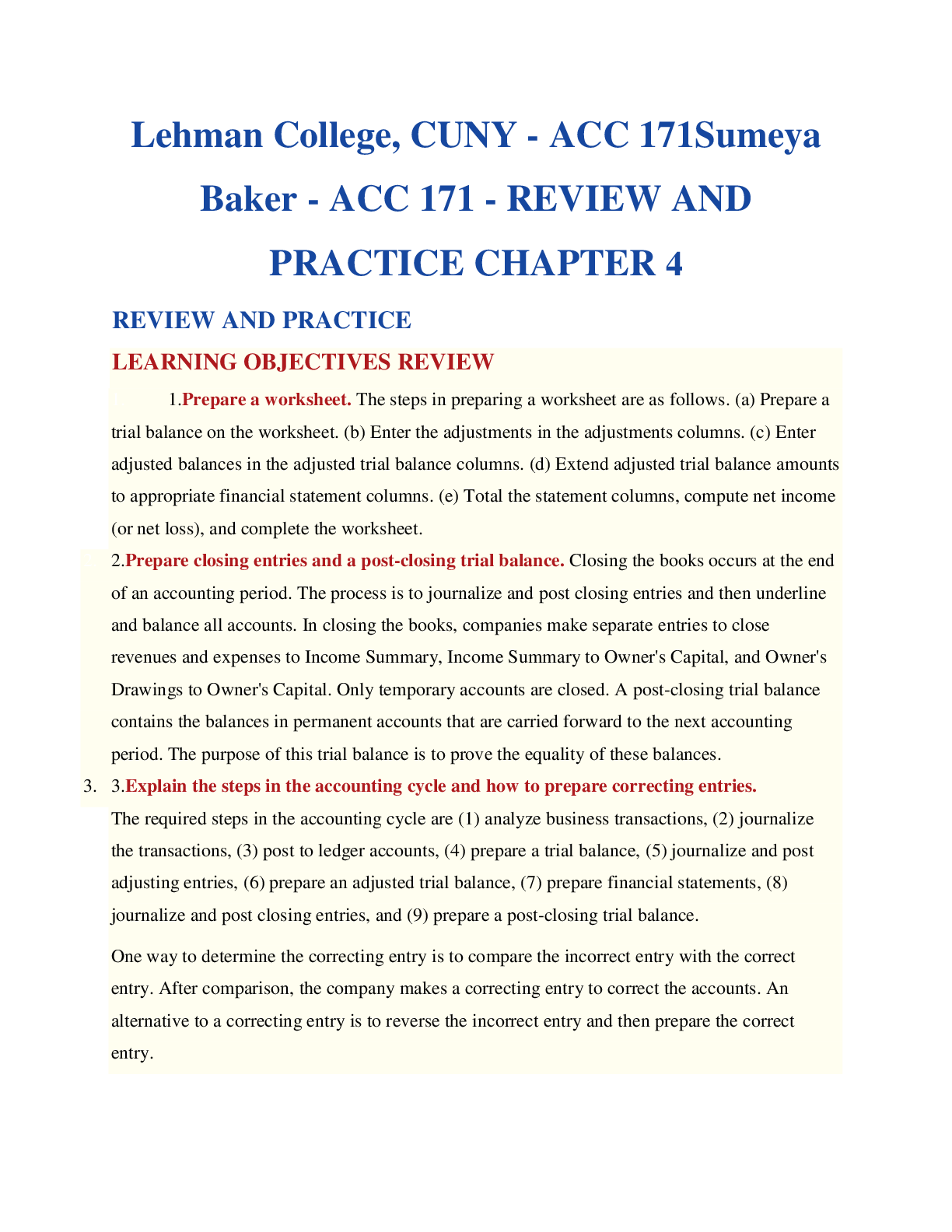

Financial Accounting > QUESTIONS & ANSWERS > Lehman College, CUNY - ACC 171Sumeya Baker - ACC 171 - REVIEW AND PRACTICE CHAPTER 4 REVIEW AND PRAC (All)

Lehman College, CUNY - ACC 171Sumeya Baker - ACC 171 - REVIEW AND PRACTICE CHAPTER 4 REVIEW AND PRACTICE. 100%

