Risk Management and Insurance > QUESTIONS & ANSWERS > California Life Accident and Health agent exam already passed (All)

California Life Accident and Health agent exam already passed

Document Content and Description Below

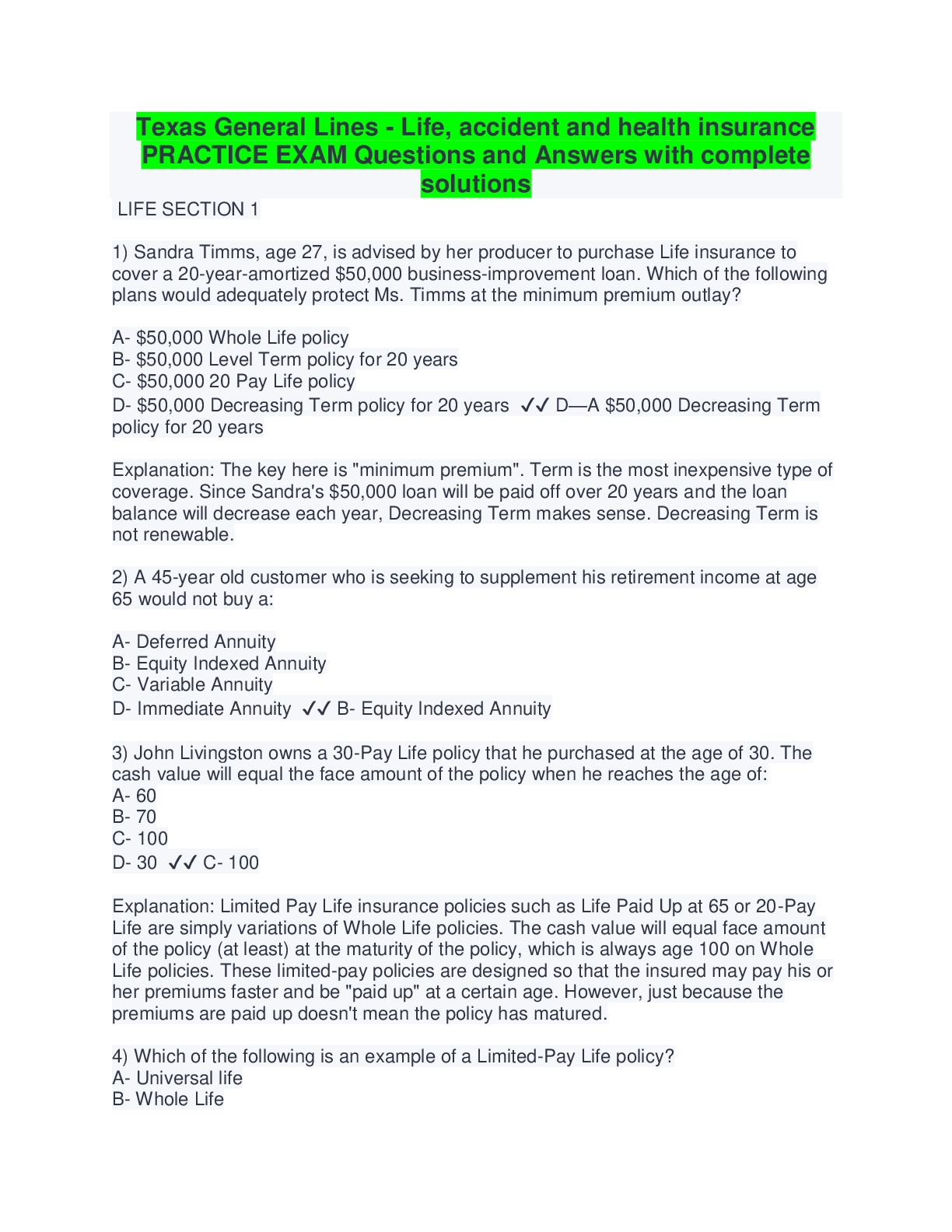

California Life Accident and Health agent exam already passed If an applicant for a health insurance policy is found to be a substandard risk, the insurance company is most likely to A) lower its ... insurability standards B) refuse to issue the policy C) charge an extra premium D) require a yearly medical examination C) charge and extra premium The premium rate will be adjusted to relflect the insurer's risk According to California Insurance Code, which of the following can be classified as an insurable event? A) extreme levels of loss B) pure risks C) unpredictable losses D) speculative risks B) pure risks Any event, whether past or future, which may damnify a person having an insurable interest, or create a liability against him/her, may be insured against. The more predictable a loss, the more insurable it becomes. Only pure risks are insurable. Speculative losses are uninsurable The type of settlement option which pays throughout the lifetimes of two or more beneficiaries is called A) Fixed amount B) Joint life C) Joint and Survivor D) Fixed Period C) Joint and Survivor a joint and survivor option pays while either beneficiary is still living How long is an open enrollment period for Medicare supplement policies? A) 1 Year B) 30 Days C) 90 Days D) 6 Months D) 6 Months An open enrollment period is a 6-month period that guarantees the applicants the right to buy Medigap once they first sign up for Medicare Part B What is a penalty tax for nonqualified distributions from a medical savings account? A) 8% B) 10% C) 16% D) 20% D) 20% If a distribution is made for a reason other than to pay for qualified medical expenses, the amount withdrawn will be subject to an income tax and an additional 20% tax. What are the 2 types of Flexible Spending Accounts? A) Medical Savings Accounts and Health Reimbursement Accounts B) Health Care Accounts and Dependent Care Accounts C) Health Care Accounts and Health Reimbursement Accounts D) Medical Savings Accounts and Dependent Care Accounts B) Health Care Accounts and Dependent Care Accounts There are 2 types of Flexible Spending Accounts : a Health Care Account for out-of-pocket health care expenses, and a Dependent Care Account to help pay for dependent care expenses which make it possible for an employee and his or her spouse, if applicable, to work As it pertains to IRA eligibility, which of the following would NOT be considered earned income? A) an annual salary B) unemployment benefits C) wages for a part-time job D) commissions B) unemployment