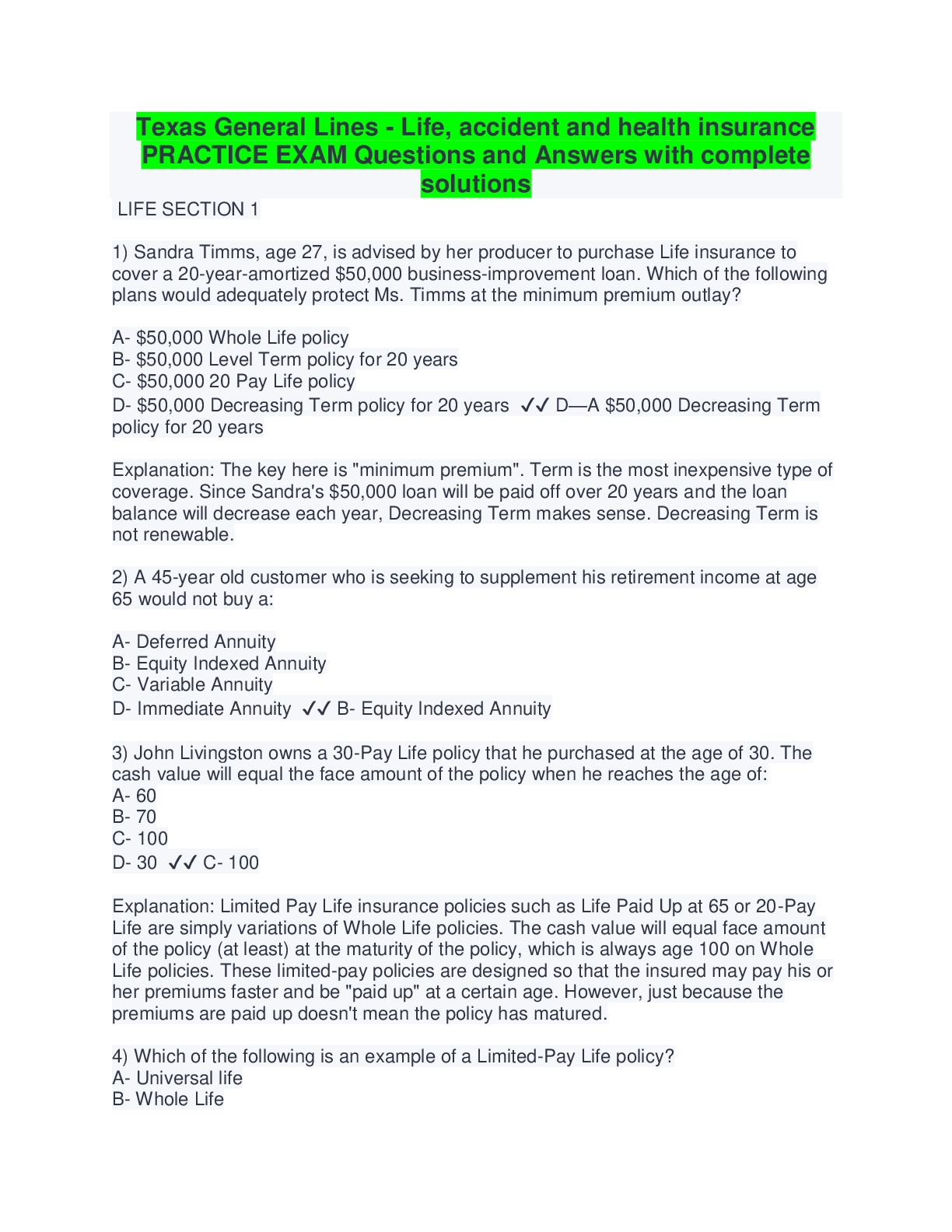

Health Care > QUESTIONS & ANSWERS > Kansas Life Accident and Health Exam (All)

