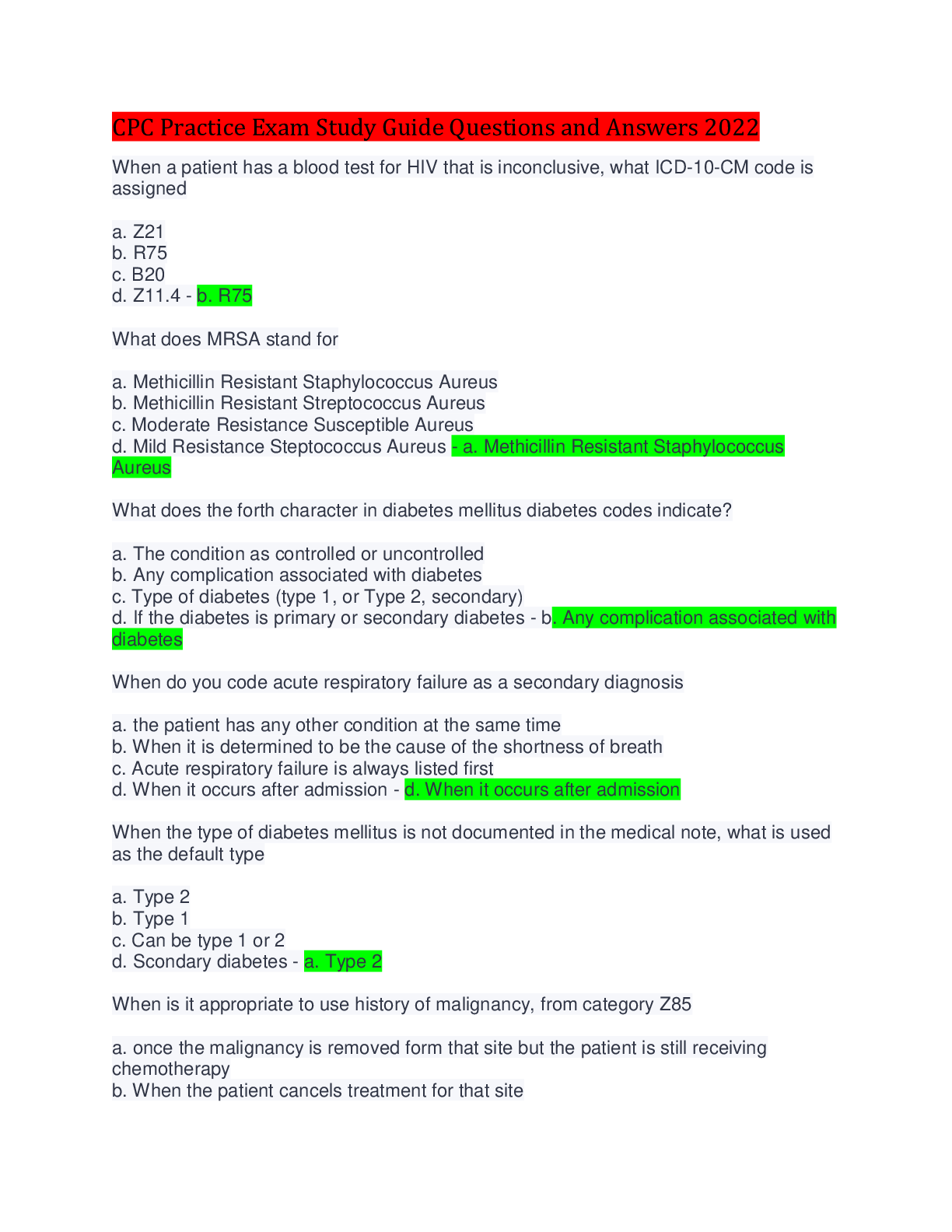

Health Care > QUESTIONS & ANSWERS > AHIP Questions and Answers (2022/2023)/ 2022 Ahip Review UNIT 1 Medicare Basics (All)

