Law > QUESTIONS & ANSWERS > CDFM - Module 3 (All)

CDFM - Module 3

Document Content and Description Below

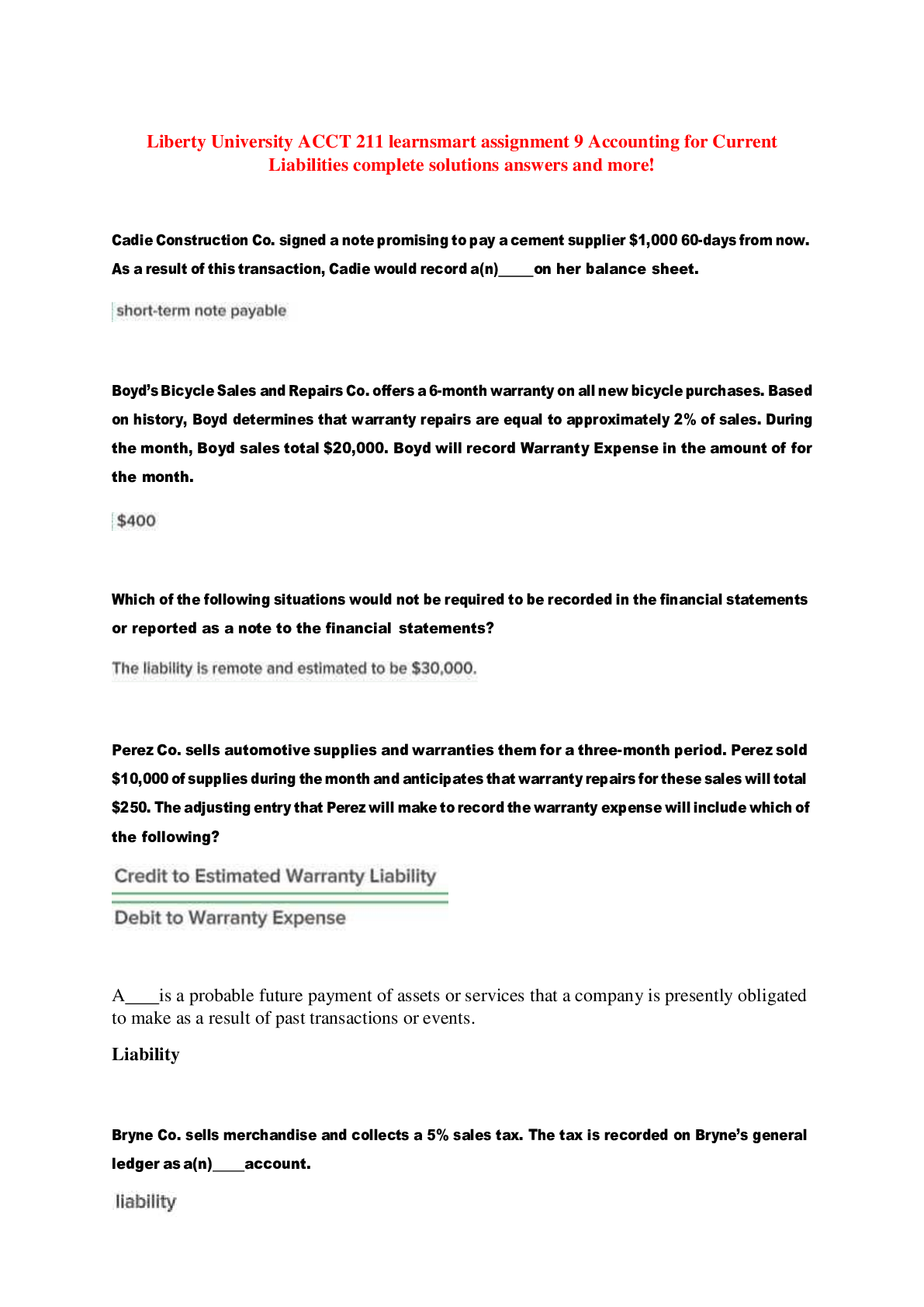

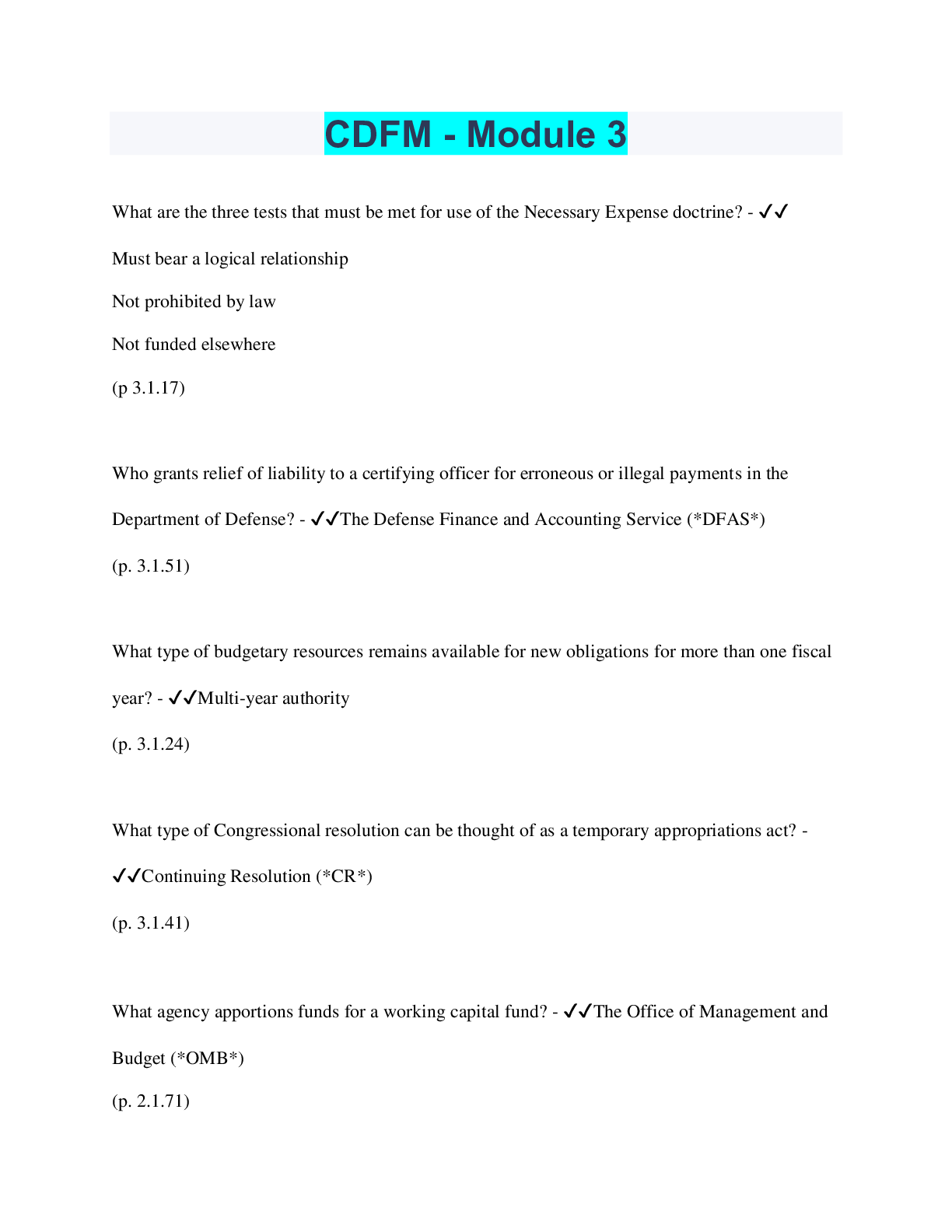

CDFM - Module 3 What are the three tests that must be met for use of the Necessary Expense doctrine? - ✔✔ Must bear a logical relationship Not prohibited by law Not funded elsewhere (p 3.1.... 17) Who grants relief of liability to a certifying officer for erroneous or illegal payments in the Department of Defense? - ✔✔The Defense Finance and Accounting Service (*DFAS*) (p. 3.1.51) What type of budgetary resources remains available for new obligations for more than one fiscal year? - ✔✔Multi-year authority (p. 3.1.24) What type of Congressional resolution can be thought of as a temporary appropriations act? - ✔✔Continuing Resolution (*CR*) (p. 3.1.41) What agency apportions funds for a working capital fund? - ✔✔The Office of Management and Budget (*OMB*) (p. 2.1.71) What is the acronym for disbursing office identification numbers? - ✔✔Disbursing Station Symbol Numbers (*DSSN*) (p. 3.2.30) What three primary types of officials are accountable Individuals in the DoD? - ✔✔Certifying Officers (*CO*), Disbursing Officers (*DO*), Departmental Accountable Officials (*DAO*) (p. 2.2.21, 2.2.64) What is the normal collection method for debts owed by active military members and civilian employees who are still in service? - ✔✔Salary Offset garnishing (p. 3.2.38) When collecting debts owed by vendors that have failed to properly respond to the demand letters, what is the next step? - ✔✔Do Not Pay List (p. 3.2.40) When in doubt about the proper use of an appropriation, what may the disbursing officer request form the OSD General Counsel on the propriety of the prospective