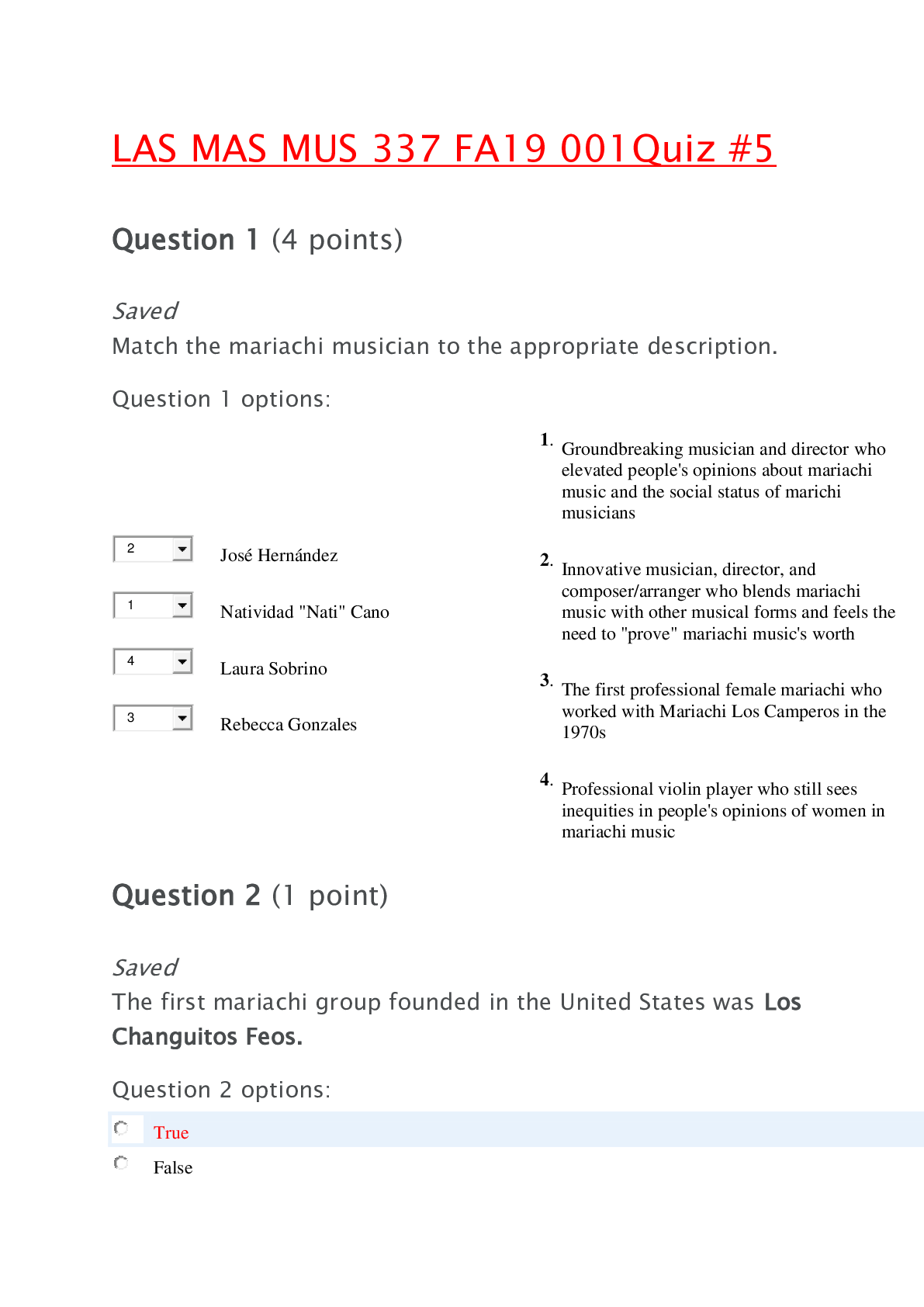

Economics > QUESTIONS & ANSWERS > Chapter 29 Secured Transactions (All)