Kansas Life Accident and Health Exam

Document Content and Description Below

Kansas Life Accident and Health Exam What type of annuity provides a pre-determined income amount for life? - ANS - Fixed Life annuity A life insurance policy which matures at the termination of a ... specified period other than age 100 is an - ANS - Endowment A type of life insurance policy that a person may purchase to make sure that a debt or loan will be paid off in case of their premature death. - ANS - Mortgage redemption insurance A whole life policy owner's cash value savings value will equal the policy's face amount at what age? - ANS - Age 100 A policy that possesses the lowest initial annual premium. - ANS - Modified Life What increases each year in an increasing term insurance rider? - ANS - The amount of coverage If an insured purchases a decreasing term life insurance policy, what portion of the contract decreases? - ANS - The Death Benefit An annuity settlement option that possesses the potential for providing the maximum amount of benefits per dollar of outlay - ANS - Straight Life Annuity A family policy is a combination of - ANS - Whole life and level term What type of refund is available to the beneficiary of an annuitant which will pay the refund in a limp sum? - ANS - Cash Refund Joe purchases a $100,000 20 year family income policy with a $1,000 per month income rider in 2000. If Joe dies in 2005, what will the primary beneficiary receive? - ANS - $1,000 a month until the year 2020 and then the $100,000 lump sum A family policy generally provides death benefit coverage for family members for what reason? - ANS - Different coverage amounts for family members Interest sensitive whole life policies utilize changing interest rates for what purpose? - ANS - To determine policy cash values What protects an individual against superannuation? - ANS - Life Annuity A universal variable life insurance policy is a what? - ANS - Securities and investment product What policy is characterized by a flexible premium and death benefit and allows the policy owner control of the investment aspect of the plan? - ANS - Variable Universal Life Premiums for policies covering multiple insureds, such as a survivorship life plan, are based upon what? - ANS - The joint probabilities of both proposed insureds How does the cash value of a universal life insurance policy accumulate? - ANS - Tax Deferred Jack owns a life insurance policy that requires that he pay premiums for a specified period only or until he dies, assuming this occurs prior to the end of the specified period. What type of policy does Jack possess? - ANS - Limited Pay Life Ted is only able to pay $25 per month for a life insurance policy. What policy would provide the greatest face amount of life insurance for this premium? - ANS - Five year term life John owns a ten year pay life plan. Premiums for this policy must be paid - ANS - For ten years or until death, whichever occurs first Interest sensitive whole life policy does what? - ANS - Interest credited increases cash value and shortens the premium payment period Each of the following is a traditional whole life insurance plan - ANS - Straight life, single premium life, limited pay life A graded premium life plan includes premiums that increase for a period of how many years before becoming fixed? - ANS - Up to ten What best describes the time frame when accumulated funds in an annuity contract are converted to a stream of monthly income? - ANS - The annuity period An annuity may be utilized for all of the following reasons - ANS - To provide income at retirement, to fund a childs education, to pay lifetime monthly benefits If an individual desires life insurance protection and cash value buildup and is willing to pay premiums until retirement, what type of policy would they purchase? - ANS - Limited Pay Life What policy is best suited to provide funds to pay for taxes due and other administrative expenses with regard to a deceased's estate? - ANS - Survivor life insurance A straight or whole life insurance policy may also be referred to as continuous premium life. What is true regarding this type of insurance? - ANS - The premium paid each year is based upon the current age of the insured What life insurance policy permits a beneficiary to receive a death benefit and the cash value upon the death of the insured? - ANS - Universal Life Option B What provides no income benefits in the future? - ANS - Immediate annuity A life insurance policy that provides an opportunity for investment growth potential and is characterized by a flexible premium best describes - ANS - Variable Universal life Jane can only pay $35 per month for a life insured premium. What policy would provide her with permanent insurance for such a premium? - ANS - Ten pay life A whole life policy may also be referred to as a continuous premium whole life policy. What is not true about this policy? - ANS - The premium paid each year is based upon the insured's current age What is an advantage of an interest sensitive whole life plan? - ANS - Interest gained increases cash value and shortens the premium payment period What policy is characterized by a flexible premium? - ANS - Universal life A securities license is needed to market what life insurance policy? - ANS - Variable Life Traditional whole life policies include what? - ANS - Straight life, limited payment life, single premium life What life insurance policy permits a policyholder to direct where the cash value will be invested? - ANS - Variable Universal Life What best describes the time frame when interest is amassed in an annuity contract? - ANS - The accumulation period An annuity is not used for what reason? - ANS - To provide death protection If an individual desires permanent life insurance protection and desires to fund the policy for no more than a decade, what have they purchased? - ANS - Limited Pay Life What policy is characterized by permanent life insurance protection? - ANS - Survivorship life If an individual makes a payment to fund an annui [Show More]

Last updated: 1 year ago

Preview 1 out of 20 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Reviews( 0 )

$10.00

Document information

Connected school, study & course

About the document

Uploaded On

Oct 05, 2022

Number of pages

20

Written in

Additional information

This document has been written for:

Uploaded

Oct 05, 2022

Downloads

0

Views

51

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Practice Exam with complete Questions and Answers.png)

.png)

.png)

.png)

.png)