Financial Accounting > QUESTIONS & ANSWERS > Lehman College, CUNY - ACC 171Sumeya Baker - ACC 171 - REVIEW AND PRACTICE CHAPTER 5 (All)

Lehman College, CUNY - ACC 171Sumeya Baker - ACC 171 - REVIEW AND PRACTICE CHAPTER 5

Document Content and Description Below

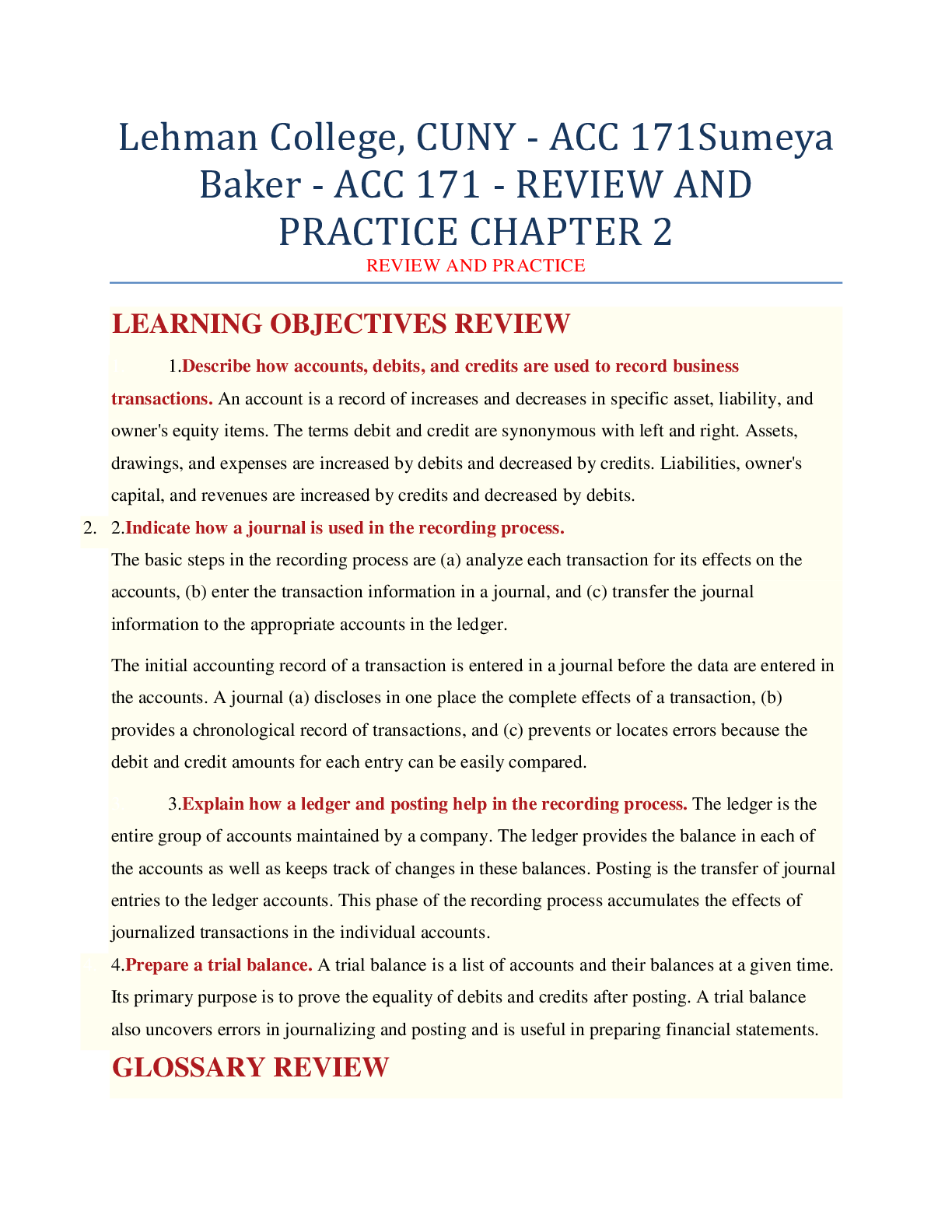

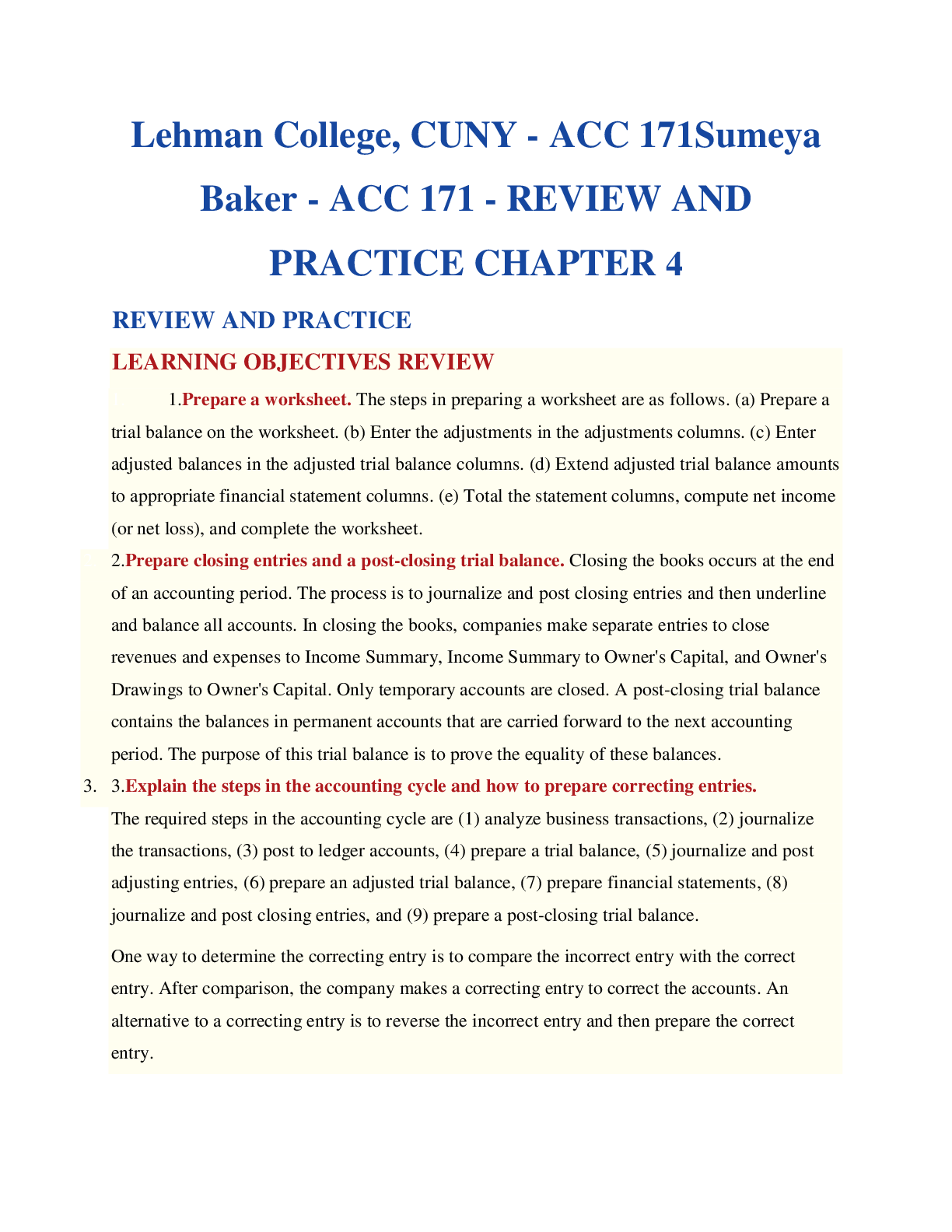

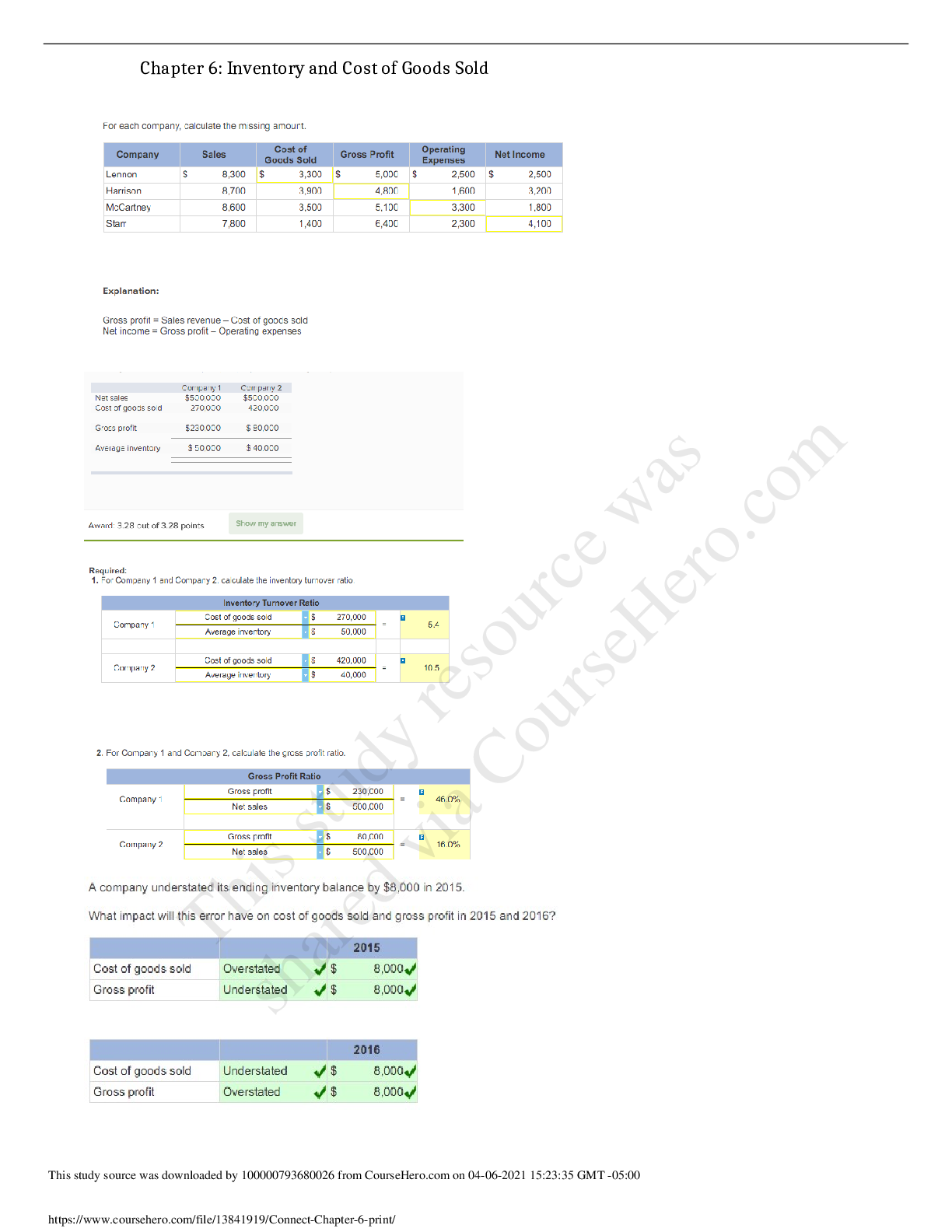

REVIEW AND PRACTICE LEARNING OBJECTIVES REVIEW 1. 1. Describe merchandising operations and inventory systems. 2. 2. Record purchases under a perpetual inventory system. 3. 3. Record sales under ... a perpetual inventory system. 4. 4. Apply the steps in the accounting cycle to a merchandising company. 5. 5. Compare a multiple-step with a single-step income statement. 6. 6. Prepare a worksheet for a merchandising company. 7. 7. Record purchases and sales under a periodic inventory system. GLOSSARY REVIEW Contra revenue account Cost of goods sold FOB destination FOB shipping point Gross profit Gross profit rate Income from operations Multiple-step income statement Net sales Nonoperating activities Operating expenses Other expenses and losses Other revenues and gains Periodic inventory system Perpetual inventory system Purchase allowance Purchase discount Purchase invoice Purchase return Sales discount Sales invoice Sales returns and allowances Sales revenue (Sales) Single-step income statement PRACTICE MULTIPLE-CHOICE QUESTIONS 5-1. (LO 1) Gross profit will result if: • (a) operating expenses are less than net income. • (b) sales revenues are greater than operating expenses. • (c) sales revenues are greater than cost of goods sold. • (d) operating expenses are greater than cost of goods sold. 5-2. (LO 2) Under a perpetual inventory system, when goods are purchased for resale by a company: • (a) Purchases on account are debited to Inventory. • (b) Purchases on account are debited to Purchases. • (c) Purchase returns are debited to Purchase Returns and Allowances. • (d) Freight costs are debited to Freight-Out. 5-3. (LO 3) The sales accounts that normally have a debit balance are: • (a) Sales Discounts. • (b) Sales Returns and Allowances. • (c) Both (a) and (b). • (d) Neither (a) nor (b). 