Chapter 29 Secured Transactions

Document Content and Description Below

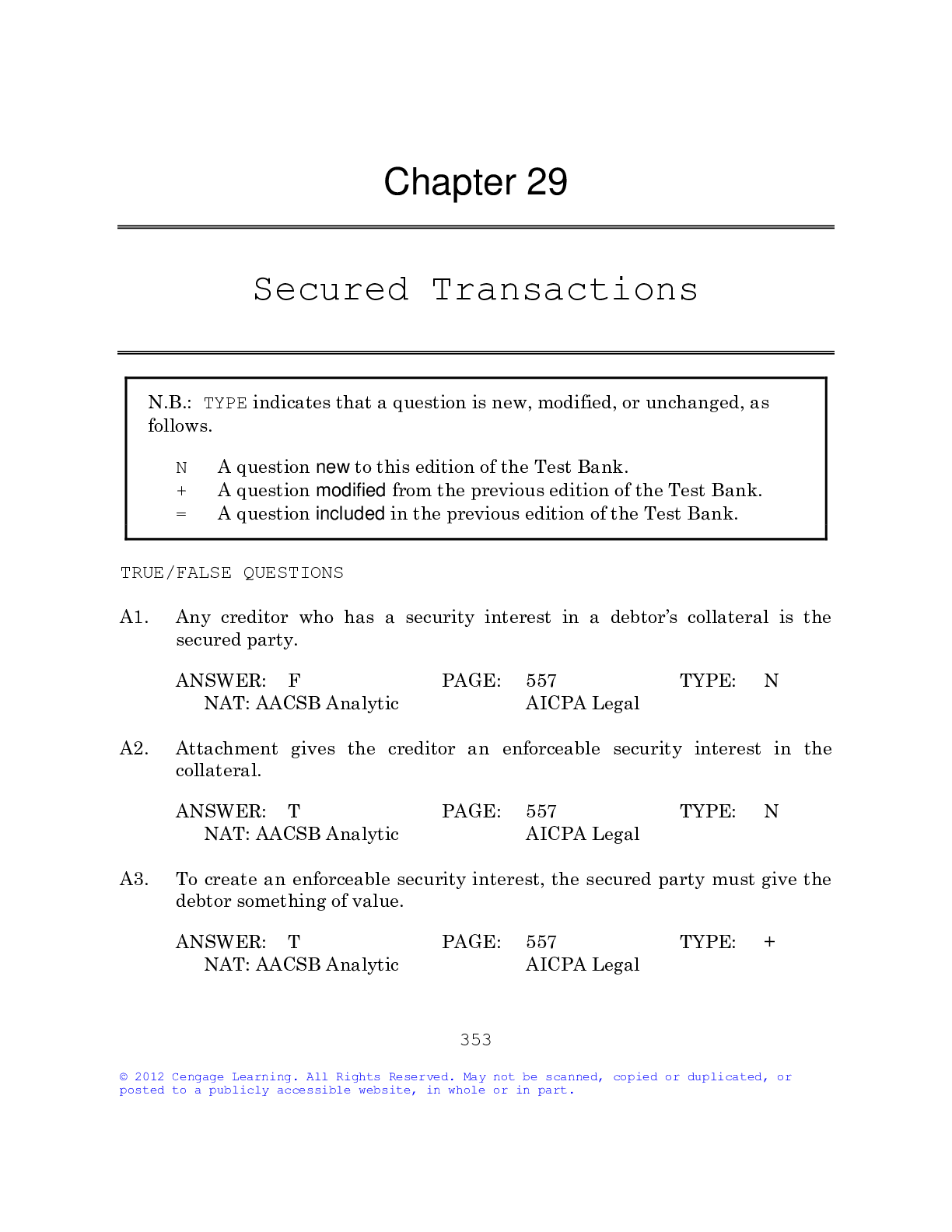

Chapter 29 Secured Transactions N.B.: TYPE indicates that a question is new, modified, or unchanged, as follows. N A question new to this edition of the Test Bank. + A question modi... fied from the previous edition of the Test Bank. = A question included in the previous edition of the Test Bank. TRUE/FALSE QUESTIONS A1. Any creditor who has a security interest in a debtor’s collateral is the secured party. : F PAGE: 557 TYPE: N NAT: AACSB Analytic AICPA Legal A2. Attachment gives the creditor an enforceable security interest in the collateral. : T PAGE: 557 TYPE: N NAT: AACSB Analytic AICPA Legal A3. To create an enforceable security interest, the secured party must give the debtor something of value. : T PAGE: 557 TYPE: + NAT: AACSB Analytic AICPA Legal A4. A security interest is enforceable only if the collateral is in the secured party’s possession. : F PAGE: 558 TYPE: = NAT: AACSB Analytic AICPA Legal A5. A security agreement must contain a description of the collateral that reasonably identifies it. : T PAGE: 558 TYPE: N NAT: AACSB Analytic AICPA Legal A6. A financing statement cannot be filed electronically. : F PAGE: 559 TYPE: N NAT: AACSB Analytic AICPA Legal A7. A financing statement must be filed under the debtor’s trade name. : F PAGE: 559 TYPE: N NAT: AACSB Reflective AICPA Legal A8. The state office in which a financing statement should be filed depends on the debtor’s location. : T PAGE: 561 TYPE: + NAT: AACSB Analytic AICPA Legal A9. Filing a financing statement with the appropriate public office is the only way to per¬fect a security interest. : F PAGE: 562 TYPE: N NAT: AACSB Reflective AICPA Legal A10. A purchase-money security interest in a business’s inventory is perfected automatically at the time of a credit sale. : F PAGE: 564 TYPE: N NAT: AACSB Analytic AICPA Legal A11. A financing statement is effective for no more than six months from the date of filing. : F PAGE: 564 TYPE: + NAT: AACSB Analytic AICPA Legal A12. A continuation statement will continue the effectiveness of a financing statement for five years. : T PAGE: 564 TYPE: N NAT: AACSB Analytic AICPA Legal A13. Advances against lines of credit can be subject to a properly perfected security interest in certain collateral. : T PAGE: 565 TYPE: + NAT: AACSB Analytic AICPA Legal A14. A security interest that provides for a security interest in after-acquired property is a floating lien. : T PAGE: 566 TYPE: + NAT: AACSB Analytic AICPA Legal A15. When more than one security interest has been perfected in the same collateral, their claims are satisfied proportionately to their value. : F PAGE: 566 TYPE: N NAT: AACSB Analytic AICPA Legal A16. A buyer in the ordinary course of business has priority unless a previously perfected security interest exists as to the goods. : F PAGE: 569 TYPE: N NAT: AACSB Analytic AICPA Legal A17. A perfected purchase-money security interest in inventory can have priority over a conflicting security interest in the same inventory. : T PAGE: 569 TYPE: N NAT: AACSB Analytic AICPA Legal A18. On the debtor’s default, a secured party can take possession of the collateral covered by the security agreement