Business > QUESTIONS & ANSWERS > Everfi module 1-6 (business finance) Quizzes_ Answered/updated 2023. (All)

Everfi module 1-6 (business finance) Quizzes_ Answered/updated 2023.

Document Content and Description Below

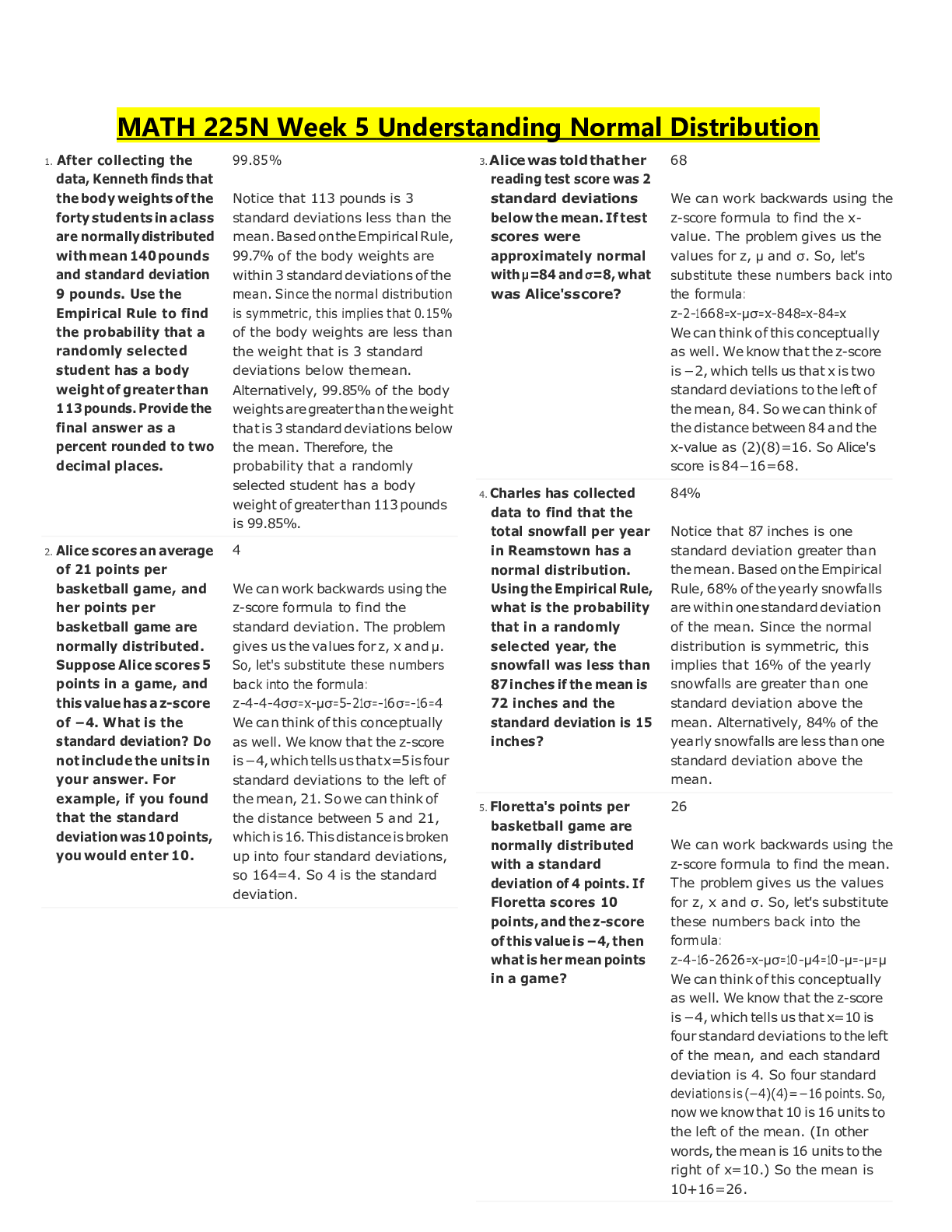

Everfi module 1-6 (business finance) Tests_ Answered/updated 2023. 1. ___ are good places to look to find your current expenses when building your budget 2. a 529 plan can help you ave more mon... ey than a traditional savings account because... 3. a mutual fund is... 4. a stock is... 5. all of the following may be a part of your benefits package available from your employer, except: 6. everyone interested in post secondary education should complete the FASFA because... 7. for most careers, which degree will most likely result in the highest lifetime earnings? 8. healthcare, paid time off, disability insurance, and matching contributions to a retirement account are all types of ___ available from your employer - 9. how can you avoid spending more than what is in your bank account? - 10. how can you ensure you don't go over your budget? 11. how does the government pay for roads, schools, and emergency services? 12. how would you reconcile your bank account to avoid spending more than you have? 13. if there is a mistake with one of your bank accounts, who should you contact to resolve the issue? 14. if there is an issue with your bank statement or account balance, who should you contact to resolve the issue? 15. in addition to needs, what should you plan for first when creating a budget? 16. investing is best for... 17. list the 4 year colleges from least to most expensive... 18. net pay is NOT... 19. paying only the minimum balance on your credit card can lead to... 20. preparing to pay for higher education can start in 9th grade or earlier by... - 21. recommended methods to protect yourself from identity theft and fraud include ___ 22. savings accounts typically offer more interest than what type of account? - 23. secured loans are less costly than unsecured loans because ___ 24. t/f: a savings account that compounds interest daily will earn a higher return than a savings account that pays simple interest daily 25. t/f: generally, the more education you receive, the higher your lifetime earnings will be 26. t/f: how much you're being paid is the only thing you need to consider when considering a job offer 27. t/f: there is no relationship between the level of education received and lifetime earnings 28. t/f: when considering a job offer, you should consider how much you're being paid and any other employee benefits before you accept the offer 29. t/f: when considering a job offer, you should only consider how much you're being paid before you accept the offer 30. t/f: your financial institution can't help you if there is a mistake on your bank account statement 31. textbooks, transportation and room and board are all... 32. the ___ is a flexible market that allows you to work short-term, independent jobs 33. the envelope method, notebook and pencil, and online software are all methods of ___ 34. to maintain a good credit score you must ___ 35. using a loan could help with the purchase of which of the following? 36. what can affect whether a public or private university is affordable 37. what could be a good option available to you if you are behind on loan payments? 38. what do you need in order to fill our your 1040? 39. what do you NOT need in order to fill out your 1040? 