Real Estate > QUESTIONS & ANSWERS > South Carolina Real Estate Exam - State Portion 100% Pass (All)

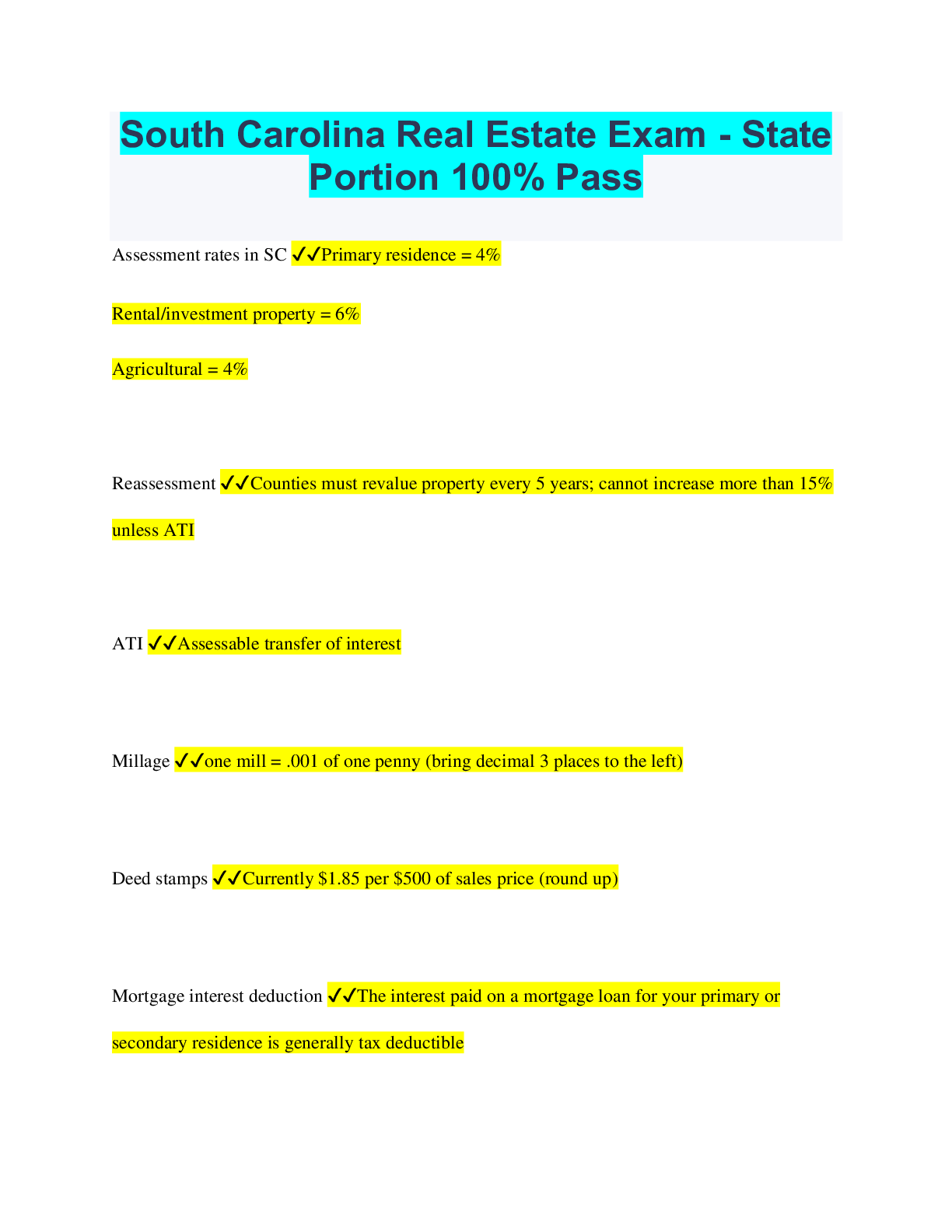

South Carolina Real Estate Exam - State Portion 100% Pass

Document Content and Description Below

South Carolina Real Estate Exam - State Portion 100% Pass Assessment rates in SC ✔✔Primary residence = 4% Rental/investment property = 6% Agricultural = 4% Reassessment ✔✔Counties must re... value property every 5 years; cannot increase more than 15% unless ATI ATI ✔✔Assessable transfer of interest Millage ✔✔one mill = .001 of one penny (bring decimal 3 places to the left) Deed stamps ✔✔Currently $1.85 per $500 of sales price (round up) Mortgage interest deduction ✔✔The interest paid on a mortgage loan for your primary or secondary residence is generally tax deductible Acquisition debt ✔✔The loan amount the buyer gets at the time of purchase Refinancing ✔✔Because there is no taxable event until there is a sale, an owner can refinance the property, taking cash out and not pay taxes on the cash generated Second mortgage ✔✔A second loan after the first mortgage Equity line of credit ✔✔A loan that is open ended. You draw against the equity line until you reach the maximum amount, pay down the loan and draw against the loan again Property tax deductions ✔✔Property tax is tax deductible; first or second home = personal; rental or investment = business Homestead Exemption Act ✔✔SC implemented HEA to give real estate property tax break to those who are age 65 or older, totally blind or 100% disabled HEA ✔✔$50,000 reduction in the appraised value of their permanent primary residence Points ✔✔Interest paid in advance; one point = 1% of loan value Points on acquisition debt ✔✔The loan taken out at the time of purchase, the interest rate can be lowered (bought down) by paying points up front Points on refinancing ✔✔A loan taken to replace the original loan, the interest rate can lowered (bought down) by paying points up front Capital gains ✔✔Difference between what you pay for a piece of property and what you sell it for Cost + Improvements = Adjusted Cost Basis ✔✔You are allowed to add to your cost basis any improvements, but not repairs. Sales price minus adjusted cost basis minus selling costs equals taxable gain Personal residence ✔✔If sold home is primary residence for 2 of the last 5 years, you do not have to pay taxes. This can be done every 2 years. 1031 tax-deferred exchange ✔✔When you exchange one real property for another like-kind real property for the purposes of income or investment, you may be able to defer the capital gain tax Boot ✔✔Any item of personal property given to even up a trade; taxable to party who receives it Depreciation ✔✔Investment property can be depreciated for tax purposes; personal residence cannot except for home office; land cannot Foreign investment and real property tax act ✔✔Requires buyer purchasing real property from a foreign person to with hold tax from the sales proceeds unless an exemption applies Rollback taxes ✔✔Occur anytime a property's use changes from agricultural to any other Lead-Based Paint Hazard Reduction Act ✔✔Applies to all residential housing built prior to 1978; landlords and agents must disclose and provide safety pamphlet Purpose of federal antitrust laws ✔✔To promote competition in the marketplace Antitrust laws ✔✔Ban monopolies as well as any contracts, combinations and conspiracies that unreasonably restrain trade Sherman Antitrust Law ✔✔Provides certain penalties for a number of illegal business activities; enforced through federal trade commission Price fixing ✔✔Procedure of setting prices for products and/or services instead of letting competition in the open market determine those prices (commissions, fees, etc.) - illegal Allocation of markets and customers ✔✔An understanding between brokers to split up their markets and avoid competing for each other's business Boycotting ✔✔Occurs when 2 or more brokerages conspire against another brokerage or agree