only by court order. : F PAGE: 572 TYPE: N NAT: AACSB Analytic AICPA Legal A19. Once default has occurred and the secured party has obtained possession of the collateral, the secured party has no more options. : F PAGE: 574 TYPE: N NAT: AACSB Analytic AICPA Legal A20. Whatever a secured party obtains on a sale of collateral is all that he or she can collect on the debt. : F PAGE: 576 TYPE: + NAT: AACSB Analytic AICPA Legal MULTIPLE CHOICE QUESTIONS A1. The payment of Dagmar’s debt to Evander is guaranteed by Dagmar’s personal property. This is a. a lien. b. a secured transaction. c. a real property mortgage. d. a violation of most state laws. : B PAGE: 557 TYPE: + NAT: AACSB Reflective AICPA Legal A2. Bayside Credit Corporation lends funds to Claude, a consumer, to apply to the cost of a boat, which is the collateral for the loan. An enforceable security interest requires a. a written agreement and Bayside’s possession of the boat. b. a written agreement or Bayside’s possession of the boat. c. the boat seller’s acknowledgement of the loan in writing. d. Claude’s possession of the boat. : B PAGE: 557 TYPE: + NAT: AACSB Reflective AICPA Legal A3. The payment of Florida’s debt to Guillermo is guaranteed by Florida’s personal property. Guillermo is a. a lienor. b. a secured party. c. a mortgagee. d. a usurer. : B PAGE: 557 TYPE: + NAT: AACSB Reflective AICPA Legal A4. The payment of Hu’s debt to Ian is guaranteed by Hu’s personal prop¬erty. To give public notice of his interest in Hu’s property, Ian is most likely to a. attach a bright label to Hu’s property. b. e-mail other potential creditors. c. file a financing statement with the appropriate authority. d. publish a collection notice in local newspapers. : C PAGE: 559 TYPE: = NAT: AACSB Reflective AICPA Legal A5. Super Chef Appliance Company allows Reba to take a set of kitchen appli-ances that she bought from Super Chef even though she has not paid the full price. Super Chef’s legally sufficient financing statement in the goods need not include a. a description of the collateral. b. a statement of the reason for allowing Reba to take the goods. c. Super Chef’s name. d. Reba’s name. : B PAGE: 559 TYPE: = NAT: AACSB Reflective AICPA Legal A6. The payment of Laine’s debt to Mingo is guaranteed by Laine’s personal property. The process by which Mingo can protect himself against the claims of third parties to this property is a. attachment. b. authentication. c. perfection. d. bankruptcy. : C PAGE: 559 TYPE: + NAT: AACSB Reflective AICPA Legal A7. Olive borrows from Polo and Quennell, using the same collateral for both loans. Only Quennell has a perfected security interest. Olive defaults on both loans. The party with first rights to the collateral is a. Olive. b. Polo and Quennell, in proportion to Olive’s debt to each. c. Polo. d. Quennell. : D PAGE: 559 TYPE: + NAT: AACSB Reflective AICPA Legal A8. The payment of Yves’s debt to Zane is guaranteed by Yves’s personal property. Their agreement describes Yves’s subject property by serial number. To establish Zane’s interest, this is a. irrelevant. b. not sufficient. c. sufficient if it accurately describes the parties’ agreement. d. sufficient unless it is too tedious to review. : C PAGE: 561 TYPE: = NAT: AACSB