Financial Accounting > QUESTIONS & ANSWERS > Variable and Absorption Costing Unit Product Costs and Income Statements Questions and Answers 100% (All)

Variable and Absorption Costing Unit Product Costs and Income Statements Questions and Answers 100%

Document Content and Description Below

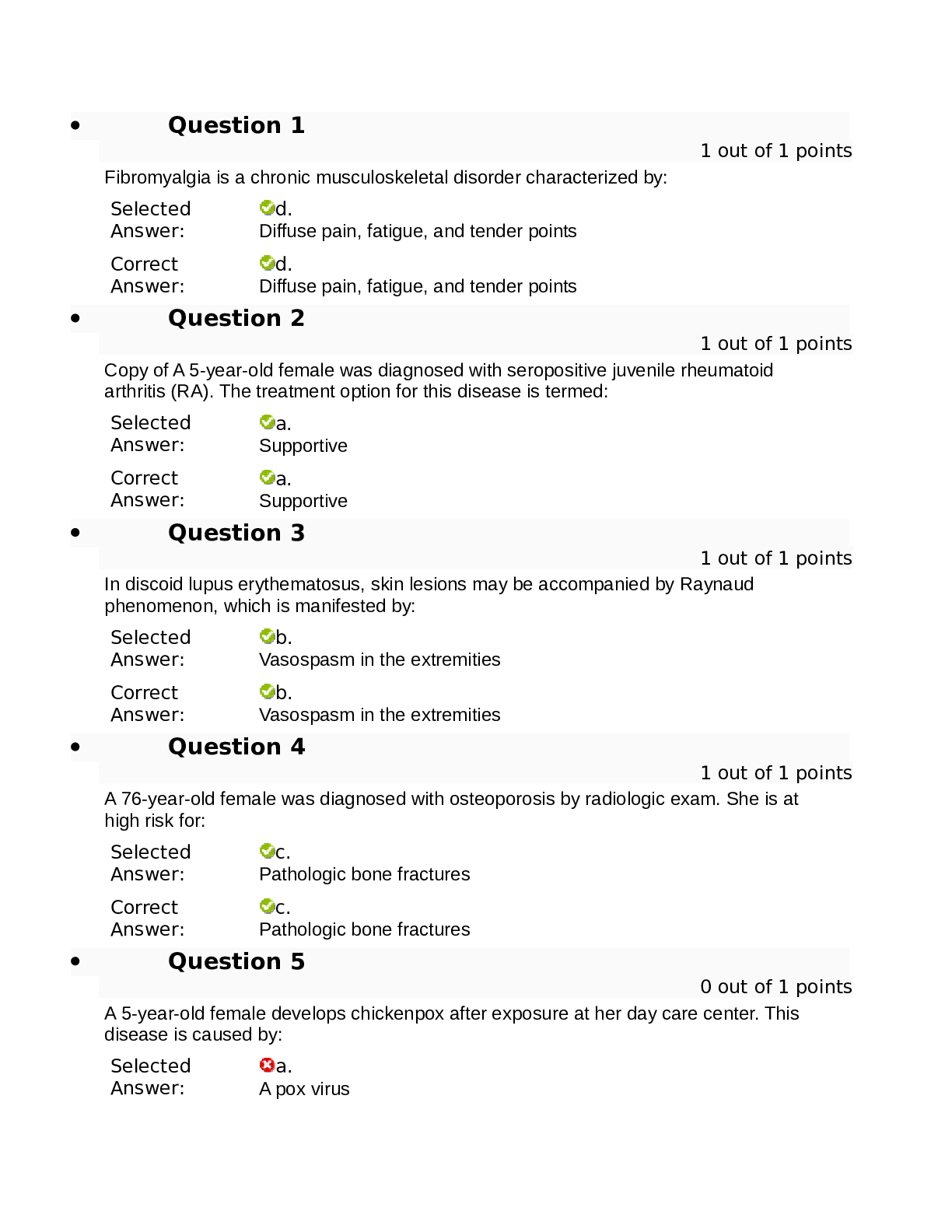

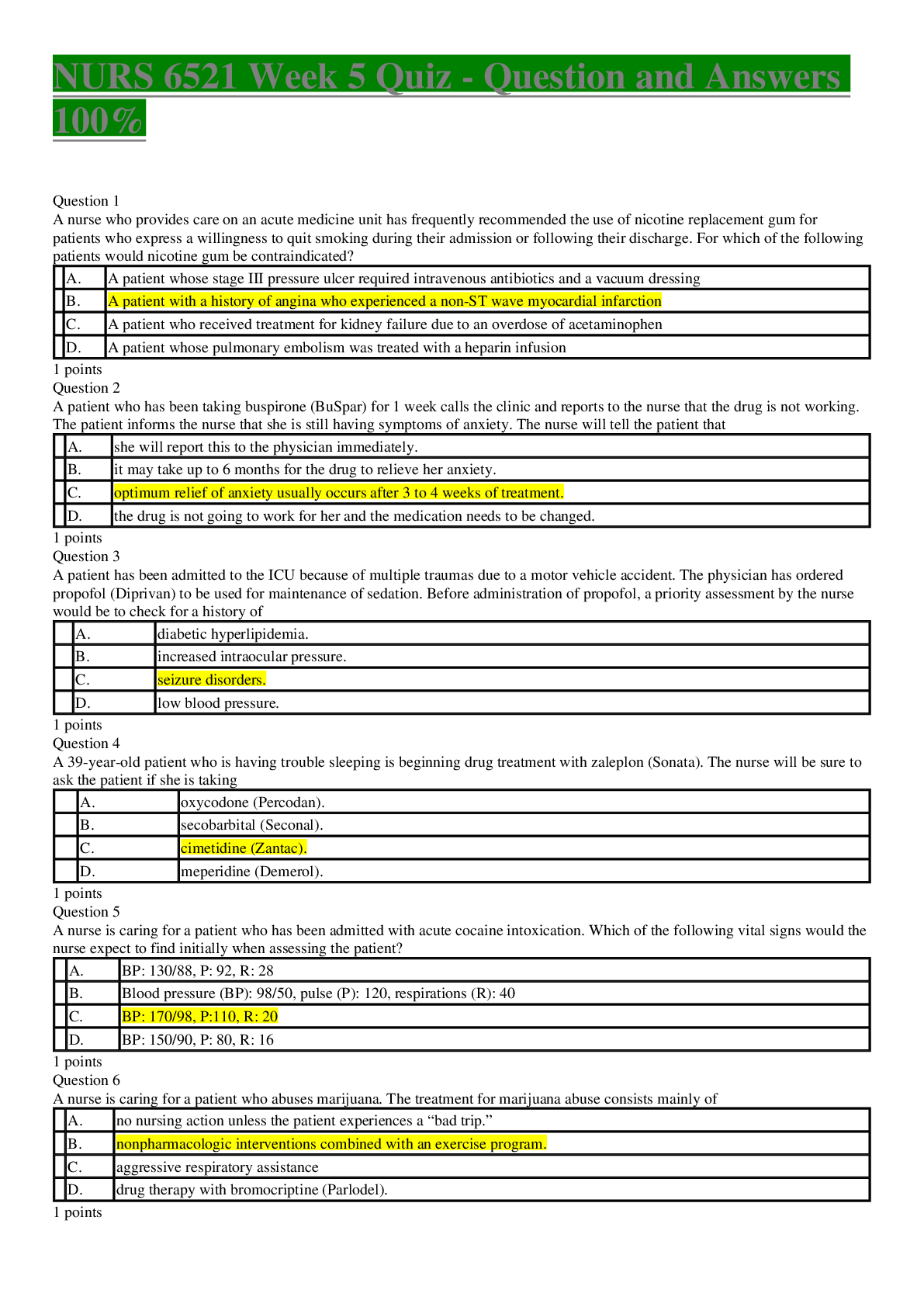

EXERCISE 6-6 Variable and Absorption Costing Unit Product Costs and Income Statements [LO6-1, LO6-2] Lynch Company manufactures and sells a single product. The following costs were incurred during th... e company's first year of operations: During the year, the company produced 25,000 units and sold 20,000 units. The selling price of the company's product is $50 per unit. Required: 1. Assume that the company uses absorption costing: a. Compute the unit product cost. b. Prepare an income statement for the year. 2. Assume that the company uses variable costing: a. Compute the unit product cost. b. Prepare an income statement for the year. Exercise 6-6 (30 minutes) 1. a. The unit product cost under absorption costing would be: Direct materials........................................................ $ 6 Direct labor.............................................................. 9 Variable manufacturing overhead............................ 3 Total variable costs................................................... 18 Fixed manufacturing overhead ($300,000 ÷ 25,000 units)......................................................... 12 Absorption costing unit product cost....................... $30 b. The absorption costing income statement: Sales (20,000 units × $50 per unit)................... $1,000,00 0 Cost of goods sold (20,000 units × $30 per unit)................................................................. 