Education > QUESTIONS & ANSWERS > Test Bank Chapter 6 Accounting and the Time Value of Money. (All)

Test Bank Chapter 6 Accounting and the Time Value of Money.

Document Content and Description Below

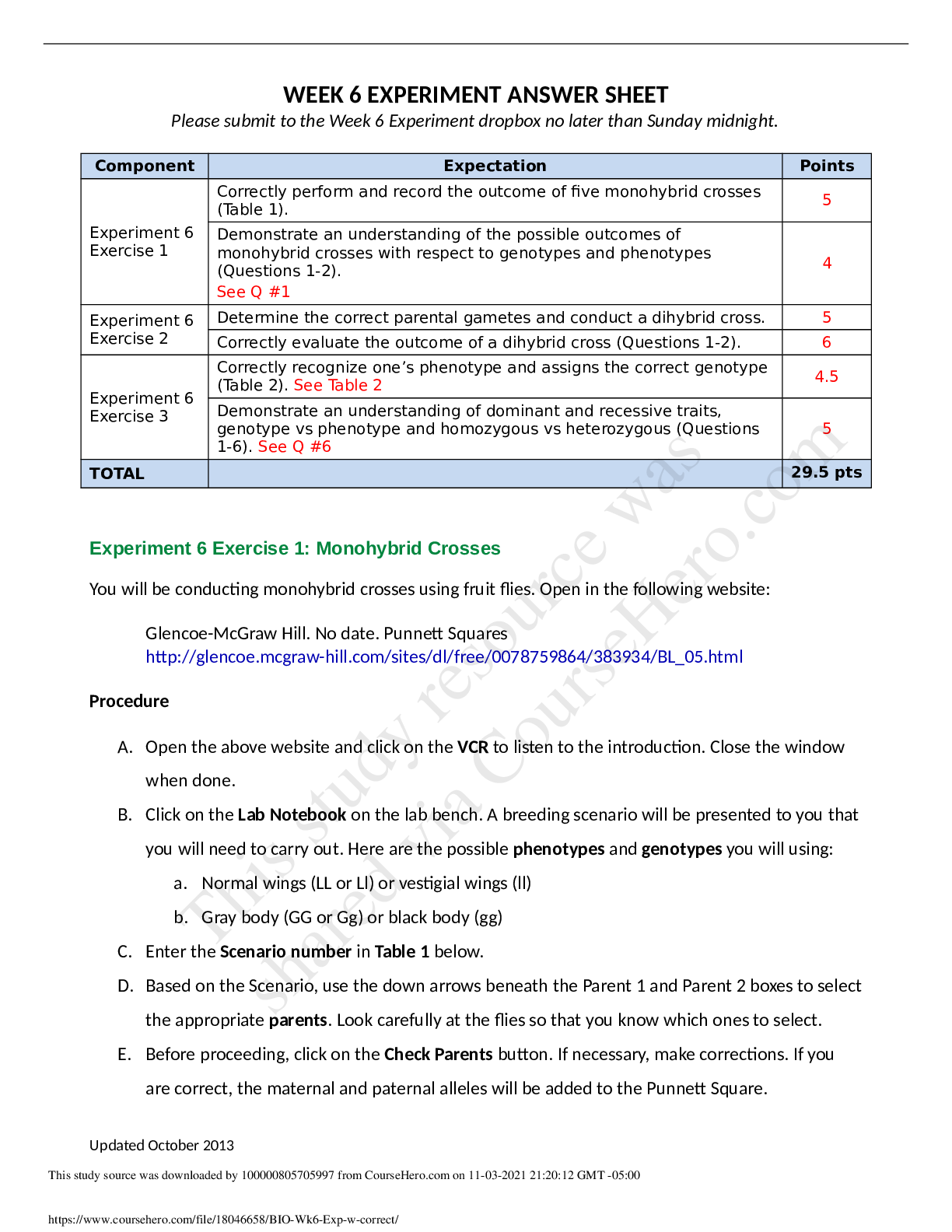

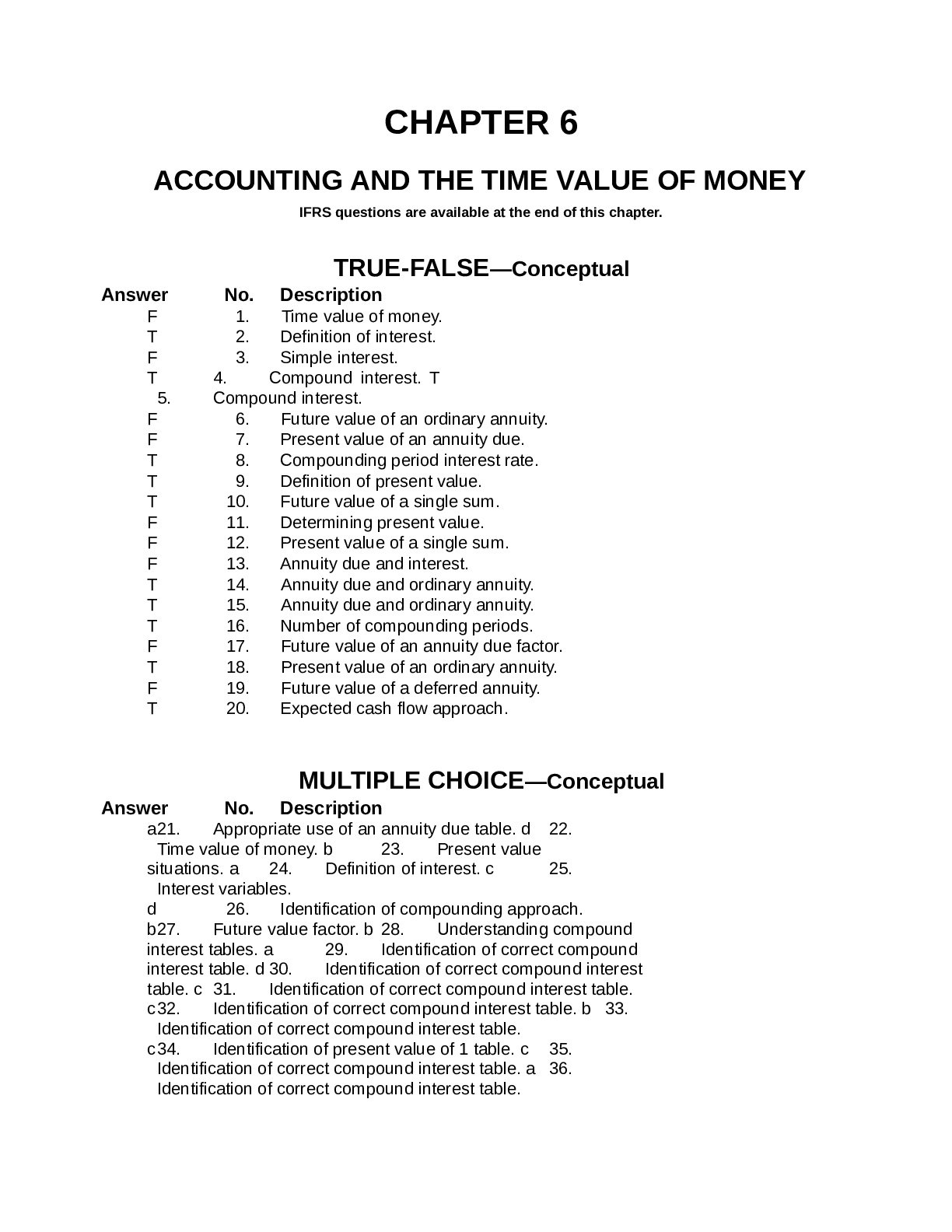

Test Bank Chapter 6 Accounting and the Time Value of Money. CHAPTER 6 ACCOUNTING AND THE TIME VALUE OF MONEY IFRS questions are available at the end of this chapter. TRUE-FA... LSE—Conceptual Description F 1. Time value of money. T 2. Definition of interest expense. F 3. Simple interest. T 4. Compound interest. T 5. Compound interest. F 6. Future value of an ordinary annuity. F 7. Present value of an annuity due. T 8. Compounding period interest rate. T 9. Definition of present value. T 10. Future value of a single sum. F 11. Determining present value. F 12. Present value of a single sum. F 13. Annuity due and interest. T 14. Annuity due and ordinary annuity. T 15. Annuity due and ordinary annuity. T 16. Number of compounding periods. F 17. Future value of an annuity due factor. T 18. Present value of an ordinary annuity. F 19. Future value of a deferred annuity. T 20. Determining present value of bonds. MULTIPLE CHOICE—Conceptual Description a 21. Appropriate use of an annuity due table. d 22. Time value of money. b 23. Present value situations. a 24. Definition of interest. c 25. Interest variables. d 26. Identification of compounding approach. b 27. Future value factor. b 28. Understanding compound interest tables. a 29. Identification of correct compound interest table. d 30. Identification of correct compound interest table. c 31. Identification of correct compound interest table. c 32. Identification of correct compound interest table. b 33. Identification of correct compound interest table. c 34. Identification of present value of 1 table. c S35. Identification of correct compound interest table. a S36. Identification of correct compound interest table. MULTIPLE CHOICE—Conceptual (cont.) Description a S37. Present value of an annuity due table. c P38. Definition of an annuity due. a P39. Identification of compound interest concept. d P40. Identification of compound interest concept. d 41. Identification of