Financial Accounting > QUESTIONS & ANSWERS > ACCT 212 Week 6 Questions and Answers 100% Graded for A+ (All)

ACCT 212 Week 6 Questions and Answers 100% Graded for A+

Document Content and Description Below

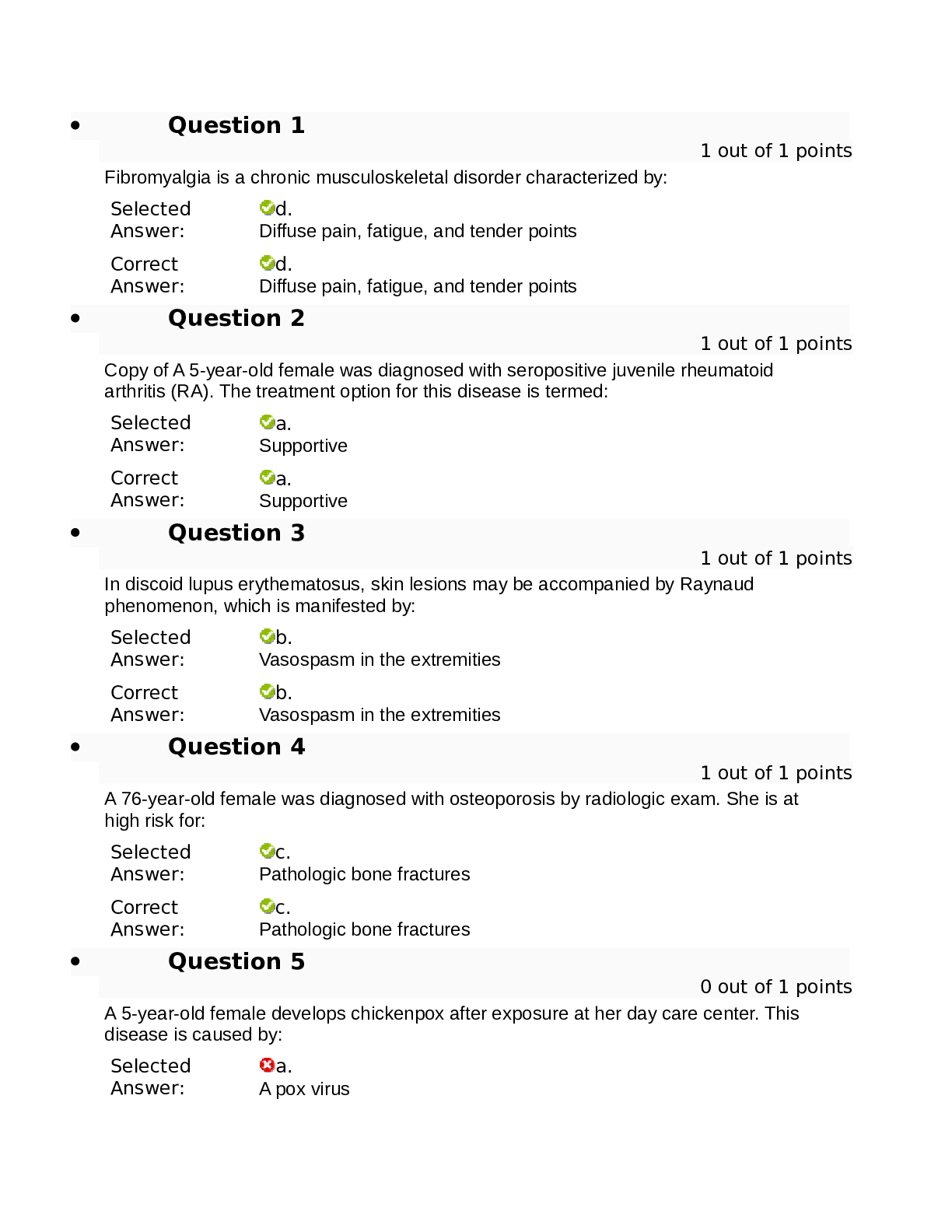

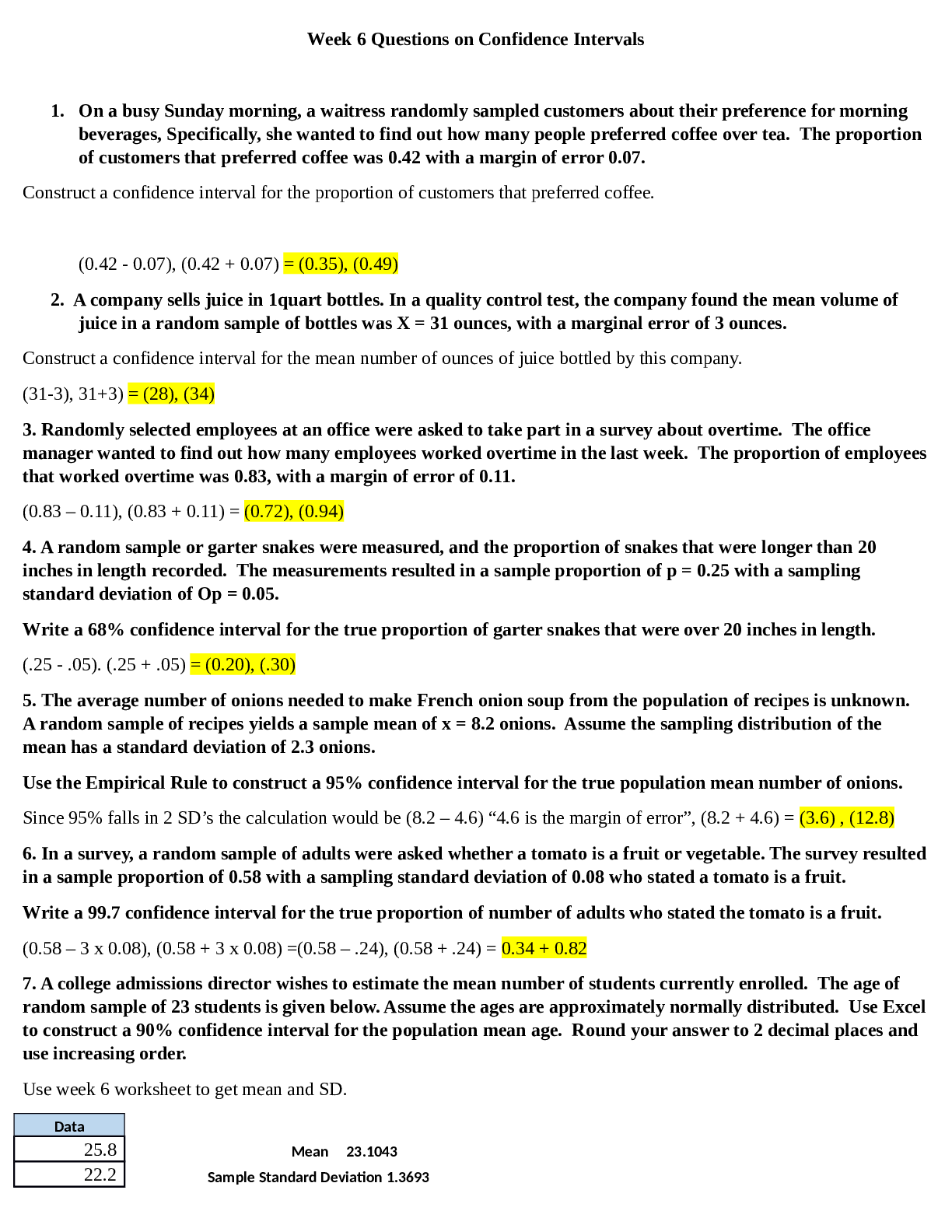

Belvidere Self Storage purchased land, paying $160,000 cash as a down payment and signing a $155,000 note payable for the balance. Belvidere also had to pay delinquent property tax of $2,500, title ... insurance costing $5,500, and $11,000 to level the land and remove an unwanted building. The company paid $52,000 to add soil for the foundation and then constructed an office building at a cost of $750,000. It also paid $53,000 for a fence around the property, $21,000 for the company sign near the property entrance, and $9,000 for lighting of the grounds. Question 1a. What is the capitalized cost of each of Belvidere land, land improvements, and building? Answer 1a: Purchase price = $160,000 + $155,000 (note payable) = $315,000 Property Tax, Title Insurance and Removal of building are provided in the exercise. Explanation 1a: The cost of land includes the following costs paid by the purchaser: purchase price, brokerage commissions, survey and legal fees, back property taxes and the cost of clearing the land and removing unwanted buildings. Since land has no finite useful life, the cost of land is not depreciated. Using the information given in the exercise, complete the table below to calculate the total cost of land. Remember, the purchase price will be the sum of the cash paid plus the note taken out to purchase the land. Question 1b: What is the capitalized cost of Land improvements Answer 1b: Note: All of this information is given in the exercise. Explanation 1b: Land improvements include the following costs: fencing, paving, sprinkler systems, signage, and lighting. These improvements have a finite useful life and therefore are depreciated. Question 1c. What is the capitalized cost of the building Answer 1c: All of this information is given in the exercise. Explanation 1c: The costs included in the cost of a building include architectural fees, building permits, and material, labor and overhead payments incurred in construction. Deluxe Pizza bought a used Ford delivery van on January 2, 2018, for $18,600. The van was xpected This study source was downloaded by 100000796615030 from CourseHero.com on 08-02-2021 09:18:07 GMT -05:00 https://www.coursehero.com/file/43320288/ACCT-212-Week-6-Homeworkdocx/ This study resource was shared via CourseHero.com to remain in service for four years (57,000 miles). At the end of its useful life, Deluxe management estimated that the van's residual value would be $1,500. The van traveled 20,500 miles the first year, 16,000 miles the second year, 15,400 miles the third year, and 5,100 miles in the fourth year. Prepare a schedule of depreciation expense per year for the van under the three depreciation