40. what is a benefit of having a good credit score? 41. what is a positive reason for using a credit card to finance purchases 42. what is net pay? 43. what is NOT a reason to compelete the FASFA? 44. what is NOT a recommended method to protect you form identity theft? - expensive specialty locking or monitoring service 45. what is NOT considered an additional cost beyond tuition for higher education? 46. what is NOT true about emergency funds? 47. what is NOT true about the Free Application for Federal Student Aid (FASFA)? 48. what is the best option for affording a Bachelorś degree? 49. what is the purpose of the W-4 form? 50. what is true about the FASFA? 51. what option will NOT be available if you are behind on loan payments? 52. what should you do before you approach an ATM? 53. what should you do before you use an ATM? 54. what should you do before you withdraw money from the ATM? 55. what type of federal funding is free money, but is based on financial need only? 56. when looking for pre-approval on a car loan you should... 57. when you start a new job, you fill out a W-4 form to... 58. which item is important to consider when selecting a credit card? 59. which of the following financial institutions typically have the highest fees? 60. which of the following is a benefit of using a budget? 61. which of the following is a possible tax or deduction that they may show up on your paycheck? 62. which of the following is NOT a benefit of using a budget? 63. which of the following is NOT a common feature of a financial institution? - 64. which of the following is NOT a possible tax or deduction that could come out of your paycheck? 65. which of the following is NOT a possible tax or deduction that could show up on your paycheck? 66. which of the following is NOT considered part of your benefits package available from your employer? 67. which of the following is TRUE regarding unexpected expenses? 68. which of the following should NOT be considered when setting current budget? 69. which of the following should you consider when setting a budget? 70. which of the following statements about check cashing companies is FALSE? 71. which of the following statements about check cashing companies is TRUE? 72. which of the following statements about investing is FALSE? 73. which of the following statements about investing is TRUE? 74. which of the following statements about savings account is FALSE? 75. which of the following statements about savings accounts is FALSE? - 76. which of the following statements about stocks is TRUE? 77. which of the following statements is true about taxes? 78. which of the following statements is TRUE? 79. which of the following will help you protect yourself from identity theft and fraud? 80. which savings account will earn you the least money? 81. which savings account will earn you the most money? 82. which type of bank account is best for everyday transactions? 83. which type of bank account typically offers the least (if any) interest? - 84. why is it important to reconcile your bank statements? 85. your employer sends you a ___ form that tells you how much you've made and how much you've paid in taxes in the last year [Show More]

Last updated: 1 year ago

Preview 1 out of 6 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jan 07, 2023

Number of pages

6

Written in

Additional information

This document has been written for:

Uploaded

Jan 07, 2023

Downloads

0

Views

140

Exam Questions and Correct Answers Graded A+.png)

.png)