number of compounding periods. a 42. Adjust the interest rate for time periods. d 43. Definition of present value. c P44. Compound interest concepts. a 45. Difference between ordinary annuity and annuity due. c 46. Future value of 1 and present value of 1 relationship. b 47. Identify future value of 1 concept. d 48. Determine best bonus option d 49. Identify future value of an ordinary annuity b 50. Identify future value of an ordinary annuity c P51. Future value of an annuity due factor. c 52. Determine the timing of rents of an annuity due. b 53. Factors of an ordinary annuity and an annuity due. c 54. Determine present value of an ordinary annuity. b 55. Identification of a future value of an ordinary annuity of 1. b 56. Present value of an ordinary annuity and an annuity due. b 57. Difference between an ordinary annuity and an annuity due. b 58. Present value of ordinary annuity and present value of annuity due relationship c 59. Identify present value of ordinary annuity concept. c 60. Determine least costly option. d 61. Definition of deferred annuities. P These questions also appear in the Problem-Solving Survival Guide. S These questions also appear in the Study Guide. MULTIPLE CHOICE—Computational Description a 62. Calculate the future value of 1. d 63. Calculate amount of interest paid. d 64. Interest compounded quarterly. c 65. Calculate present value of a future amount. b 66. Calculate a future value. a 67. Calculate a future value of an annuity due. b 68. Calculate a future value. c 69. Calculate a future value. c 70. Calculate present value of a future amount. d 71. Calculate present value of a future amount. a 72. Calculate present value of an annuity due. d 73. Calculate the future value of 1. b 74. Present value of a single sum. c 75. Present value of a single sum, unknown number of periods. c 76. Future value of a single sum. MULTIPLE CHOICE—Computational (cont.) Description b 77. Present value of a single sum. b 78. Present value of a single sum, unknown number of periods. c 79. Future value of a single sum. d 80. Calculate the present value of 1. c 81. Calculate the future value of 1. a 82. Calculate the present value of 1. c 83. Calculate interest rate. a 84. Calculate number