Reflective AICPA Legal A9. Danica borrows $1,000 from Evermore Bank, using her motorcycle as collateral. To perfect its security in¬terest, the bank must file its financing statement with a. the secretary of state. b. the county clerk. c. the city treasurer. d. the ward alderman. : A PAGE: 561 TYPE: N NAT: AACSB Reflective AICPA Legal A10. Mona lives in New Jersey, but she works in New York. Mona borrows $1,000 from National Bank, using her motorcycle as collateral. To perfect its security in¬terest, the bank must file its financing statement in at least a. every state. b. New Jersey. c. New Jersey and New York. d. New York. : B PAGE: 561 TYPE: = NAT: AACSB Reflective AICPA Legal Fact Pattern 29-1A (Questions A11–A13 apply) Luxuro Vehicles, Inc., makes and sells automobiles to auto dealers, including MotorPros Auto & Truck Sales. MotorPros sells the cars to consumers and businesses. A11. Refer to Fact Pattern 29-1A. A car in MotorPros’s possession is most likely a. a consumer good. b. an instrument. c. equipment. d. inventory. : D PAGE: 562 TYPE: + NAT: AACSB Reflective AICPA Legal A12. Refer to Fact Pattern 29-1A. Nani, a professional driver, buys a customized Luxuro from MotorPros to drive in a Grand Prix race. Nani’s Luxuro is a. a consumer good. b. an instrument. c. equipment. d. inventory. : C PAGE: 562 TYPE: + NAT: AACSB Reflective AICPA Legal A13. Refer to Fact Pattern 29-1A. Oakes, a police officer, buys a Luxuro from MotorPros to drive in his off-duty hours. Oakes’s Luxuro is a. a consumer good. b. an instrument. c. equipment. d. inventory. : A PAGE: 562 TYPE: + NAT: AACSB Reflective AICPA Legal A14. Saf-T Lenders, Inc., takes possession of Tiara’s stock in Urgent Care Corporation to perfect Saf-T’s security interest in the stock. This is a. after-acquired property. b. a pledge. c. a purchase-money security interest. d. a violation of most state laws. : B PAGE: 562 TYPE: + NAT: AACSB Reflective AICPA Legal A15. OK Investments, Inc., files a financing statement to provide no¬tice of its security interest in the property of Pancake House Restaurant. The initial ef¬fec¬tive term of a financing statement is a period of a. five days. b. five months. c. five weeks. d. five years. : D PAGE: 564 TYPE: = NAT: AACSB Reflective AICPA Legal A16. Clear Sky Credit Corporation asks Dimension Games Company to agree to a security agreement that provides for coverage of the proceeds from the sale of after-acquired prop¬erty. This is a. the first-in, first-out rule. b. a floating lien. c. a violation of most state laws. d. a future advance. : B PAGE: 566 TYPE: + NAT: AACSB Reflective AICPA Legal A17. Experienced Capital Company and First Street Bank are secured parties with security interests in property owned by Grande Oil Corpora¬tion. Between these security interests, the first to be filed or perfected has prior¬ity over other filed or per¬fected security interests in a. most circumstances. b. no circumstances. c. states that have not adopted Article 9 of the UCC. d. states that require a security agreement to be signed and dated by the creditor. : A PAGE: 566 TYPE: = NAT: AACSB Reflective AICPA Legal A18. Elias repays his debt, incurred to buy consumer goods, to Finance Bank and immediately files a written request for