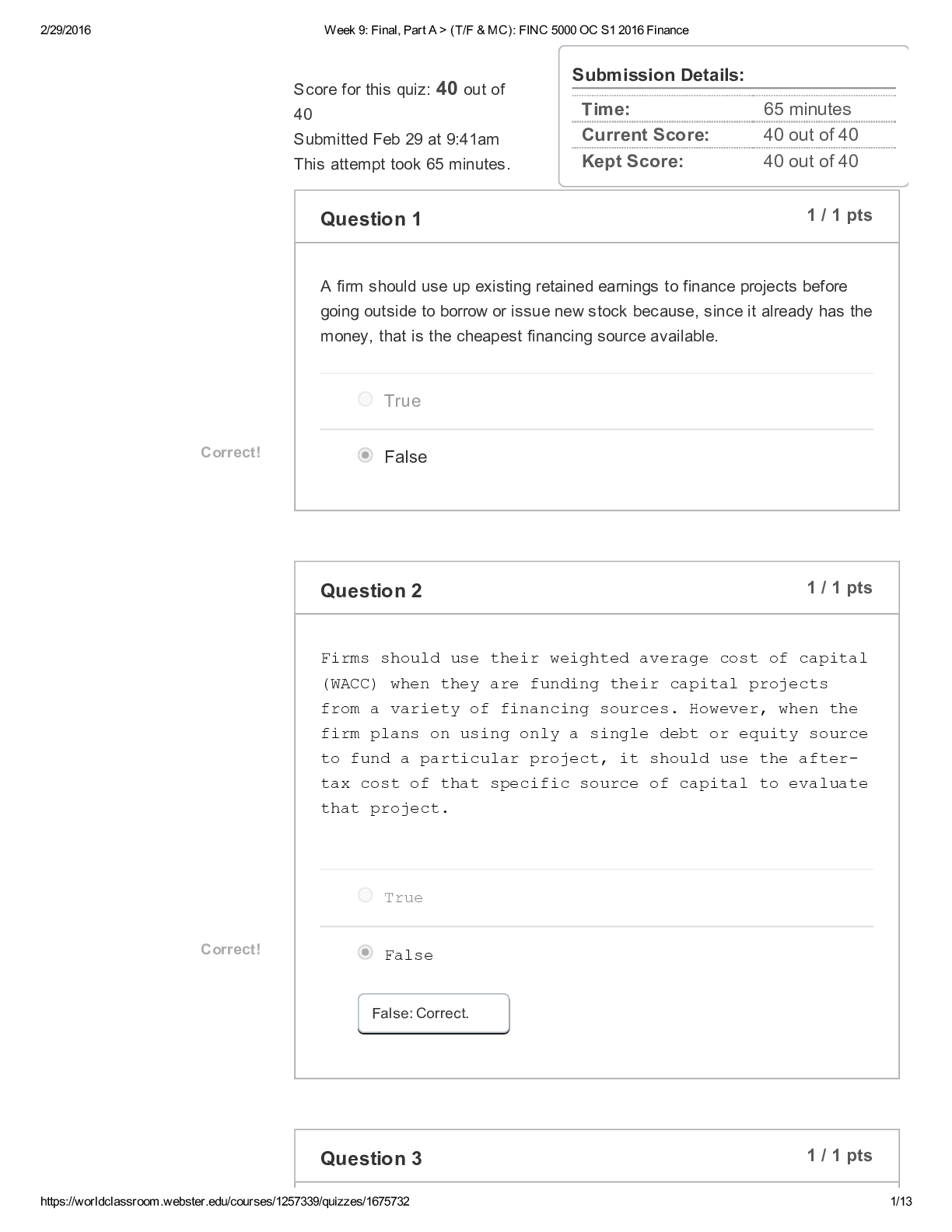

FINC 5000 Week 9 Final Exam Part A Answers (Webster University) A firm should use up existing retained earnings to finance projects before going outside to borrow or issue new stock because, since it ... already has the money, that is the cheapest financing source available. Firms should use their weighted average cost of capital (WACC) when they are funding their capital projects from a variety of financing sources. However, when the firm plans on using only a single debt or equity source to fund a particular project, it should use the aftertax cost of that specific source of capital to evaluate that project. If a proposed investment has an NPV of zero, it means that you can expect to get a zero percent return from it if it is adopted. Conflicts between two mutually exclusive projects, where the NPV method chooses one project but the IRR method chooses the other, should generally be resolved in favor of the project with the higher NPV. Whenever a firm goes into debt, it is using financial leverage. Three factors affecting a firm's business risk are the variability of demand for the firm's products, variability of the products' sales prices, and the extent to which operating costs are fixed. As a firm's sales grow its current asset accounts tend to increase. For instance, as sales increase the firm's inventories increase and its level of accounts payable will increase. Thus, spontaneously generated funds will arise from transaction accounts that increase as sales increase. An increase in a current asset must be accompanied by a corresponding increase in a current liability. If a firm takes actions that reduce its days sales outstanding (DSO), then, other things held constant, this will lengthen its cash conversion cycle (CCC). Suppose the RiskFree Rate is 8%, the Expected Return this year on the S&P 500 stock market index is 13%, and the stock of Joe's Junkyard has a Beta of 1.4. Given these conditions what is the required rate of return for Joe's stock? To raise money to finance the capital budget projects you've been evaluating, your firm plans to borrow money at an interest rate of 14%, beforetax. If your firm's effective tax rate is 40%, what is the aftertax cost in percent of the new loan? Here is a condensed version of your firm's balance sheet: Total liabilities..................$30,000,000 Preferred stock................$10,000,000 Common Stock................$60,000,000 Total assets...$100,000,000 Total liabilities & equity...$100,000,000 If your firm's aftertax cost of debt is 6%, the cost of preferred stock is 10%, and the cost of common stock is 11%, what is the Weighted Average Cost of Capital (WACC)? Michigan Mattress Company is considering the purchase of land and the construction of a new plant. The land, which would be bought immediately (at t = 0), has a cost of $100,000 and the building, which would be erected at the end of the first year (t = 1), would cost $500,000. It is estimated that the firm's aftertax cash flow will be $100,000 starting at the end of the second year, and that this incremental inflow would increase at a 10 