methods. (For units-of-production and double-declining-balance methods, round to the nearest two decimal places after each step of the calculation.) Question 2a. Straight-Line method Answer 2a: Note: First calculate depreciation expense Then complete the table to calculate total depreciation expense using the Straight Line method over the four-year period. Explanation 2a: First Calculate the depreciation expense, then use that expense to complete the table! Remember, that the straight-line depreciation assigns an equal amount to each year, so the annual depreciation expense amount that you calculated above will be the amount of depreciation taken on the van each year for 2018 through 2021. Question 2b: Units of Production Method Answer 2b: Explanation 2b: The units-of-production method best fits an asset that wears out because of physical use, rather than obsolescence. Depreciation is recorded only when the asset is used, and more use leads to greater depreciation. First calculate the depreciation per unit for the units-of-production method. (Round your answer to two decimal places.) Note: The cost, residual value and useful life in units were all provided in the exercise. Then use the depreciation per unit to calculate the depreciation cost per year. Year Miles Traveled x Depreciation per unit = Depreciation Amount 2018 20,500 $0.30 $6,150 2019 16,000 $0.30 $4,800 2020 15,400 $0.30 $4,620 2021 5,100 $0.30 $1,530 Total = 17,100 This study source was downloaded by 100000796615030 from CourseHero.com on 08-02-2021 09:18:07 GMT -05:00 https://www.coursehero.com/file/43320288/ACCT-212-Week-6-Homeworkdocx/ This study resource was shared via CourseHero.com Question 2c. Double declining balance method Answer 2c: Year Double Declining Balance 2018 $9,300 2019 $4,650 2020 $2,325 2021 $825 Total 17,100 Explanation 2c: The next depreciation method is the double-declining-balance method. The depreciation is calculated in a few steps. 1. First, compute the straight-line depreciation rate. For example, this equipment has a useful life of 4-years. Therefore the equipment has a straight-line depreciation rate of 1/4 or 25% each year (e.g. 100%/4 years = 25%). 2. Second, multiply the straight-line rate by 2 to compute the DDB rate. The 4-year equipment would therefore have a DDB of 50% (25% x 2). 3. Third, multiply the DDB rate by the period's beginning book value (cost less accumulated depreciation). Under the DDB method the residual value is ignored when calculating depreciation, except during the last year. Year 1 Beginning Value x DBB rate = Depreciation 2018 18,600 x 50% (or .5) = $9,300 Year Beginning Value - Accumulated Depreciation x DBB Rate = Depreciation 2019 18,600 - $9,300 x .50 = $4650 2020 18,600 - ($9,300 + $4,650)=13,950 x .50 = $2,325 Book Value Residual Value Depreciation 2021 $2,325 - 1,500 = $825 Question 2d: Which method best tracks the wear and tear on the van? Answer 2d: Units-of-production method best fits an asset that