Financial Accounting > QUESTIONS & ANSWERS > ACCT 4210 Cost Accounting: A Managerial Emphasis CHAPTER 11 DECISION MAKING AND RELEVANT INFORMATION (All)

ACCT 4210 Cost Accounting: A Managerial Emphasis CHAPTER 11 DECISION MAKING AND RELEVANT INFORMATION QUESTIONS AND ANSWERS

Document Content and Description Below

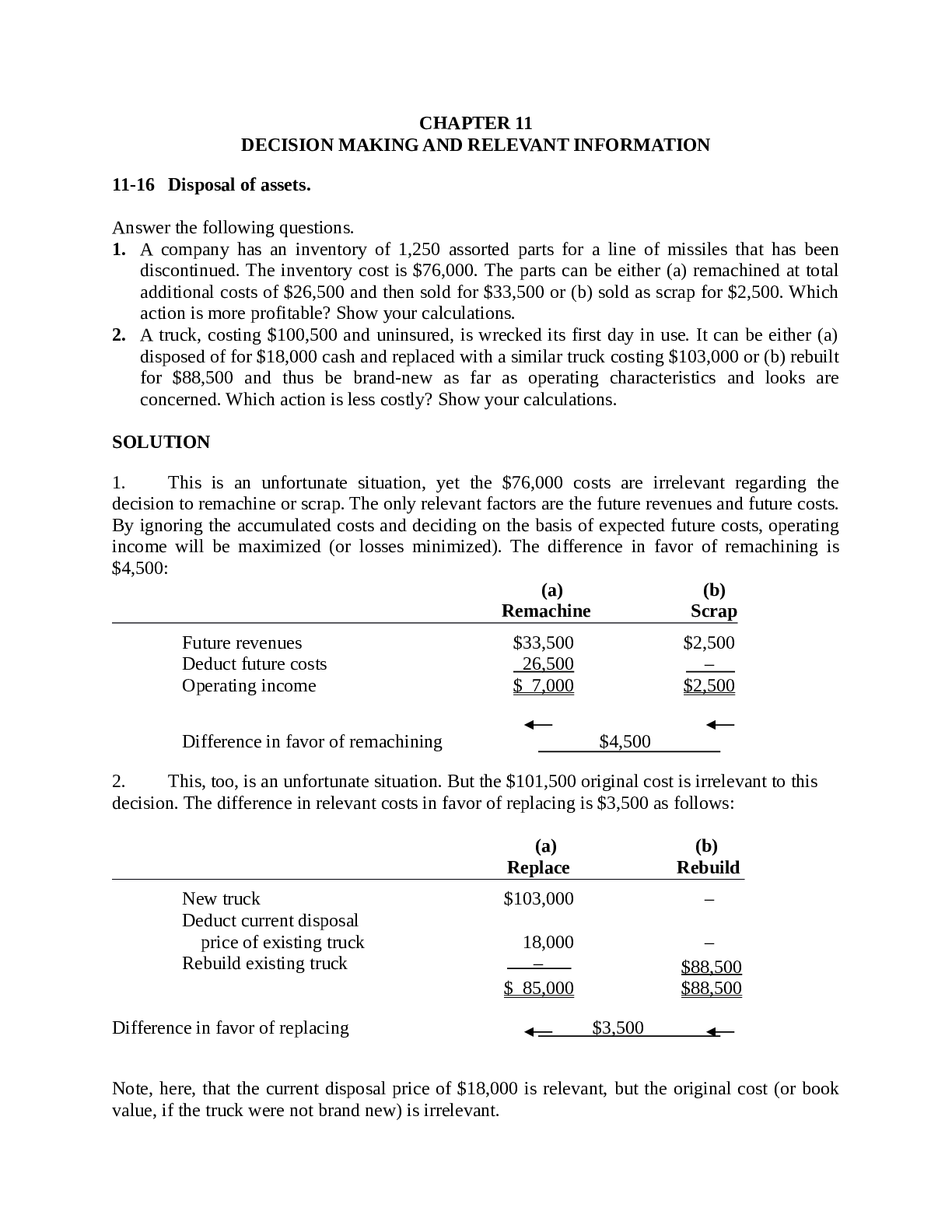

1. A company has an inventory of 1,250 assorted parts for a line of missiles that has been discontinued. The inventory cost is $76,000. The parts can be either (a) remachined at total additional cos... ts of $26,500 and then sold for $33,500 or (b) sold as scrap for $2,500. Which action is more profitable? Show your calculations. 2. A truck, costing $100,500 and uninsured, is wrecked its first day in use. It can be either (a) disposed of for $18,000 cash and replaced with a similar truck costing $103,000 or (b) rebuilt for $88,500 and thus be brand-new as far as operating characteristics and looks are concerned. Which action is less costly? Show your calculations. SOLUTION 1. This is an unfortunate situation, yet the $76,000 costs are irrelevant regarding the decision to remachine or scrap. The only relevant factors are the future revenues and future costs. By ignoring the accumulated costs and deciding on the basis of expected future costs, operating income will be maximized (or losses minimized). The difference in favor of remachining is $4,500: (a) (b) Remachine Scrap Future revenues $33,500 $2,500 Deduct future costs 26,500 – Operating income $ 7,000 $2,500 Difference in favor of remachining $4,500 2. This, too, is an unfortunate situation. But the $101,500 original cost is irrelevant to this decision. The difference in relevant costs in favor of replacing is $3,500 as follows: (a) (b) Replace Rebuild New truck $103,000 – Deduct current disposal price of existing truck 18,000 – Rebuild existing truck – $88,500 $ 85,000 $88,500 Difference in favor of replacing $3,500 11-1Note, here, that the current disposal price of $18,000 is relevant, but the original cost (or book value, if the truck were not brand new) is irrelevant. 11-211-17 (20 min.) Relevant and irrelevant costs. Answer the following questions. 1. DeCesare Computers makes 5,200 units of a circuit board, CB76, at a cost of $280 each. Variable cost per unit is $190 and fixed cost per unit is $90. Peach Electronics offers to supply 5,200 units of CB76 for $260. If DeCesare buys from Peach it will be able to save $10 per unit in fixed costs but continue to incur the remaining $80 per unit. Should DeCesare accept Peach’s offer? Explain. 