Business > QUESTIONS & ANSWERS > SOPHIA PATHWAYS Principals of Finance Milestone 1,2,3,4 Questions and Answers 100% Correct! (All)

SOPHIA PATHWAYS Principals of Finance Milestone 1,2,3,4 Questions and Answers 100% Correct!

Document Content and Description Below

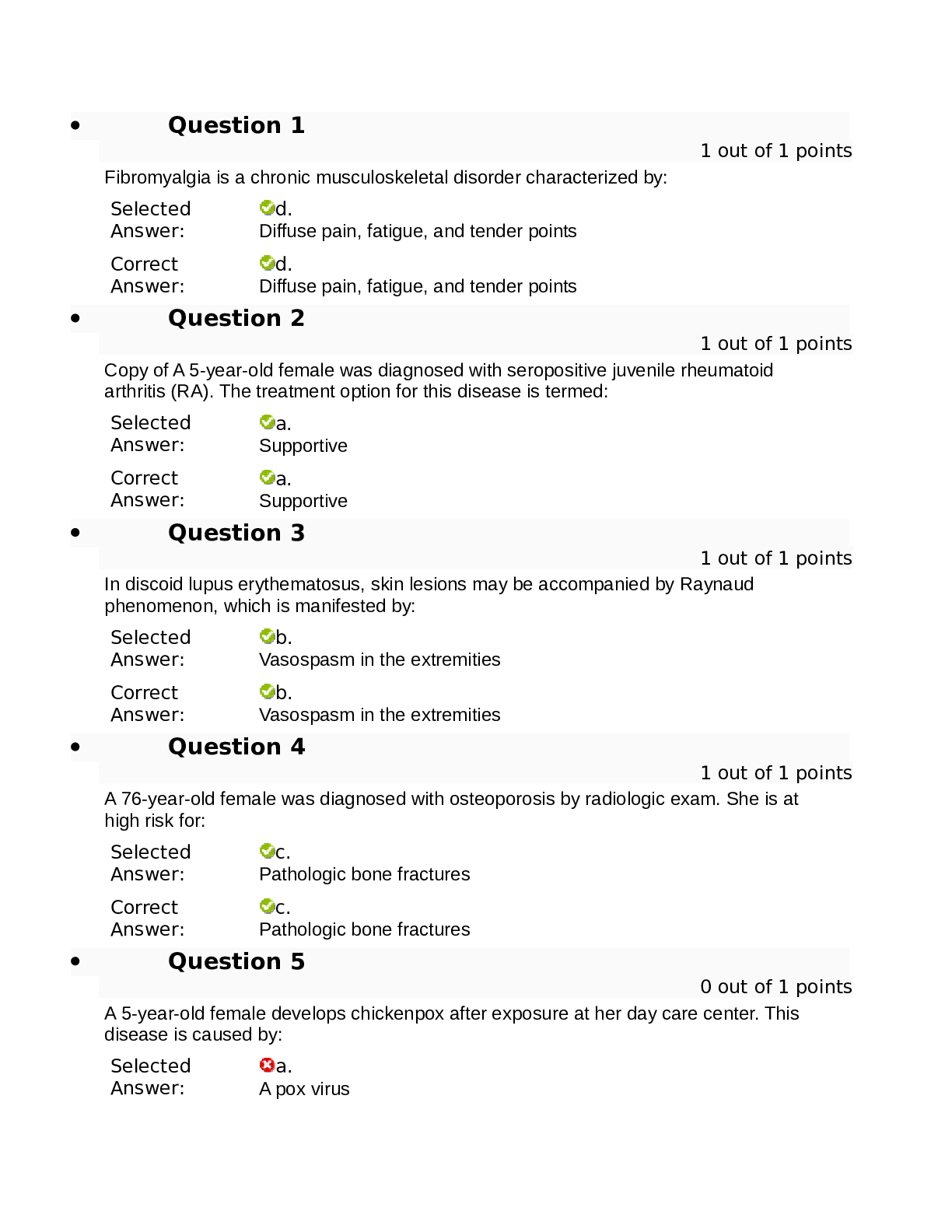

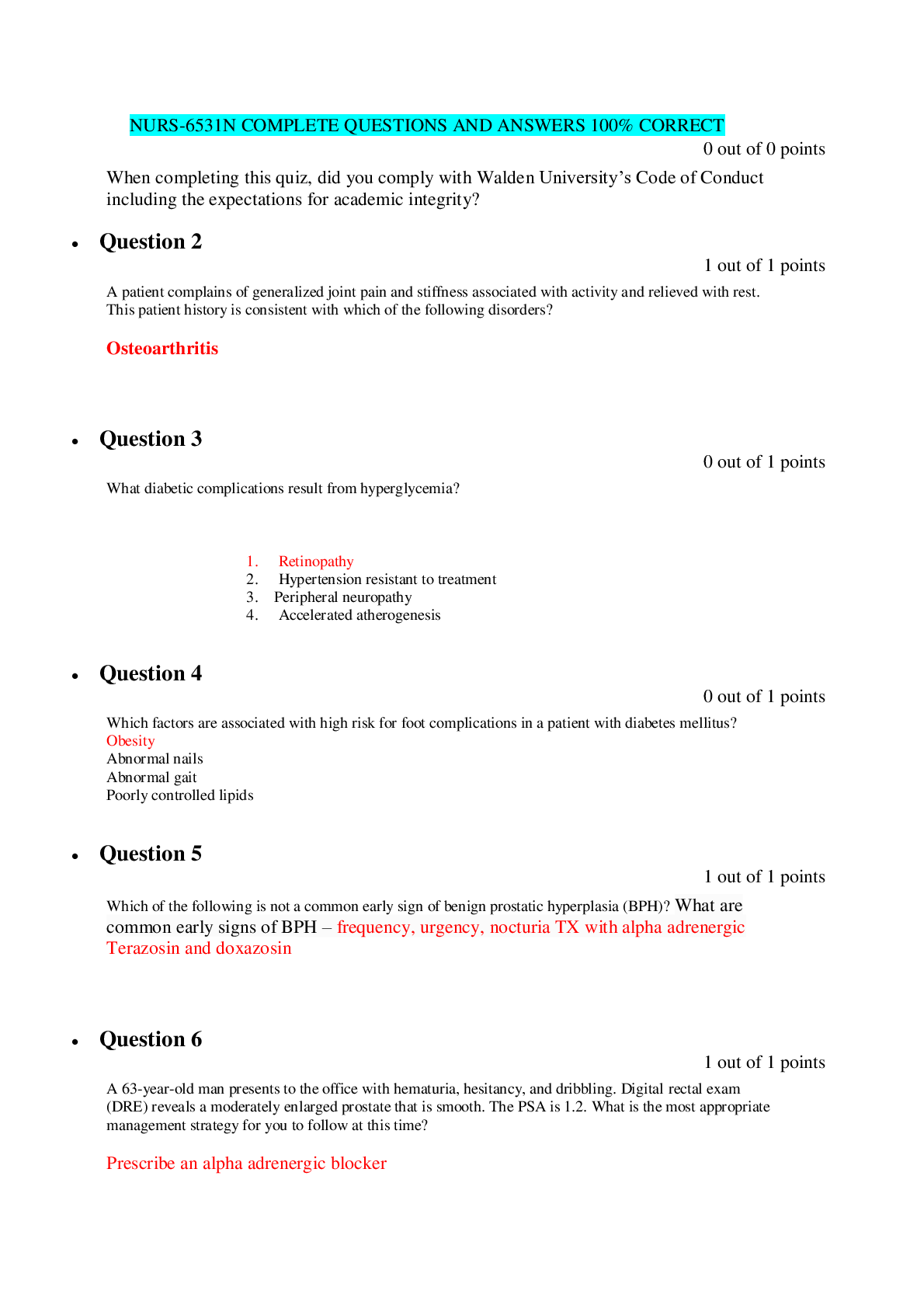

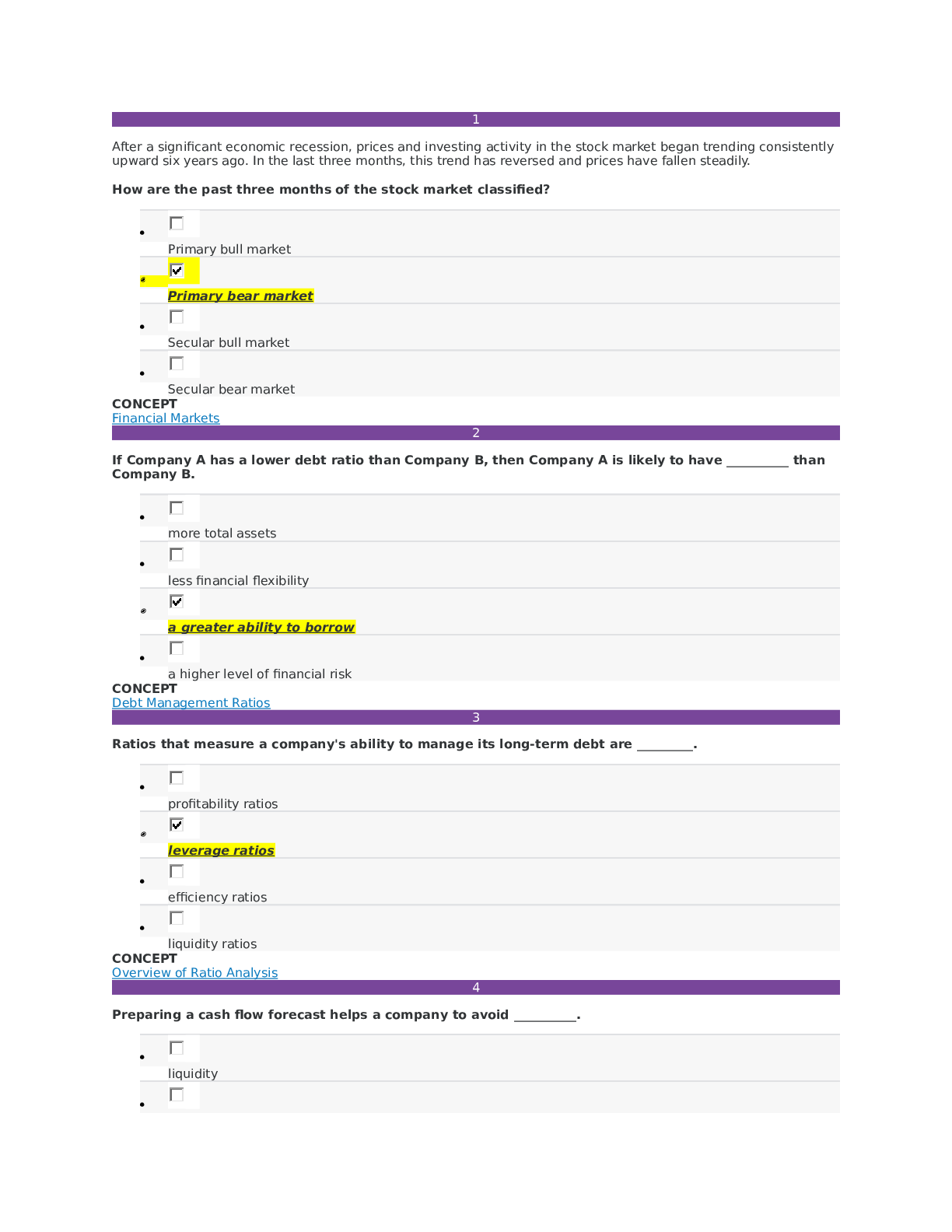

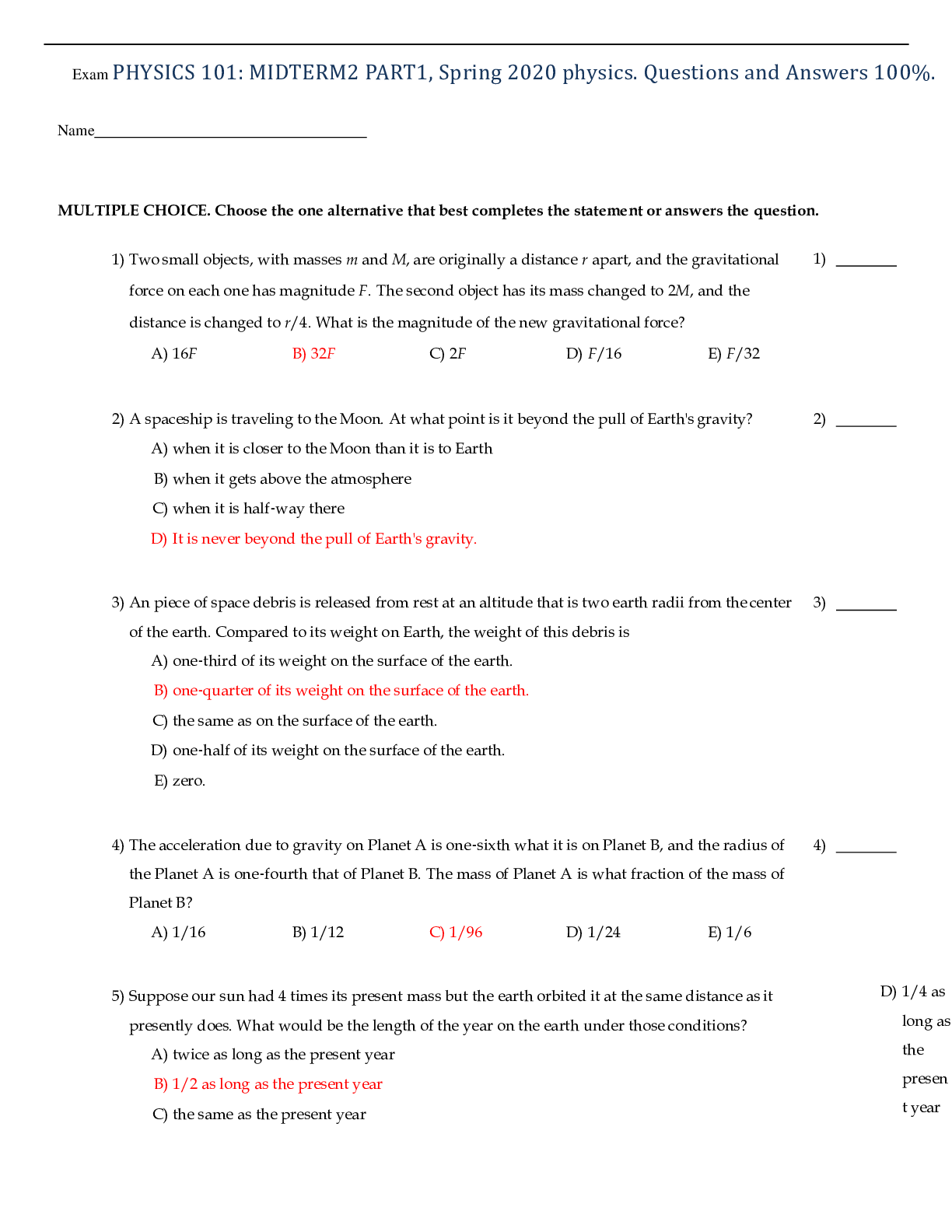

After a significant economic recession, prices and investing activity in the stock market began trending consistently upward six years ago. In the last three months, this trend has reversed and price... s have fallen steadily. How are the past three months of the stock market classified? Primary bull market Primary bear market Secular bull market Secular bear market CONCEPT Financial Markets 2 If Company A has a lower debt ratio than Company B, then Company A is likely to have __________ than Company B. more total assets less financial flexibility a greater ability to borrow a higher level of financial risk CONCEPT Debt Management Ratios 3 Ratios that measure a company's ability to manage its long-term debt are _________. profitability ratios leverage ratios efficiency ratios liquidity ratios CONCEPT Overview of Ratio Analysis 4 Preparing a cash flow forecast helps a company to avoid __________. liquidity net losses higher financing costs opportunity costs CONCEPT Building a Cash Budget 5 Xander is looking