AHIP Questions and Answers (2022/2023)/ 2022 Ahip Review UNIT 1 Medicare Basics

Document Content and Description Below

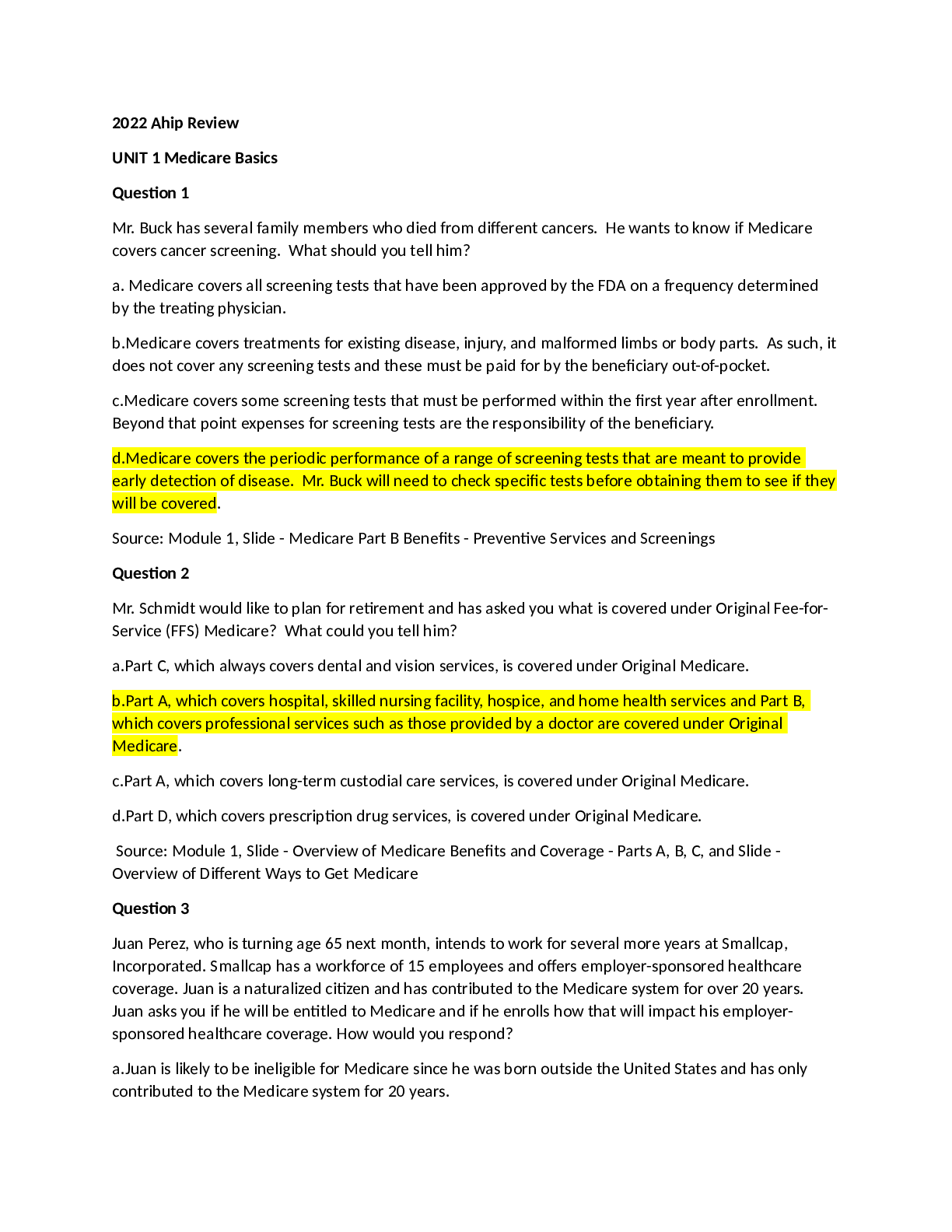

2022 Ahip Review UNIT 1 Medicare Basics Question 1 Mr. Buck has several family members who died from different cancers. He wants to know if Medicare covers cancer screening. What should you tell h... im? a. Medicare covers all screening tests that have been approved by the FDA on a frequency determined by the treating physician. b.Medicare covers treatments for existing disease, injury, and malformed limbs or body parts. As such, it does not cover any screening tests and these must be paid for by the beneficiary out-of-pocket. c.Medicare covers some screening tests that must be performed within the first year after enrollment. Beyond that point expenses for screening tests are the responsibility of the beneficiary. d.Medicare covers the periodic performance of a range of screening tests that are meant to provide early detection of disease. Mr. Buck will need to check specific tests before obtaining them to see if they will be covered. Source: Module 1, Slide - Medicare Part B Benefits - Preventive Services and Screenings Question 2 Mr. Schmidt would like to plan for retirement and has asked you what is covered under Original Fee-forService (FFS) Medicare? What could you tell him? a.Part C, which always covers dental and vision services, is covered under Original Medicare. b.Part A, which covers hospital, skilled nursing facility, hospice, and home health services and Part B, which covers professional services such as those provided by a doctor are covered under Original Medicare. c.Part A, which covers long-term custodial care services, is covered under Original Medicare. d.Part D, which covers prescription drug services, is covered under Original Medicare. Source: Module 1, Slide - Overview of Medicare Benefits and Coverage - Parts A, B, C, and Slide - Overview of Different Ways to Get Medicare Question 3 Juan Perez, who is turning age 65 next month, intends to work for several more years at Smallcap, Incorporated. Smallcap has a workforce of 15 employees and offers employer-sponsored healthcare coverage. Juan is a naturalized citizen and has contributed to the Medicare system for over 20 years. Juan asks you if he will be entitled to Medicare and if he enrolls how that will impact his employersponsored healthcare coverage. How would you respond? a.Juan is likely to be ineligible for Medicare since he was born outside the United States and has only contributed to the Medicare system for 20 years. b. Juan is likely to be eligible for Medicare once he turns age 65 and if he enrolls Medicare would become the primary payor of his healthcare claims but Smallcap must continue to offer him coverage under its employer-sponsored group health plan and would become a secondary payor. c.Juan is likely to be eligible for Medicare once he turns age 65 and if he enrolls his employer-sponsored coverage would continue to be the primary payor while Medicare would be considered a secondary payor of his healthcare claims. Incorrect: Medicare is the primary payor for individuals who have group health coverage due to their continued employment with a small employer. A small group health plan is one offered by a company with fewer than 20 employees. d. Juan is likely to be eligible for Medicare once he turns age 65 and if he enrolls Medicare would become the primary payor of his healthcare claims and Smallcap does not have to continue to offer him coverage comparable to those under age 65 under its employer-sponsored group health plan. Source: Module 1, Slide - Eligibility for Part A and Part B Benefits and Slide - Medicare for Individuals Who Are Still Working - Small GHPs and Slide - Medicare Coordination with Employer Group Health Plans Question 4 Mr. Bauer is 49 years old, but eighteen months ago he was declared disabled by the Social Security Administration and has been receiving disability payments. He is wondering whether he can obtain coverage under Medicare. What should you tell him? a.After receiving such disability payments for 24 months, he will be automatically enrolled in Medicare, regardless