wears out because of physical use, rather than obsolescence. Explanation 2d: The three different methods of depreciation result in the same total amount of depreciation over the life of the asset, even though they allocate different amounts to each period. For the units-of-production method, depreciation is recorded only when the asset isused, and more use leads to greater depreciation. Question 2e. Which method would Deluxe prefer to use for income tax purposes? Explain your reasoning in detail. Answer 2e: The double-declining-balance (DDB) method. Explanation 2e: The double-declining-balance (DDB) method is also known as the accelerated method. It accelerates the depreciation, the earlier years will receive more depreciation which leads to larger tax deductions in the early years of use and less (depreciation and tax deductions) in the later years of the assets life. This study source was downloaded by 100000796615030 from CourseHero.com on 08-02-2021 09:18:07 GMT -05:00 https://www.coursehero.com/file/43320288/ACCT-212-Week-6-Homeworkdocx/ This study resource was shared via CourseHero.com East Sales Company completed the following note payable transactions: Question 3a. How much interest expense must be accrued at December 31, 2018? (Round your answer to the nearest whole dollar.) Answer 3a: Explanation 3a: A short-term note payable is a liability of a business. A business that signs a promissory note agrees to pay interest as a cost of borrowing the money. Interest accrues on a note payable with the passage of time. Therefore, even though the interest won't be paid until the maturity date, at year end it is necessary to accrue interest on the notes payable. Interest accrued between April 1 and December 31, 2018 for a period of 9 months or (9/12). (Round your final answer to the nearest whole dollar.) All other details are provided in the exercise. Question 3b: Determine the amount of East Sales' final payment on April 1, 2019. Answer 3b: Explanation 3b: When the note matures on April 1, 2019, East will pay back the principle of the note, plus any interest accrued on the note for the time the money was owed. Use the formula below to calculate the amount of interest due when the note payable is paid. (Round your final answer to the nearest whole dollar.) Question 3c. Compute the final payment. Answer 3c: Explanation 3c: Final Payment is $54,000 + $3,240 = $57,240. Remember, we will pay back the principal of the note plus the interest on the note at maturity. Question 3d: How much interest expense will East Sales report for 2018 and for 2019? (If needed, round your answer to the nearest whole dollar.) Answer 3d: Explanation 3d: We have calculated the interest on the note from the date that the money was borrowed through December 31, 2018. Now we must determine the amount of interest that was incurred for the 33 months in 2019. This is the amount that will be recognized as an expense for 2019 on this note. We can use the same