Law > QUESTIONS & ANSWERS > Notary Signing Agent Questions and Answers Already Graded A (All)

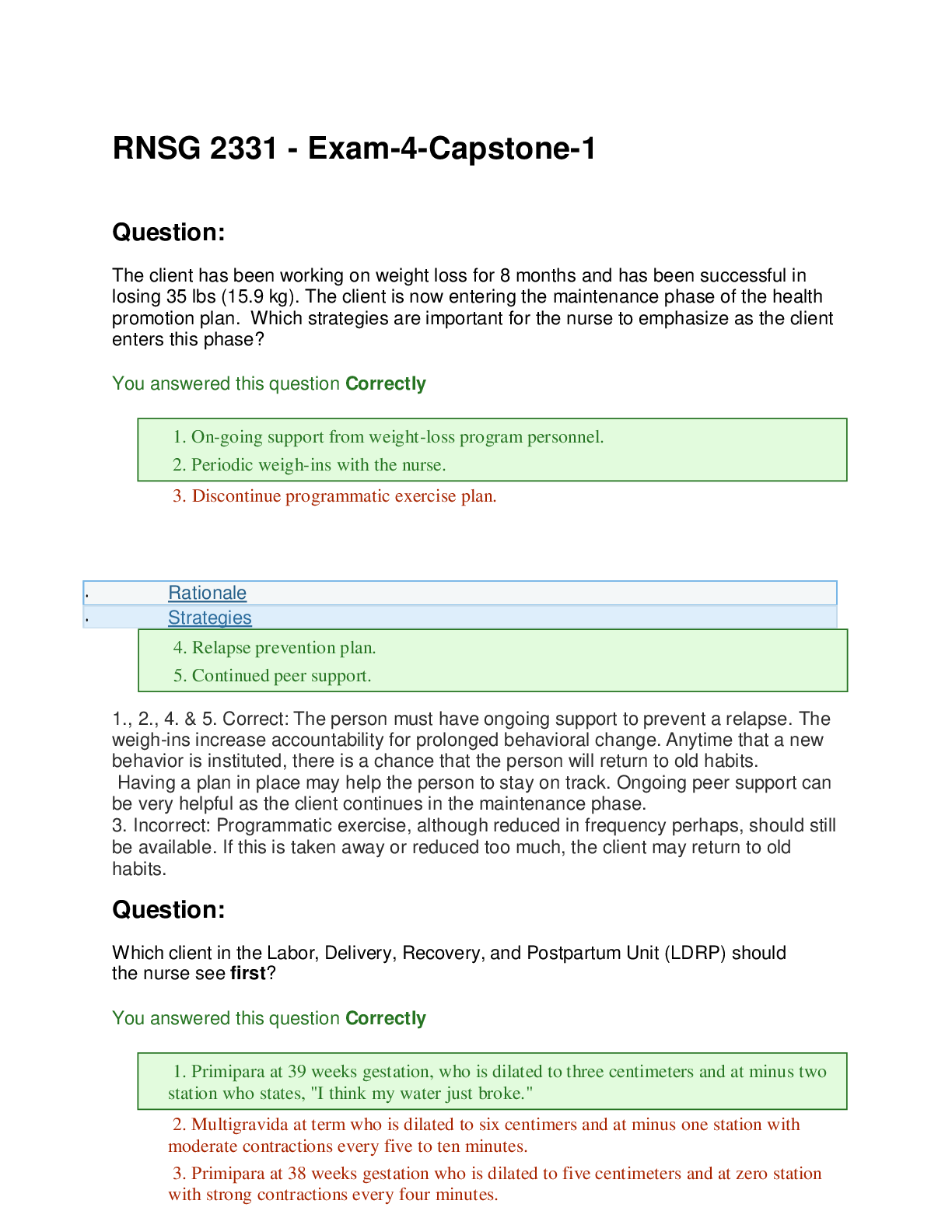

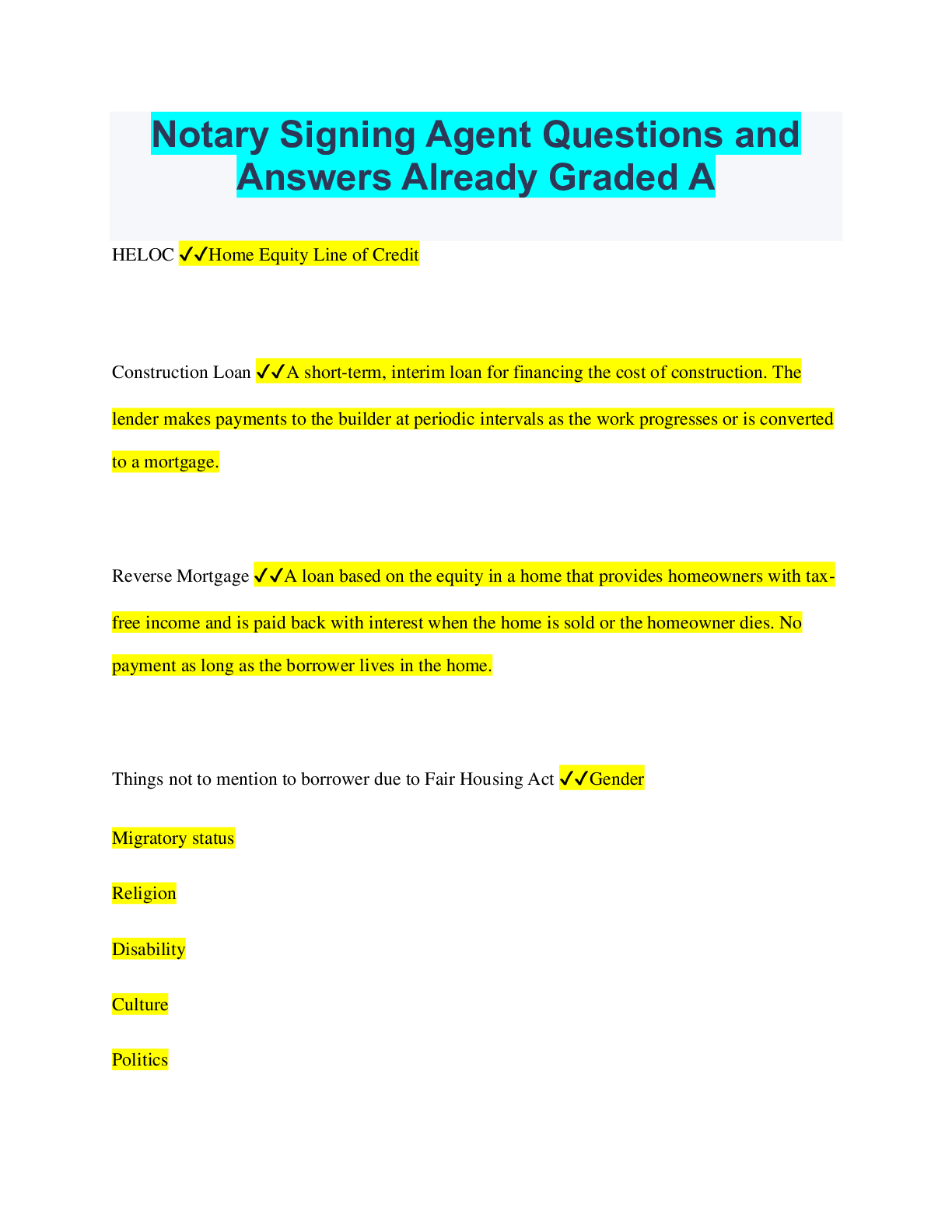

Notary Signing Agent Questions and Answers Already Graded A

Document Content and Description Below

Notary Signing Agent Questions and Answers Already Graded A HELOC ✔✔Home Equity Line of Credit Construction Loan ✔✔A short-term, interim loan for financing the cost of construction. The le... nder makes payments to the builder at periodic intervals as the work progresses or is converted to a mortgage. Reverse Mortgage ✔✔A loan based on the equity in a home that provides homeowners with taxfree income and is paid back with interest when the home is sold or the homeowner dies. No payment as long as the borrower lives in the home. Things not to mention to borrower due to Fair Housing Act ✔✔Gender Migratory status Religion Disability Culture Politics Questions to ask a contracting company if not provided automatically ✔✔How many pages need to be faxed back? Are there any special circumstances, such as more than 2 borrowers or multiple locations of borrowers? After hours contact info for contract company contact, closing agent, including names, phone numbers and email addresses Independent Contractor's Agreement if first time working with this company Things to keep on hand in case of unsolicited assignments ✔✔Copy of Drivers License Proof of Notary Commission Proof of E&O Insurance Completed W9 Proof of Surety Bond What you should receive soon after accepting assignment ✔✔Confirmation Form, Assignment Sheet, or Instruction Sheet. Reply in writing (could be via text or email) AFTER reading and understanding. Borrower Call Checklist ✔✔* My name, why I'm calling * Confirm address and time * What will happen at appointment - Will be signing loan documents, there will be two sets, one to sign and one to keep * Will take 45 minutes to an hour * What I need from them Government issued ID, current, with exact name, current * Explain roles and limitations * End on a positive note What to do if name on ID doesn't match loan exactly ✔✔* Is there another ID or is there a credible reference who has an ID How long after getting assignment should you call the borrower? ✔✔Within one hour Items to check when printing out/reviewing loan package ✔✔Have all pages printed completely? Sometimes get cut off on bottom of page. Are there barcodes at the bottoms of the pages? If so, are they on every page? Do the names and information on the info sheet match the names and info in the loan package? Are all critical documents present and complete? No inappropriate blank spaces How to prep a loan package ✔✔1. Locate and highlight NSA instructions only 2. See if there are any blank spaces 3. Identify and flag all signature/initial/notary 4. Highlight/flag anything out of the ordinary 5. Flag anything specifically mentioned in instructions 6. Make a list of any questions 7. Note the original order in case it gets dropped 8. Place HUD-1 or Closing Disclosure on top (flag original location) 9. Fill out the Notarial Evidence Form 10. Check the Uniform Residental Loan App (1003) for loan officer contact info in case its needed 11. Check to see that IRS Form 4506-T has enough copies. There should be 2 if there are 2 borrowers, plus the one extra. 