Document Content and Description Below

Lehman College, CUNY - ACC 171Sumeya Baker - ACC 171 - REVIEW AND PRACTICE CHAPTER 4 REVIEW AND PRACTICE LEARNING OBJECTIVES REVIEW 1. 1.Prepare a worksheet. 2. 2.Prepare closing entries and a po... st-closing trial balance. 3. 3.Explain the steps in the accounting cycle and how to prepare correcting entries. 4.Identify the sections of a classified balance sheet. 4. 5.Prepare reversing entries. GLOSSARY REVIEW Classified balance sheet Closing entries Correcting entries Current assets Current liabilities Income Summary Intangible assets Liquidity Long-term investments Long-term liabilities Operating cycle Permanent (real) accounts Post-closing trial balance Property, plant, and equipment Reversing entry Stockholders' equity Temporary (nominal) accounts Worksheet PRACTICE MULTIPLE-CHOICE QUESTIONS 4-1. (LO 1) Which of the following statements is incorrect concerning the worksheet? • (a) The worksheet is essentially a working tool of the accountant. • (b) The worksheet is distributed to management and other interested parties. • (c) The worksheet cannot be used as a basis for posting to ledger accounts. • (d) Financial statements can be prepared directly from the worksheet before journalizing and posting the adjusting entries. 4-2. (LO 1) In a worksheet, net income is entered in the following columns: • (a) income statement (Dr) and balance sheet (Dr). • (b) income statement (Cr) and balance sheet (Dr). • (c) income statement (Dr) and balance sheet (Cr). • (d) income statement (Cr) and balance sheet (Cr). 4-3. (LO 1) In the unadjusted trial balance of its worksheet for the year ended December 31, 2017, Knox Company reported Equipment of $120,000. The year-end adjusting entries require an adjustment of $15,000 for depreciation expense for the equipment. After the adjusted trial balance is completed, what amount should be shown in the financial statement columns? • (a) A debit of $105,000 for Equipment in the balance sheet column. • (b) A credit of $15,000 for Depreciation Expense—Equipment in the income statement column. • (c) A debit of $120,000 for Equipment in the balance sheet column. • (d) A debit of $15,000 for Accumulated Depreciation—Equipment in the balance sheet column. 4-4. (LO 2) An account that will have a zero balance after closing entries have been journalized and posted is: • (a) Service Revenue. • (b) Supplies. • (c) Prepaid Insurance. • (d) Accumulated Depreciation—Equipment. 4-5. (LO 2) When a net loss has occurred, Income Summary is: • (a) debited and Owner's Capital is credited. • (b) credited and Owner's Capital is debited. • (c) debited and Owner's Drawings is credited. • (d) credited and Owner's Drawings is debited. 4-6. (LO 2) The closing process involves separate entries to close (1) expenses, (2) drawings, (3) revenues, and (4) income summary. The correct sequencing of the entries is: • (a) (4), (3), (2), (1). • (b) (1), (2), (3), (4). • (c) (3), (1), (4), (2). • (d) (3), (2), (1), (4). 4-7. (LO 2) Which types of accounts will appear in the post-closing trial balance? • (a) Permanent (real) accounts. • (b) Temporary (nominal) accounts. • (c) Accounts shown in the income statement columns of a worksheet. • (d) None of these answer choices is correct. 4-8. (LO 3) All of the following are required steps in the accounting cycle except: • (a) journalizing and posting closing entries. • (b) preparing financial statements. • (c) journalizing the transactions. • (d) preparing a worksheet. 4-9. (LO 3) The proper order of the following steps in the accounting cycle is: • (a) prepare unadjusted trial balance, journalize transactions, post to ledger accounts, journalize and post adjusting entries. • (b) journalize transactions, prepare unadjusted trial balance, post to ledger accounts, journalize and post adjusting entries. • (c) journalize transactions, post to ledger accounts, prepare unadjusted trial balance, journalize and post adjusting entries. • (d) prepare unadjusted trial balance, journalize and post adjusting entries, journalize transactions, post to ledger accounts. 4-10. (LO 3) When Ramirez Company purchased supplies worth $500, it incorrectly recorded a credit to Supplies for $5,000 and a debit to Cash for $5,000. Before correcting this error: • (a) Cash is overstated and Supplies is overstated. • (b) Cash is understated and Supplies is understated. • (c) Cash is understated and Supplies is overstated. • (d) Cash is overstated and Supplies is understated. 