formula to calculate the interest. (Round your final answer to the nearest whole dollar.) This study source was downloaded by 100000796615030 from CourseHero.com on 08-02-2021 09:18:07 GMT -05:00 https://www.coursehero.com/file/43320288/ACCT-212-Week-6-Homeworkdocx/ This study resource was shared via CourseHero.com Western Electronics completed these selected transactions during June 2018: Question 4a. Report these items on Western Electronics' balance sheet at June 30, 2018. Answer 4a: Explanation 4a: First, select the balance sheet accounts. Then calculate the costs of each account. Provided in the exercise Review Answers 4b and 4c to see how this is calculated. Review Answer 4d Review Answer 4e Provided in the exercise Review Answer 4f Total all of the above This study source was downloaded by 100000796615030 from CourseHero.com on 08-02-2021 09:18:07 GMT -05:00 https://www.coursehero.com/file/43320288/ACCT-212-Week-6-Homeworkdocx/ This study resource was shared via CourseHero.com $65,000 – 13,000 = $52,000 Provided in the exercise Question 4b. Then begin calculating the actual expenses for each account. Remember Sales of $2,200,000 are subject to an accrued warranty cost of 7%. The accrued warranty payable at the beginning of the year was $40,000, and warranty payments for the year totaled $62,000. Now calculate the warranty expense. Answer 4b: Explanation 4b: The business uses an estimate usually based on prior history. Western Electronics estimates that warranty costs, or expense, will be 7% of sales revenue. (Enter the interest rate as a whole number.) Question 4c: Calculate the Accrued Warranty balance reported on the balance sheet at June 30. Answer 4c: Explanation 4c: Now that we’ve calculated the warranty expense. Determine the ending balance. All other information was provided in the exercise. Question 4d: On June 1, Western Electronics signed a $65,000 note payable that requires annual payments of $13,000 plus 4% interest on the unpaid balance beginning June 1, 2019. (Enter the interest rate as a whole number. Round your answer to the nearest whole dollar.) Answer 4d: Explanation 4d: The note payable is due in annual installments. Review the terms of the note and determine the amount that will be due within one year of the balance sheet date; that is the current portion of the long-term note payable. In addition, we have interest due annually. We signed the note on June 1, 2018. We must now accrue interest on the note as of June 30, 2018. Remember the note was signed on June 1 and we are reporting liabilities at June 30, 2018 [Show More]

Last updated: 1 year ago

Preview 1 out of 8 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 02, 2021

Number of pages

8

Written in

Additional information

This document has been written for:

Uploaded

Aug 02, 2021

Downloads

0

Views

58

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

answers.png)

Coronary Artery Disease and Acute Coronary Syndrome.png)

.png)