12. Check to see that there are enough Notices of Right to Cancel. There should be 5 if there are two borrowers since each borrower gets 2. 13. Check to see that each borrower has a W9 and Patriot Act form. 14. Check to see that something is checked in the Impound Authorization and First Payment document. If not, the borrower will need to check something. 15. Pull Tax Information Sheet if there is one because it should NOT be presented to the borrower. Return it when you're done. Other names for Signing Agent Instructions ✔✔NSA Instructions Confirmation Sheet Lender's Instructions Assignment Sheet May be separate email or PDF What are the Critical Documents? ✔✔Closing Disclosure or HUD-1 and Truth in Lending Notice of Right to Cancel Note Deed of Trust/Mortgage What documents may be highlighted ✔✔NSA Instructions only. Never highlight the actual loan package. What's included in the Closing Document? ✔✔Outlines lender disclosures to borrower Page 1: Closing info, transaction info, loan info, including -- Disbursement date, appraised value or sale price, loan terms, payment info, cost at closing, balloon payments, prepayment penalties, property taxes and other charges, costs at closing (cash to close) Page 2: Itemization of Closing Costs Page 3: Payoffs and Payments for refi, calculating costs to close Page 4: Disclosures, Adjustable Payments, Adjustable Interest Rates Page 5: May differ, but often APR info, lender contact info, signature request. What should you check in the Closing Document? ✔✔No blank spaces Are there any ballon payments or pre-payment penalties to point out to borrower Adjustable payment/adjustable interest rates Check Costs at Closing, Cash to Close to see if there's anything to collect Compare Calculating Costs to Close / Payoffs & Payments to page 1 estimate to see if there were any changes Signature Request - If there isn't a signature line, you MUST have a separate signature loan acceptance page What to watch for on HUD-1 ✔✔Page 2 may require borrower signature Do not sign space for settlement agent signature Line 103 ? Notice of Right to Cancel ✔✔* Two copies must be given to each borrower, so you need 5 total. These instructions may not be included by lender, so you need to know this. * Cancellation date CAN be filled in by borrower (not you) or can be crossed out and changed by borrower * Be careful that the "I Wish to Cancel" line is not accidentally signed * Check that end of recission date is correct. Truth in Lending Disclosure ✔✔Not included if there is a Closing Document Contains APR Must be signed and dated What is the difference between APR and interest rate? ✔✔APR contains the interest rate plus finance charges such as fees and points Note ✔✔The most critical document Obligates borrower to repay loan and sets out the terms for doing so Many provisions are the same as HUD-1 and Closing Document, but point them out anyway Interest rate is spelled out in paragraph 2 (not the APR) Where to pay First and last payment date Right to prepay Failure to pay Payment amount Must be signed ("seal" means sign, not notary) but not always dated Where can I find the interest rate? ✔✔Note Where can I find where to make payments ✔✔Note Where can I find