Accounting > QUESTIONS & ANSWERS > NetSuite ERP Certification-Related Questions with Complete Solutions (All)

NetSuite ERP Certification-Related Questions with Complete Solutions

Document Content and Description Below

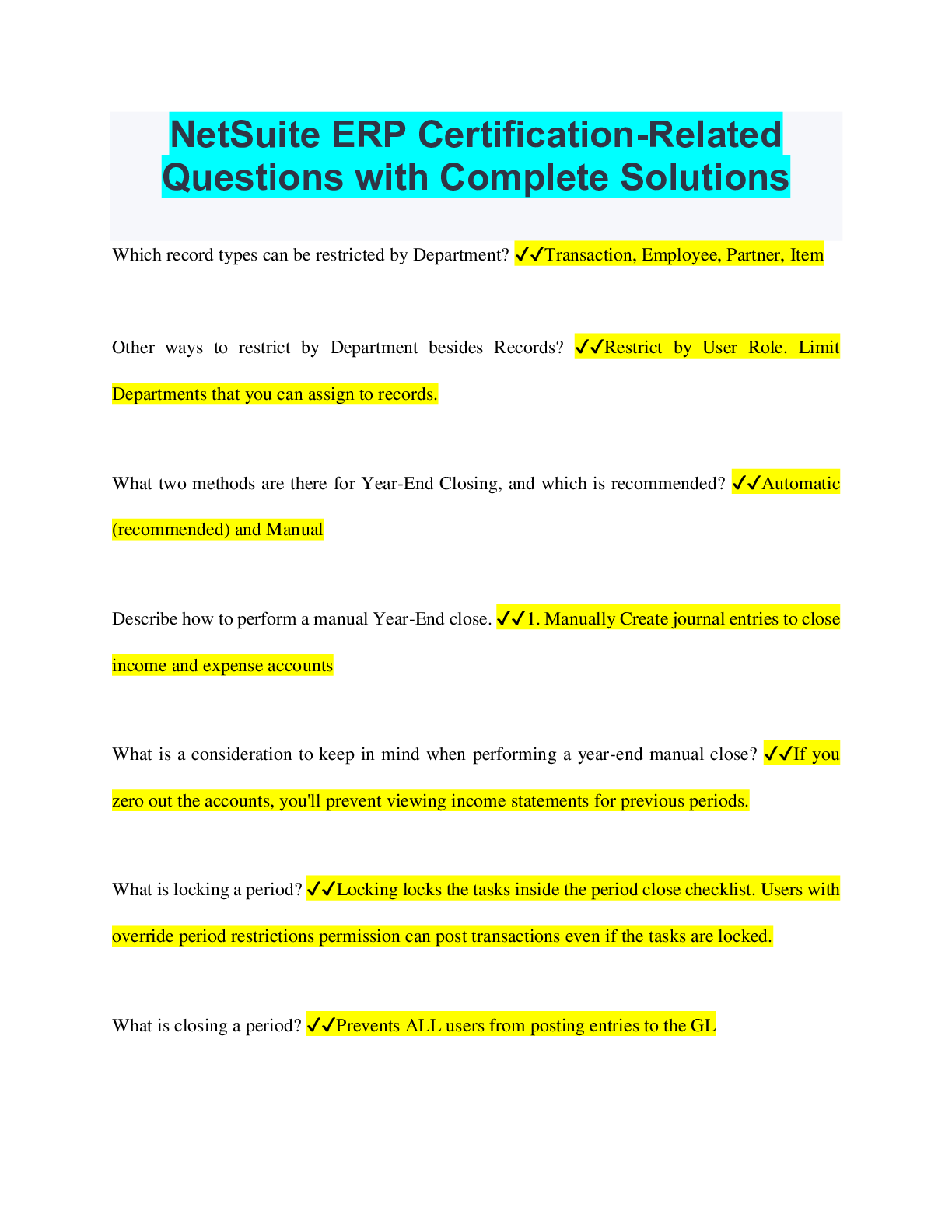

NetSuite ERP Certification-Related Questions with Complete Solutions Which record types can be restricted by Department? ✔✔Transaction, Employee, Partner, Item Other ways to restrict by Departm... ent besides Records? ✔✔Restrict by User Role. Limit Departments that you can assign to records. What two methods are there for Year-End Closing, and which is recommended? ✔✔Automatic (recommended) and Manual Describe how to perform a manual Year-End close. ✔✔1. Manually Create journal entries to close income and expense accounts What is a consideration to keep in mind when performing a year-end manual close? ✔✔If you zero out the accounts, you'll prevent viewing income statements for previous periods. What is locking a period? ✔✔Locking locks the tasks inside the period close checklist. Users with override period restrictions permission can post transactions even if the tasks are locked. What is closing a period? ✔✔Prevents ALL users from posting entries to the GL Effect of multi-book accounting on closing books ✔✔Separate books can be closed and opened/reopened To what sections can you limit posting transactions to with the period close checklist? ✔✔1. AP, AR, Payroll, Lock All What adjustments can be made with the period close checklist? ✔✔create intercompany adjustments, revalue open foreign currency balances, calculate consolidated exchange rates, GL audit numbering (if enabled) Describe exampe use case for quick closing a period ✔✔Changing an individual transaction, and the closing the period while skipping the period close checklist Are Tax Periods the same frames of time as Accounting Periods? ✔✔No When should a tax period be closed? ✔✔Before running/filing any tax reports, and after closing all previous periods for a subsidiary What happens if you create a taxable transaction such as an invoice and there's no open tax period in which the transaction can be reported? ✔✔NS prevents saving the transaction What happens for transaction taxes when a transaction is created for a closed period? ✔✔The transaction taxes are reported for the next open tax period Considerations when deleting a transaction for a closed tax period: ✔✔It can result in inconsistent GL impact What should be done when editing or deleting a taxable transaction for a closed tax period? ✔✔1. Open both