payment? - ✔✔An Advance Decision (p. 3.2.12) When a civilian employee moves from a job overseas to a job in the states, which organization pays for the Permanent Duty Travel? - ✔✔The "*losing*" activity (the *OCONUS* activity) (p. 3.2.22) Name the supporting documents required in the DoD Payment Package? - ✔✔Contract Invoice Proof of Receipt Acceptance Document (p. 3.2.24) Name two key forms that provide accountability and control by Disbursing Officers? - ✔✔Standard Form *1219*, Statement of Accountability (monthly) DD Form *2657*, Daily Statement of Accountability (p. 3.2.44) What term is used to describe Federal Government funds that have been paid but have not yet been identified to a specific organization? - ✔✔Undistributed Disbursement (p. 3.3.39) The aggregate amount of an entity's funds in the Treasury is in what account? - ✔✔Fund Balance with Treasury (p. 3.3.39) Which three Federal agencies established the FASAB? - ✔✔The Government Accountability Office (*GAO*), the Department of Treasury, and the Office of Management and Budget (*OMB*) (p. 3.3.13) What is the Federal law that specifically required existing CFO agencies to have financial statements that successfully pass a financial audit? - ✔✔The Government Management Reform Act of 1994 (p. 3.4.5) Which standards generally apply to all Federal Government audits? - ✔✔GAO Standards or GAGAS (p. 3.4.10) How many hours of continuing professional education must an auditor complete every 2 years? - ✔✔80 hours in 2 years (p. 3.4.14) What is the minimum number of hours that must be completed in any year of the 2-year period? - ✔✔20 hours minimum each year (p. 3.4.14) The auditor is restricted access to essential data necessary to satisfy the audit objective. What type of impairment would