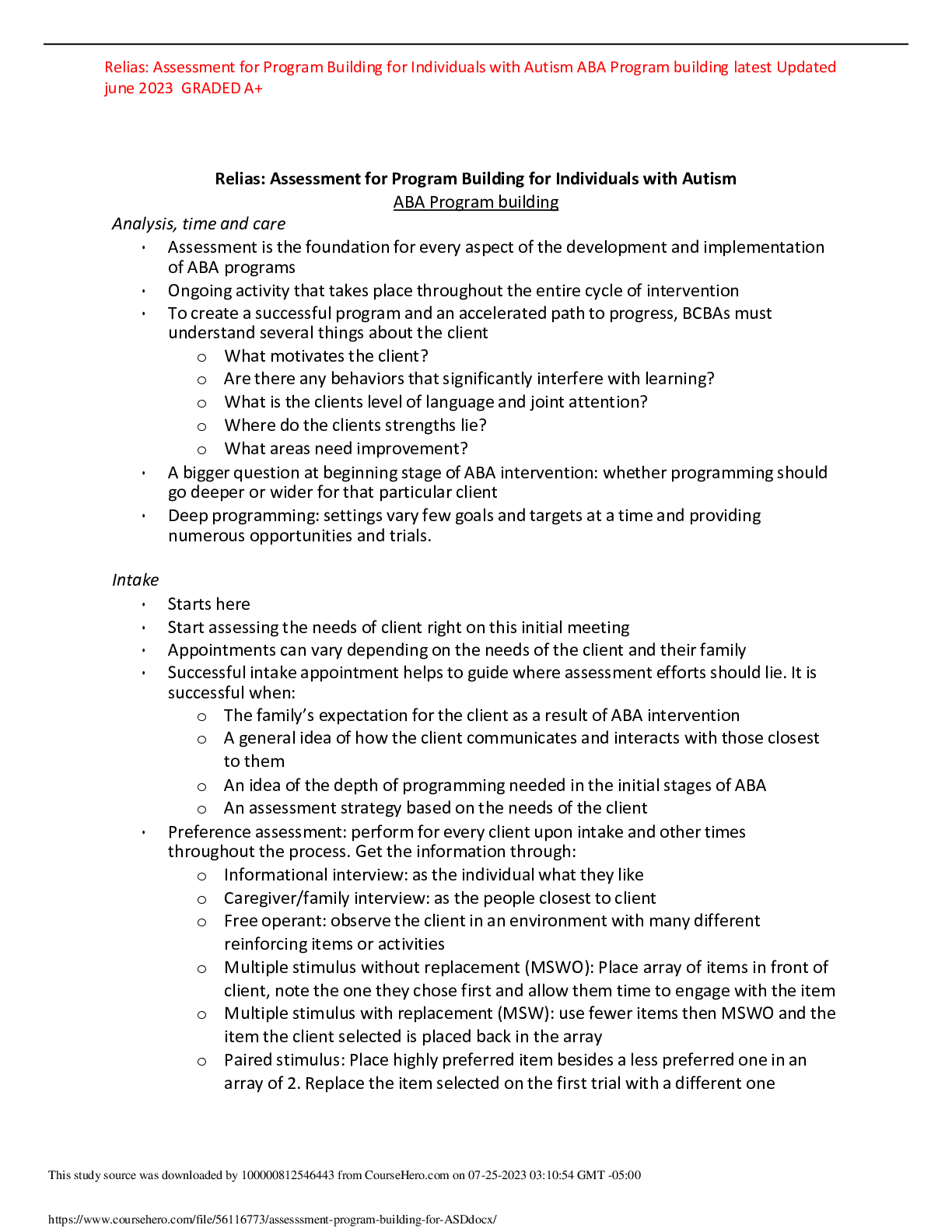

Project Management > ASSIGNMENT > FIN 3003 - Mr. Joseph - Assignment 1 ALL SOLUTION 2023 LATEST SOLUTION AID GRADE A+ (All)