5-4. (LO 3) A credit sale of $750 is made on June 13, terms 2/10, net/30. A return of $50 is granted on June 16. The amount received as payment in full on June 23 is: • (a) $700. • (b) $686. • (c) $685. • (d) $650. 5-5. (LO 2) Which of the following accounts will normally appear in the ledger of a merchandising company that uses a perpetual inventory system? • (a) Purchases. • (b) Freight-In. • (c) Cost of Goods Sold. • (d) Purchase Discounts. • (c) Cost of Goods Sold. The Cost of Goods Sold account normally appears in the ledger of a merchandising company using a perpetual inventory system. The other choices are incorrect because (a) the Purchases account, (b) the Freight-In account, and (d) the Purchase Discounts account all appear in the ledger of a merchandising company that uses a periodic inventory system. 5-6. (LO 3) To record the sale of goods for cash in a perpetual inventory system: • (a) only one journal entry is necessary to record cost of goods sold and reduction of inventory. • (b) only one journal entry is necessary to record the receipt of cash and the sales revenue. • (c) two journal entries are necessary: one to record the receipt of cash and sales revenue, and one to record the cost of goods sold and reduction of inventory. • (d) two journal entries are necessary: one to record the receipt of cash and reduction of inventory, and one to record the cost of goods sold and sales revenue. • (c) 5-7. (LO 4) The steps in the accounting cycle for a merchandising company are the same as those in a service company except: • (a) an additional adjusting journal entry for inventory may be needed in a merchandising company. • (b) closing journal entries are not required for a merchandising company. • (c) a post-closing trial balance is not required for a merchandising company. • (d) a multiple-step income statement is required for a merchandising company. • (a) 5-8. (LO 5) The multiple-step income statement for a merchandising company shows each of the following