Urban Policy and Planning > QUESTIONS & ANSWERS > HUD Practice test questions and answers already passed (All)

HUD Practice test questions and answers already passed

Document Content and Description Below

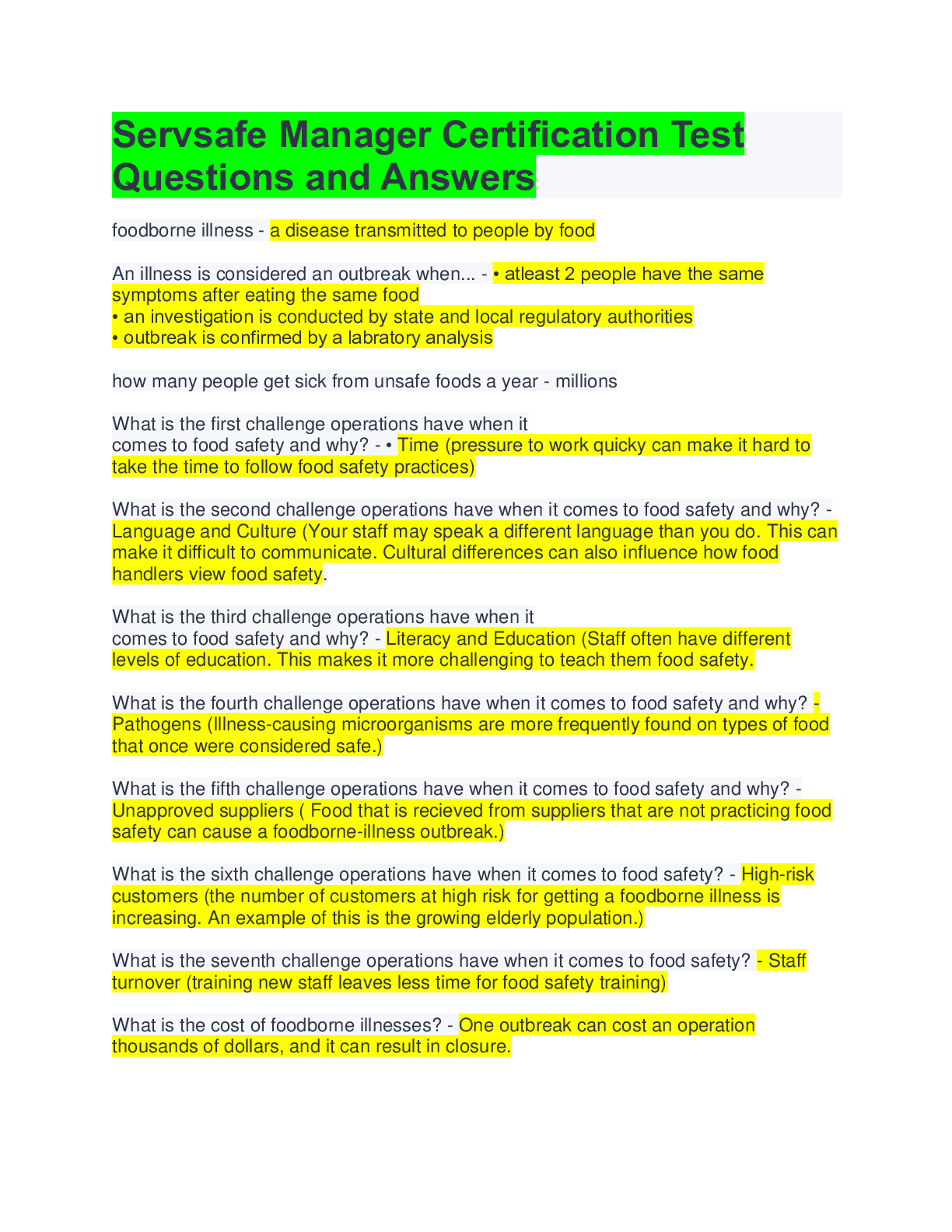

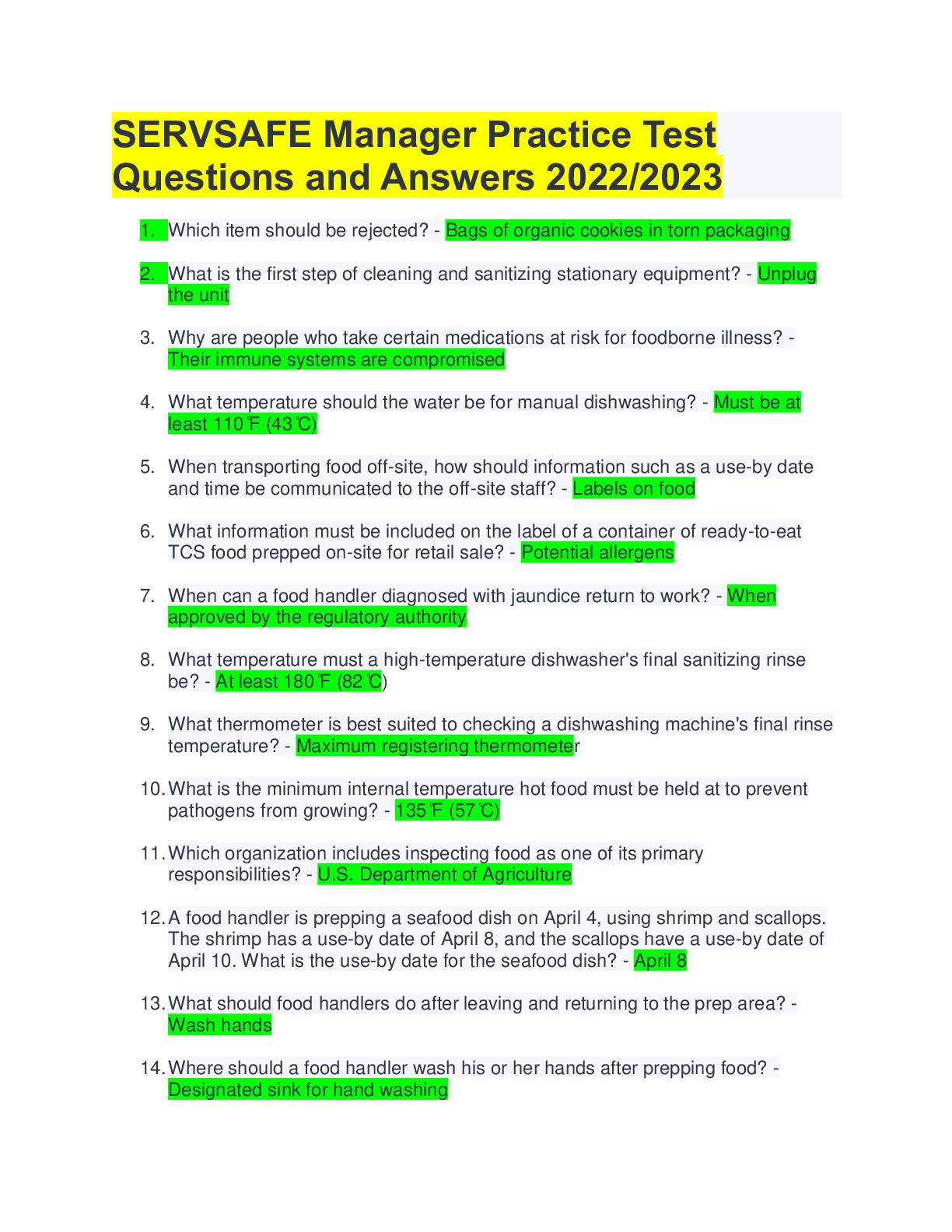

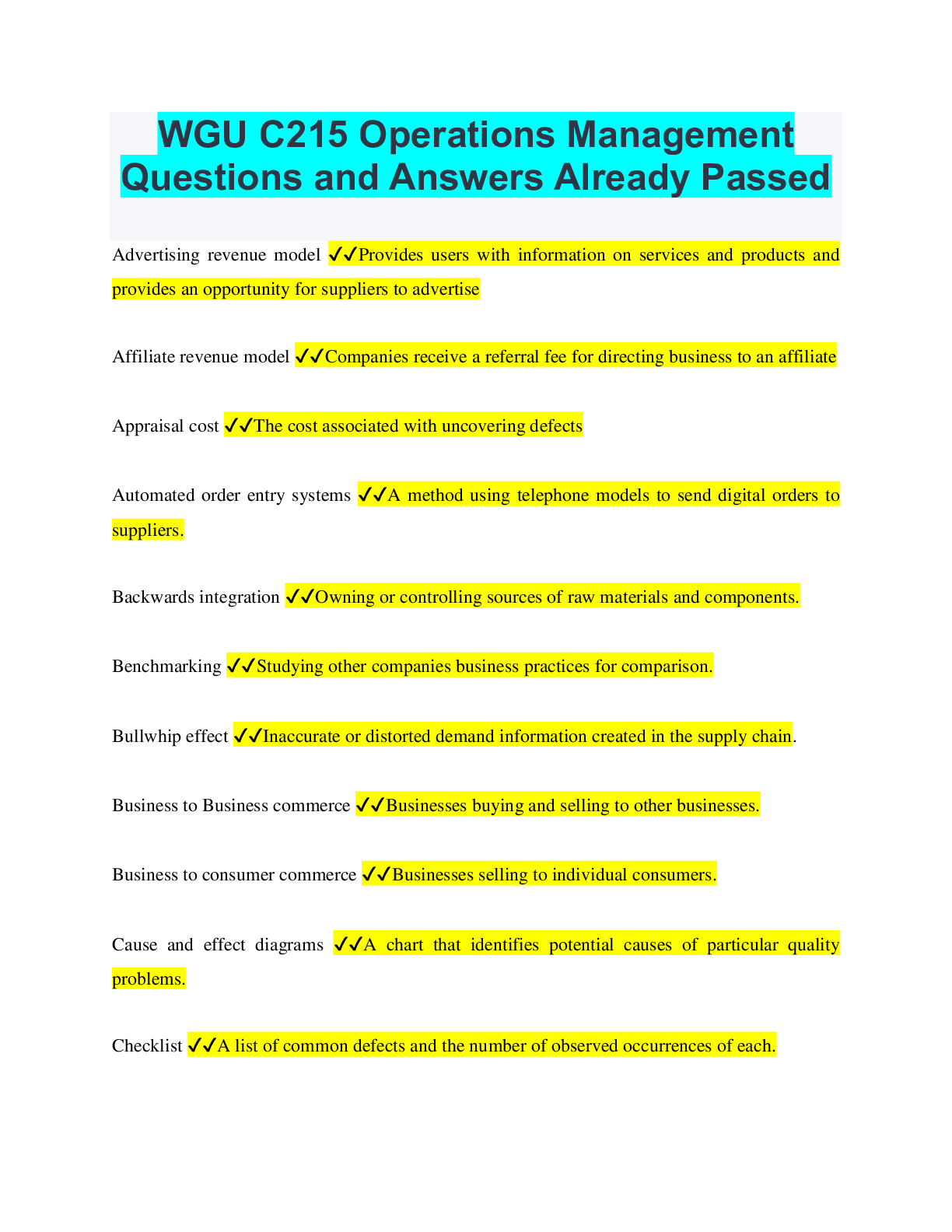

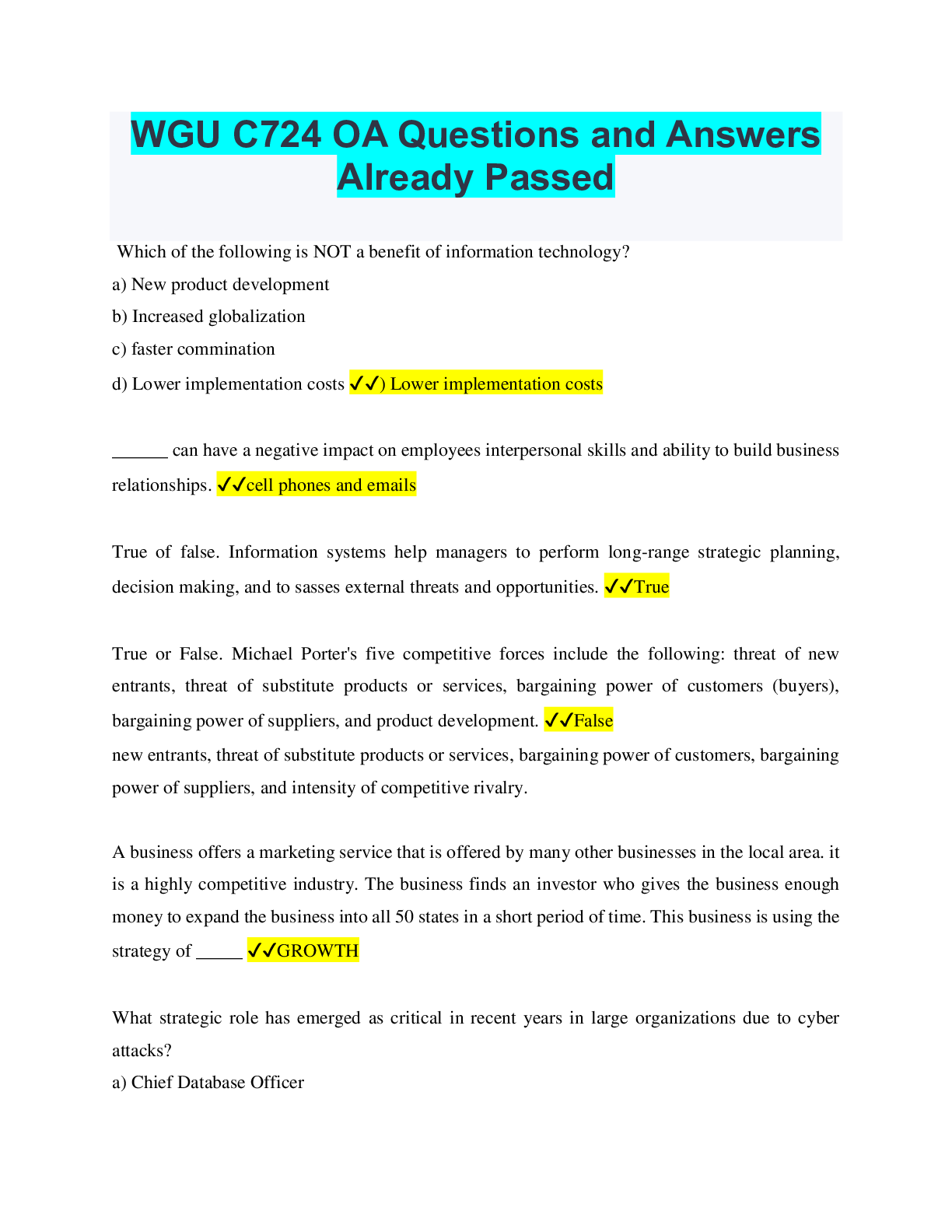

HUD Practice test questions and answers already passed 1) A client would like to purchase a house within one year. The client is motivated to increase household income as a way to save for a down p... ayment and qualify for a loan. Which is the best solution for the client to reach this goal? ✔✔Find a second job 2) Six months ago a client left a job as a reporter to start a business in the retail industry. To prepare to buy a house, the client closed credit card accounts and has been using savings to pay down credit card debt and