600,000 Gross margin...................................................... 400,000 Selling and administrative expenses [(20,000 units × $4 per unit) + $190,000]..... 270,000 Net operating income........................................ $ 130,00 This study source was downloaded by 100000796615030 from CourseHero.com on 08-05-2021 14:57:46 GMT -05:00 https://www.coursehero.com/file/13173721/Exercise-6-6solution/ This study resource was shared via CourseHero.com 0 2. a. The unit product cost under variable costing would be: Direct materials....................... $ 6 Direct labor.............................. 9 Variable manufacturing overhead............................... 3 Variable costing unit product cost....................................... $18 b. The variable costing income statement: Sales (20,000 units × $50 per unit).... $1,000,00 0 Variable expenses: Variable cost of goods sold (20,000 units × $18 per unit)......... $360,00 0 Variable selling expense (20,000 units × $4 per unit)........... 80,00 0 440,000 Contribution margin............................. 560,000 Fixed expenses: Fixed manufacturing overhead.......... 300,000 Fixed selling and administrative expense.......................................... 190,00 0 490,000 Net operating income.......................... $ 70,000 [Show More]

Last updated: 1 year ago

Preview 1 out of 2 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$8.00

Document information

Connected school, study & course

About the document

Uploaded On

Aug 05, 2021

Number of pages

2

Written in

Additional information

This document has been written for:

Uploaded

Aug 05, 2021

Downloads

0

Views

55

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

answers.png)

Coronary Artery Disease and Acute Coronary Syndrome.png)

.png)