of age. b.Individuals who become eligible for such disability payments only have to wait 12 months before they can apply for coverage under Medicare. c.Individuals receiving such disability payments from the Social Security Administration continue to receive those payments but only become eligible for Medicare upon reaching age 65. d.He became eligible for Medicare when his disability eligibility determination was first made. Source: Module 1, Slide - Medicare Enrollment Part A & B Question 5 Ms. Moore plans to retire when she turns 65 in a few months. She is in excellent health and will have considerable income when she retires. She is concerned that her income will make it impossible for her to qualify for Medicare. What could you tell her to address her concern? a.Medicare is a program for people who have incomes and assets below specific limits, so you will have to find out her exact financial situation before telling her whether she can obtain Medicare coverage. b.Eligibility for Medicare is based on whether or not a person has ever been employed by the federal government. If she or her husband were ever employed by the federal government, she can enroll in Medicare. c.Medicare is a program for people of all ages with specific mental health disabilities. Since she is in excellent health, she would not qualify, but should instead look into her state’s Medicaid program if she wants further coverage. d.Medicare is a program for people age 65 or older and those under age 65 with certain disabilities, endstage renal disease, and Lou Gehrig’s disease so she will be eligible for Medicare. Source: Module 1, Slide - Eligibility for Part A and Part B Benefits Question 6 Mrs. Duarte is enrolled in Original Medicare Parts A and B. She has recently reviewed her Medicare Summary Notice (MSN) and disagrees with a determination that partially denied one of her claims for services. What advice would you give her? a. Mrs. Duarte should file an appeal of this initial determination within 120 days of the date she received the MSN in the mail. b.Mrs. Duarte has no right to appeal this determination since her claim has been partially paid. c. Mrs. Duarte should file an appeal of this initial determination within 90 days of the date she received the MSN in the mail. If she still disagrees with Medicare Administrative Contractor's (MAC's) further decision she should request a reconsideration by a qualified independent party within 10 days. Incorrect: Beneficiaries must file an appeal related to Part A or B services within 120 days of the date they get the MSN in the mail. If a beneficiary disagrees with the Medicare Administrative Contractor’s decision, he/she has 180 days after getting the decision notice to request a reconsideration by a Qualified Independent Contractor. d.Mrs. Duarte should request a reconsideration of the decision by a qualified independent party within 60 days of the date she received the MSN in the mail. Source: Module 1, Slide - Appeals related to Part A and Part B Coverage and Payment Determinations. Question 7 Mr. Moy's wife has a Medicare Advantage plan, but he wants to understand what coverage Medicare Supplemental Insurance provides since his health care needs are different from his wife’s needs. What could you tell Mr. Moy? a.Medicare Supplemental Insurance would cover his dental, vision and hearing services only. b.Medicare Supplemental Insurance would help cover his Part A and Part B deductibles or coinsurance in Original Fee-for-Service (FFS) Medicare as well as possibly some services that Medicare does not cover. c.Medicare Supplemental Insurance would cover all of his IRS approved health care expenditures not covered under Original Fee-for-Service (FFS) Medicare. d.Medicare Supplemental Insurance would cover his long-term care services. Source: Module 1, Slide - Medigap (Medicare Supplement Insurance) [Show More]

Last updated: 1 year ago

Preview 1 out of 41 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jul 20, 2022

Number of pages

41

Written in

Additional information

This document has been written for:

Uploaded

Jul 20, 2022

Downloads

0

Views

115

.png)

.png)

.png)

.png)

.png)

.png)

.png)