2. LN Manufacturing is deciding whether to keep or replace an old machine. It obtains the following information: LN Manufacturing uses straight-line depreciation. Ignore the time value of money and income taxes. Should LN Manufacturing replace the old machine? Explain. SOLUTION 1. Make Buy Relevant costs Variable costs $190 Avoidable fixed costs 10 Purchase price ____ $260 Unit relevant cost $200 $260 DeCesare Computers should reject Peach’s offer. The $80 of fixed costs is irrelevant because it will be incurred regardless of this decision. When comparing relevant costs between the choices, Peach’s offer price is higher than the cost to continue to produce. 2. Keep Replace Difference Cash operating costs (3 years) $52,500 $46,500 $6,000 Current disposal value of old machine (2,200) 2,200 Cost of new machine _ _____ 9,000 (9,000) 11-3Total relevant costs $52,500 $53,300 $ (800) LN Manufacturing should keep the old machine. The cost savings are less than the cost to purchase the new machine. 11-18 (15 min.) Multiple choice. (CPA) Choose the best answer. 1. The Dalton Company manufactures slippers and sells them at $12 a pair. Variable manufacturing cost is $5.00 a pair, and allocated fixed manufacturing cost is $1.25 a pair. It has enough idle capacity available to accept a one-time-only special order of 5,000 pairs of slippers at $6.25 a pair. Dalton will not incur any marketing costs as a result of the special order. What would the effect on operating income be if the special order could be accepted without affecting normal sales: (a) $0, (b) $6,250 increase, (c) $28,750 increase, or (d) $31,250 increase? Show your calculations. 2. The Sacramento Company manufactures Part No. 498 for use in its production line. The manufacturing cost per u [Show More]

Last updated: 1 year ago

Preview 1 out of 20 pages

Instant download

Instant download

Also available in bundle (1)

ACCOUNTING QUESTIONS, SOLUTIONS & EXPLANATIONS-VERIFIED BY EXPERTS-A COMPLETE GUIDE FOR EAXAM PREPARATION-GRADED A+

ACCOUNTING QUESTIONS, SOLUTIONS & EXPLANATIONS-VERIFIED BY EXPERTS-A COMPLETE GUIDE FOR EAXAM PREPARATION-GRADED A+

By d.occ 2 years ago

$45

8

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jul 09, 2021

Number of pages

20

Written in

Additional information

This document has been written for:

Uploaded

Jul 09, 2021

Downloads

0

Views

58

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)