for ways to reduce his non-operating expenses to improve his company's overall financial performance, so he consults his most recent income statement. Which of the following should he focus on? Depreciation Income taxes Amortization Wages CONCEPT The Income Statement 6 The pro forma balance sheet shows how the __________ resulting from a strategic plan will be financed. sales forecast inventory AFN equity CONCEPT Forecasting the Balance Sheet 7 Capacity planning answers the question "__________" How can we be most efficient? What will our revenue be? How will we decide which direction to go? How will we finance it? CONCEPT Financial Forecasting 8 Consider the price to book ratios of the following companies: Company A: 5.45 Company B: 14.30 Company C: 10.08 Company D: 19.62 Which company do investors believe will create the most value from its assets? Company B Company C Company D Company A CONCEPT Market Value Ratios 9 Why are ethical issues complicated for businesses that operate in the global economy? Because their employees won't know what the laws are in other countries. Because different cultures have different norms and values. Because they don't have as much moral character as small, local businesses. Because they tend to have more employees. CONCEPT Ethics: An Overview 10 Under what circumstance would agency conflict be most likely to increase? When oversight by the board is adequate. When the incentives of a manager align with those of owners. When owners are very close to the business. When owners are separated from the business. CONCEPT Agency and Conflicts of Interest 11 Which of the following would explain a company’s day sales outstanding ratio rising from 32 to 41.25? The company's accounts receivable has decreased while the average inventory has increased. The company's accounts receivable has decreased while total sales has increased. The company's accounts receivable has decreased while the average inventory has remained constant. The company's accounts receivable has remained constant while total sales has decreased. CONCEPT Asset Management Ratios 12 If net income is $90 million and total assets are $480 million, then the ROA is __________. incalculable without EBIT data 18.75% 25.00% incalculable without gross profit data CONCEPT Profitability Ratios 13 In which scenario would benchmarking be least useful? Comparing financial ratios of a company in an extractive industry and a tertiary industry Comparing financial ratios of a company in a tertiary industry and a service industry Comparing financial ratios of a company in a primary industry and an extractive industry Comparing financial ratios of a company in a secondary industry and a manufacturing industry CONCEPT Using Financial Ratios for Analysis 14 If a sales increase is forecasted, how will it affect expenses on the pro forma income statement if market conditions are expected to remain