the payment amount? ✔✔Note Where can I find the APR? ✔✔Truth in Lending if there is one, or Closing Document Where can I find out about prepayment? ✔✔Note, Closing Document Where can I find where my first and last payments are due? ✔✔Note Deed of Trust (or Mortgage, but not in WA) ✔✔This is the "Security Instrument" referred to in the Note Places a lien on property as security for the Note There are usually 3 parties: borrower, lender and trustee (often a title company) The lender is the beneficiary Where can I find info on balloon payments, adjustable rates? ✔✔Closing Document What documents are usually notarized? ✔✔Occupancy and Financial Status Affadavit Signature Affadavit and AKA Statement Limited Power of Attorney Compliance Agreement Notarial Evidence Form What document should be filled out by you before meeting with the borrower? What should you do with it at the meeting? ✔✔Notarial Evidence Form Show it to them, but they do not do anything with it What documents are commonly referred to as the "Borrower's Disclosures"? ✔✔Uniform Residential Loan App, or 1003 HUD/VA Addendum (only for these loans) USA Patriot Act Customer ID Verification Borrower's Certification Authorization IRS Form 4506-T IRS Form W-9 Uniform Residential Loan App ✔✔Also referred to as the 1003 by lenders Requires initials on every page and several signatures "Loan officer" or "Loan originator" name/info is here; make a note of it before you go in case borrower has questions Items to take with you ✔✔Supply of blue and black pens that are all alike Notepad for borrower questions with loan officer phone number Extra Notary Affadavits Tent card with date, signature and initial requirements Mints Notary stamp ID Phone on silent USA Patriot Act Customer ID Verification ✔✔Filled out by notary Title is Signing Agent, not Notary Do not notarize Verify documents or go to jail IRS Form 4506-T ✔✔If a joint loan, will need 2 forms Each borrower signs as both primary and secondary on different forms Check to be sure this is correct in package IRS Form W-9 ✔✔Verify that social security number is correct. Several sign and initials. One per borrower. What documents are known as the Lender's Disclosures? ✔✔Servicing Disclosure Statement Impound Authorization and First Payment Notice Loan Estimate Notice of Assignment Good Faith Estimate Servicing Disclosure Statement ✔✔Discloses to the borrower whether the lender intends to service the loan or transfer it to another lender or servicing company. HUD/VA Addendum ✔✔ Borrower's Certification Authorization ✔✔Certifies all of the information provided in the loan application is true and complete. Impound Authorization and First Payment Notice ✔✔Impound means escrow States if taxes, etc. are being placed in escrow If nothing is checked, have the borrower check which one applies to them Loan Estimate (LE) ✔✔A disclosure to inform the borrower on the estimated costs of closing and the cost of getting a loan. Notice of Assignment ✔✔Notifies if the loan can be (?) or is (?) being assigned to another company Good Faith Estimate ✔✔For HELOC and Reverse Mortgages only, an estimate of the fees due at closing for a mortgage loan that must be provided by a lender to a borrower within three days of the lender taking a borrower's loan