collections. The client has not been able to save much for a down payment with all the debt payments but knows about an affordable homeownership program that only requires a 1% down payment with an FHA Loan. What might result from the client closing the credit card accounts? ✔✔It decreases credit utilization, causing a positive impact on the credit score 3. Which family is most likely to qualify for the Earned Income Tax Credit (EITC) ✔✔An individual employed part time in a minimum wage job 4. A client shopping for a mortgage loan present a housing counselor with an offer from a local mortgage lender. The interest rate on the offer is 7.5% for a 30 year fixed rate mortgage with a 20% down payment required. The counselor reviews the client file and determines the client's credit score is 725 and the client's total debt to income ratio is 20%. The client asks the housing counselor if the offer is a case of illegal predatory lending. How should the housing counselor respond? ✔✔I am unable to determine whether the loan is predatory, but I suggest you shop around with other lending sources. 5. Which does a servicer do in the non-judicial foreclosure? ✔✔Issues a Notice of Default (NOD) to the borrower 6 Under which circumstance must a servicer refrain from the foreclosure process ✔✔The client has a pending loan modification application 7. What should a counselor and borrower focus on when developing an emergency budget? ✔✔Increasing income and decreasing expenses 8. A client who is not behind on the mortgage was recently informed of a reduction of income for two months by the client's employer. The Client has an FHA loan and would like to take action as soon as possible to avoid a mortgage delinquency. Which FHA Loss Mitigation option is likely best for this client? ✔✔Informal/formal forbearance 9. How should a homeowner interpret a letter from a lawyer offering to stop foreclosure proceedings for an upfront fee? ✔✔As a possible scam Which option allows the borrower to avoid foreclosure by disposing of a property for an amount less than the outstanding mortgage balance? ✔✔Short Sale Which section of a credit report will contain employer details? ✔✔Personal information [Show More]

Last updated: 1 year ago

Preview 1 out of 3 pages

.png)

Also available in bundle (1)

.png)

HUD BUNDLED EXAMS QUESTIONS AND ANSWERS WITH VERIFIED SOLUTIONS

HUD BUNDLED EXAMS QUESTIONS AND ANSWERS WITH VERIFIED SOLUTIONS

By Nutmegs 1 year ago

$20

18

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jan 19, 2023

Number of pages

3

Written in

Additional information

This document has been written for:

Uploaded

Jan 19, 2023

Downloads

0

Views

99

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)