of years. b 85. Calculate the future value of 1. c 86. Calculate the present value of 1. c 87. Calculate the present value of 1. d 88. Calculate the present value of 1 and present value of an ordinary annuity. d 89. Calculate number if years. b 90. Calculate the amount of annual deposit. d 91. Calculate the amount of annual deposit. d 92. Calculate the amount of annual deposit. a 93. Present value of an ordinary annuity. b 94. Present value of an annuity due. c 95. Future value of an ordinary annuity. d 96. Future value of a annuity due. a 97. Present value of an ordinary annuity. b 98. Present value of an annuity due. c 99. Future value of an ordinary annuity. d 100. Future value of an annuity due. a 101. Calculate future value of an annuity due. a 102. Calculate future value of an ordinary annuity. d 103. Calculate future value of an annuity due. c 104. Calculate annual deposit for annuity due. d 105. Calculate cost of machine purchased on installment. a 106. Calculate present value of an ordinary annuity. b 107. Calculate present value of an annuity due. b 108. Calculate cost of machine purchased on installment. c 109. Calculate cost of machine purchased on installment. a 110. Calculate the annual rents of leased equipment. b 111. Calculate present value of an investment in equipment. b 112. Calculate proceeds from issuance of bonds. b 113. Calculate proceeds from issuance of bonds. c 114. Calculate present value of an ordinary annuity. d 115. Calculate interest rate. a 116. Calculate present value of an annuity due. b 117. Calculate effective interest rate. d 118. Calculate present value of an ordinary annuity. b 119. Calculate present value of an annuity due. b 120. Calculate annual interest rate. c 121. Calculate interest rate. b 122. Calculate annual lease payment. a 123. Calculate selling price of bonds. MULTIPLE CHOICE—CPA Adapted Description c 124. Calculate interest expense of bonds. d 125. Identification of correct compound interest table. c 126. Calculate interest revenue of a zero-interest-bearing note. a 127. Appropriate use of an ordinary annuity table. b 128. Calculate annual deposit of annuity due. a 129. Calculate the present value of a note. a 130. Calculate the present value of