application. What documents are considered to be the Lender's Instructions or Closing Instructions? ✔✔General Closing Instructions Specific Closing Instructions Tax Information Sheet General Closing Instructions ✔✔The signature space for Agent is NOT YOU. Leave this blank. Specific Closing Instructions ✔✔Contains a list of documents that should be checked for accuracy Contains loan terms, includes some stipulations Usually must be signed by the borrower Tax Information Sheet ✔✔This is a prep sheet only, don't do anything with it and DO NOT present it to the borrower. What documents should notaries NOT complete (ever)? ✔✔* Positive Proof of ID and Notary Signature Affidavit * Notary Identification Certification * Blank Acknowledgement Certificates What should you do if your loan package includes a Positive Proof of ID and Notary Signature Affidavit? ✔✔Don't sign it, send it back with a note saying by law you are unable to fulfill this request because it does not have notarial wording and does not require borrower signatures. What should you do if your loan package includes a Notary Identification Certification? ✔✔Don't sign it, send it back with a note saying by law you are unable to fulfill this request because you cannot certify your own signature and cannot stamp paper that doesn't include notarial wording. Suggest they check with the agency that issues notary commissions in your state for verification. What should you do if you are asked to notarize blank Acknowledgement Certificates? ✔✔Don't do it, send it back with a note saying by law you are unable to fulfill this request because there are no documents attached to the certificates. How do you turn a How, When or What question from a borrower into something you can answer? ✔✔Make it a Where question instead. Point out where they can find this information in the documents. Point to the answer. What should you do if the loan documents are sent directly to the borrower? ✔✔A. Contact the borrower to verify: 1. Name is exactly correct, including spelling 2. Ask them to read you the info on their ID and match it to your form and theirs. 3. Property address 4. Loan terms 5. Dates B. Instruct them to contact the lender with any questions. C. Instruct them NOT to sign until you arrive. What fees am I paying? ✔✔This can be found on the Closing Document HUD-1 or Good Faith Estimate (HELOC and Reverse only) Loan Estimate Where do I send my check? ✔✔Tell borrower this information can be found on the Deed of Trust or Mortgage How much money did I end up borrowing? ✔✔Tell borrower this information can be found in the Closing Documents, Note, and Impound Authorization and First Payment Notification documents How long is the loan for? ✔✔Tell the borrower this info can be found in the Note or Specific Closing Instructions [Show More]

Last updated: 11 months ago

Preview 1 out of 16 pages

Instant download

Buy this document to get the full access instantly

Instant Download Access after purchase

Add to cartInstant download

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Jun 26, 2023

Number of pages

16

Written in

Additional information

This document has been written for:

Uploaded

Jun 26, 2023

Downloads

0

Views

136

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)