features except: • (a) gross profit. • (b) cost of goods sold. • (c) a sales section. • (d) an investing activities section. • (d) an investing activities section. An investing activities section appears on the statement of cash flows, not on a multiple-step income statement. Choices (a) gross profit, (b) cost of goods sold, and (c) a sales section are all features of a multiple-step income statement. 5-9. (LO 5) If sales revenues are $400,000, cost of goods sold is $310,000, and operating expenses are $60,000, the gross profit is: • (a) $30,000. • (b) $90,000. • (c) $340,000. • (d) $400,000. • (b) $90,000. , not (a) $30,000, (c) $340,000, or (d) $400,000. 5-10. (LO 5) A single-step income statement: • (a) reports gross profit. • (b) does not report cost of goods sold. • (c) reports sales revenue and “Other revenues and gains” in the revenues section of the income statement. • (d) reports operating income separately. • (c) reports sales revenue and “Other revenues and gains” in the revenues section of the income statement. Both sales revenue and “Other revenues and gains” are reported in the revenues section of a single-step income statement. The other choices are incorrect because (a) gross profit is not reported on a single-step income statement, (b) cost of goods sold is included in the expenses section of a single-step income statement, and (d) income from operations is not shown separately on a single-step income statement. 5-11. (LO 5) Which of the following appears on both a single-step and a multiple-step income statement? • (a) Inventory. • (b) Gross profit. • (c) Income from operations. • (d) Cost of goods sold. • (d) Cost of goods sold. Cost of goods sold appears on both a single-step and a multiple-step income statement. The other choices are incorrect because (a) inventory does not appear on either a single-step or a multiple-step income statement and (b) gross profit and (c) income from operations appear on a multiple-step income statement but not on a single-step income statement. 