a note. d 131. Determine the issue price of a bond. b 132. Determine the acquisition cost of a franchise. EXERCISES Item Description E6-133 Present and future value concepts. E6-134 Compute estimated goodwill. E6-135 Present value of an investment in equipment. E6-136 Future value of an annuity due. E6-137 Present value of an annuity due. E6-138 Compute the annual rent. E6-139 Calculate the market price of a bond. E6-140 Calculate the market price of a bond. PROBLEMS Item Description P6-141 Present value and future value computations. P6-142 Annuity with change in interest rate. P6-143 Present value of ordinary annuity and annuity due. P6-144 Finding the implied interest rate. P6-145 Calculation of unknown rent and interest. P6-146 Deferred annuity. CHAPTER LEARNING OBJECTIVES 1. Identify accounting topics where the time value of money is relevant. 2. Distinguish between simple and compound interest. 3. Use appropriate compound interest tables. 4. Identify variables fundamental to solving interest problems. 5. Solve future and present value of 1 problems. 6. Solve future value of ordinary and annuity due problems. 7. Solve present value of ordinary and annuity due problems. 8. Solve present value problems related to deferred annuities and bonds. SUMMARY OF LEARNING OBJECTIVES BY QUESTIONS Item Type Item Type Item Type Item Type Item Type Item Type Item Type Learning Objective 1 1. TF 2. TF 21. MC 22. MC 23. MC 24. MC 25. MC Learning Objective 2 3. TF 4. TF 5. TF 26. MC 62. MC 63. 124. MC Learning Objective 3 6. TF 27. MC 30. MC 33. MC S36. MC 64. MC 7. TF 28. MC 31. MC 34. MC S37. MC 125. MC 8. TF 29. MC 32. MC S35. MC P38. MC Learning Objective 4 9. TF P39. MC P40. MC 41. MC 42. MC Learning Objective 5 10. TF 46. MC 69. MC 76. MC 82. MC 88. MC 135. E 11. TF 47. MC 70. MC 77. MC 83. MC 89. MC 141. P 12. TF 48. MC 71. MC 78. MC 84. MC 124. MC 43. MC 65. MC 73. MC 79. MC 85. MC 126. MC P44. MC 66. MC [Show More]

Last updated: 1 year ago

Preview 1 out of 27 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Nov 04, 2020

Number of pages

27

Written in

Additional information

This document has been written for:

Uploaded

Nov 04, 2020

Downloads

0

Views

39

.png)

.png)

.png)

.png)

.png)