to withhold their patronage to reduce competition Penalties for antitrust violations ✔✔Civil and criminal; may be severe Truth in advertising ✔✔Administered by FTC; advertising cannot be deceptive or misleading SC Consumer Protection Act ✔✔- No maximum interest rate - Buyer has right to select attorney and title insurer - Max assumption fee is 1% or $400, whichever is less - Residential mortgage loan of $180K or less can be prepaid with no penalty - Must assure meaningful disclosure of credit terms SC Residential Landlord Tenant Act ✔✔- Became effective July 8, 1986 - Only covers residential property - Landlord must repay security deposit within 30 days - Landlord responsible for maintenance and upkeep - 14 days to repair after written notice Retaliation ✔✔Retaliation for tenants complaining makes landlord liable for 3X the rent or treble damages sustained Tenant must ✔✔- Comply with all housing codes - Keep dwelling unit reasonably safe and clean - Maintain unit and allow access - Occupy for legal use only Abandonment ✔✔Unexplained absence of tenant for 15 days after default of rent payment Constructive eviction ✔✔When the apartment becomes uninhabitable due to actions or lack of actions by the landlord SC Vacation Timesharing Plan Act ✔✔- Must register with SCREC and obide by their laws - Must have a broker-in-charge - Must establish an escrow or trust account SC Vacation Rental Act ✔✔Protects tourists from losing their vacation accomodations because a new owner decides not to rent the property Megan's Law ✔✔- Requires convicted sex offenders to register with local law enforcement agencies - Requires authorities to release the information but does not require active notification - Homebuyer inquiries should be referred to police - Not licensee's responsibility to be aware of sex offenders Coastal Zone Management Act ✔✔- Purpose is to protect quality of coastal environment - Office of Ocean and Coastal Resource Management reviews projects in coastal zones - Army Corps of Engineers delineates wetlands Smoke detectors required ✔✔Applies to residential rental properties SC 7% non-resident tax ✔✔Paid by non-resident seller on capital gain, collected by buyer, delivered to SC Dept. of Revenue SC Human Affairs Commission ✔✔Mission is to eliminate and prevent unlawful discrimination employment, housing and public accomodations SC Uniform Securities Act ✔✔Laws pertaining to securities when real estate is sold as investment only SC High Cost and Consumer Home Loan Act ✔✔Targets predatory lending Superfund sites ✔✔Areas of environmental contamination designated by the EPA as hazardous and requiring cleanup Superfund ✔✔Program established to address hazardous waste sites and the money to clean them up Homeowner's responsibilities regarding environmental hazards ✔✔Required to disclose potential environmental hazards on their property but not for correcting the problem Electronic Signature in Global and National Commerce Act of 2000 ✔✔ESIGN - Purpose is to facilitate use electronic records and signatures Uniform Electronic Transactions Act of 2004 ✔✔South Carolina specific version of ESIGN - electronic signatures are acceptable in most real estate transactions, but not foreclosure, eviction, acceleration notices under credit or rental agreements for a primary residence Protecting Tenants at Foreclosure Act of 2009 ✔✔Allows a tenant with a bona fide lease that was signed before foreclosure to remain in a foreclosed home until the end of the lease unless the lender sells the property to someone who intends to make it their primary residence [Show More]

Last updated: 11 months ago

Preview 1 out of 10 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$10.00

Document information

Connected school, study & course

About the document

Uploaded On

Jul 21, 2023

Number of pages

10

Written in

Additional information

This document has been written for:

Uploaded

Jul 21, 2023

Downloads

0

Views

86

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)