5-12. (LO 6) In a worksheet using a perpetual inventory system, Inventory is shown in the following columns: • (a) adjusted trial balance debit and balance sheet debit. • (b) income statement debit and balance sheet debit. • (c) income statement credit and balance sheet debit. • (d) income statement credit and adjusted trial balance debit. • (a) adjusted trial balance debit and balance sheet debit. In a worksheet using a perpetual inventory system, inventory is shown in the adjusted trial balance debit column and in the balance sheet debit column. The other choices are incorrect because the Inventory account is not shown in the income statement columns. 5-13. (LO 7) In determining cost of goods sold in a periodic system: • (a) purchase discounts are deducted from net purchases. • (b) freight-out is added to net purchases. • (c) purchase returns and allowances are deducted from net purchases. • (d) freight-in is added to net purchases. • (d) freight-in is added to net purchases. In determining cost of goods sold in a periodic system, freight-in is added to net purchases. The other choices are incorrect because (a) purchase discounts are deducted from purchases, not net purchases; (b) freight-out is a cost of sales, not a cost of purchases; and (c) purchase returns and allowances are deducted from purchases, not net purchases. 5-14. (LO 7) If beginning inventory is $60,000, cost of goods purchased is $380,000, and ending inventory is $50,000, cost of goods sold is: • (a) $390,000. • (b) $370,000. • (c) $330,000. • (d) $420,000. • (a) $390,000. , not (b) $370,000, (c) $330,000, or (d) $420,000. 5-15. (LO 7) When goods are purchased for resale by a company using a periodic inventory system: • (a) purchases on account are debited to Inventory. • (b) purchases on account are debited to Purchases. • (c) purchase returns are debited to Purchase Returns and Allowances. • (d) freight costs are debited to Purchases. • (b) PRACTICE EXERCISES 5-1. Prepare purchase and sales entries. (LO 2, 3) On June 10, Spinner Company purchased $10,000 of merchandise from Lawrence Company, FOB shipping point, terms 2/10, n/30. Spinner pays the freight costs