a termination state¬ment. Finance a. must comply within one month of receipt of the letter. b. must comply within twenty days of receipt of the letter. c. must refund $500 to Elias. d. is not required not comply. : B PAGE: 571 TYPE: = NAT: AACSB Reflective AICPA Legal A19. Ron does not make a payment on his car loan for several months. The dealer, Star Auto, repossesses the car by towing it from a public parking lot. Ron sues Star for breach of the peace. Ron will probably a. prevail, because Ron has not formally defaulted on the car loan. b. prevail, because the car was in a public lot when it was towed. c. not prevail, because the repossession was not a breach of the peace. d. not prevail, because a creditor can repossess property in which it holds an interest if no threats or force are used against a debtor. : C PAGE: 572 TYPE: = NAT: AACSB Reflective AICPA Legal A20. Hal’s Hardware store defaults on a debt to Intrastate Bank, which takes possession of the collateral securing the debt. Intrastate sells the collat¬eral. The proceeds from the sale are applied first to a. Hal’s debt to Intrastate. b. Hal’s debts to other creditors. c. Intrastate’s fees for the sale. d. payments Hal’s made on the debt to Intrastate. : C PAGE: 576 TYPE: = NAT: AACSB Reflective AICPA Legal ESSAY QUESTIONS A1. Efrem owns Fans & Players, a retail sporting goods shop. When Great Hill Lodge, a new ski resort, is built in the area, Efrem decides to expand and borrows a large sum from Hometown Bank. The bank takes a secu¬rity interest in Efrem’s present inventory and any after-acquired inven¬tory as collateral for the loan. The bank properly perfects the security in¬terest by filing a financing statement. Efrem’s business is profitable, and he begins doubling his inventory. A year later, an avalanche destroys the ski slope and lodge. Efrem’s business takes a turn for the worse, and he defaults on his debt to the bank. The bank seeks possession of his en¬tire inventory, even though the inventory is twice as large as it was when the loan was made. Efrem claims that the bank has rights to only half of his inventory. Is Efrem correct? Explain. A2. Discount Stores, Inc., borrows $5,000 each from EZ Loan Corporation, First National Bank, and Great Products Corporation. Discount uses its “present inventory and any thereafter acquired” to secure the loans from EZ Loan and First National. EZ Loan perfects its interest on April 1, fol¬lowed by First National on April 5. Discount buys new inventory on April 10 from Great Products and signs a security agreement, giving Great Products a purchase-money security interest in the new inven¬tory. On the same day, Great Products perfects its interest and notifies EZ Loan and First National. Discount takes possession of the new inven¬tory on April 15. On April 20, Discount defaults on all of the loans. Whose security interest has priority? [Show More]

Last updated: 1 year ago

Preview 1 out of 15 pages

Reviews( 0 )

Document information

Connected school, study & course

About the document

Uploaded On

Dec 18, 2019

Number of pages

15

Written in

Additional information

This document has been written for:

Uploaded

Dec 18, 2019

Downloads

0

Views

58

.png)

.png)

.png)

.png)

.png)

.png)

.png)