stable? Expenses will increase. Expenses will decrease. It depends on the type of product being sold. There will be no effect on expenses. CONCEPT Forecasting the Income Statement 15 Lucas is worried about his company's short-term viability. What type of financial statement should he look at? Cash flow statement Income statement Statement of changes in equity Balance sheet CONCEPT Introducing Financial Statements 16 Consider the following information: Total current assets $62,301 Deferred income taxes $1,345 Inventories $5,664 Prepaid expenses $2,034 Other assets $2,906 Total current liabilities $29,748 What is the quick ratio? 1.90 2.09 2.02 1.82 CONCEPT Liquidity Ratios 17 Which method of depreciation calculation gives a company an equal tax benefit from one year to the next? Declining balance Straight line Salvage Activity-based CONCEPT Tax Considerations 18 Valuation of a business relies on __________. maximizing shareholder value maximizing market value strengthening corporate governance keeping accurate financial statements CONCEPT Goals of Financial Management 19 Roger is a graphic designer who is in the early phases of launching his own business. So far he has only a handful of employees, and he prefers to make all of the operational decisions for the business himself. Which form of business structure would clearly meet Roger's needs? Functional Matrix Pre-bureaucratic Divisional CONCEPT Types of Business Organizations 20 What principle of corporate governance requires public clarification of the roles and responsibilities of board and management in order to provide stakeholders with a level of accountability? Integrity and ethical behavior Shareholder rights Disclosure and transparency Interests of other stakeholders CONCEPT Corporate Governance 21 What is a question that should be asked about inventory when forecasting? What are the current storage costs? What is the anticipated ratio of credit to cash sales? How quickly can we collect cash receipts? Is the company's liquidity sufficient? CONCEPT Analyzing Forecasts 22 Under GAAP, how would dividends paid to company stockholders be accounted for on the statement of cash flows? As an increase in cash flow from financing As a decrease in cash flow from financing As an increase in cash flow from operations As a decrease in cash flow from investment CONCEPT The Statement of Cash Flows 23 The primary factor behind al [Show More]

Last updated: 1 year ago

Preview 1 out of 48 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$14.00

Document information

Connected school, study & course

About the document

Uploaded On

Apr 04, 2022

Number of pages

48

Written in

Additional information

This document has been written for:

Uploaded

Apr 04, 2022

Downloads

0

Views

206

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

answers.png)

Coronary Artery Disease and Acute Coronary Syndrome.png)

.png)