of $600 on June 11. Damaged goods totaling $700 are returned to Lawrence for credit on June 12. The fair value of these goods is $300. On June 19, Spinner pays Lawrence in full, less the purchase discount. Both companies use a perpetual inventory system. Instructions (a) Prepare separate entries for each transaction on the books of Spinner Company. (b) Prepare separate entries for each transaction for Lawrence Company. The merchandise purchased by Spinner on June 10 had cost Lawrence $6,400. Prepare multiple-step and single-step income statements. (LO 5) In its income statement for the year ended December 31, 2017, Sale Company reported the following condensed data. Interest expense $ 50,000 Net sales $1,650,000 Operating expenses 590,000 Interest revenue 20,000 Cost of goods sold 902,000 Loss on disposal of equipment 7,000 Instructions (a) Prepare a multiple-step income statement. (b) Prepare a single-step income statement. PRACTICE PROBLEM Prepare a multiple-step income statement. (LO 5) The adjusted trial balance columns of Falcetto Company's worksheet for the year ended December 31, 2017, are as follows. Debit Credit Cash 14,500 Accumulated Depreciation—Equipment 18,000 Accounts Receivable 11,100 Inventory 29,000 Notes Payable 25,000 Prepaid Insurance 2,500 Accounts Payable 10,600 Equipment 95,000 Owner's Capital 81,000 Owner's Drawings 12,000 Sales Revenue 536,800 Sales Returns and Allowances 6,700 Interest Revenue 2,500 Sales Discounts 5,000 673,900 Cost of Goods Sold 363,400 Freight-Out 7,600 Advertising Expense 12,000 Salaries and Wages Expense 56,000 Utilities Expense 18,000 Rent Expense 24,000 Depreciation Expense 9,000 Insurance Expense 4,500 Interest Expense 3,600 673,900 Instructions Prepare a multiple-step income statement for Falcetto Company. Solution [Show More]

Last updated: 1 year ago

Preview 1 out of 23 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

May 28, 2020

Number of pages

23

Written in

Additional information

This document has been written for:

Uploaded

May 28, 2020

Downloads

0

Views

47

.png)

.png)

.png)

.png)

.png)