benefits Earned income means salary, wages, commissions, but would not include income from investments, unemployment benefits, income from trust funds, and any other forms of payment that are unearned Which renewability provision allows an insurer to terminate a policy for any reason, and to increase the premiums for any class of insureds? A) guaranteed renewable B) optionally renewable C) conditionally renewable D) cancellable B) optionally renewable The renewability provision in an optionally renewable policy gives the insurer the option to terminate the policy for any reason on the date specified in the contract (usually a renewal date). Furthermore, this provision allows the insurer to increase the premium for any class of optionally renewable insureds. Insurance is the transfer of A) hazard B) peril C) risk D) loss C) risk Insurance is the transfer of financial responsibility associated with a potential of a loss (risk) to an insurance company. The annuity owner dies during the accumulation period of his annuity. The cash value of his annuity exceeds the premiums he paid. There is no named beneficiary. Which of the following is true? A) The premium value will be paid to the annuitant's estate B) The state government will receive the amount of premiums paid C) The state government will receive the cash value of the annuity D) The cash value will be paid to the annuitant's estate D) The cash value will be paid to the annuitant's estate If an annuitant dies during the accumulation period, the beneficiary is paid either the cash value of the policy or the amount of premiums paid, which ever is the larger amount. In this case, a beneficiary is not named, so the cash value will be paid to the annuitant's estate The death benefit under th [Show More]

Last updated: 1 year ago

Preview 1 out of 16 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

We Accept:

Also available in bundle (2)

California Life Insurance Bundled Exams Questions and Answers (2022/2023) (Verified Solutions)

California Life Insurance Bundled Exams Questions and Answers (2022/2023) (Verified Solutions)

By Nutmegs 1 year ago

$35

20

.png)

CALIFORNIA LIFE, ACCIDENT AND HEALTH INSURANCE BUNDLED EXAMS QUESTIONS AND ANSWERS WITH VERIFED SOLUTIONS

CALIFORNIA LIFE, ACCIDENT AND HEALTH INSURANCE BUNDLED EXAMS QUESTIONS AND ANSWERS WITH VERIFED SOLUTIONS

By Nutmegs 1 year ago

$22

15

Reviews( 0 )

$10.00

Document information

Connected school, study & course

About the document

Uploaded On

Feb 11, 2023

Number of pages

16

Written in

Additional information

This document has been written for:

Uploaded

Feb 11, 2023

Downloads

0

Views

104

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Practice Exam with complete Questions and Answers.png)

.png)

.png)

.png)