this be? - ✔✔External Impairment (p. 3.4.12) Which type of audit is expected to determine whether: - The financial information is presented in accordance with established stated criteria; - The entity has adhered to specific financial compliance requirements; and - The entity's internal control structure over financial reporting and/or safeguarding of assets is suitably designed and implemented to achieve the control objective? - ✔✔Financial Audit (p. 3.4.22) Which type of audit is expected to determine whether: - The entity is acquiring, using, and protecting its resources economically and efficiently; - The entity's programs are achieving the desired results or benefits; and - The entity is accomplishing its mission in accordance with applicable laws, regulations, and public policies. - ✔✔Performance Audit (p. 3.4.22) What does Title 31 do? - ✔✔Provides statutory authority for the use, control, and accountability of public funds. The established rule is that the expenditure of public funds is proper only when authorized by Congress, not that public funds may be expended unless prohibited by Congress. - ✔✔Basic Axiom of Fiscal Law What are the sources of Fiscal Law? - ✔✔- The Constitution - Authorization Acts - Appropriation Acts - General Statutes - CG Decisions & Courts Which part of the constitution empowers the Congress to pass bills for the raising of revenue, and delineates how bills will pass from the Congress to [Show More]

Last updated: 10 months ago

Preview 1 out of 60 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Aug 02, 2023

Number of pages

60

Written in

Additional information

This document has been written for:

Uploaded

Aug 02, 2023

Downloads

0

Views

74

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)