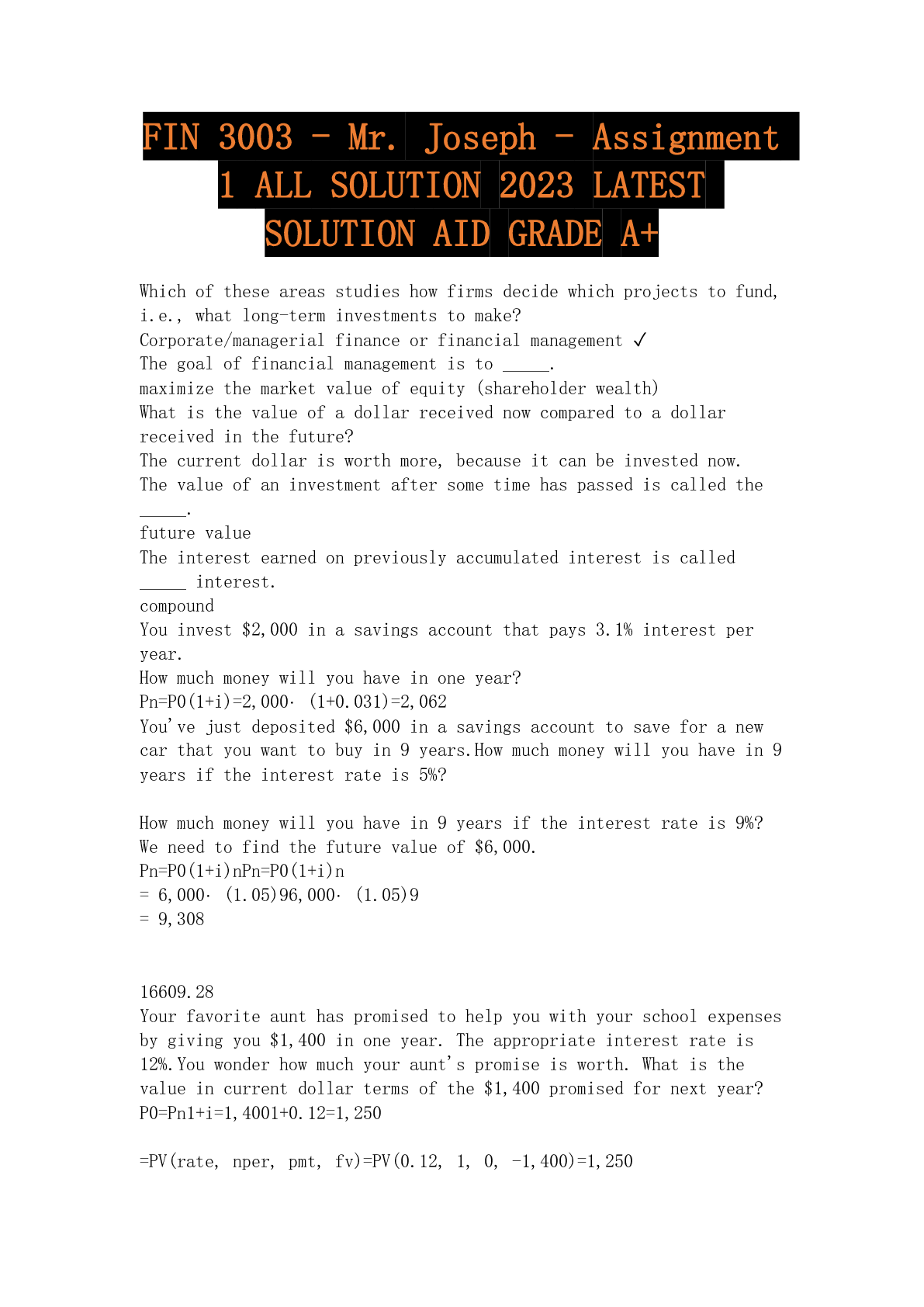

FIN 3003 - Mr. Joseph - Assignment 1 ALL SOLUTION 2023 LATEST SOLUTION AID GRADE A+

Document Content and Description Below

Which of these areas studies how firms decide which projects to fund, i.e., what long-term investments to make? Corporate/managerial finance or financial management ✓ The goal of financial managem... ent is to _____. maximize the market value of equity (shareholder wealth) What is the value of a dollar received now compared to a dollar received in the future? The current dollar is worth more, because it can be invested now. The value of an investment after some time has passed is called the _____. future value The interest earned on previously accumulated interest is called _____ interest. compound You invest $2,000 in a savings account that pays 3.1% interest per year. How much money will you have in one year? Pn=P0(1+i)=2,000⋅(1+0.031)=2,062 You've just deposited $6,000 in a savings account to save for a new car that you want to buy in 9 years.How much money will you have in 9 years if the interest rate is 5%? How much money will you have in 9 years if the interest rate is 9%? We need to find the future value of $6,000. Pn=P0(1+i)nPn=P0(1+i)n = 6,000⋅(1.05)96,000⋅(1.05)9 = 9,308 16609.28 Your favorite aunt has promised to help you with your school expenses by giving you $1,400 in one year. The appropriate interest rate is 12%.You wonder how much your aunt's promise is worth. What is the value in current dollar terms of the $1,400 promised for next year? P0=Pn1+i=1,4001+0.12=1,250 =PV(rate, nper, pmt, fv)=PV(0.12, 1, 0, -1,400)=1,250 The risk-free interest rate is 2% per year.What amount of money received now would make you indifferent to receiving $6,000 in one year? What amount of money received in one year would make you indifferent to receiving $6,000 now? 2830.19 3180 You've just deposited $6,000 in a savings account to save for a new car that you want to buy in 6 years.How much money will you have in 6 years if the interest rate is 2%? How much money will you have in 6 years if the interest rate is 11%? 5975.46 13865.39 What is the value of a dollar received now compared to a dollar received in the future? The current dollar is worth more, because it can be invested now. ✓ The annual interest rate is 8%.What is the present value (PV) of $1,000 that you'll receive in 13 years? 367.70 P0=Pn(1+i)n=1,000(1+0.08)13=367.7P0=Pn(1+i)n=1,000(1+0.08)13=367.7 Your grandmother left you $70,000 that you'll receive when you turn 40 in 15 years. Since you'd rather have some money now, you want to sell your claim to the inheritance. What is the minimum amount that you should sell your claim for now if the interest rate is 2%? What is the minimum amount that you should sell your claim for now if the interest rate is 9%? P0=Pn(1+i)n=70,000(1+0.02)15=52,011 P0=Pn(1+i)n=70,000(1+0.09)15=19,218 You expect to receive a payment of $1,000 from a trust fund in 14 years. The annual interest rate is 3%. What is the present value of that amount? If you invest the $1,000 at the same interest rate for another 14 years when you receive it in 14 years, what will be the future value? P0=Pn(1+i)n=1,000(1+0.03)14=661.12 Pn=P0(1+i)n=1,000⋅(1+0.03)14=1,512.59 CONTINUED.. [Show More]

Last updated: 1 year ago

Preview 1 out of 3 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Apr 22, 2023

Number of pages

3

Written in

Additional information

This document has been written for:

Uploaded

Apr 22, 2023

Downloads

0

Views

69