4-11. (LO 3) Cash of $100 received at the time the service was performed was journalized and posted as a debit to Cash $100 and a credit to Accounts Receivable $100. Assuming the incorrect entry is not reversed, the correcting entry is: • (a) debit Service Revenue $100 and credit Accounts Receivable $100. • (b) debit Accounts Receivable $100 and credit Service Revenue $100. • (c) debit Cash $100 and credit Service Revenue $100. • (d) debit Accounts Receivable $100 and credit Cash $100. 4-12. (LO 4) The correct order of presentation in a classified balance sheet for the following current assets is: • (a) accounts receivable, cash, prepaid insurance, inventory. • (b) cash, inventory, accounts receivable, prepaid insurance. • (c) cash, accounts receivable, inventory, prepaid insurance. • (d) inventory, cash, accounts receivable, prepaid insurance. 4-13. (LO 4) A company has purchased a tract of land. It expects to build a production plant on the land in approximately 5 years. During the 5 years before construction, the land will be idle. The land should be reported as: • (a) property, plant, and equipment. • (b) land expense. • (c) a long-term investment. • (d) an intangible asset. 4-14. (LO 4) In a classified balance sheet, assets are usually classified using the following categories: • (a) current assets; long-term assets; property, plant, and equipment; and intangible assets. • (b) current assets; long-term investments; property, plant, and equipment; and tangible assets. • (c) current assets; long-term investments; tangible assets; and intangible assets. • (d) current assets; long-term investments; property, plant, and equipment; and intangible assets. 4-15. (LO 4) Current assets are listed: • (a) by expected conversion to cash. • (b) by importance. • (c) by longevity. • (d) alphabetically. 4-16. (LO 5) On December 31, Kevin Hartman Company correctly made an adjusting entry to recognize $2,000 of accrued salaries payable. On January 8 of the next year, total salaries of $3,400 were paid. Assuming the correct reversing entry was made on January 1, the entry on January 8 will result in a credit to Cash $3,400 and the following debit(s): • (a) Salaries and Wages Payable $1,400 and Salaries and Wages Expense $2,000. • (b) Salaries and Wages Payable $2,000 and Salaries and Wages Expense $1,400. • (c) Salaries and Wages Expense $3,400. • (d) Salaries and Wages Payable $3,400. PRACTICE EXERCISES 4-1. Journalize and post closing entries, and prepare a post-closing trial balance. (LO 2) Hercules Company ended its fiscal year on August 31, 2017. The company's adjusted trial balance as of the end of its fiscal year is as shown below. HERCULES COMPANY Adjusted Trial Balance August 31, 2017 No. Account Titles Debit Credit 101 Cash $10,900 112 Accounts Receivable 6,200 157 Equipment 10,600 167 Accumulated Depr.—Equip. $ 5,400 201 Accounts Payable 2,800 208 Unearned Rent Revenue 1,200 301 Owner's Capital 31,700 306 Owner's Drawings 12,000 404 Service Revenue 42,400 429 Rent Revenue 6,100 711 Depreciation Expense 2,700 720 Salaries and Wages Expense 37,100 732 Utilities Expense 10,100 $89,600 $89,600 Instructions (a) Prepare the closing entries using page J15 in a general journal. (b) Post to Owner's Capital and No. 350 Income Summary accounts. (Use the three-column form.) (c) Prepare a post-closing trial balance at August 31, 2017. Solution Instructions (a) Prepare an income statement and an owner's equity statement for the year ended August 31, 2017. Hercules did not make any capital investments during the year. (b) Prepare a classified balance sheet at August 31, 2017. Prepare worksheet and classified balance sheet, and journalize closing entries. (LO 1, 2, 4) At the end of its first month of operations, Pampered Pet Service has the following unadjusted trial balance. PAMPERED PET SERVICE August 31, 2017 Trial Balance Debit Credit Cash $ 5,400 Accounts Receivable 2,800 Supplies 1,300 Prepaid Insurance 2,400 Equipment 60,000 Notes Payable $40,000 Accounts Payable 2,400 Owner's Capital 30,000 Owner's Drawings 1,000 Service Revenue 4,900 Salaries and Wages Expense 3,200 Utilities Expense 800 Advertising Expense 400 $77,300 $77,300 Other data: • 1.Insurance expires at the rate of $200 per month. • 2.$1,000 of supplies are on hand at August 31. • 3.Monthly depreciation on the equipment is $900. • 4.Interest of $500 on the notes payable has accrued during August. Instructions (a) Prepare a worksheet. (b) Prepare a classified balance sheet assuming $35,000 of the notes payable are long-term. (c) Journalize the closing entries. [Show More]

Last updated: 1 year ago

Preview 1 out of 25 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 28, 2020

Number of pages

25

Written in

Additional information

This document has been written for:

Uploaded

May 28, 2020

Downloads

0

Views

45