percent rate annually over the next 10 years. What is the approximate payback period? loyd Enterprises has a project which has the following cash flows: Year 0 1 2 3 4 5 Cash Flow $200,000 50,000 100,000 150,000 40,000 25,000 The cost of capital is 10 percent. What is the project's discounted payback? Which of the following events is likely to encourage a company to raise its target debt ratio? Which of the following statements is most correct? Ridgefield Enterprises has total assets of $300 million and EBIT of $45 million. The company currently has no debt in its capital structure. The company is contemplating a recapitalization where it will issue debt at 10 percent and use the proceeds to buy back shares of the company's common stock. If the company proceeds with the recapitalization, its operating income, total assets, and tax rate will remain the same. Which of the following will occur as a result of the recapitalization? If you constructed a set of pro forma financial statements for 2014 and found that projected Total Assets exceeded projected Total Liabilities and Equity by $11,250, you would know that: Considering each action independently and holding other things constant, which of the following actions would reduce a firm's need for additional capital? Consider the following condensed Income Statement: Sales COGS Gross Profit 2013 $8,000,000 6,500,000 1,500,000 Sales growth in 2014 is expected to be 15% If COGS is assumed to vary directly with sales, then Gross Profit for 2014 will be: Kenney Corporation recently reported the following income statement for 2013 (numbers are in millions of dollars): Sales Total operating costs EBIT Interest Earnings before tax (EBT) Taxes (40%) Net income available to common shareholders $7,000 3,000 4,000 200 3,800 1,520 2,280 The company forecasts that its sales will increase by 10 percent in 2014 and its operating costs will increase in proportion to sales. The company's interest expense is expected to remain at $200 million, and the tax rate will remain at 40 percent. The company plans to pay out 50 percent of its net income as dividends, the other 50 percent will be additions to retained earnings. What is the forecasted addition to retained earnings for 2014? Other things held constant, which of the following will cause an increase in net working capital? Paul Stone can get 3/15, net 65 from his suppliers. Paul would like to delay paying the suppliers as long as possible because his cash account balance is very low, but his Dad, a famous financial expert, recommends that he borrow from his local bank at 10% and pay early to take advantage of the discount. Which of the following should Paul do? Stone's Stones and Rocks buys on terms of 2/10, net 30 from its suppliers. If it pays on the 8th day, taking the discount, what is the percent cost of the trade credit that it receives? [Show More]

Last updated: 1 year ago

Preview 1 out of 13 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jun 09, 2021

Number of pages

13

Written in

Additional information

This document has been written for:

Uploaded

Jun 09, 2021

Downloads

0

Views

55

.png)