the tax and accounting periods 2. Edit or delete the transaction 3. Reclose the periods 4. Submit an additional tax report to the tax authority to report the change Are tax periods tracked for deposits? ✔✔No Where are tax period changes saved? ✔✔System information How does NS determine transaction tax periods? ✔✔From transaction's date and open tax periods. Can tax periods be entered manually on a transaction record for standard NS? ✔✔No. The form can be customized to show the tax period column. Is the Multiple Calendars feature enabled by default? ✔✔No Is Multiple Calendars feature available for non-OneWorld accounts? ✔✔No Under what circumstances can the Multiple Calendars feature be disabled? ✔✔New Fiscal Calendars have not been assigned to Subsidiaries Can an entity record be saved as another type of entity record? ✔✔Yes. When one entity record is updated, the others are as well Consolidated Customer Payments feature ✔✔Accept payments from either top-level customer or the individual sub-customer. Consolidated Customer Payments feature invoice visibility: ✔✔Invoices will appear for all in the hierarchy when viewing the top-level customer Consolidated Customer Payments balance fields: ✔✔consolidate balance, overdue, days, consolidated deposit balance, consolidate unbilled orders, consolidated aging fields What are additional features of the Consolidated Customer Payments feature? ✔✔Customer statements, credit limits and holds, reports and KPIs Can you accept payments for a sub customer in a different subsidiary? ✔✔No. Alternate solution: creates journal entries to record payment in different subsidiaries. Once created, the JE for the customer child is offset against the open invoice via the Accept Customer Payment page. How many subsidiaries do vendors get with Multi-Subsidiary Vendors enabled? ✔✔One primary subsidiary, unlimited number of secondary subsidiaries With Multi-Subsidiary vendors, what can [Show More]

Last updated: 1 year ago

Preview 1 out of 17 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Also available in bundle (1)

.png)

NETSUITE BUNDLED EXAMS QUESTIONS AND ANSWERS LATEST 2022 GRADED A

NETSUITE BUNDLED EXAMS QUESTIONS AND ANSWERS LATEST 2022 GRADED A

By Nutmegs 1 year ago

$15

8

Reviews( 0 )

$10.00

Document information

Connected school, study & course

About the document

Uploaded On

Oct 23, 2022

Number of pages

17

Written in

Additional information

This document has been written for:

Uploaded

Oct 23, 2022

Downloads

0

Views

69

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)